- Large Optimism transactions spiked by 58%

- On-chain and technical indicators pointed to a bullish rally on the charts

As a seasoned researcher who has navigated through countless market cycles and trends, I must say that the recent surge in Optimism transactions and whale activity is a sight to behold. With my keen eye for detail and understanding of market dynamics, it appears that the bullish rally on Optimism’s charts could indeed be more than just a fleeting moment.

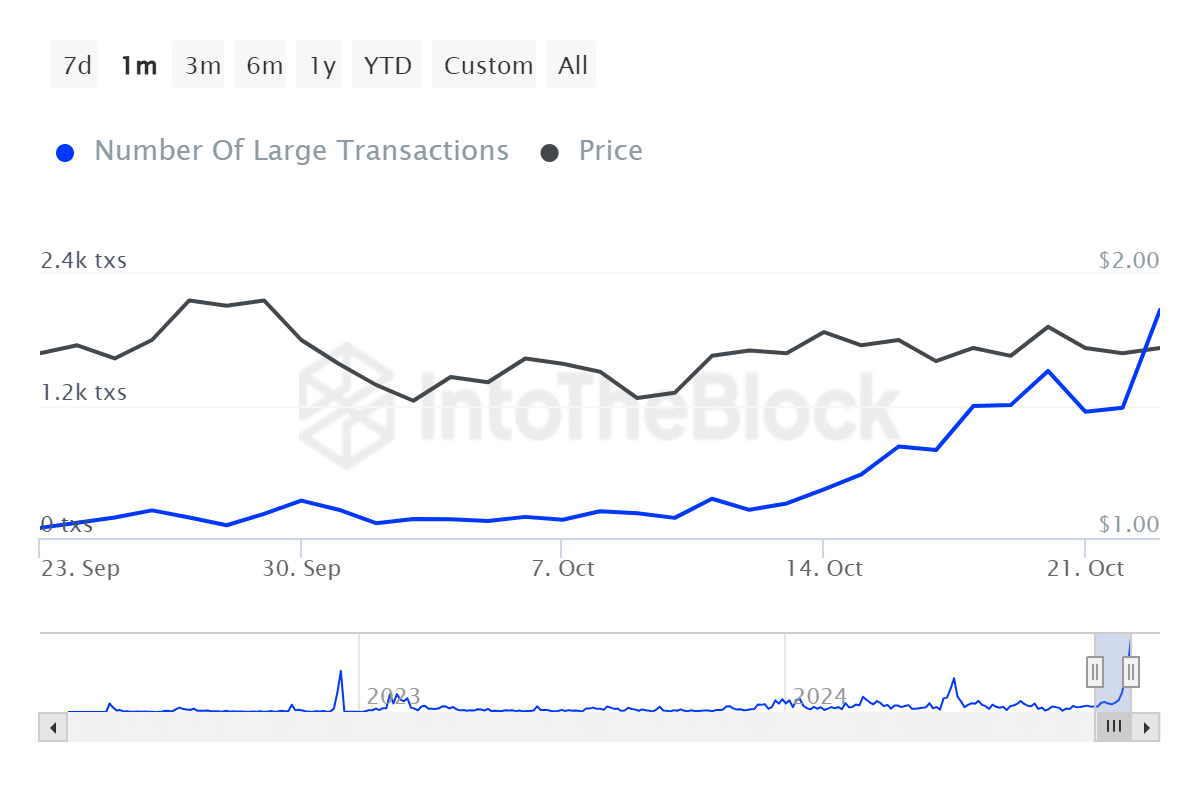

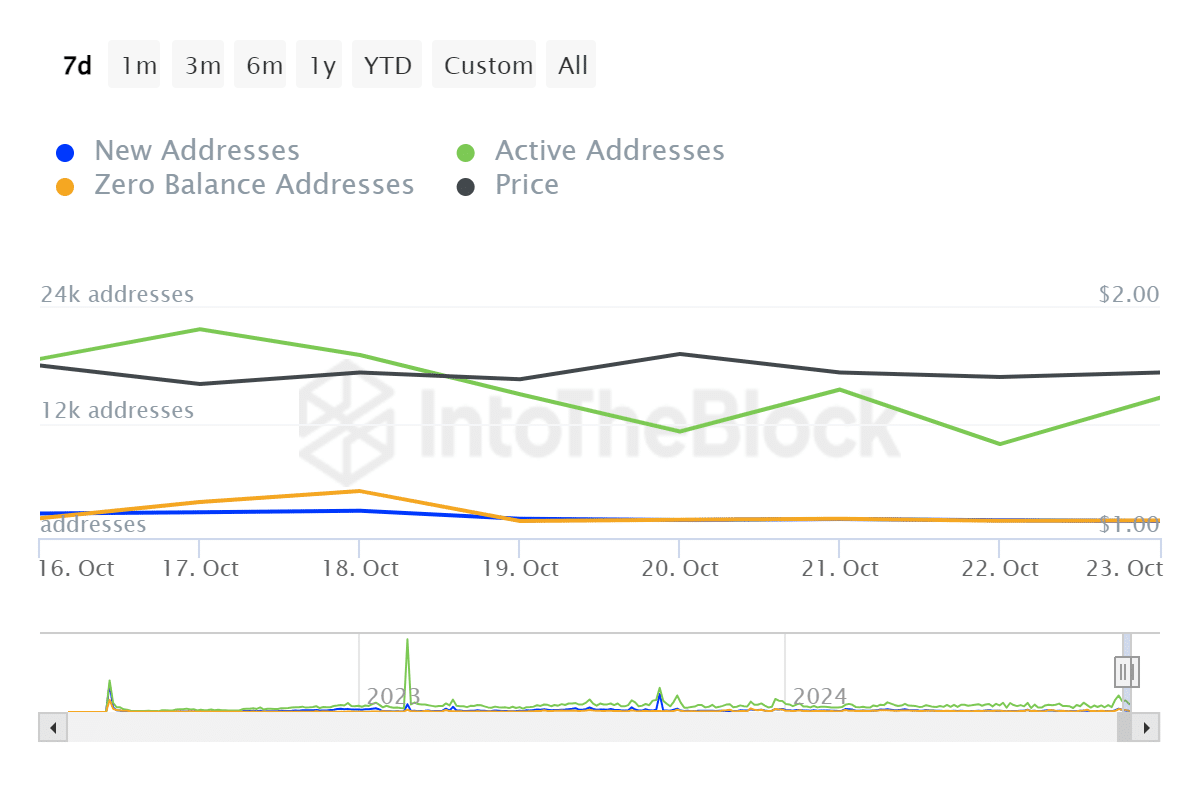

As an analyst, I observed a significant increase in Optimism’s transaction count, soaring up to 58% and reaching a total value of $766 million, based on IntoTheBlock data. Simultaneously, the number of active addresses on the Bitcoin network escalated by 48%, indicating robust activity across major networks.

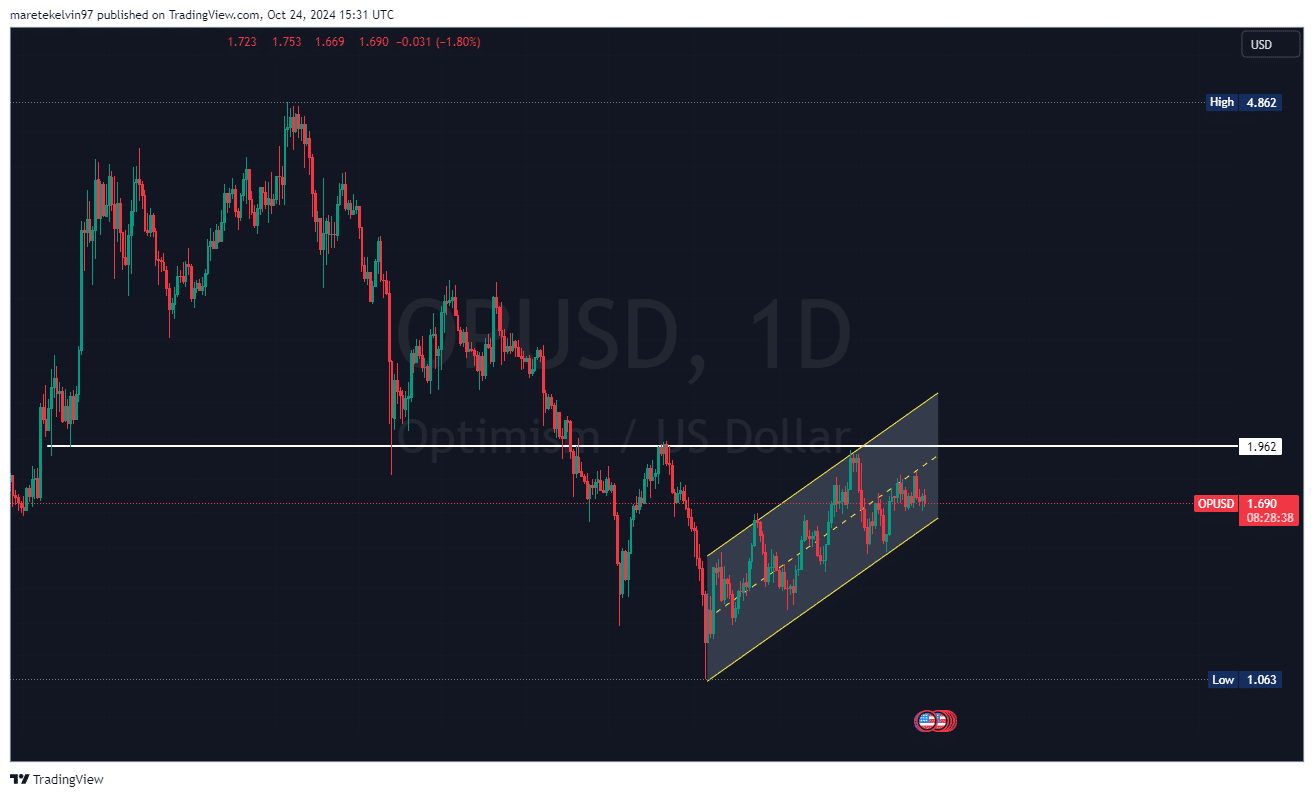

Additionally, the OPT bull flag consolidation implied that an uptrend continuation could happen.

Given these circumstances, we’re wondering if the consolidation along with the growing influence of major investors (whales) will manage to drive Open Project’s price beyond its critical resistance point at $1.96?

Whale activity sparks Optimism momentum

Optimism has been a hot topic, and whale investors have greatly increased their activity. In fact, according to IntoTheBlock, the number of large transactions on the network rose by 58% and accounted for a value of $766 million.

Displaying high confidence is common among many market players, often indicating a positive sentiment or optimism within the cryptocurrency market.

An uptick in social volume

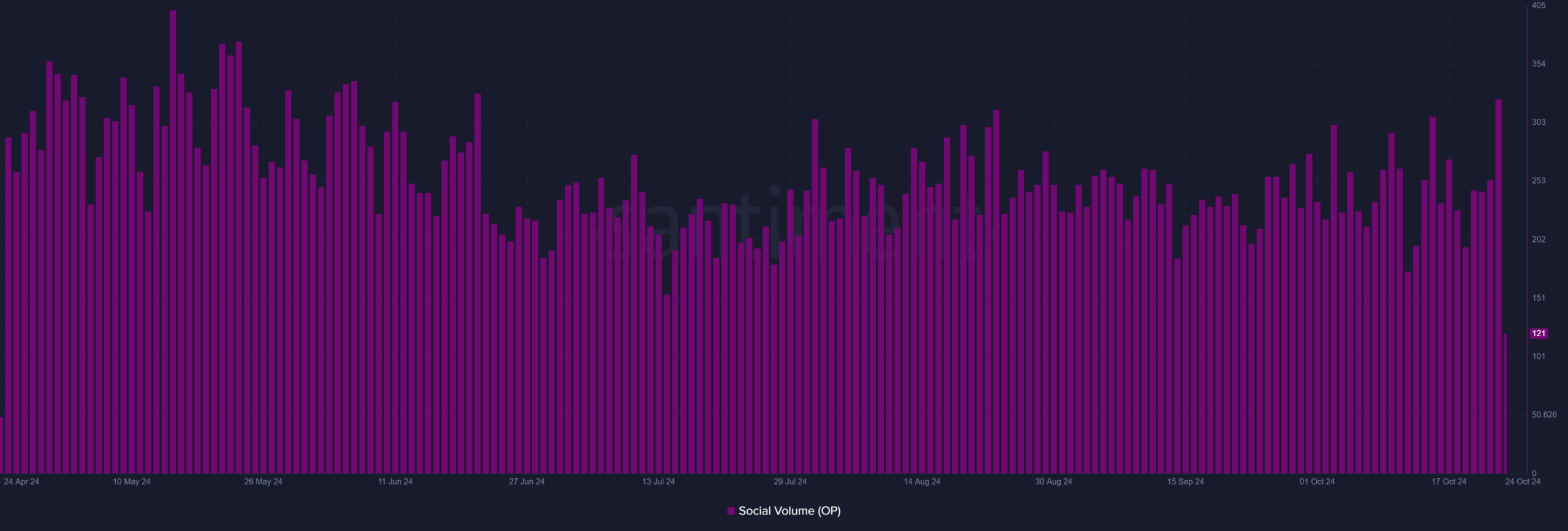

Alongside an increase in significant deals, the social activity on Optimism has also been growing noticeably, as indicated by its graphs.

1) Social media mentions of a hike suggest broader public interest and community engagement. Similarly, optimism is not immune to this pattern.

An increase in social chatter about Optimism lately could boost the existing optimistic feelings among investors and traders, potentially attracting fresh participants to the market.

Bullish flag pattern signals a potential breakout?

An increase in significant trades, combined with a positive accumulation trend, might suggest that ‘whales’ are leaning towards pushing the price of OP beyond its current resistance at $1.96.

If Optimism pushes past this current level, it could potentially initiate a stronger upward trend. This rise might entice more investors to join the network.

Previously mentioned increases in significant transactions, along with the optimistic accumulation of assets, hinted at potential whale involvement propelling prices past the resistance level of $1.96.

If optimism overcomes and surpasses this point, it might initiate a more significant upward trend, potentially igniting a rally that favors the bulls.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-25 12:07