- Solana network fees recently reached an all-time high after surpassing $5 million.

- Solana is outperforming the Ethereum blockchain in fees and revenues as the SOL/ETH chart formed a new high.

As an experienced crypto investor with a knack for spotting promising opportunities, I must admit that Solana [SOL] has caught my attention lately. The recent surge in network activity and usage, coupled with its outperformance of Ethereum [ETH] in fees and revenues, is nothing short of impressive.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastIn the past week, the price of Solana (SOL) has climbed more than 13% and is currently trading at $173. This recent increase in value aligns with a spike in network activity and usage. Remarkably, the Solana blockchain surpassed other networks such as Ethereum [ETH] in significant performance indicators during this time.

As an analyst, I’m observing a significant upward trend with Solana. This trajectory could propel Solana further, potentially surpassing the $200 mark.

Solana flips Ethereum in network fees

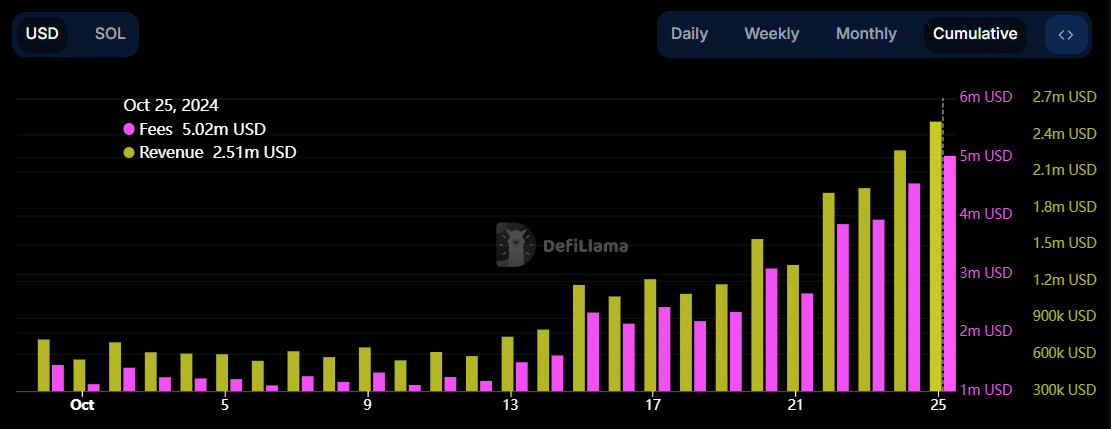

According to DeFiLlama, transaction fees on the Solana network have surpassed $5 million and are currently at a record level. This figure represents a substantial increase of around 500% compared to the beginning of this month.

As a crypto investor, I’ve noticed that along with fee earnings, Solana’s income has been steadily climbing and was reported to be around $2.5 million at the time of the latest news update.

Compared to Ethereum, Solana’s fee earnings were significantly higher ($3.47 million vs. $2.48 million) at the time of reporting, indicating a growing trend in network activity that surpasses Ethereum.

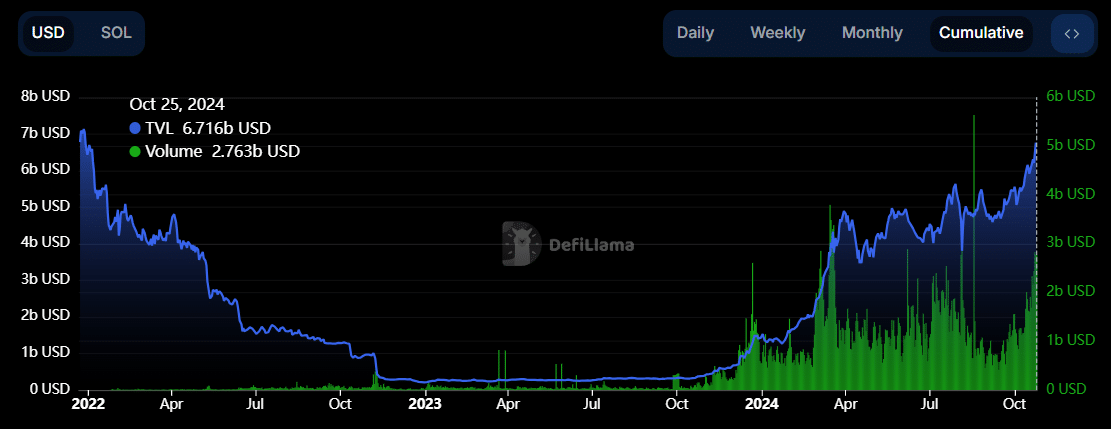

Recently, the decentralized finance (DeFi) activity on the Solana network has reached unprecedented levels. The Total Value Locked (TVL) has soared to an impressive $6.7 billion, nearing a three-year peak. In just this month, Solana’s DeFi TVL has increased by over $1 billion.

DeFi volumes have also increased to $2.7 billion, the highest level in two months.

DappRadar indicates a steady increase in the usage of Solana’s decentralized applications (dApps) this month, suggesting that the blockchain is expanding.

As a seasoned researcher with years of experience in the cryptocurrency market, I have observed numerous trends and fluctuations. However, this week’s surge in Solana’s dApp volumes to $341 million is particularly noteworthy. It’s been two months since we last saw such high activity, and it’s a testament to the growing interest and adoption of Solana.

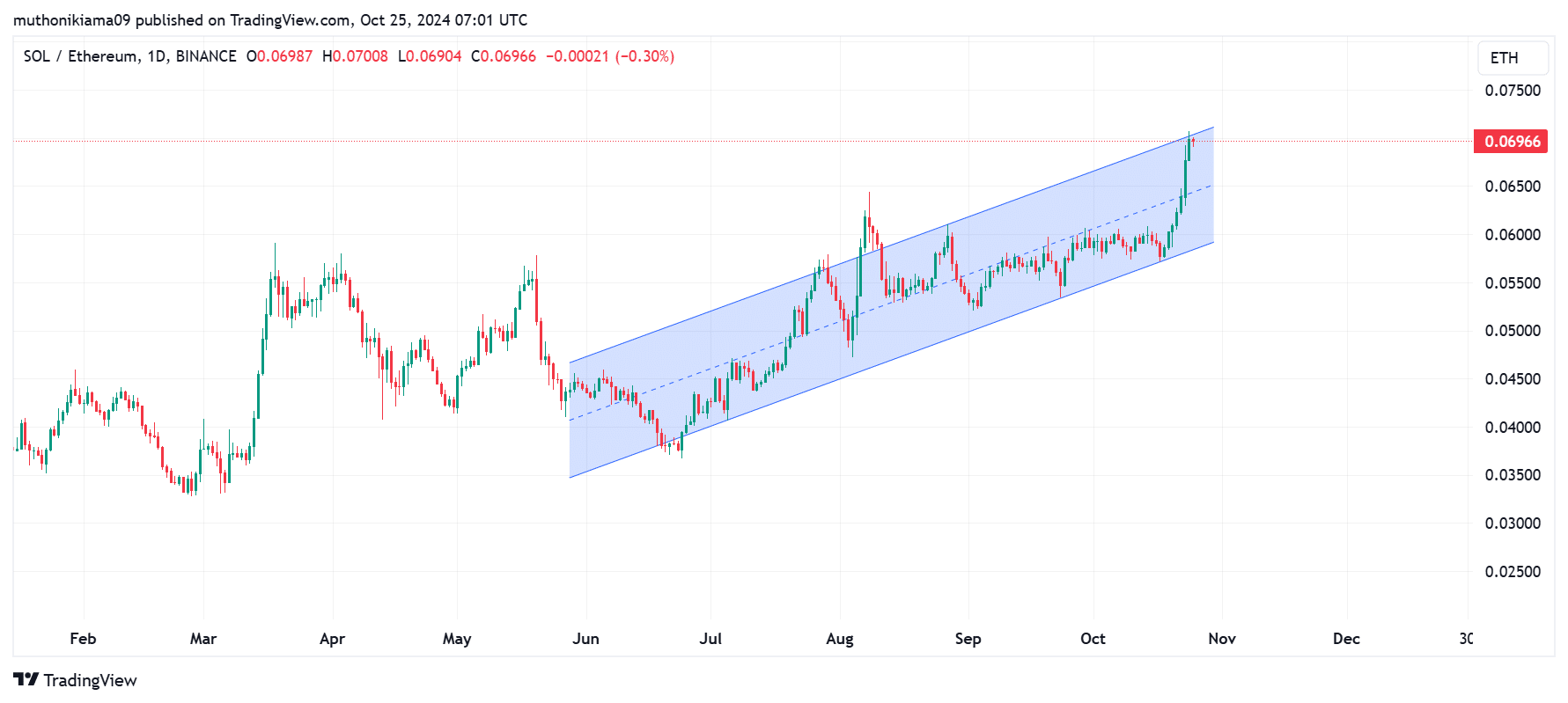

Solana makes a new high against Ethereum

In terms of both network activity and price trends, Solana surpasses Ethereum. A look at the SOL/ETH graph reveals that Solana has recently set a new record against Ethereum following its rise to $0.07.

Over the past few months, starting from June, there’s been a clear upward trend for SOL/ETH, indicating that Solana has been consistently gaining ground over Ethereum, moving within a rising channel pattern.

Read Solana’s [SOL] Price Prediction 2024–2025

Currently, Solana has reached the top limit of its current range. If it surpasses this level, the upward trend might persist.

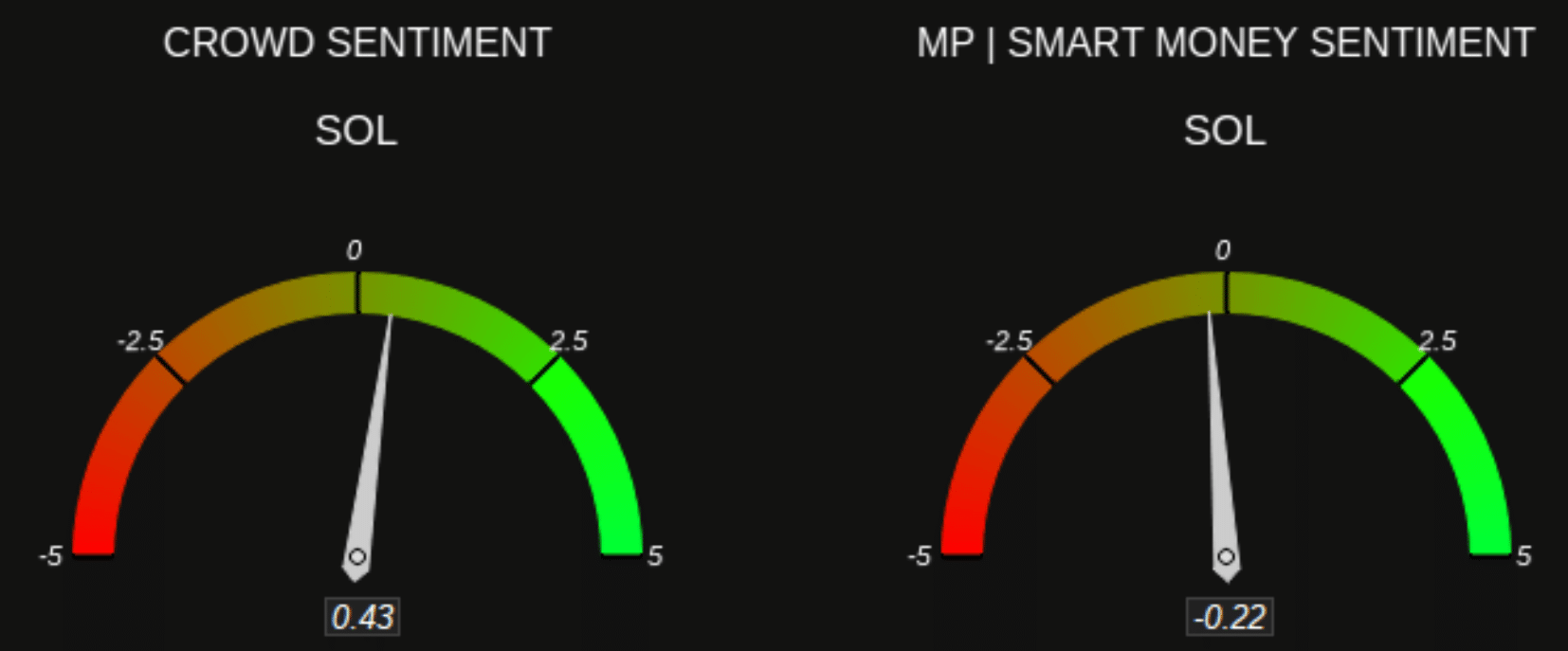

The surge in activity on the Solana blockchain has renewed positive sentiment. Per Market Prophit, the crowd sentiment on SOL is bullish. At the same time, smart money sentiment is bearish, showing concerns over the sustainability of the recent price gains.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-25 22:15