- Ethereum’s netflows to derivatives and increased leverage point to potential volatility and market risk.

- Retail interest in Ethereum remains strong despite recent price challenges, with active addresses reaching new highs.

As a seasoned crypto investor with a few battle scars to show for it, I’ve learned to read between the lines when it comes to market indicators and trends. After reviewing the recent developments with Ethereum [ETH], my instincts are telling me that we might be in for some turbulence ahead.

In the past few days, Ethereum [ETH] has encountered difficulties and hasn’t been able to regain its previous heights above $3,000. After dropping below that price point, it has remained under this level, resulting in a 5.8% decrease over the last week.

Currently, Ethereum is being traded at $2,478 per unit, marking a 2.7% decrease over the past day. This shift in price has sparked a range of opinions within the Ethereum community, as analysts offer differing perspectives on where the asset might head in the immediate future.

ETH’s increase in netflow

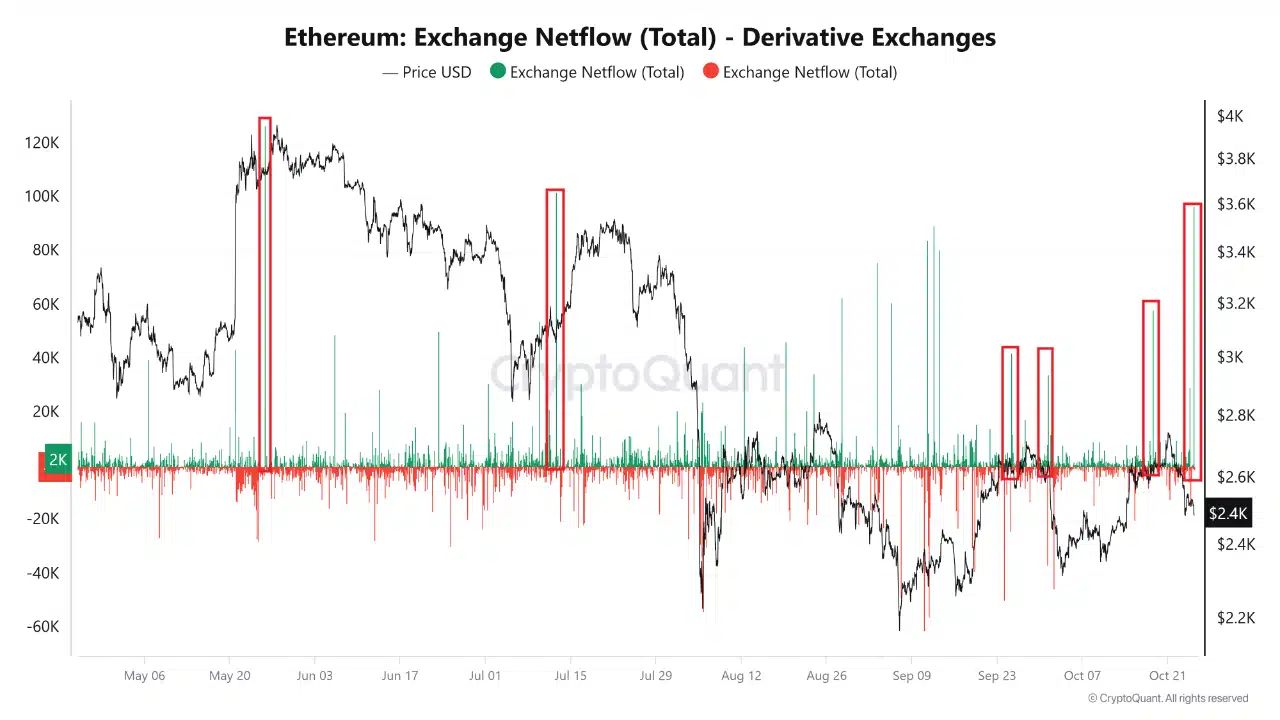

As per CryptoQuant analyst Amr Taha’s analysis, significant increases in Ethereum transfers to derivative exchange platforms may point towards increased market action in the near future. Notably, Taha emphasized a massive deposit of approximately 96,000 ETH into derivatives exchanges, which represents one of the most substantial recent netflows on record.

Previously, surges in Ethereum’s netflows, like those seen in May and July, have often corresponded with heightened volatility and subsequent drops in its price. Such patterns imply that investors might be preparing for possible declines in the asset’s value.

Taha pointed out that the most recent netflow data suggests increased market turbulence. Moreover, he mentioned that traders’ attitudes within derivative markets can serve as a precursor to future pricing patterns in Ethereum.

Apart from analyzing netflows, Taha looked into Ethereum’s future market mood, particularly focusing on spikes in the sentiment index. These spikes could potentially act as contrary signals. In the past, such spikes have been indicative of local market peaks, since a high level of bullishness in futures contracts often precedes price corrections.

This trend suggests that heightened optimism among futures traders may indicate a possible price correction for Ethereum.

Taha pointed out that the red-marked peaks in the futures sentiment graph signal times when the market has become excessively optimistic, setting up conditions favorable for a market flip.

Ethereum retail interest and leverage ratio

At the same time, various other on-chain measurements for Ethereum offer valuable perspectives about the ongoing market trends.

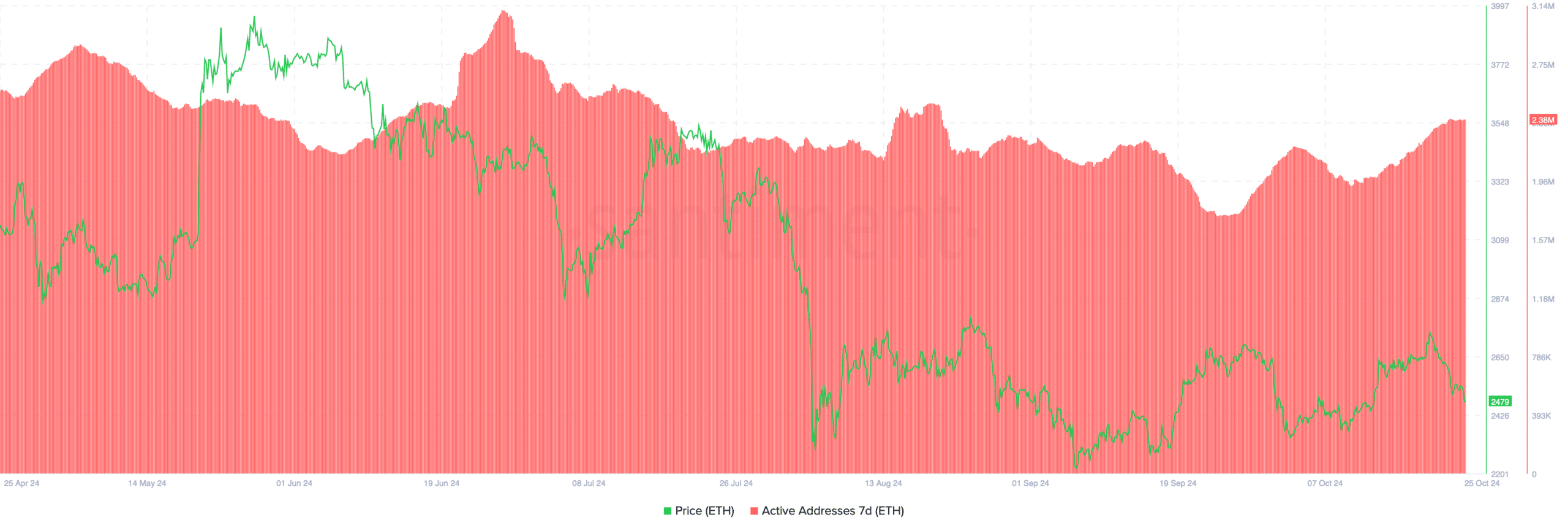

As per Santiment’s data, there’s been a surge in individual investor involvement with Ethereum over the past few weeks. This is evident in the rise of active Ethereum addresses, which have climbed from around 1.8 million last month to nearly 2.4 million at present.

The increase in active Ethereum addresses suggests a surge of retail investor curiosity, possibly signaling a more robust desire in the open market.

A rise in the number of actively used addresses could be interpreted as a sign of improved liquidity and continued market participation for Ethereum, suggesting that people remain interested in it even during periods of decreasing prices.

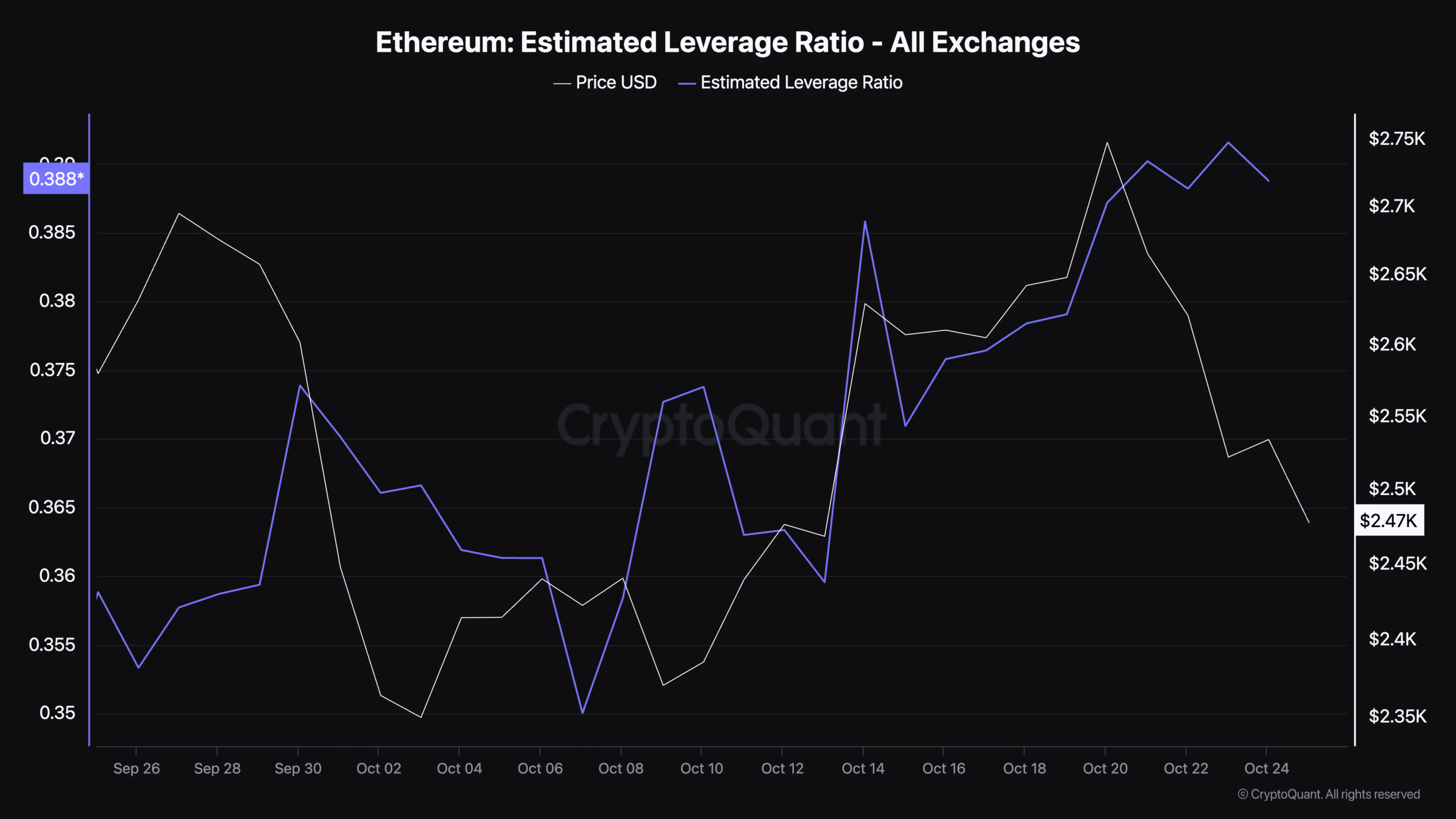

Apart from an increase in retail interest, the projected debt-to-equity ratio (leverage ratio) has climbed recently as well, now sitting at 0.38.

The ratio offered by CryptoQuant gauges the amount of borrowing employed in Ethereum trading transactions, serving as a potential indicator of the market’s risk level.

Read Ethereum’s [ETH] Price Prediction 2024–2025

A larger leverage ratio implies that traders are progressively relying more on borrowed capital to boost the size of their investments.

In periods of rising markets, such a strategy could potentially yield greater profits. However, it increases the magnitude of losses during falling markets, thereby enhancing overall investment risk. The current level of leverage suggests that traders are likely positioning themselves for potential market shifts.

Read More

2024-10-26 01:11