- Institutional appetite for Bitcoin combined with strong whale demand underpin recent BTC upside.

- Bitcoin hash rate’s recent new ATH signals the state of activity around the cryptocurrency.

As a seasoned crypto investor with a knack for deciphering market trends, I can confidently say that the recent surge in Bitcoin’s price is not just a fluke, but rather a testament to the growing institutional and whale demand. The hash rate’s new ATH is a clear indication of the increased activity surrounding Bitcoin, which is always an exciting sight for any crypto enthusiast.

It appears that Bitcoin (BTC) is exhibiting more significant transactions, particularly among large investors (whales) and institutions. These groups are believed to hold considerable influence over Bitcoin’s price fluctuations.

Over the past six weeks, Bitcoin has consistently shown strength and climbed higher compared to its previous struggle to remain above $60,000. This recent surge appears more steady than typical, suggesting a high level of institutional interest may be driving the trend.

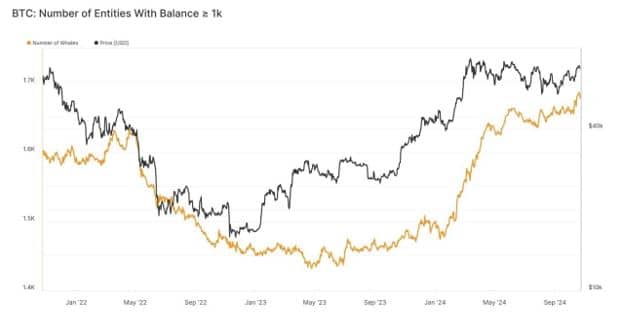

As the perception towards Bitcoin improved, there was a noticeable increase in institutional interest, demonstrated by the rise in the number of entities owning more than 1,000 Bitcoins. Data from Glassnode indicates that these large holders have surpassed the levels seen in May 2022.

Previously, Bitcoin owners within the same group experienced a substantial decrease that stabilized in May of the previous year. This indicates they’ve been actively buying more, but the pace appears to have moderated from May through August.

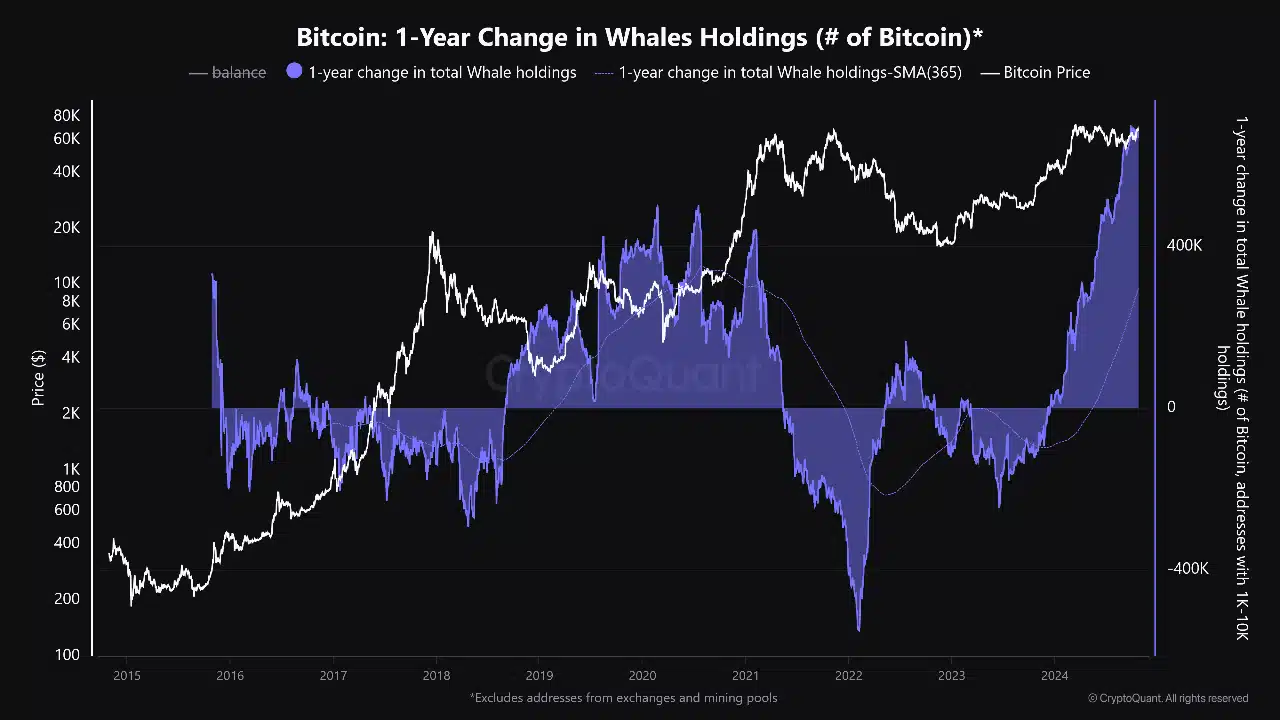

Bitcoin whale holdings soar to new highs

Since September, the positive trend seems to have resumed its ascent, while the data on whale activity shows a similar surge.

According to recent findings, large Bitcoin investors (referred to as “whales”) are said to be holding more than 670,000 BTC. This is reportedly the maximum amount that whales have ever held in one go. CryptoQuant analyst BaroVirtual interprets this trend as a buildup towards a significant price shift or movement.

2023 saw a shift in the significant Bitcoin holdings, with subsequent accumulation surpassing the peaks reached in 2021.

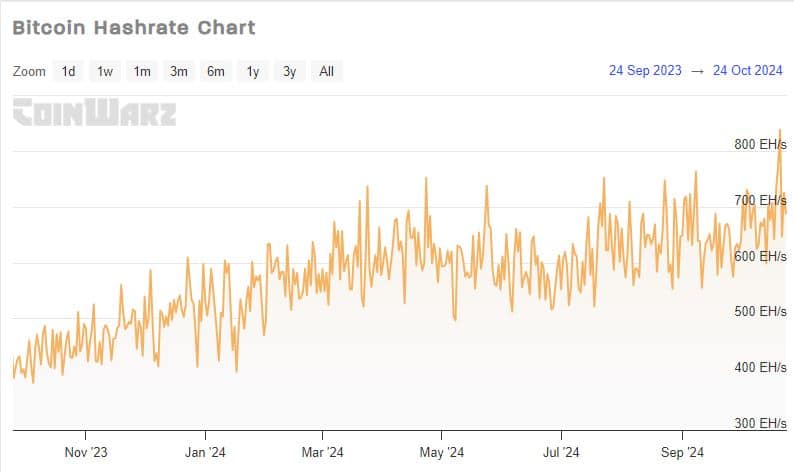

In the past two months, there’s been a significant increase in both institutional involvement and whale activity, which has led to an uptick in Bitcoin transactions. Consequently, the demand for network capacity has grown as well.

Bitcoin mining operations have been amplified in response to increased network activity, leading to a record-high hash rate of 918.72 TH/s.

On the 21st of October, this very week, the network managed an impressive achievement. The all-time high (ATH) in the hash rate implies that miners have experienced considerable profits.

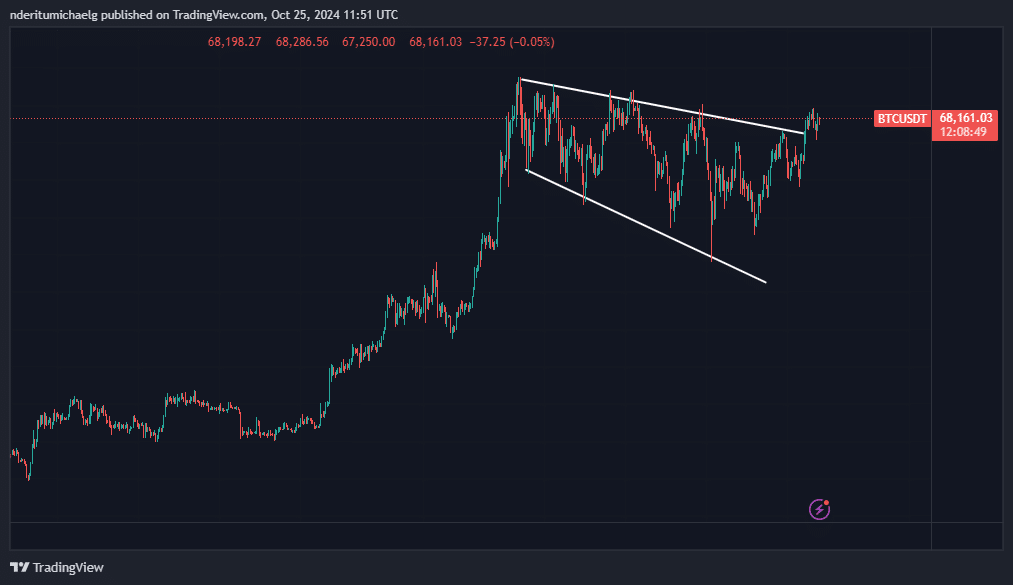

It’s clear that the recent increase in demand for Bitcoin has influenced its price behavior. Since March, Bitcoin has been trending within a bullish flag formation.

Is your portfolio green? Check the Bitcoin Profit Calculator

It seems the recent positive trend has propelled it beyond its resistance level, hinting at a possibility of further growth in the upcoming months.

The buildup of whales (large investors) and institutions could indicate significant shifts ahead. Yet, this pattern might also signal that Bitcoin could undergo highly volatile changes over the near to medium-term period.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-26 04:07