- Analysis reveals that TIA has formed an inverse head-and-shoulders pattern, a signal that an asset is gearing up for gains.

- However, the anticipated rally has been delayed, with technical indicators hinting at a potential minor pullback.

As a seasoned researcher with years of experience in the volatile and fascinating world of cryptocurrencies, I’ve seen my fair share of market ups and downs. The latest analysis on Celestia [TIA] has certainly piqued my interest.

Over the past month, Celestia [TIA] has seen bearish momentum, with its price falling by 6.54% to $5.93. Yet, despite this downward pressure, bullish signs are emerging, suggesting a possible trend reversal on the horizon.

As I check the market now, it looks like my favorite cryptocurrency has dipped another 3.15% over the past day. It seems we might see more drops before things start looking up again for a promising rally.

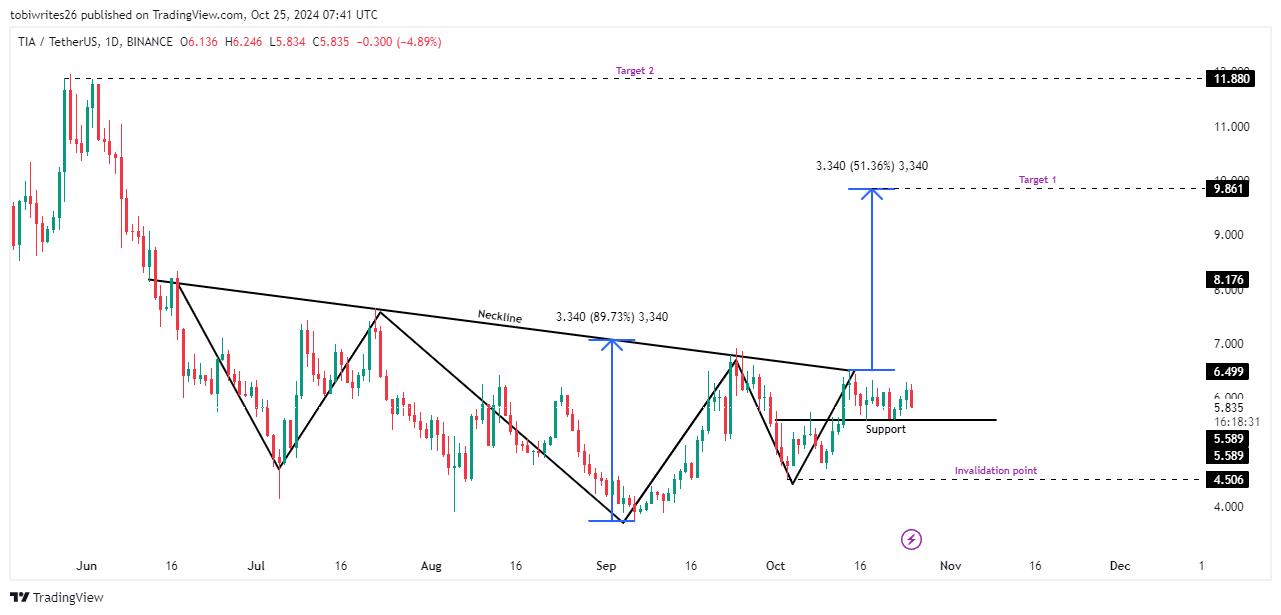

Bullish inverse head-and-shoulders pattern sets TIA for potential upside

For TIA, we’ve noticed an inverted head-and-shoulders pattern emerging, which is usually a positive sign before a substantial increase. This pattern usually indicates an upward trend, and the potential goal is determined by measuring the distance from the neckline to the pattern’s highest point.

As a crypto investor, I’m excited about the potential growth of TIA. Based on current projections, it seems that TIA could surge by approximately 51.36%, reaching a price point of around $9.861. If this positive momentum continues, there might even be a secondary target for TIA at an impressive $11.880.

At present, the price of TIA is dropping but might stabilize around $5.589, a point that could trigger an upturn and further upward movement. But if TIA dips below $4.506, it would contradict the bullish inverse head-and-shoulders pattern we’ve been observing.

Celestia sees corrective move causing a downtick

TIA’s rally is being postponed at the moment, because it hasn’t managed to surpass the significant line (neckline) that signals a possible surge in value.

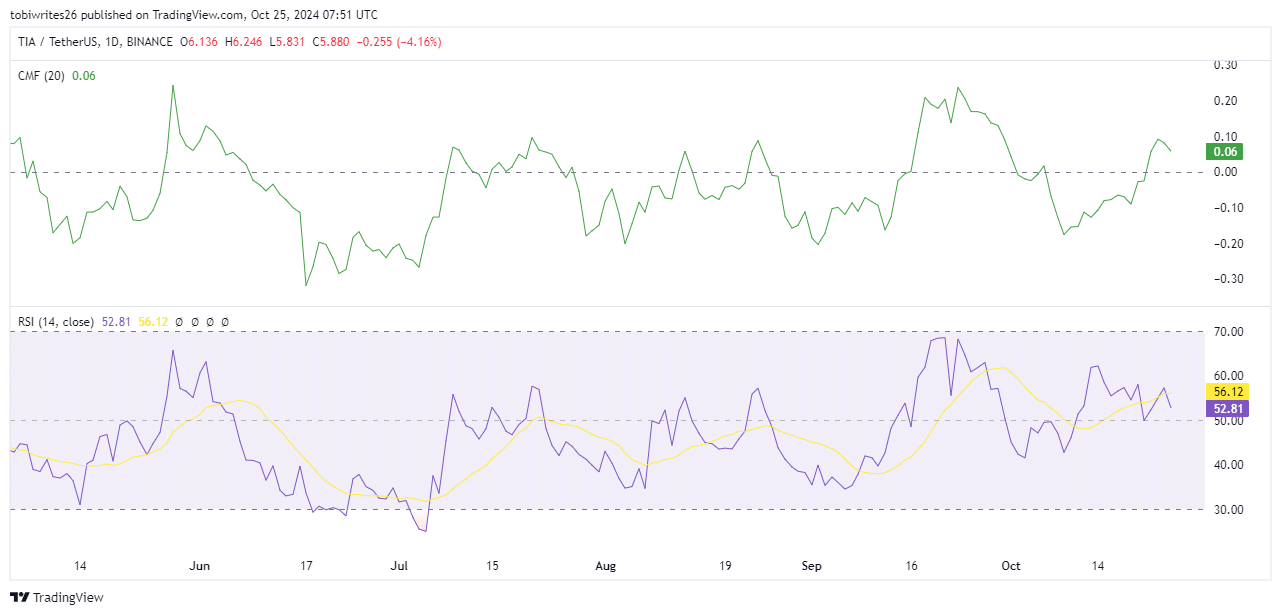

According to AMBCrypto’s analysis, which employs crucial technical markers, there might be a brief dip, but the general trend for TIA remains optimistic. Both these technical indicators continue to show positive readings.

A key element we’re focusing on in our examination is the Chaikin Money Flow, or CMF. This tool measures the strength of buying and selling actions by integrating price and volume data to help us determine if an asset is being stockpiled (indicating buying pressure) or offloaded (showing selling pressure).

Presently, the Composite Market Flower (CMF) shows a positive trend. This indicates that there’s a strong undercurrent of buying activity, which suggests that any temporary dip or decrease might just be a brief correction in the market.

In much the same way, the Relative Strength Index (RSI), which gauges the rate and amplitude of price changes, shares similarities with the CMF’s perspective. Even though there has been a recent dip, the RSI continues to reside in the positive region, thereby suggesting a bullish sentiment.

As an analyst, I am suggesting that a flip in these indicators upward could significantly impact TIA’s pricing, potentially driving it higher, and possibly leading to even more growth.

Broad market outlook

On a larger time scale, AMBCrypto’s assessment indicates that the general attitude toward TIA is optimistic, as investors are displaying a growing preference for keeping their holdings instead of offloading them.

According to the data from Coinglass’s Exchange Netflow, there is a significant outflow of TIA tokens from exchanges, suggesting that fewer TIA tokens are being put into exchanges compared to those being taken out. This pattern suggests that investors tend to keep their TIA tokens instead of selling them.

Should this trend persist, it might cause the price of TIA to rise from its present point, propelled by a persistent desire among market players to hold onto their shares.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-26 06:15