- Polymarket claims there is no evidence of manipulation, despite significant whale bets on Trump

- Prediction market odds have diverged from traditional polls, complicating election outcome predictions

As a seasoned researcher and data analyst who has been closely following the political landscape for years, I find myself both intrigued and concerned by the recent developments surrounding prediction markets like Polymarket. On one hand, it’s fascinating to witness the evolution of these platforms as tools for gauging public sentiment and making predictions about election outcomes. However, the allegations of potential manipulation, particularly in the case of significant whale bets on Trump, cast a shadow over their credibility.

Over the next fortnight, I find myself immersed in the build-up to the United States’ Presidential elections. The rivalry between Donald Trump and his contenders is heating up, and I’m keenly observing this political dance. To get a pulse on the public’s leanings, prediction markets such as Polymarket and Kalshi have proven to be invaluable resources for me, offering unique insights into the electoral landscape.

Polymarket defies all allegations

Recently, Polymarket has been making news with their assertion that they found no signs of market manipulation, even though a large, influential investor, frequently known as a “whale,” had made substantial bets.

This specific person, who is French and has a strong history in finance, put more than $45 million towards supporting Trump’s election campaign.

Remarking on the same, Polymarket spokesperson told Bloomberg,

From our findings, it appears that this person’s stance is influenced by their personal opinions regarding the election. So far, our investigation hasn’t uncovered any evidence suggesting they’ve tried to influence the market in a manipulative way. They’ve also agreed not to create additional accounts without prior notice.

Speculations surrounding the prediction market

For those who may not be aware, this situation originated from recurring doubts that have arisen concerning the possibility of interference with Polymarket’s operations. These doubts were primarily centered around Donald Trump’s strong lead in the polls.

Some analysts and digital sleuths are sounding warnings that an account called “Fredi9999” might be manipulated by a sole investor, who could potentially be trying to sway the betting odds towards Donald Trump.

This theory raises worries about the openness of wagering transactions within this platform, as well as the trustworthiness of the forecasts generated from it.

Elon, using the alias Fredi9999, has directly invested $7 million in the political marketplace. This investment was made to support Republican candidates’ victories, regardless of their initial standing.

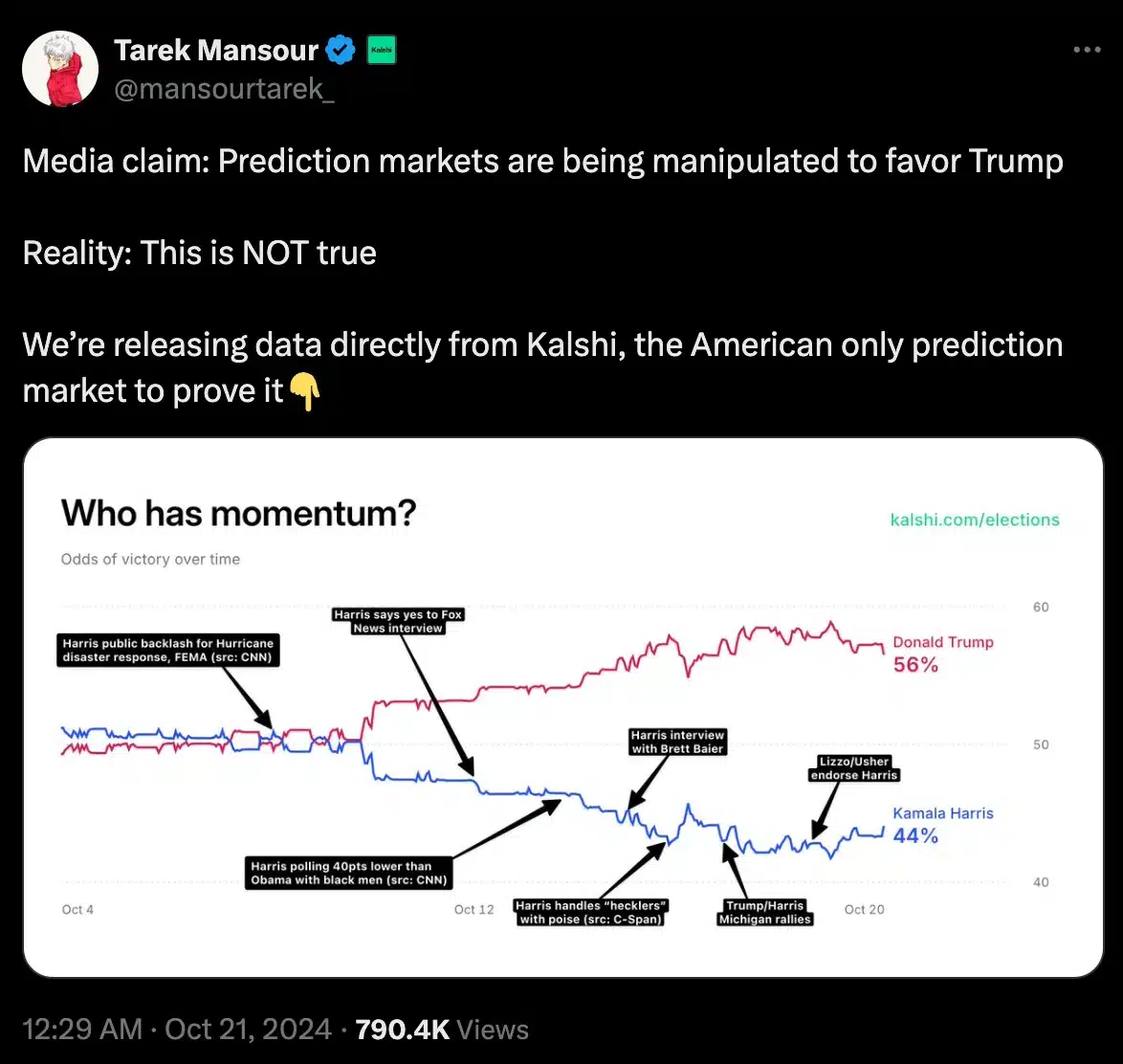

Indeed, Tarek Mansour, a partner at Kalshi, further highlighted on X that media stories frequently stray quite a bit from reality’s true picture.

Polymarket’s election trends

In simple terms, the market for predicting the winner of the U.S. Presidential election on Polymarket has grown significantly and now represents the platform’s biggest sector. This market has generated a staggering $2.4 billion in trades ever since it started in January.

Right now, Trump enjoys a significant edge over Kamala Harris according to Polymarket’s data, with the odds standing at approximately 2 to 1 in his favor, translating to about 64.3% for Trump and 35.6% for Harris.

Although there are limitations on U.S users regarding some platforms, the betting odds on Polymarket mirror those found on legal platforms such as Kalshi quite closely. As of the press time, Kalshi reported a 61% probability for Trump and a 39% probability for Harris. Meanwhile, PredictIt showed Trump’s chances at 59%, while Harris had 45%.

In simpler terms, this terrain shows additional intricacies since nationwide polls suggest a narrow lead for Harris at 49%, compared to Biden’s 46%. This underscores the contrast and inconsistencies between conventional poll results and the behavior patterns in prediction markets.

Providing clarity on the same, a Kaiko analyst said,

Additionally, it’s important to remember that market odds aren’t the same as polls. They serve distinct purposes. Polls are designed to predict outcomes within a certain range of accuracy, whereas users on platforms like Polymarket focus more on picking the winner, regardless of whether the victory is by a single vote or a landslide.

As the election nears, it’s fascinating to consider if prediction markets can stand up to criticism or examination.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-26 11:36