- LINK, at press time, was showing signs of a potential breakout, supported by bullish technical indicators

- Exchange reserves dropped, while long liquidations highlighted strong bullish sentiment

As a seasoned crypto investor with a knack for spotting promising opportunities, I find myself drawn to Chainlink (LINK) at this juncture. The technical indicators are bullishly beaming, and on-chain signals are painting a rosy picture of increased usage.

Recently, Chainlink [LINK] has been progressing notably, thanks to its technological advancements and enhanced market performance. Post the introduction of CCIP Private Transactions tailored for banks and integration with Bitcoin, Chainlink is carving out a niche as a frontrunner in cross-chain settlements of tokenized assets.

Using ANZ’s trial program and an artificial intelligence project for handling unstructured financial information, LINK experienced a 4.46% price increase over the past 24 hours. At this moment, the stock is trading at $11.79, nearing a significant resistance level.

The question now is – Can this momentum push it to new highs?

Is LINK set for a breakout?

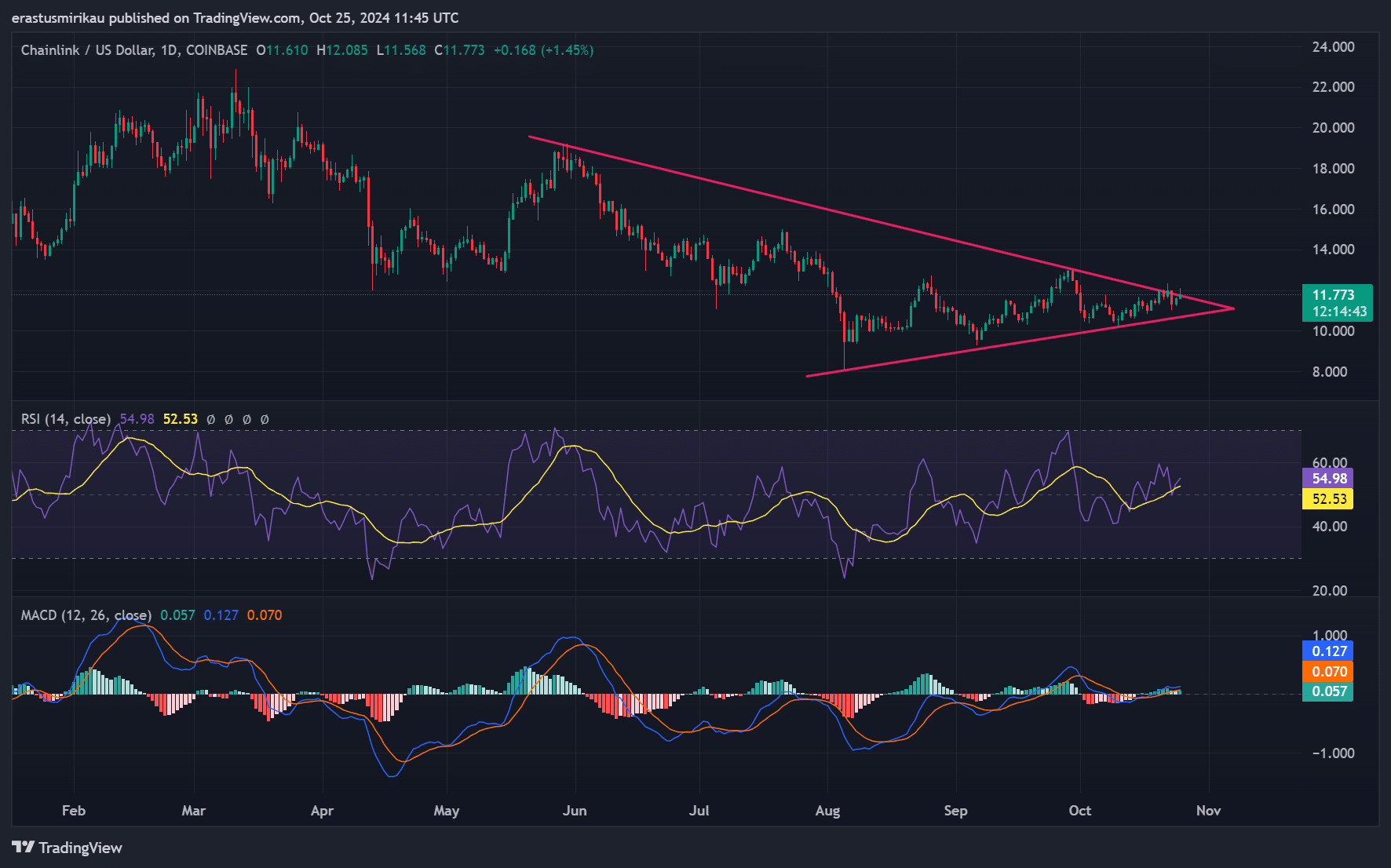

As a researcher, I recently noticed an intriguing pattern in the data for LINK – a symmetrical triangle formation that has been narrowing since mid-July. Currently, LINK is trading close to the peak of this triangle, at approximately $11.77. Furthermore, the Relative Strength Index (RSI) indicates a value of 54.98, signifying a potentially bullish trend for LINK.

Furthermore, the Moving Average Convergence Divergence (MACD) has recently shown a bullish crossing, indicating potential positive movement. If LINK manages to break beyond its current triangle formation, its next potential price point might reach the round figure of $13.

Strong on-chain signals indicate increased usage

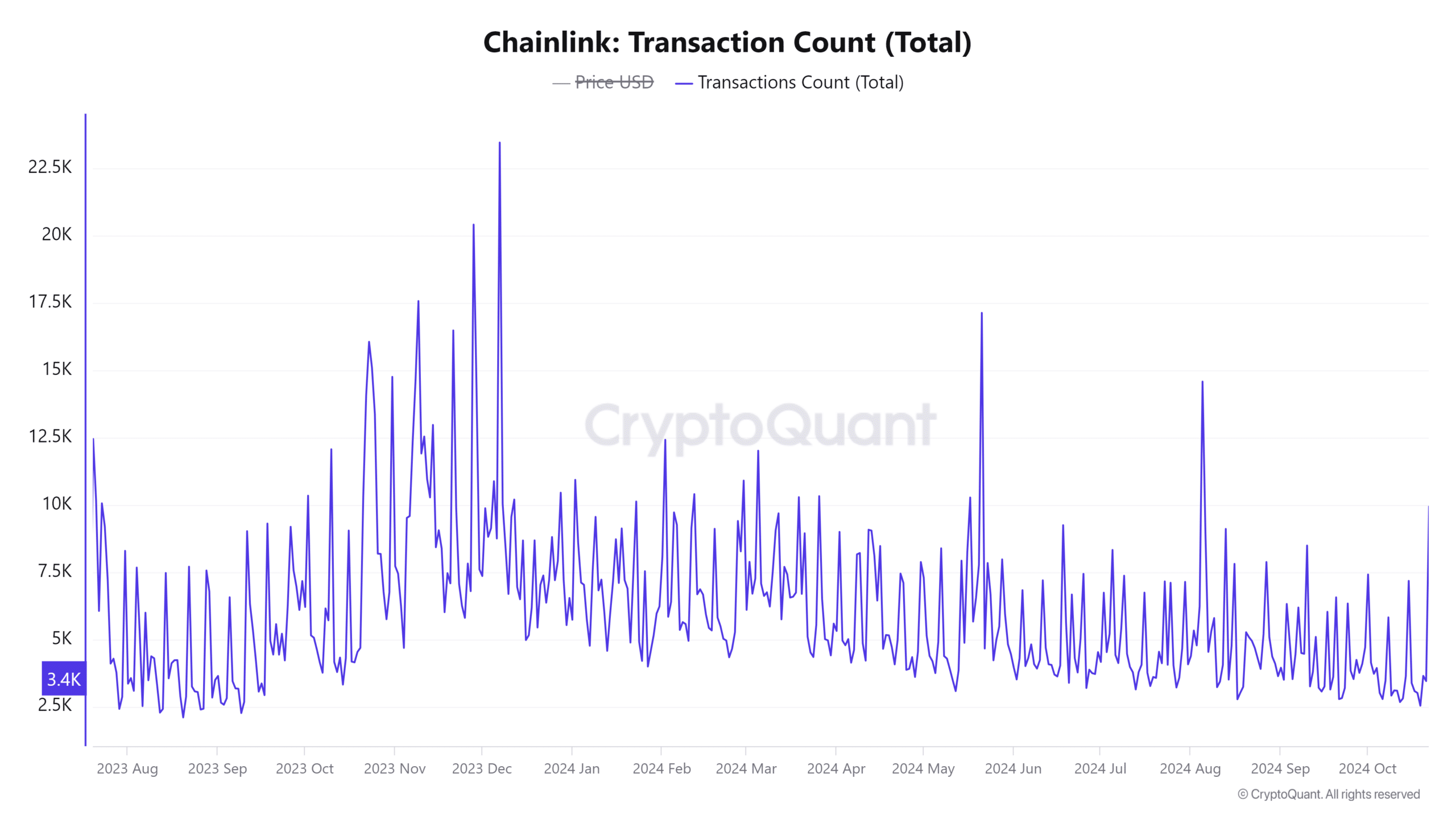

In the past day, there’s been an increase of about 1.11% in active addresses on the Chainlink blockchain, reaching approximately 176,450. This suggests that there is growing curiosity and engagement within the Chainlink community.

Moreover, there was a 1.18% increase in the number of transactions, indicating that an increasing number of users are making use of the platform’s decentralized offerings. This trend, along with other indicators, bolstered the bullish sentiment, underlining a higher level of network interaction.

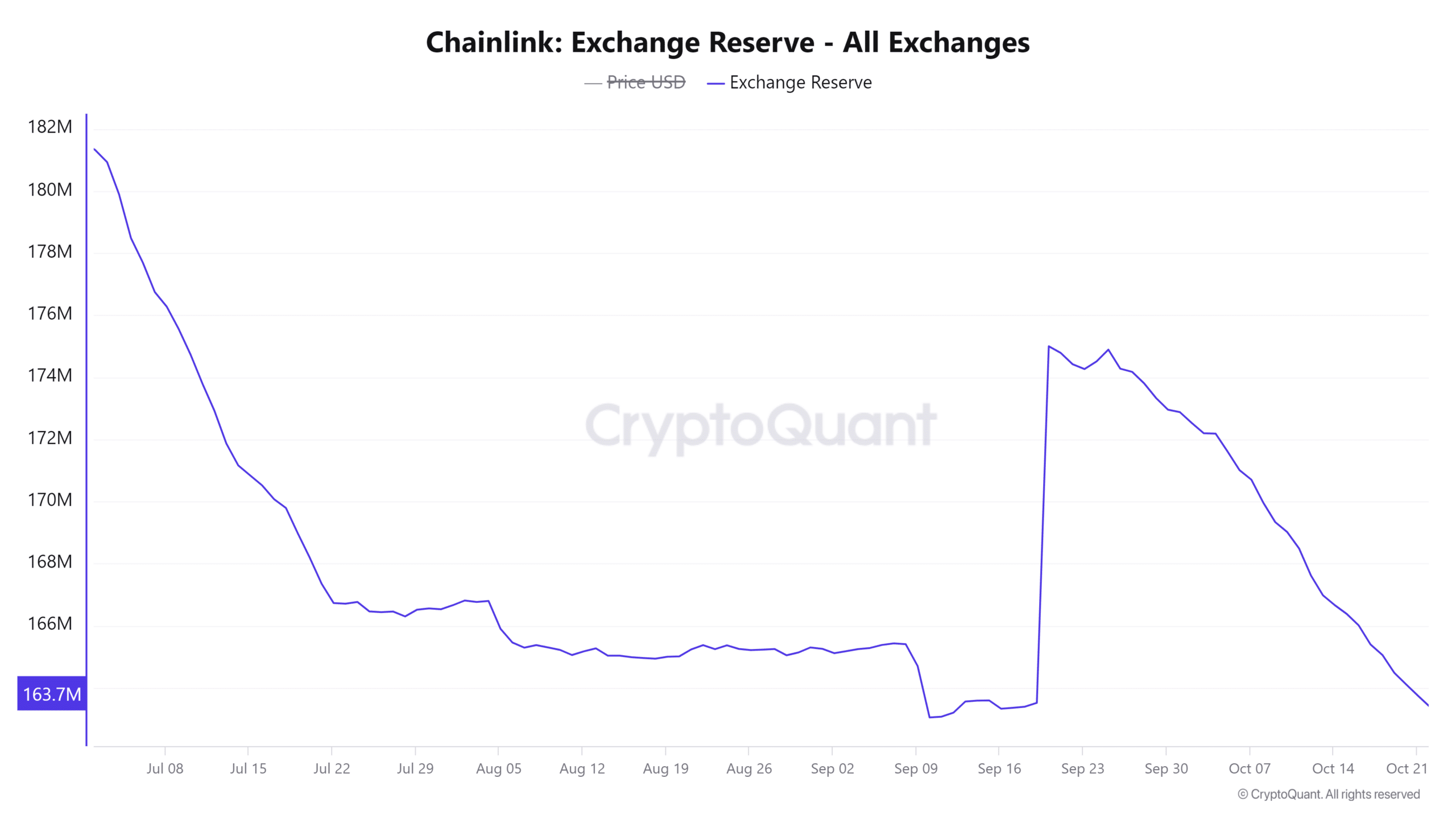

LINK exchange reserves drop, indicating supply constraints

It’s worth noting that the quantity of LINK in exchange reserves decreased by approximately 0.27% within the past week, reaching a total of 163.97 million tokens. This decrease may indicate that investors are transferring their holdings from exchanges to personal wallets.

This situation might indicate reduced eagerness among sellers, potentially leading to an increase in price as long as demand keeps growing.

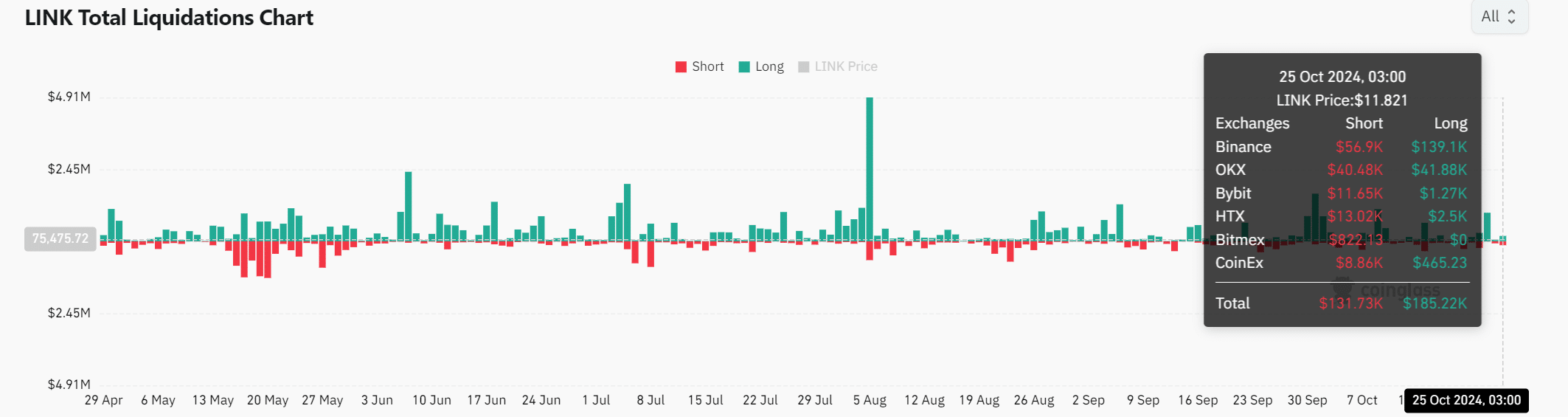

Long liquidations add fuel to the bullish fire

One reason LINK may see a surge is the disproportionate number of open long positions versus short positions, also known as an unbalanced liquidation situation.

Data revealed that $185.22k in long positions were liquidated, compared to $131.73k in shorts. This tilt towards long liquidations underlined traders’ confidence in a bullish move – Accelerating LINK’s price breakout.

Currently, Chainlink seems poised for an upward surge as its network activity escalates, exchange reserves dwindle, and the general market sentiment remains optimistic.

Should it surpass $12 with success, it might swiftly aim for more challenging resistance points. Yet, traders need to stay vigilant since the $12 resistance might cause a temporary reversal prior to additional growth.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-26 12:08