- Ethereum’s dominance dipped below 14%

- Short-term net inflows suggested selling pressure, while long-term outflows indicated potential accumulation

As a seasoned crypto investor with memories of the 2017 bull run still fresh in my mind, I find myself once again navigating through the turbulent waters of the Ethereum (ETH) market. The recent dip in ETH’s dominance below 14% is a sight that’s all too familiar, yet it’s hard not to feel a pang of unease when I look at the charts.

The influence of Ethereum (ETH) within the cryptocurrency market decreased significantly over the past year, falling from 18.85% to 13.36%. This substantial reduction in ETH’s share of the overall crypto market was pointed out by analyst Benjamin Cowen. Essentially, this decline could be interpreted as ongoing selling pressure on ETH, given its difficulty in maintaining higher dominance levels.

Over the years, I’ve observed that Ethereum has consistently encountered resistance at approximately 16% and 22% market dominance, repeatedly failing to surpass these levels since 2018. This persistent downtrend aligns with a descending triangle pattern, which is typically indicative of a bearish market movement.

In the provided graph, the top line (highlighted) indicates a series of decreasing peaks, while the bottom line functions as a durable floor for longer-term price levels.

Free-fall to 9-10% ETH dominance?

As a researcher delving into the subject, according to Cowen’s analysis, if the current negative trend persists, the next significant support level might fall within the range of approximately 9% to 10% dominance. This suggests a more pronounced downturn, fueled by waning buying interest.

In simple terms, a 9% historical backing might prove vital for ETH. This is particularly important if the overall cryptocurrency market doesn’t show favoritism towards altcoins like Ethereum in the next few months.

As a crypto investor, I find myself closely watching the support level for Ethereum (ETH). If this holds steady, it might bring about some stability in ETH’s dominance, potentially leading to an upturn in its performance as we approach 2025. However, should ETH dip below the 9% mark, I fear this could be an indication of a prolonged period of subpar performance compared to other altcoins and the broader crypto market.

Ethereum’s recent price action and market activity

Currently, Ethereum was being exchanged for about $2,542.29 per token at the time of reporting, marking a 0.59% increase over the past day but a 3.11% decrease during the last week. The 24-hour trading volume was roughly $17.6 billion, demonstrating high levels of activity in the market. Given its circulating supply of around 120 million ETH, this translates to an estimated market capitalization of about $306.29 billion.

As per DefiLlama’s latest figures, the Total Value Locked (TVL) on the Ethereum network stands at approximately $47.91 billion as of now. This figure translates to daily fees worth around $3.55 million and earnings of about $2.55 million. In the past 24 hours, the network has seen inflows amounting to roughly $38.78 million, while there were approximately 372,911 active addresses.

These metrics, together, highlighted Ethereum’s sustained use, despite its declining dominance.

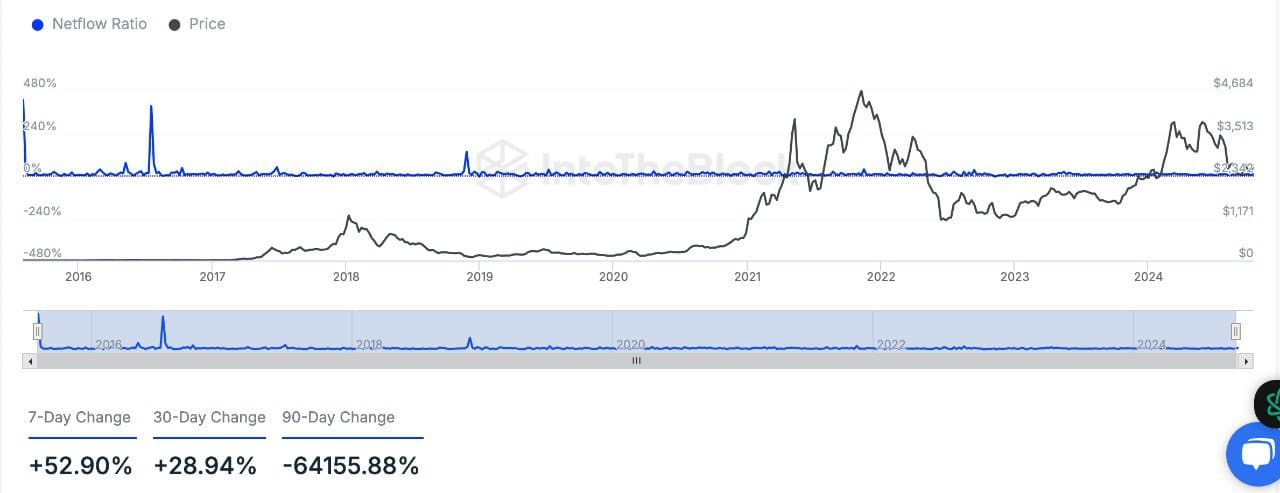

Netflow data underlines short-term selling pressure

In summary, data from IntoTheBlock shows an increase of approximately 52.90% over the past week and 28.94% over the last month, suggesting an upward flow of funds into exchanges. This pattern is typically associated with traders transferring assets to trading platforms in anticipation of selling or cashing out their profits.

For approximately 3 months, there was an extraordinary decrease of about -64,155.88%, representing a transition towards net outflows. This suggests a persistent pattern over time where investors are transferring Ethereum away from exchanges.

The increase in short-term investments matches the broader pessimistic outlook of the market. This trend becomes particularly noticeable as more Ethereum is transferred to trading platforms, often suggesting a plan to offload holdings.

Conversely, extended periods of net outflows suggest potential accumulation, as I, as an analyst, observe that users might be transferring ETH from exchanges for safekeeping or staking purposes.

Analysts collectively predict that Ethereum may continue to fall temporarily, but they anticipate a possible recovery by the year 2025.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-10-26 13:12