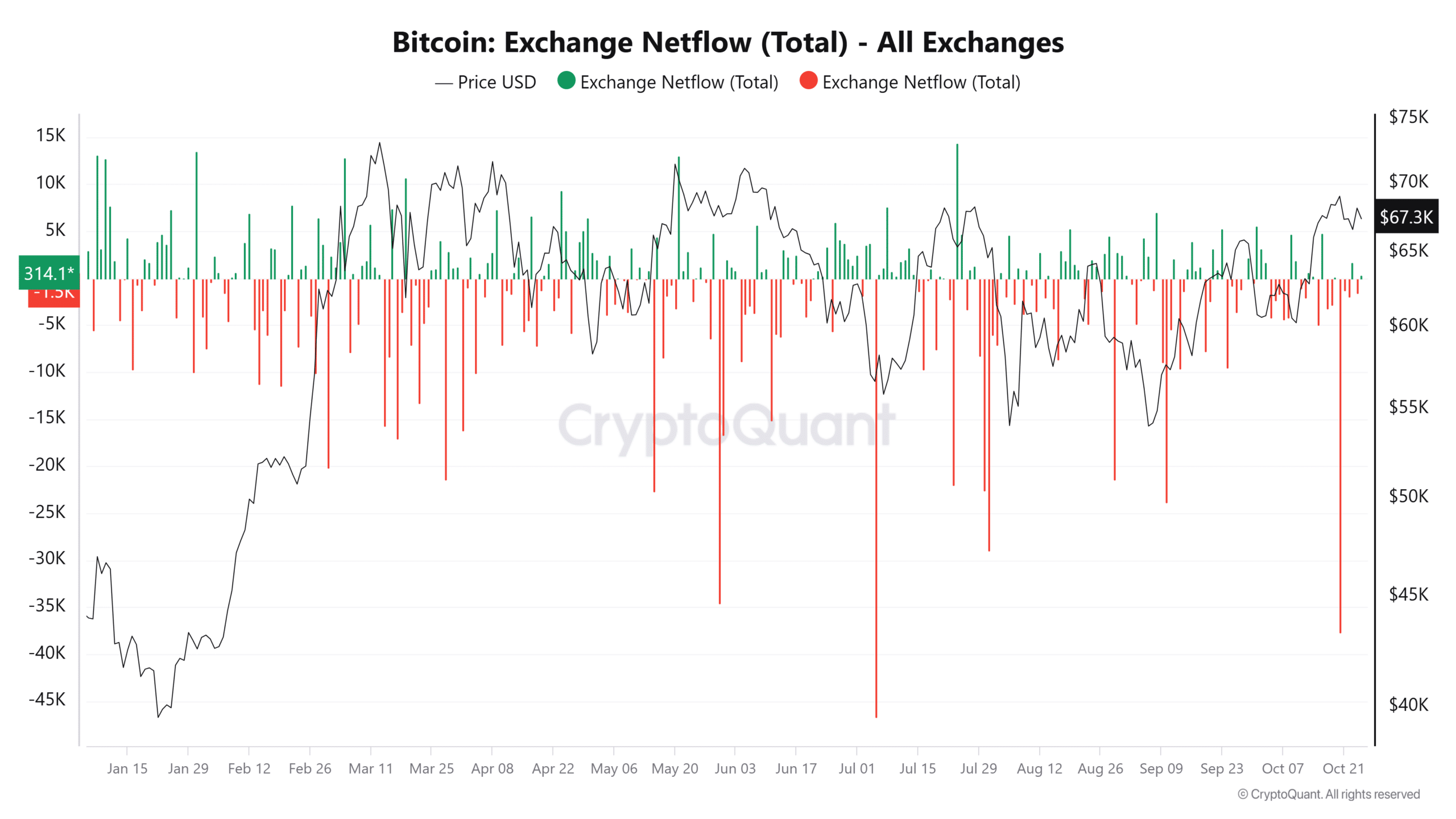

- Bitcoin has experienced its largest single-day exchange outflow since mid-September.

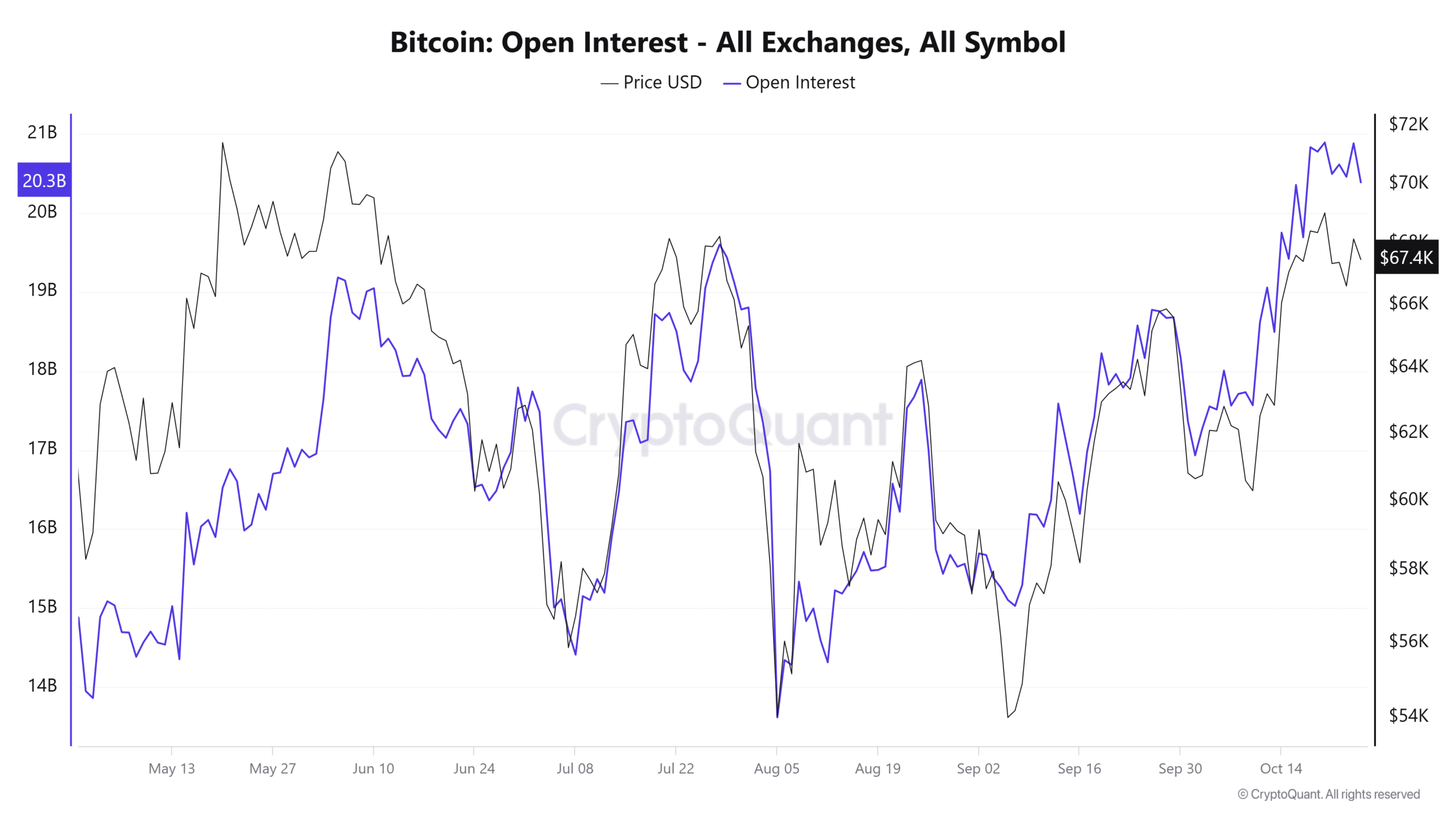

- Open Interest has surged to $20.3 billion, reflecting increased speculative activity.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find the recent surge in Bitcoin exchange outflows and Open Interest particularly intriguing. The largest single-day exchange outflow since mid-September is a clear sign that investors are accumulating BTC, hinting at their confidence in its future price movements. This trend aligns with my personal observation that when the whales start moving, it’s usually a bullish signal.

Bitcoin (BTC) has seen the most significant withdrawal from exchanges since mid-September, suggesting an increase in purchasing activity among investors. As they move their BTC to personal wallets, it indicates that they are taking their holdings out of circulation on trading platforms.

As Bitcoin remains about 10% under its record peak, it’s fueling market optimism. Flows of Bitcoin from exchanges are typically seen as a positive sign by investors.

Bitcoin exchange outflows signal accumulation

Based on information from CryptoQuant, approximately 15,000 Bitcoins were taken out of exchanges on October 22nd, which represents the biggest one-day withdrawal in about a month.

Moving large amounts of Bitcoin from exchanges often suggests that investors have faith in the cryptocurrency’s potential price increases.

This change indicates a preference towards long-term investment, since Bitcoin approaches significant resistance levels near its record peak.

The pattern of exchange outflows has been building as BTC’s price steadily climbed above $67,000.

As withdrawals coincide with price increases, it’s evident that a positive outlook or “bullishness” is emerging in the market.

The habit of this buildup usually signals upcoming surges, since fewer Bitcoins available for trading on exchanges may decrease selling pressure, potentially causing a price surge or breakout.

Open Interest shows increased speculative activity

Alongside the exchange outflows, Bitcoin’s Open Interest in futures contracts has risen to $20.3 billion, suggesting a surge in speculative activity.

Open Interest refers to the overall worth of all active derivative trades in progress. An increase in Open Interest alongside outflows typically indicates a combination of long-term investment buildup by strategic investors and temporary market speculation by short-term traders.

Based on my years of trading experience, I’ve noticed that when a trend suggests traders are gearing up for price volatility, it could mean they’re either protecting their investments by hedging or taking a gamble on further gains. As someone who has weathered many market storms, I can tell you this: it’s crucial to stay vigilant and adaptable in such situations, as the market’s twists and turns can be unpredictable.

On the other hand, a large Open Interest may also indicate potential market turbulence. Any swift price fluctuations might initiate the unwinding of leveraged positions, which could spread throughout the market.

Such activity often leads to short-term price swings, even amid an overarching bullish sentiment.

Bitcoin price action nears key resistance levels

At the moment of reporting, Bitcoin was hovering near $66,900, approaching a potential resistance point. If this barrier is broken, it might lead to more upward price movements.

As an analyst, I find that the Chaikin Money Flow (CMF) indicator, a tool for assessing capital movements in and out of an asset, currently reads 0.13 for Bitcoin. This suggests a positive trend, as the inflow of capital into Bitcoin is observed.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I’m keenly observing the market for a breach of the current resistance level. Such a development might spark a robust upward trend.

As a crypto investor, I’ve noticed that the surge in Open Interest is flashing a warning signal. It might indicate a potential rise in market volatility ahead. However, if Bitcoin successfully breaks through its current resistance level, it could ignite a substantial bullish trend.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

2024-10-26 17:12