- BTC has declined over the past week by 1.67%.

- Bitcoin’s number of individual investors must remain above 54 million for it to rally.

As a seasoned crypto investor with a decade of experience under my belt, I find myself cautiously observing the recent market correction of Bitcoin (BTC). The 1.67% decline over the past week, coupled with a staggering 62% drop in trading volume, has left me with a bittersweet taste in my mouth.

For the last seven days, Bitcoin [BTC] has undergone a substantial market adjustment, often referred to as a correction. This adjustment came with a steep drop in transactions, which translates to a decrease of approximately 62% in trading volume. This reduced activity suggests lower demand and fewer traders involved.

The drop in the number of participants in Bitcoin (BTC) has sparked discussions among analysts about the influence of individual investors on a potential BTC surge. One such analyst is Burak Kesmeci from CryptoQuant, who posits that for a BTC rally to occur, there should be over 54 million unique individual investors involved.

Why 54 million individual investors are critical

According to Kesmeci’s interpretation, a significant increase in individual investor participation could be the key driver behind Bitcoin’s price upward trend.

As per his viewpoint, Bitcoin requires approximately 54 million unique investor accounts to witness an increase in its price. Since dropping to 43 million in January 2023, the number of individual investors has been on an upward trend for a full year.

During this timeframe, the figure rose significantly to reach approximately 52.4 million, marking a 22% increase. However, following the acceptance of ETFs, it dropped slightly to 51.6 million in February 2024.

During the March 2024 rally, this figure continued to climb and reached a high of 54.14 million in June. But since then, the number of individual investors has been decreasing.

Historically, a rise in the count of individual Bitcoin investors tends to mirror BTC’s price movements. To illustrate, BTC experienced a 300% surge in January 2023 as more individual investors entered the market.

As a result of the peak in individual investor numbers reached in June 2024, the value of Bitcoin subsequently dropped.

Bitcoin’s number of participants continues to decline

According to Kesmeci’s analysis, an influx of new investors in the Bitcoin market could lead to an upward trend or rally. In other words, it seems that fresh participation from investors plays a significant role in driving up the price of Bitcoin. So, let’s consider whether there is indeed an increase in the number of new market entrants.

According to AMBCrypto’s analysis, Bitcoin is experiencing a decline in the number of participants.

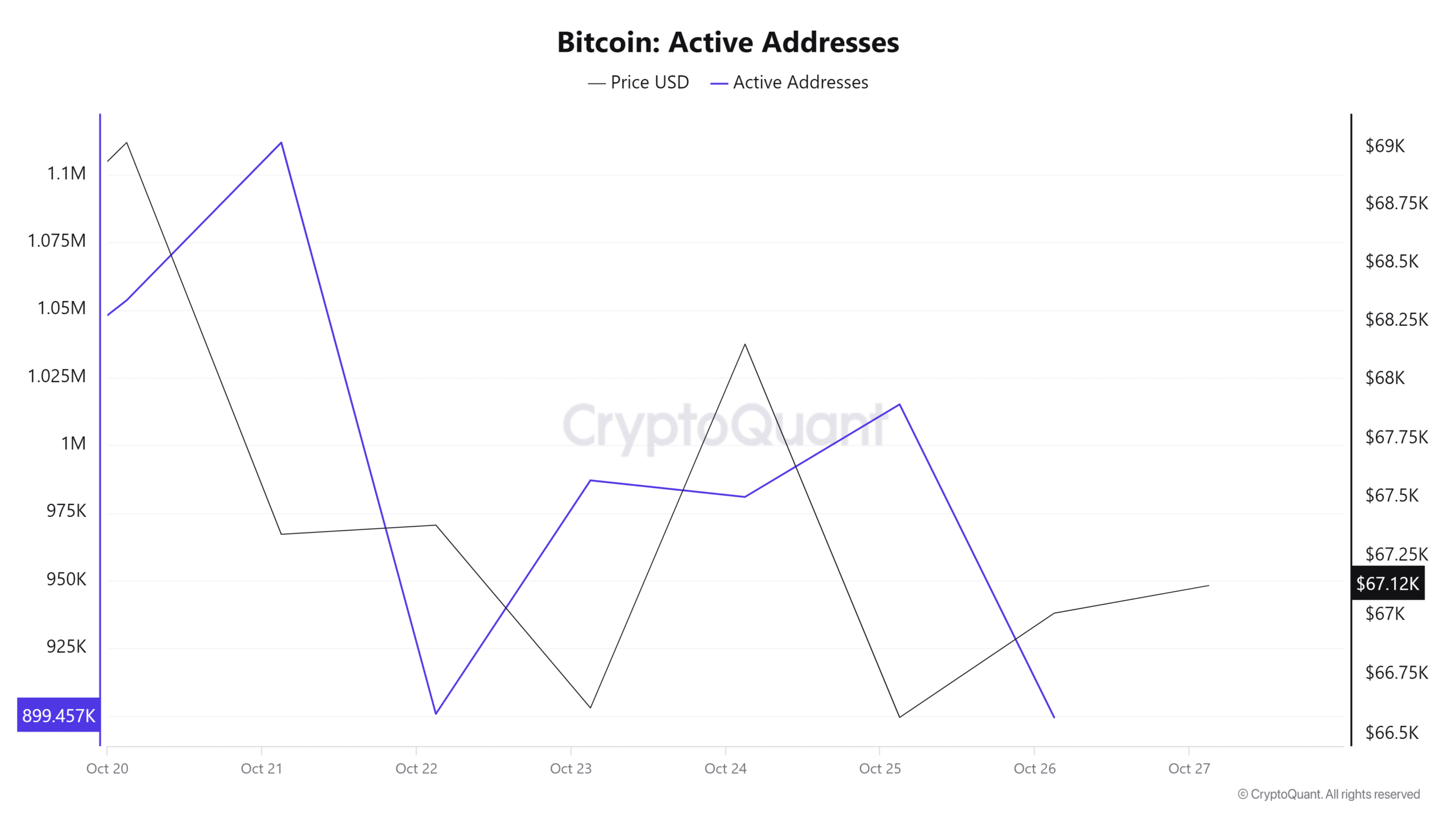

To illustrate, the number of daily unique Bitcoin users has been decreasing. In just the last seven days, this figure has fallen from 1.1 million to about 899 thousand. This could indicate a decrease in new investors joining the market, suggesting a potential decline in the number of individual participants.

Is your portfolio green? Check the Bitcoin Profit Calculator

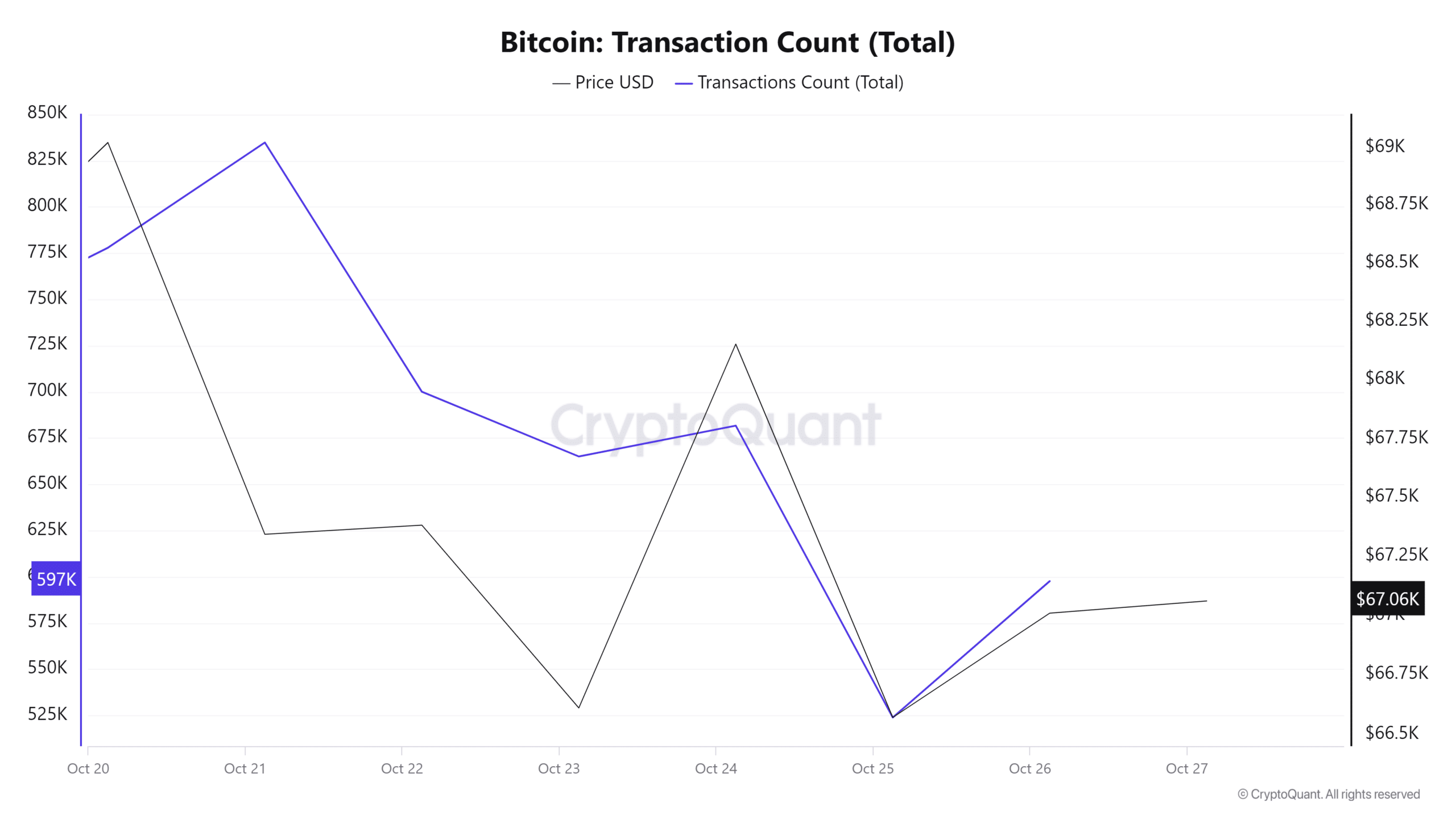

Moreover, during the last seven days, the number of Bitcoin transactions has dropped from 834,000 to 598,000. This suggests a decrease in interest for Bitcoin, as there seems to be less investor activity on the blockchain.

It appears that the number of people participating in BTC is decreasing, which often leads to market adjustments. For instance, over the last week, Bitcoin was trading at approximately $67,074. If this trend continues, there’s a possibility that BTC could drop even lower, potentially reaching around $65,757.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 17:12