- Bitcoin’s October gains largely stem from halving-driven supply scarcity.

- As per AMBCrypto, a supply shock has yet to dissipate.

As a seasoned analyst with over two decades of market analysis under my belt, I find myself intrigued by the ongoing dynamics surrounding Bitcoin [BTC]. The post-halving supply squeeze has been a recurring theme in my career, and it’s fascinating to observe how this scarcity is shaping the current market landscape.

For the last week, Bitcoin [BTC] has been holding steady between approximately $66,000 and $67,000, currently trading at $67,160, showing a minor increase of 0.57% compared to the previous day. This period of stability resembles Bitcoin’s behavior in July, where it encountered resistance at $68,000, resulting in a quick drop below $55,000. Therefore, maintaining this range is crucial to prevent a similar price decrease from occurring.

It’s noteworthy that the significant increase in October has primarily been fueled by a shortage of supply following the halving event, adding a new level of scarcity to the market. As Bitcoin finishes its highly bullish month, there could be a potential supply shortfall if demand continues in this manner.

Bitcoin halving impact is yet to materialize

Historically, after a halving event, there has been a strong tendency for Bitcoin prices to increase significantly, especially from an economic perspective. This is because as the supply of Bitcoin decreases, miners tend to be affected the most, often resulting in them selling off their holdings en masse, which is commonly referred to as “miner capitulation”.

As the amount of block rewards lessens, miners might struggle to meet their expenses, which could lead a significant number of them to leave the mining market.

After this process, only the most productive miners remain within the system. This could lead to a stronger setting for an increase in value, as the supply gradually decreases due to scarcity.

Source : X

According to the graph provided, it appears that mineral reserves have been gradually decreasing since the April halving, showing this trend.

Despite the common belief that a decrease in Bitcoin supply among miners could lead to increased selling, the relatively small amount of Bitcoin available compared to its overall market volume hasn’t noticeably affected the market dynamics.

If the demand stays strong, most of the push to sell will be counterbalanced, leading to an optimal situation where there’s likely to be a shortage in supply.

As an analyst, I found myself in a favorable environment during October, as Bitcoin was almost touching the $70K mark, suggesting a bullish trend. Yet, a breakthrough beyond this level has not been realized, hinting that the predicted supply surge has yet to materialize.

This scenario maintains optimism for a potential parabolic rally as we approach the end of Q4.

Efficient miners are still in the game

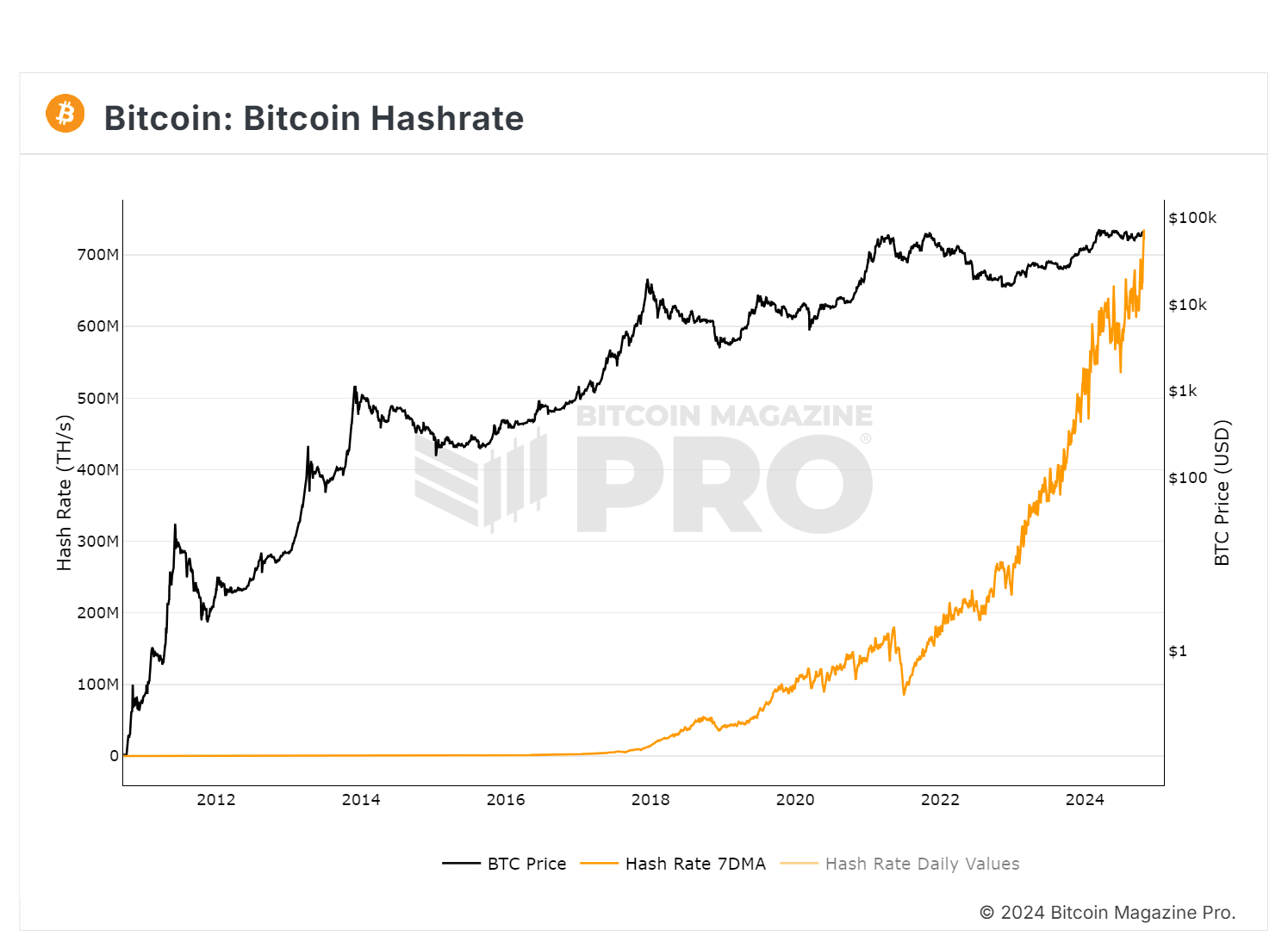

The effects of the halving are evident: Bitcoin’s mining difficulty has reached an all-time high, meaning it now requires more computational power to process transactions. This situation is forcing out less efficient miners.

Source : Bitcoin Magazine Pro

Consequently, the mining rate has grown as well, suggesting a stronger and more resilient network. This development underscores the concentration of mining activities, with only the most advanced technology and cost-efficient operations being able to thrive.

In summary, there’s a possibility that a large-scale surrender or giving up might occur, which could cause the supply to decrease significantly while demand remains high. This could potentially lead to an increase in prices.

Institutional interest is growing

At present, all cryptocurrency exchanges are experiencing a surge in Bitcoin holdings, which suggests strong selling activity predominantly from the mining sector due to the factors explained earlier.

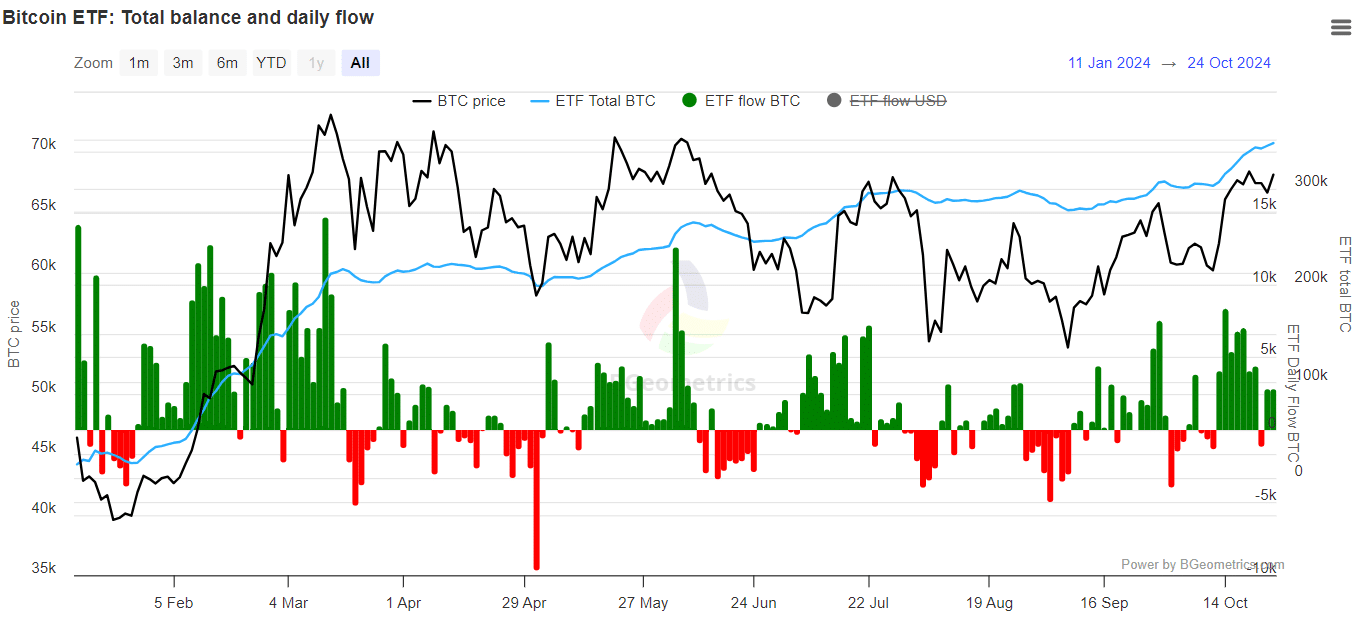

Previously mentioned, a sudden change in supply may happen if demand continues to be strong despite the current strain; otherwise, we could experience another cycle like the one in July. Notably, there’s been an increase in ETF investments during October, indicating a growing curiosity among retail investors.

Source : BGeometrics

To add to that, BlackRock’s Bitcoin holdings have surpassed 400,000 units, reaching a total of 403,725 Bitcoin, which is equivalent to approximately $26.98 billion. Over the course of just two weeks, they have added 34,085 more Bitcoins to their portfolio, representing a value of about $2.3 billion.

This suggests an increase in demand for institutions, strengthening our original idea at AMBCrypto that a shortage in supply could be developing.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As an analyst, I see that the ongoing consolidation plays a significant role in safeguarding Bitcoin (BTC) from potential setbacks. However, it’s essential to maintain a steady equilibrium between demand and supply if we hope to witness BTC reaching a new All-Time High (ATH) before this quarter concludes.

Regardless, the miner capitulation highlights the effects of the post-halving environment; their exit now requires a more sustained buying effort at current prices. While a slight retracement may occur, a full-fledged pullback seems unlikely.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 18:16