- AERO has surged +1200 in the past year.

- Base growth has been the most significant driver – will the trend continue?

As a seasoned crypto investor with a knack for spotting promising projects and riding their waves of growth, my radar has been consistently pinging at Aerodrome Finance [AERO]. The past year has seen this token skyrocket by an astounding 1200%, largely due to the meteoric rise of Base, an Ethereum L2.

The cryptocurrency Aero (AERO) has experienced significant surge in value due to the rapid escalation of Base, a scalability solution on the Ethereum network.

In the Base environment, an Aerodrome functions as a crucial central entity providing liquidity. It operates both as a Decentralized Exchange (DEX) and an Automatic Market Maker (AMM), facilitating seamless transactions and maintaining market equilibrium.

2024 saw a significant boost in the Total Value Locked (TVL) of Base, which expanded sixfold, from approximately $500 million to about $3 billion. This massive growth of Base has played a vital role in the evolution of the protocol.

Over the same period, Aerodrome Finance’s TVL increased from $100 million to over $1.3 billion (13x).

Among all, the token AERO appears to have seen the greatest advantage, surging by an impressive 1200% year over year. With predictions of additional expansion for Base, is it advisable to keep an eye on AERO and consider adding it to your list of investments to monitor?

AERO’s potential

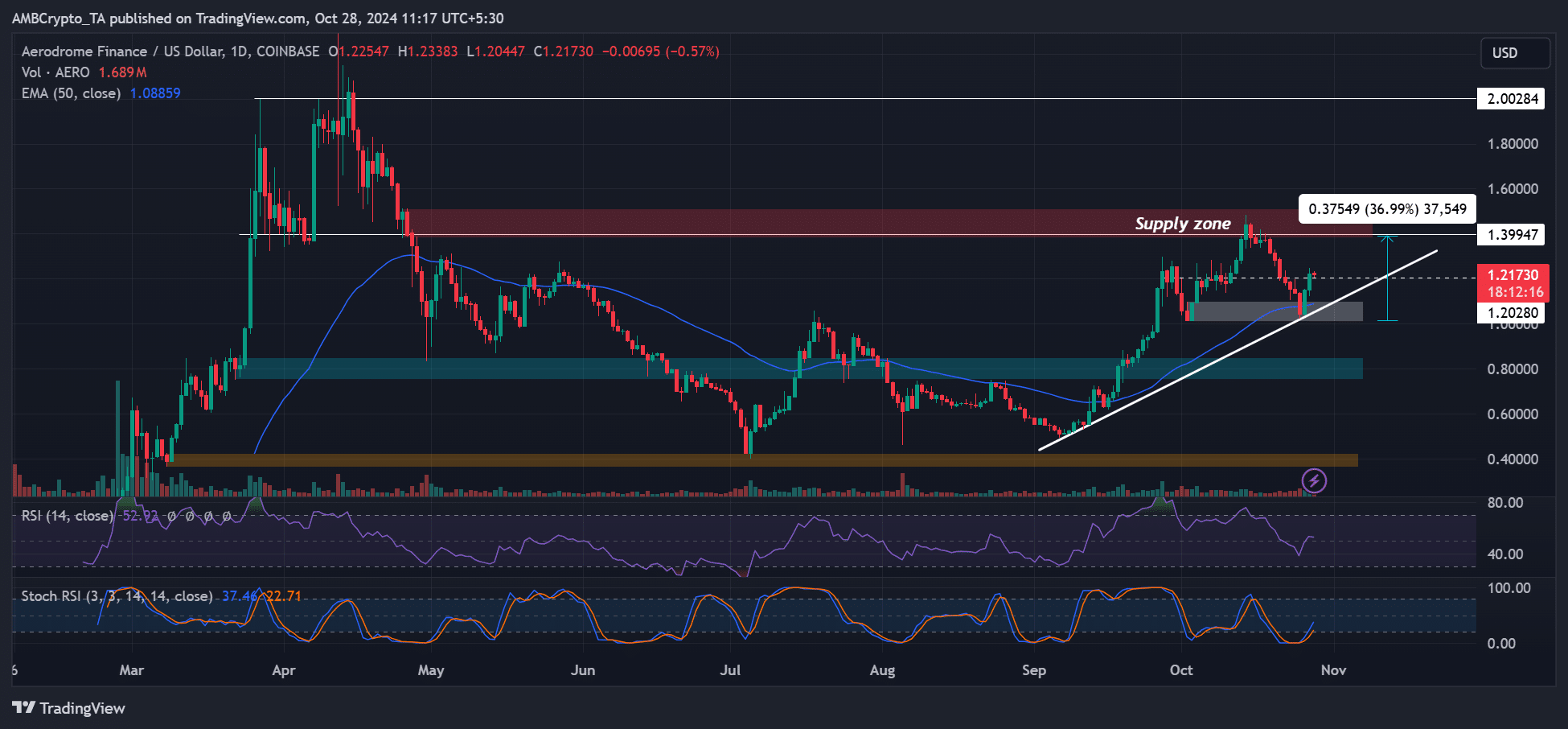

During the market recovery in September, AERO experienced more than a 140% increase in returns. Yet, it encountered resistance and a drop in price around the $1.3 to $1.5 range, which is marked as a red, or high-supply, area.

Instead, let’s note that the price retreat was halted around $1.2 due to significant demand, which means this point is now an important one to keep an eye on.

If the price continues to climb upward, reaching around $1.5, it might lead to a 36% price increase. However, if there’s a stronger surge taking us to $2, this could result in approximately a 100% price jump.

Technical chart indicators suggested there was still potential for further increase as they were well away from being considered overly bought, indicating there might be more upward momentum ahead.

Even though the U.S. elections are approaching in a few days, causing potential market instability and fluctuations, a drop below $1.2 might present an attractive buying opportunity at $0.8.

Weekend spot demand

Read Aerodrome Finance [AERO] Price Prediction 2024-2025

Over the weekend, the significant 18% increase was largely fueled by immediate demands, evident from the surge in instant CVD (Cumulative Volume Delta).

The metric measures the gap between the amount bought and sold. A surge in this gap indicates higher buying activity, suggesting a positive or ‘bullish’ outlook.

However, interest in the Futures market tapered slightly, as shown by a nearly 1 million AERO drop in open interest (OI) rates. Should the decline extend, a move to $1.5 could be delayed.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-28 13:43