- BONK was at a critical juncture, having traded off two major support zones recently.

- However, recent metrics indicate mixed market signals, putting any potential rally at risk.

As an analyst with years of market experience under my belt, I find myself cautiously optimistic about BONK’s current situation. On one hand, the coin has found support at multiple levels and is showing signs of resurgence, which could potentially set the stage for a rally. However, technical indicators such as the MACD and RSI suggest ongoing bearish momentum, pointing towards a possible downturn.

Over the past week, the value of Bonk [BONK] has dropped by about 12.03%, but it’s found multiple zones where its price intersects, potentially offering support. Although a consistent upward trend remains unclear, a modest increase of 0.43% in the last day suggests a possible revival in purchasing activity.

AMBCrypto’s examination provides a broad perspective on the current market trends, along with predictions about future developments.

Multiple rally confluences surfaces for BONK

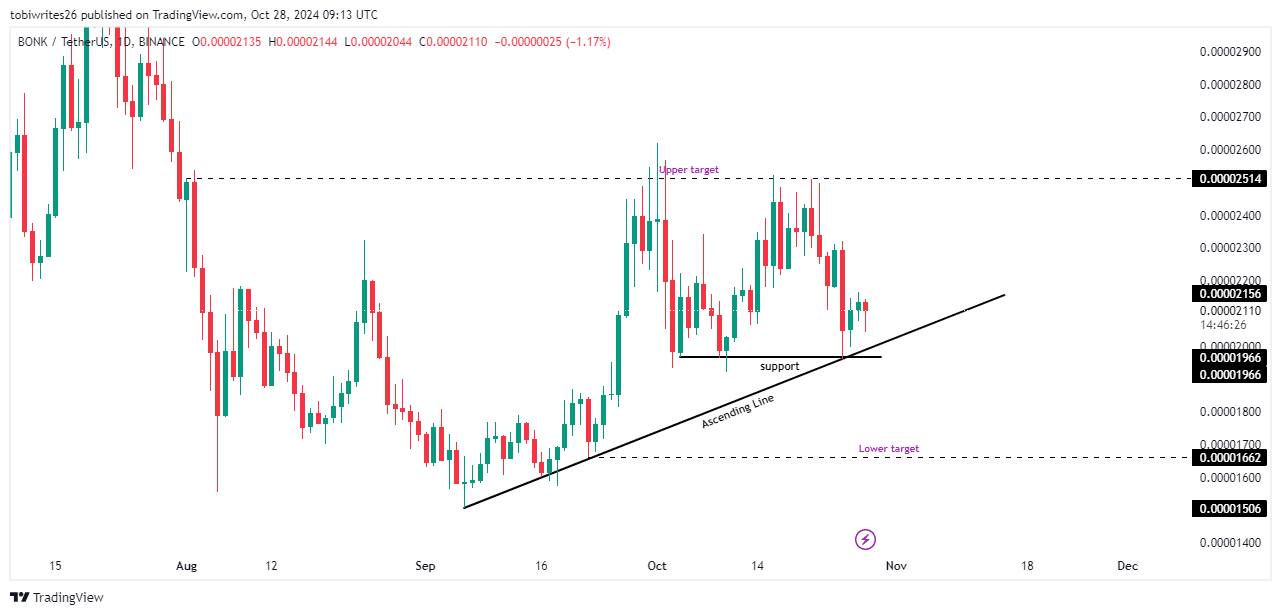

Lately, BONK has bounced back from a key support point at 0.00001966, which coincides with an ascending triangle pattern. This combination strengthens optimistic feelings in the market. However, it’s worth noting that the future direction remains unclear. In simpler terms, this could suggest a possible price increase, but predictions are still uncertain.

Should the current support level remain intact, BONK may encounter its first significant resistance at approximately 0.0002514 in the near future. This potential resistance could pave the way for additional growth.

Instead, should the support weaken, there’s a strong possibility that BONK might retreat to 0.00001662. Further selling could push it even lower, approaching the bottom of its present upward trendline.

As an analyst, I’ve been scrutinizing the trends indicated by AMBCrypto’s analysis and I find that while there are signs of potential growth, a prolonged surge is yet to be assured.

Indicators signal bearish sentiment for BONK

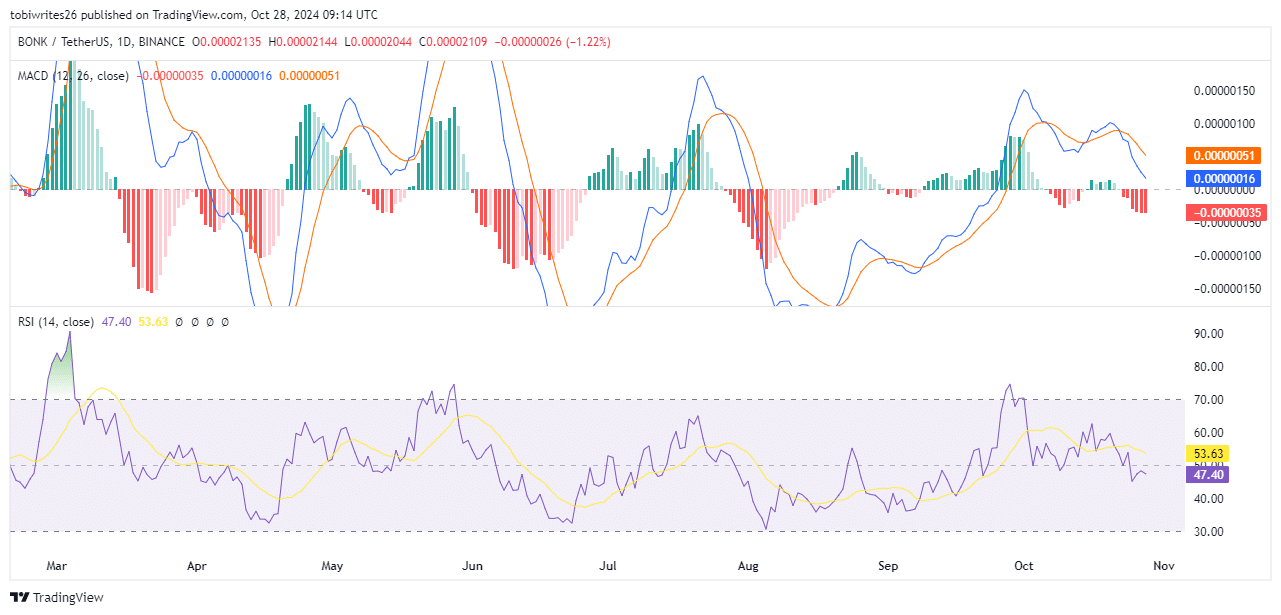

Currently, the technical analysis indicates a bearish trend for BONK, contradicting a bullish perspective. The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) both point towards persistent downward momentum.

In simpler terms, the MACD (Moving Average Convergence Divergence), a tool that measures market momentum, suggests an upcoming market drop because both the MACD line and the signal line are diving further into negative areas. This decline is also supported by the increase in bearish momentum bars, which mirrors the pessimistic feelings among traders.

In a similar vein, just like the Relative Strength Index (RSI), which gauges the pace and direction of price fluctuations, is currently dropping. This decrease indicates an increase in selling activity, potentially causing BONK’s price to persistently fall further.

With both indicators showing further losses, BONK may be set for a sustained decline.

Bullish sentiment persists despite mixed signals

As an analyst, I’ve observed a fascinating trend in the data from Coinglass. The open interest, a crucial indicator of market sentiment, is skewed towards long positions for BONK at the moment. This suggests a strong bullish sentiment among investors, indicating they are optimistic about BONK’s future price movements.

Read Bonk’s [BONK] Price Prediction 2024–2025

According to recent figures, the open interest for BONK has increased by approximately 12.75%, reaching a total of $7.31 million. This suggests that there are more long contracts than short ones, potentially leading to a favorable situation in the market.

Nevertheless, since the technical indicators are providing conflicting information about BONK’s future trend, it is essential to gather more evidence to determine its potential upcoming movement clearly.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- WCT PREDICTION. WCT cryptocurrency

2024-10-29 02:47