- XRP’s price action shows signs of a potential breakout, supported by rising transaction count and wallet growth.

- Exchange reserves and open interest reflect mixed sentiment, but bullish indicators hint at possible upward momentum.

As a seasoned crypto investor who has weathered countless market cycles, I must admit that XRP’s recent price action and on-chain metrics have piqued my interest. The surge in active addresses and new wallet creations suggest renewed investor interest, which could indeed be a sign of strong bullish momentum.

Ripple‘s on-chain actions have climbed to their highest point in the past six months, as the number of active addresses jumped to 12,230 and there was an increase of 10.39% in new wallet creations, resulting in approximately 18,321 additional accounts being added.

This rise indicates renewed enthusiasm from investors and might signal robust bullish energy. Yet, one may wonder if it’s merely a passing fad, or if we’re about to witness a prolonged upward trend.

Analyzing XRP’s price action for signs of a breakout

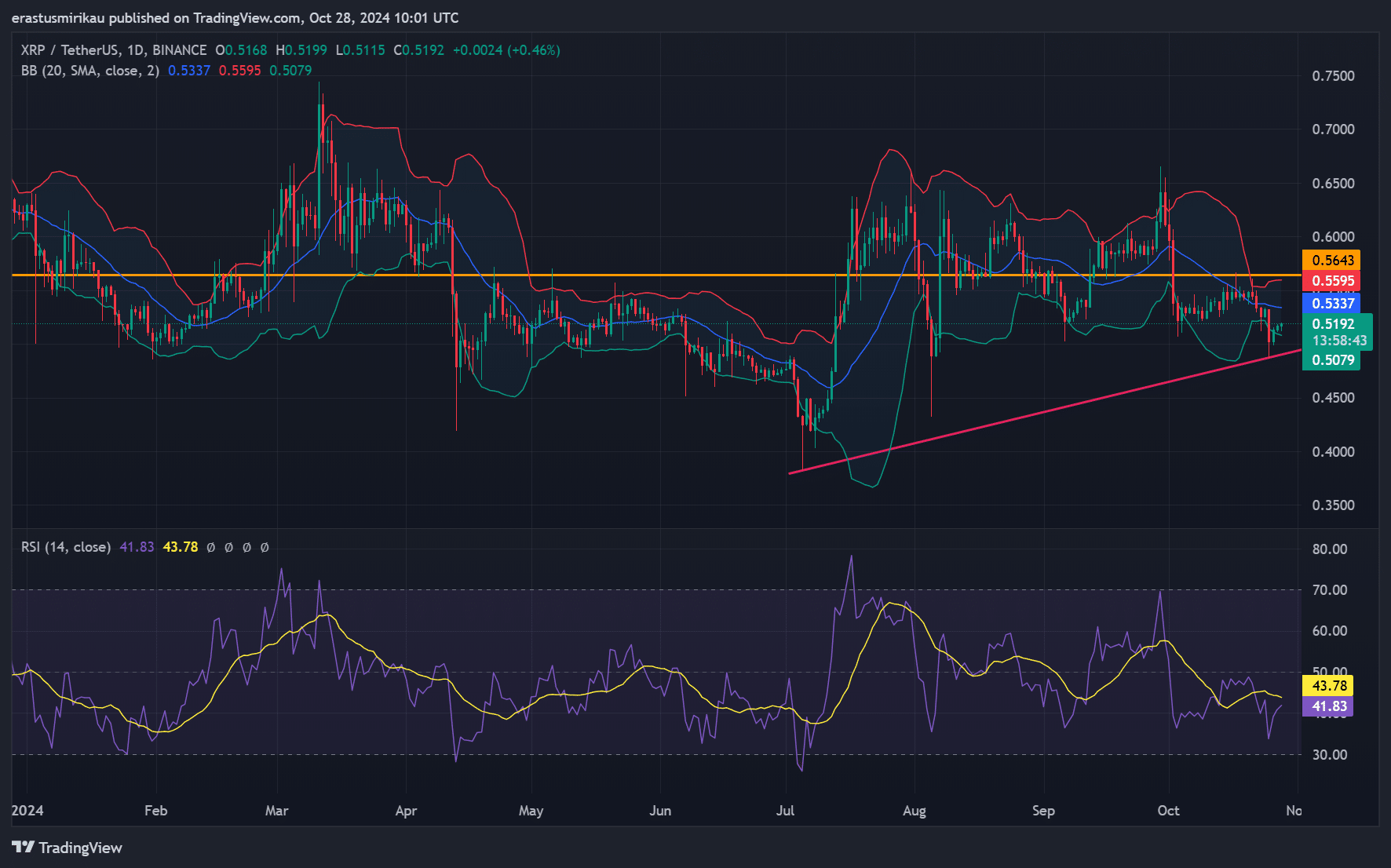

Currently, one XRP is being sold for approximately $0.5192, representing an increase of 0.46% over the last day. Over the past few months, XRP’s price movement has remained within a wide consolidation range. However, recent patterns suggest a possible breakout may be imminent.

By checking the Bollinger Bands, it appears that XRP’s current trading position is near the midline, suggesting that volatility levels are relatively stable. However, there could potentially be an emerging bullish trend on the horizon.

With a Relative Strength Index (RSI) of 41.83, we’re nearing the region where prices might be considered oversold. If XRP maintains its current upward trajectory and the RSI sustains an increase, it could potentially generate positive price movements due to increased buying pressure.

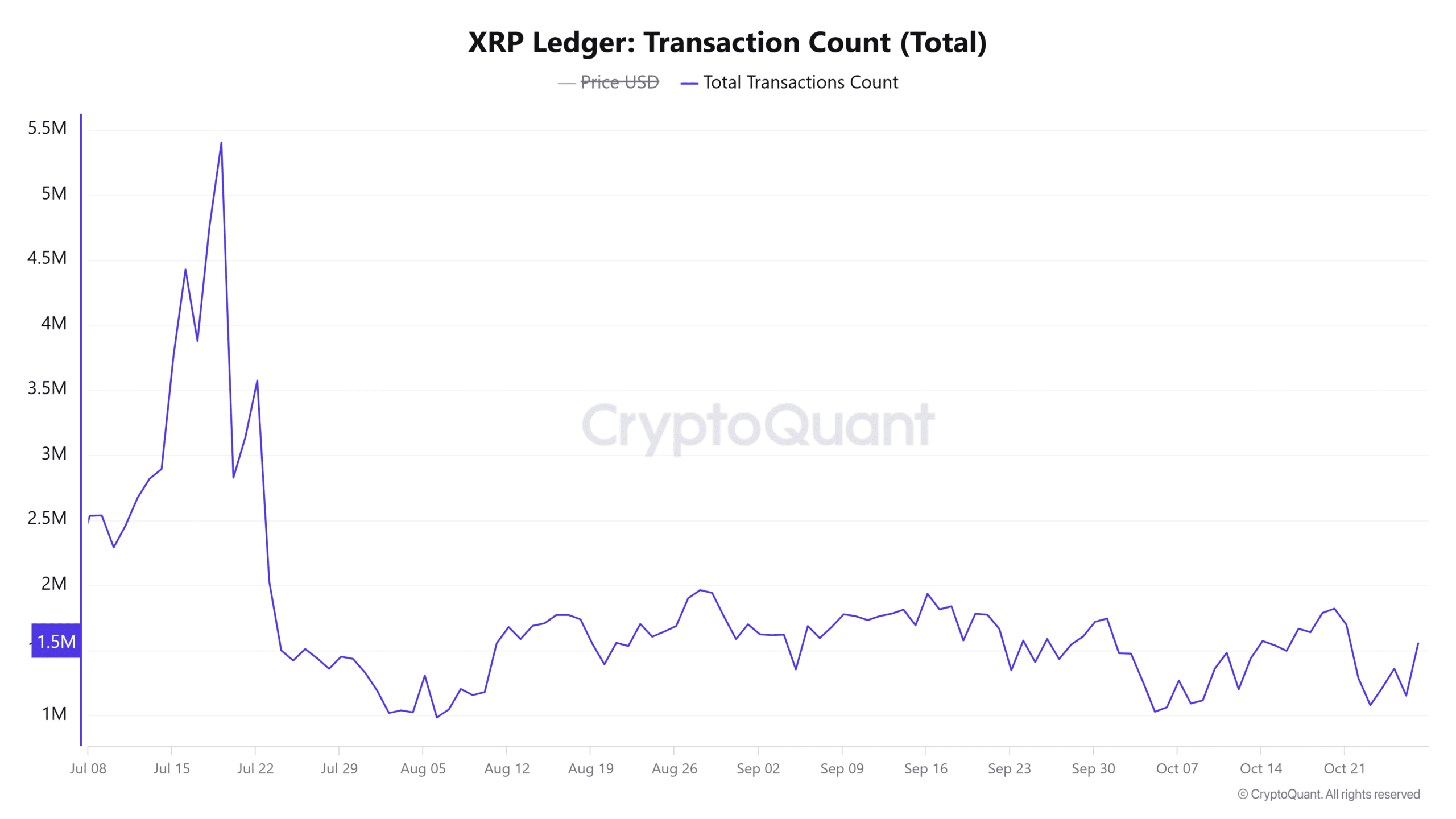

Transaction count highlights increased network engagement

5655 million transactions on XRP’s network were recorded in the last 24 hours, marking a 1.24% increase. This steady growth in transaction volume suggests a higher level of user interaction, a trend that frequently coincides with escalating market value trends.

As a result, the increase in XRP transactions might indicate a growing demand. Should this trend persist with more transactions, it could boost prices, suggesting a rising enthusiasm for XRP’s functionality and possible value increase.

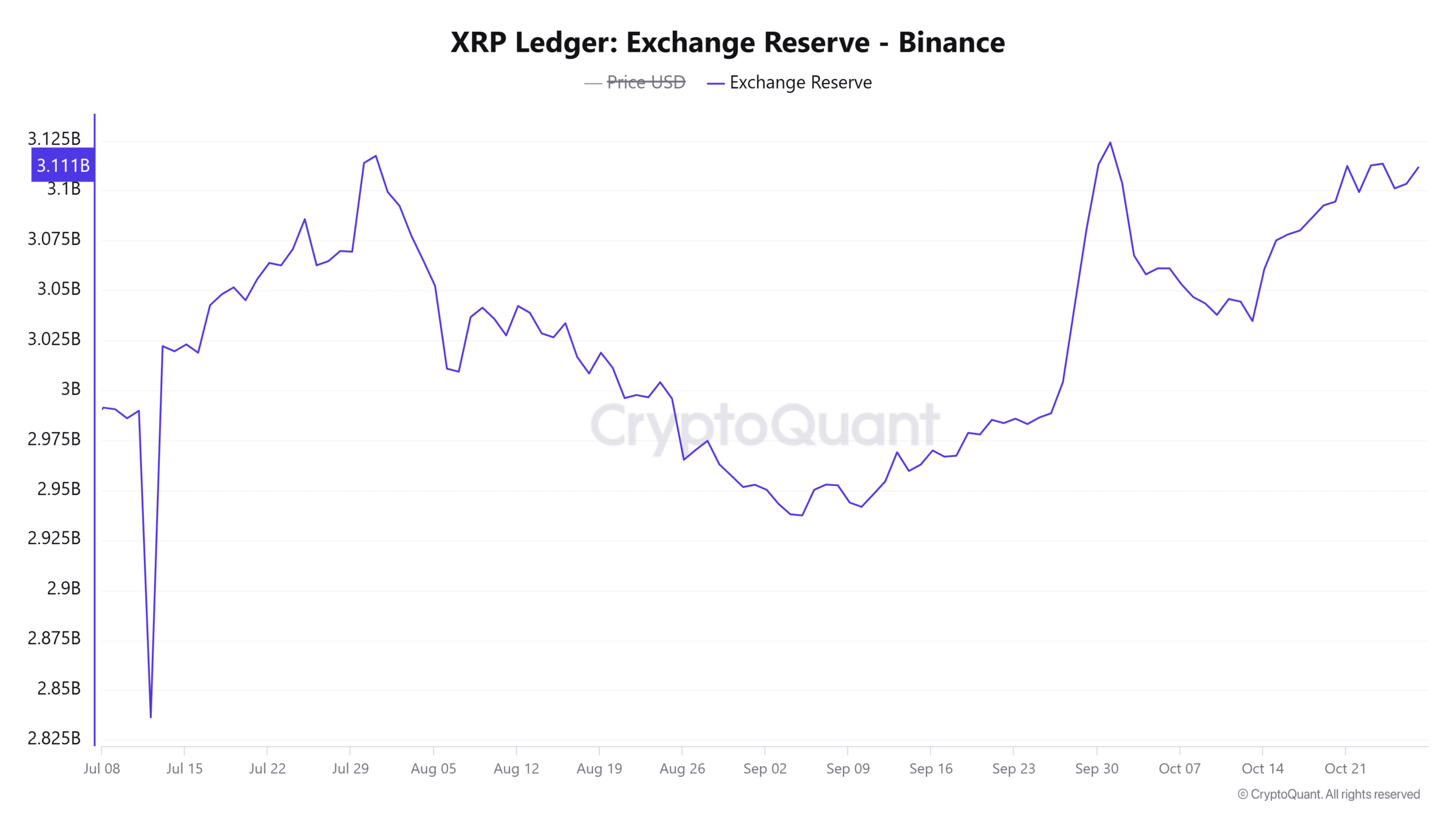

XRP exchange reserves indicate caution in buying pressure

At present, the reserve balance is approximately 3.11 billion, indicating a modest 0.36% rise compared to the previous day. A boost in reserve balances typically means that more coins are being stored on exchanges, which may hint at possible selling pressure building up.

This uptick could pose a challenge to XRP’s upward momentum.

If the amount of assets held by exchanges begins to decrease, this might suggest reduced selling activity. Consequently, such a situation could lead to a stronger market surge. Thus, it’s crucial to keep an eye on these reserves to get a clear understanding of immediate market sentiments.

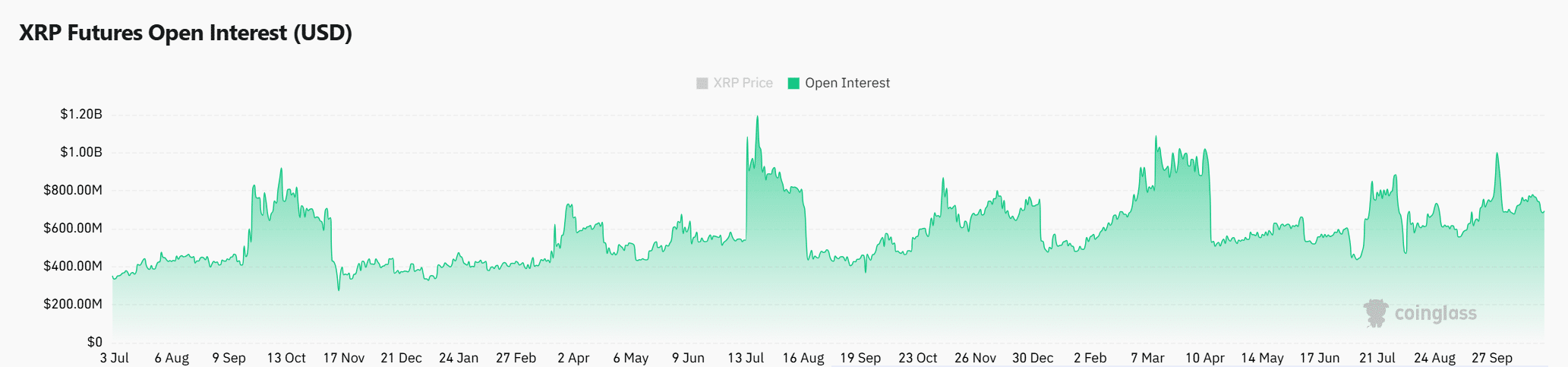

Rising open interest signals growing speculation

The number of active positions in futures trading has grown by approximately 1.61%, amounting to a total of $701.52 million, signifying increased market involvement. This surge in active positions indicates that traders are anticipating substantial price movements, particularly in the realm of altcoins, where interest is mounting regarding their future performance.

If this trend continues, it might support a positive outlook, particularly when paired with decreasing exchange reserves and an increasing Relative Strength Index (RSI).

Realistic or not, here’s XRP’s market cap in BTC’s terms

Is XRP primed for an uptrend?

The increased transaction count and open interest underscore growing optimism and strong market engagement. However, elevated exchange reserves indicate a potential selling pressure that could slow a rally.

To maintain the current positive trend and potentially trigger a bullish surge for XRP, it’s essential that exchange reserves decrease significantly while there’s consistent purchasing interest. If these conditions are met, XRP might very well be primed for a significant price increase.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How to Get to Frostcrag Spire in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-10-29 07:04