- Tether faces an investigation over alleged ties to illegal activities and sanctioned entities.

- Despite the scrutiny, Tether explores opportunities for growth in the commodity sector.

As a seasoned researcher with a keen eye for detail and years of experience in the cryptocurrency market, I find myself intrigued by the ongoing saga surrounding Tether (USDT). The latest development – an investigation into alleged ties to illegal activities and sanctioned entities – is certainly a significant blow to the stablecoin’s reputation. However, it seems that Tether remains unfazed, even exploring new opportunities in the commodity sector.

This year, stablecoins like USDC from Circle and USDT from Tether have significantly shaped the digital currency market, with their rivalry standing out as a key factor.

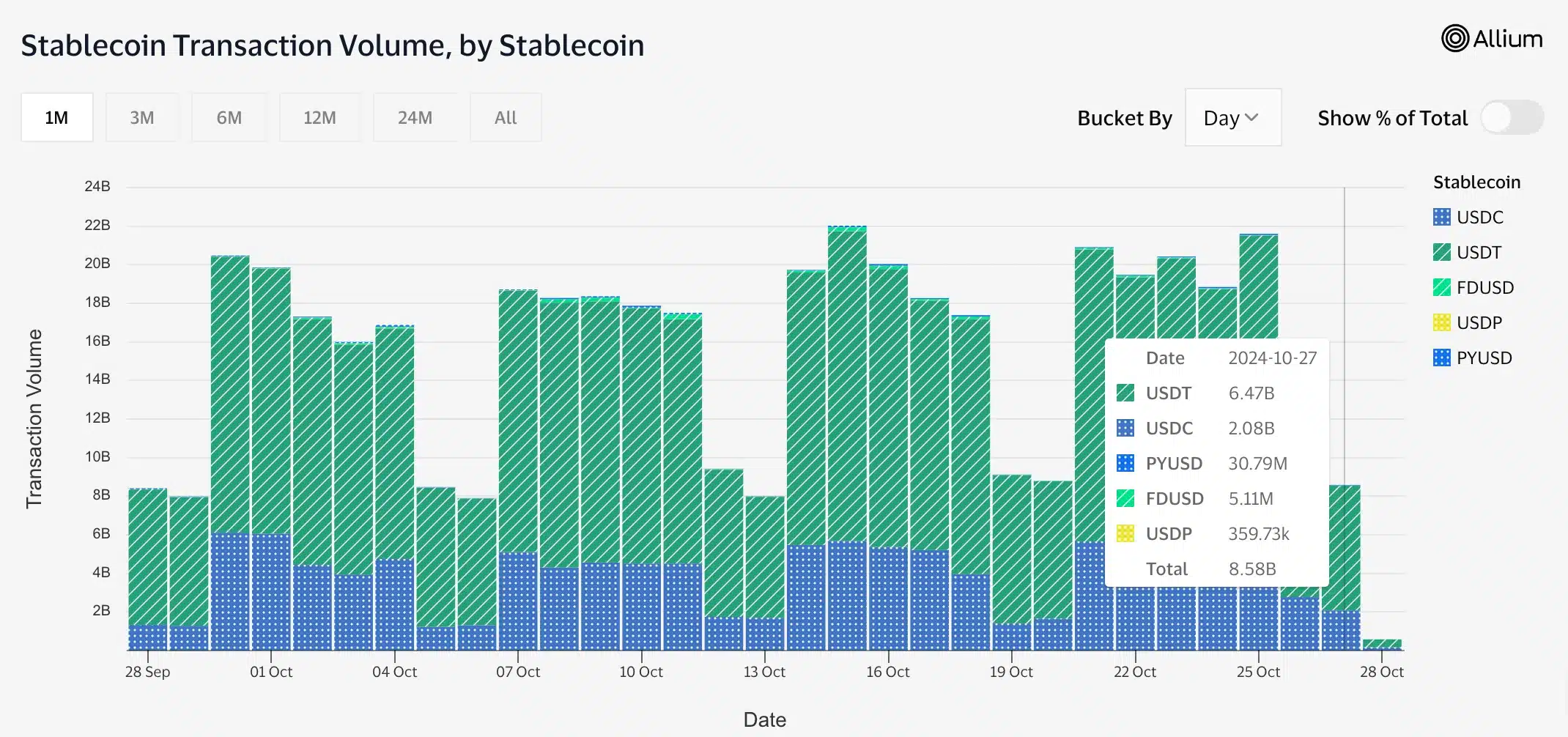

On the blockchain, analysis showed that Tether (USDT) had a transaction volume of approximately $6.47 billion on October 27th, which was substantially higher than USD Coin’s (USDC) volume of about $2.08 billion during the same period.

Tether under threat?

In light of USDT’s rising prominence, it has been disclosed by The Wall Street Journal that the U.S. Attorney’s Office in Manhattan is examining USDT for possible links to illicit activities, such as drug dealing, funding terrorist acts, and money laundering.

Yet, the situation shifted dramatically when Tether’s CEO asserted that he saw no indications of an ongoing federal investigation.

Taking to X, Tether’s CEO Paolo Ardoino noted,

We’ve clarified to the Wall Street Journal that there’s currently no evidence suggesting an investigation into Tether. The Journal seems to be repeating outdated rumors, and that concludes our statement.

Tether echoed this sentiment and asserted,

Though Tether has stated they have no information about any investigations concerning the company, these narratives seem to be entirely conjectural.

They added,

The piece, however, seems to overlook in a casual manner the thorough history of Tether’s interactions with law enforcement, which is widely documented, as they have consistently worked to prevent malicious users from exploiting Tether and various other cryptocurrencies.

Instead, the Wall Street Journal maintained its stance, implying that investigators were looking into potential cases where the stablecoin might have unintentionally enabled dealings with restricted parties.

What’s going on with Tether?

To clarify, American legal authorities were examining a company that issues stablecoins due to accusations that they had links to illegal activities, specifically dealing with organizations under sanctions like Russian weapons traders.

Moreover, the Treasury Department was considering imposing restrictions that would prevent American citizens from engaging in transactions involving USDT. This digital coin is well-known for its substantial daily trading volume, typically around $190 billion. However, worries about Tether’s potential links to national security matters, such as North Korea’s nuclear aspirations and relationships with Mexican drug cartels, have sparked increased interest in the stablecoin, leading to closer examination by relevant authorities.

As a crypto investor, I’ve been following the recent allegations against Tether closely. However, Tether has unequivocally refuted any claims of wrongdoing, emphasizing their dedication to collaborating with law enforcement and upholding transparency. This commitment is evident in their recent actions such as freezing 1,850 wallets and strengthening their regulatory framework by bringing on board industry experts.

What’s more to it?

The investigation has brought up similarities between Tether’s business operations and those of FTX, fueling concerns about its business model and compliance with regulations. Additionally, it appears that users in countries like Venezuela and Russia may have used USDT to circumvent sanctions, which has sparked worries about the possibility of USDT being misused by state entities or criminal groups.

Regardless of the close examination of its activities, Tether (USDT) was proactively planning various strategic advancements for the approaching year.

Recent reports indicated that the stablecoin issuer is considering an entry into the commodity sector, which could provide significant opportunities for growth.

If this venture proves successful, it could offer Tether the opportunity to invest in credit-short businesses, thereby establishing itself as a significant figure in a fresh market. This strategic move might also boost its income sources.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Solo Leveling Arise Tawata Kanae Guide

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Marvel’s Spider-Man 2 PC Graphics Analysis – How Does It Stack Up Against the PS5 Version?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- ANKR PREDICTION. ANKR cryptocurrency

2024-10-29 08:08