- BNB rallied closer to $600 amid positive funding rate transition

- Significant liquidation leverage and technical indicators backed market’s bullish momentum

As a seasoned analyst with years of market observation under my belt, I must say that the recent BNB price action has caught my attention. The positive funding rate transition and the significant liquidation leverage are reminiscent of a bull market on the horizon, much like a sunrise after a long, dark night.

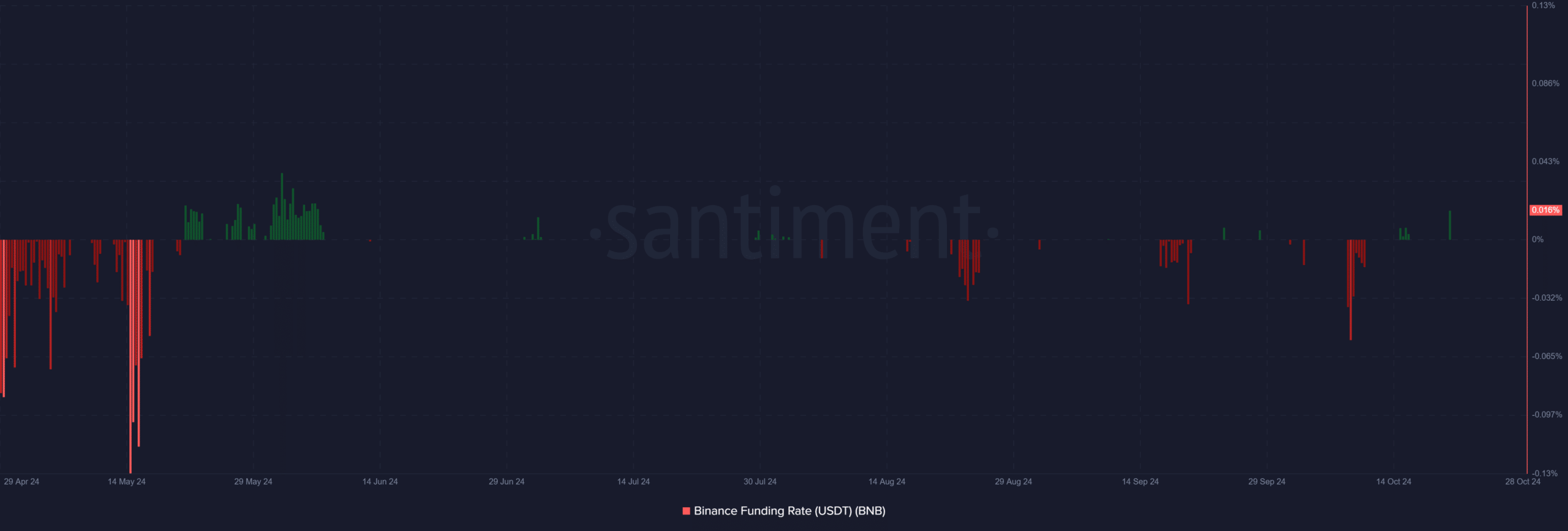

Currently, Binance Coin (BNB) is noticeably surging, edging towards approximately $600 at this moment. This recent price increase can be attributed to investors noticing a significant shift in market sentiment, as the trend has turned bullish following a prolonged period of bearishness. Additionally, funding rates have switched to positive, indicating increased optimism among traders.

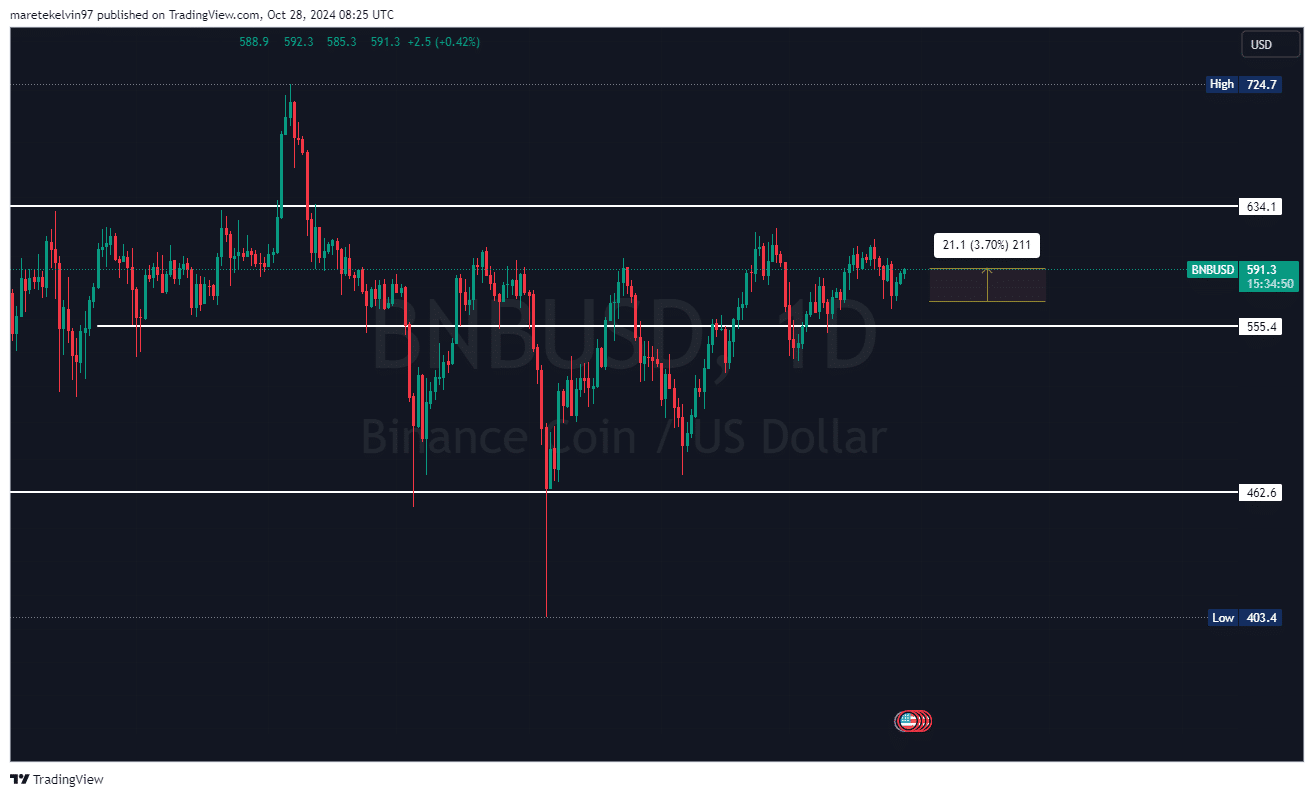

Furthermore, the technical terrain suggests a more robust market setup. The price of BNB has found strong footing at approximately $555.4, and continues to hold above past highs of around $462.6. Both these figures are crucial and have been repeatedly rejected in recent times.

BNB’s metrics flash green

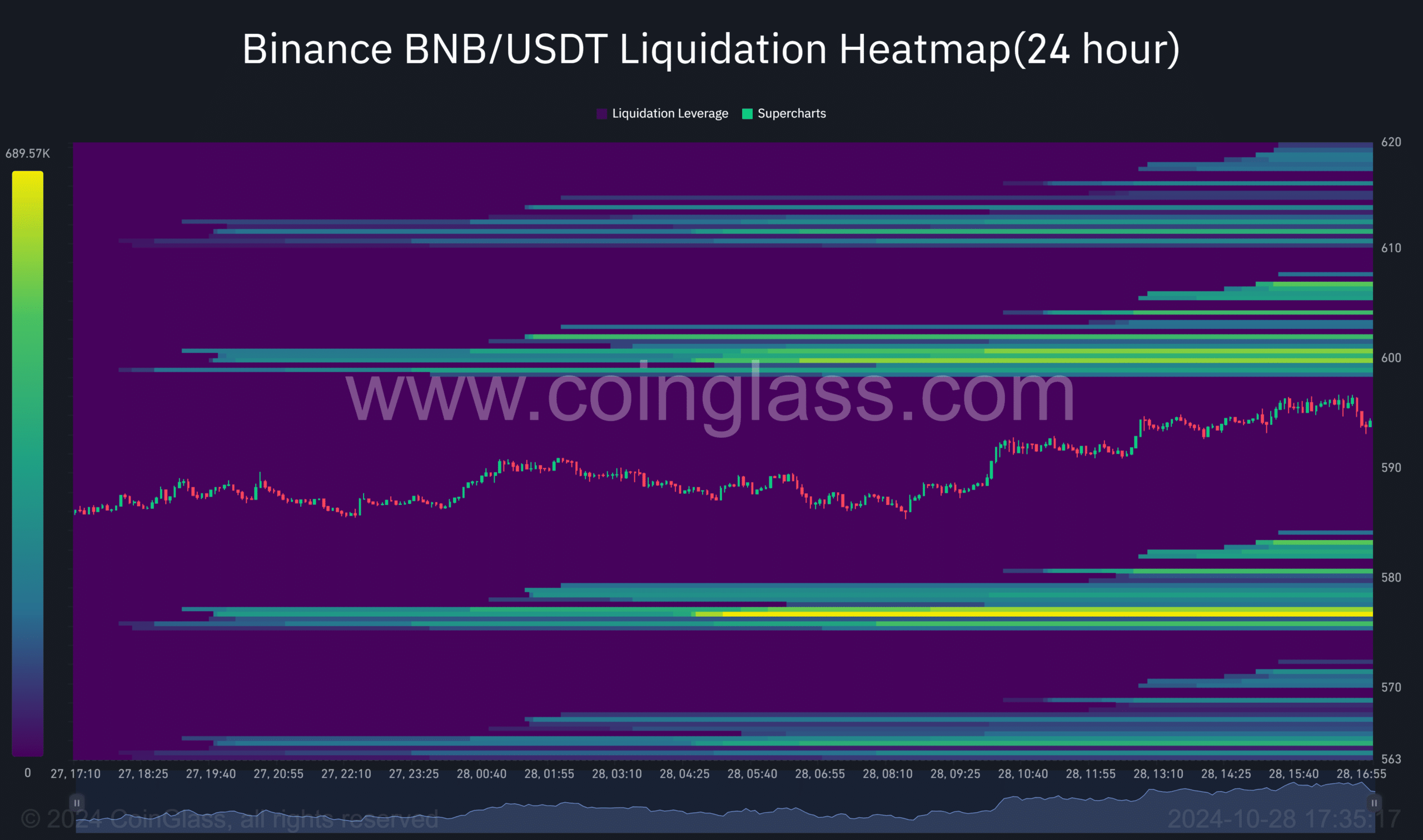

Furthermore, the level of liquidation leverage surged beyond 2 million, indicating that market participants continue to exhibit a strong sense of confidence.

The BNB market appears to be leaning positively, as a substantial amount of liquidation occurs near $600. This could potentially push the price of BNB even higher. It’s also noteworthy that the recent upward trend in price is directly linked to the withdrawal of liquidity from the pool.

In summary, the change in funding rates reinforced the optimistic feelings in the market. The flip of BNB from negative to positive status suggested a possible shift in trends, and this was even more noteworthy when considering the increased liquidation indicators.

Such a confluence of indicators typically precedes major price movements.

Strategic price levels shape the trading landscape

Therefore, everyone is closely watching the important $634.1 resistance level, a historical hurdle for potential future advancements. This level holds significance because it has previously denied several attempts at progression.

Nevertheless, the firm support at $555.4 could serve as a solid basis for any potential uptrend, establishing a distinct trading zone. With BNB’s bullish momentum gradually building up, the resistance point at $634 is now becoming increasingly visible to the market’s optimistic traders.

The positive funding environment further seemed to reinforce the potential for upward continuation.

A clear path forward emerges for BNB

The strong trend in BNB’s market, supported by rising lending fees and significant liquidation opportunities, suggests a persuasive scenario for continued growth as depicted on price graphs.

As long as the $634.1 level serves as a significant barrier, the convergence of favorable signals points towards an increase in positive trajectory in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-29 12:07