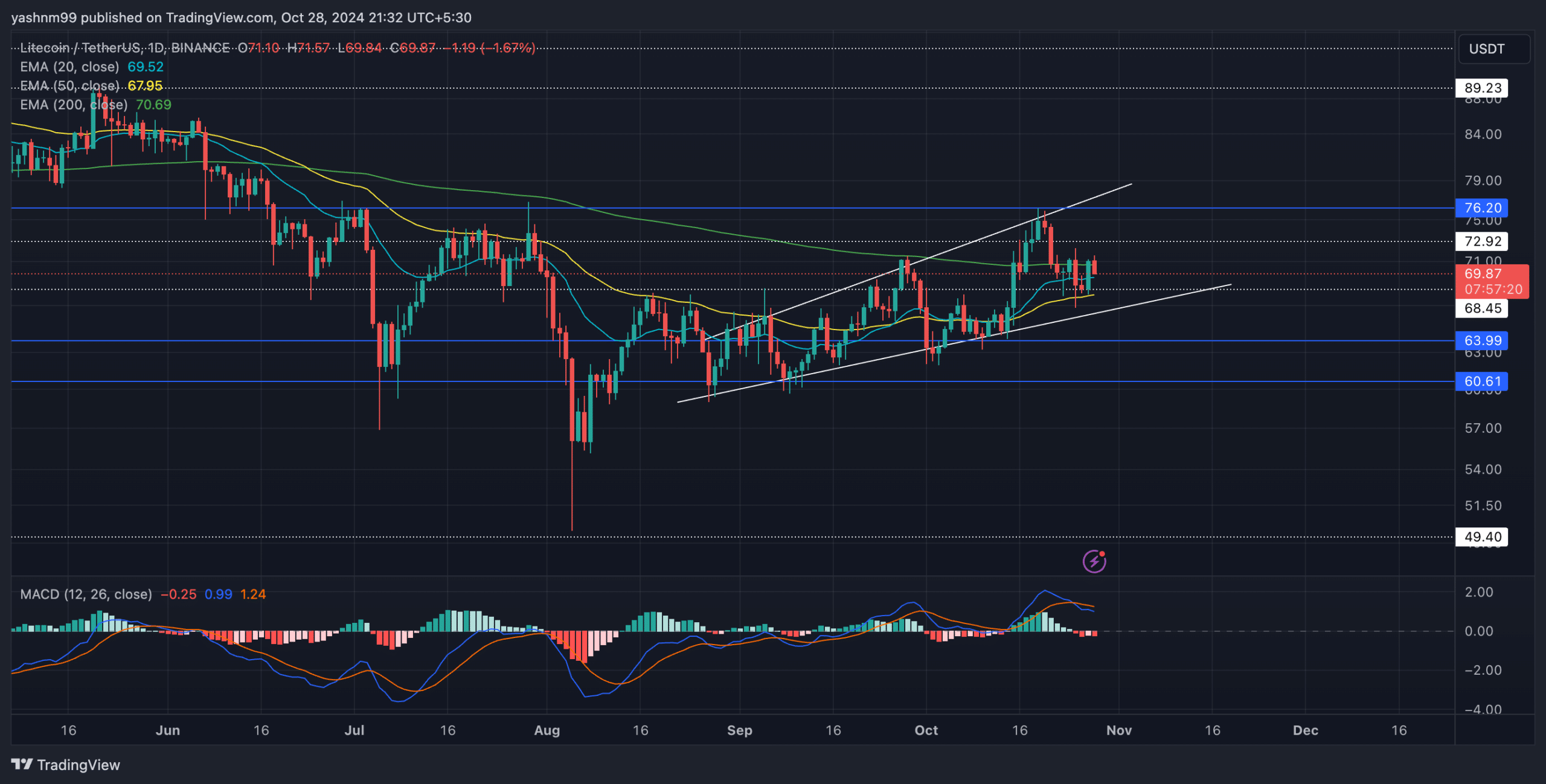

- Litecoin, at press time, was at a critical point, facing immediate resistance at $72 and support levels around the 20-day and 50-day EMAs

- Traders should watch for a patterned breakout to gauge the altcoin’s near-term sentiment

As a seasoned crypto investor with years of experience navigating volatile markets, I find myself closely watching Litecoin [LTC] at this critical juncture. Having witnessed its resilience bounce back from the $60 support level earlier this month, I’m intrigued by its current retest of the $72 resistance.

After initially bouncing back from the $60 support point in early September, Litecoin [LTC] has been climbing higher. On its day-to-day chart, it has formed a broadening ascending wedge pattern while trying to break through the $72 resistance level, as we speak.

At press time, LTC was trading at $69.98, down by around 1% in the last 24 hours.

Key EMAs and recent price action

As a researcher, I’ve noticed an upward trajectory in Litecoin’s price over the past few months. Notably, it has surpassed both its 20-day Exponential Moving Average (EMA) at approximately $69.53 and its 50-day EMA at around $67.95. At the moment, it’s hovering just under the 200-day EMA ($70.69), suggesting a growing demand from buyers.

The aforementioned price level is quite crucial because if buyers can push above the $72 resistance, the next target would be around $76. This might confirm a patterned trajectory and trigger a near-term decline from that resistance.

As a result, the altcoin might revisit its support level of $68.45. If selling pressure increases, further drops could happen, with potential support found at $63.99 and $60.61.

The MACD signal exhibited conflicting messages. Specifically, the MACD line was positioned beneath the Signal line, yet both lines appeared to reside within a zone suggesting a potential advantage for buyers, albeit a slight one.

If the trend goes below the horizontal axis, it suggests that buyers are gaining more power. On the other hand, an upward intersection (bullish crossover) might counteract any immediate bearish assumptions.

Derivatives data overview

The data on derivatives showed an uptick in trading, as the volume surged by nearly 47.32% to reach approximately $170.12 million. Conversely, Open Interest dipped slightly by 2.06%, currently standing at about $249.49 million. This discrepancy implies that traders may have been adjusting their positions in response to market fluctuations, potentially hinting at a significant shift upcoming.

For Litecoin, the 24-hour long-to-short ratio was 0.8629, suggesting a slightly bearish outlook. On the other hand, traders on Binance and OKX seemed more bullish with ratios of 1.733 and 2.65 respectively, highlighting their optimism about Litecoin’s future price movements on these specific platforms.

The leading traders on Binance for Litecoin (LTC) against Tether (USDT) showed a positive long/short position ratio of approximately 2.0257, suggesting that these prominent figures anticipate an increase in the coin’s value.

Ultimately, the value of LTC may be influenced by fluctuations in Bitcoin‘s price. Therefore, it would be wise for traders to monitor the broader market trends prior to making any investment decisions.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-29 12:39