- Toncoin is seeing an average of 500,000 new holders daily.

- While holders have grown, they have struggled to remain profitable.

As an experienced analyst with a background in both traditional finance and cryptocurrencies, I have seen my fair share of market fluctuations and trends. The rapid growth Toncoin [TON] is experiencing in terms of new holders is indeed impressive, but it’s essential to delve deeper into the numbers to truly understand its current standing.

Toncoin (TON) has shown remarkable expansion since its debut, indicating potential for outgrowing Ethereum (ETH) in terms of the total number of owners.

Recent information shows a consistent rise in the number of Toncoin owners, suggesting it might surpass Ethereum’s total by year-end. Yet, although ownership has soared, profits associated with Toncoin have been decreasing, implying a somewhat uncertain future for this asset.

Toncoin’s rapid increase in holders

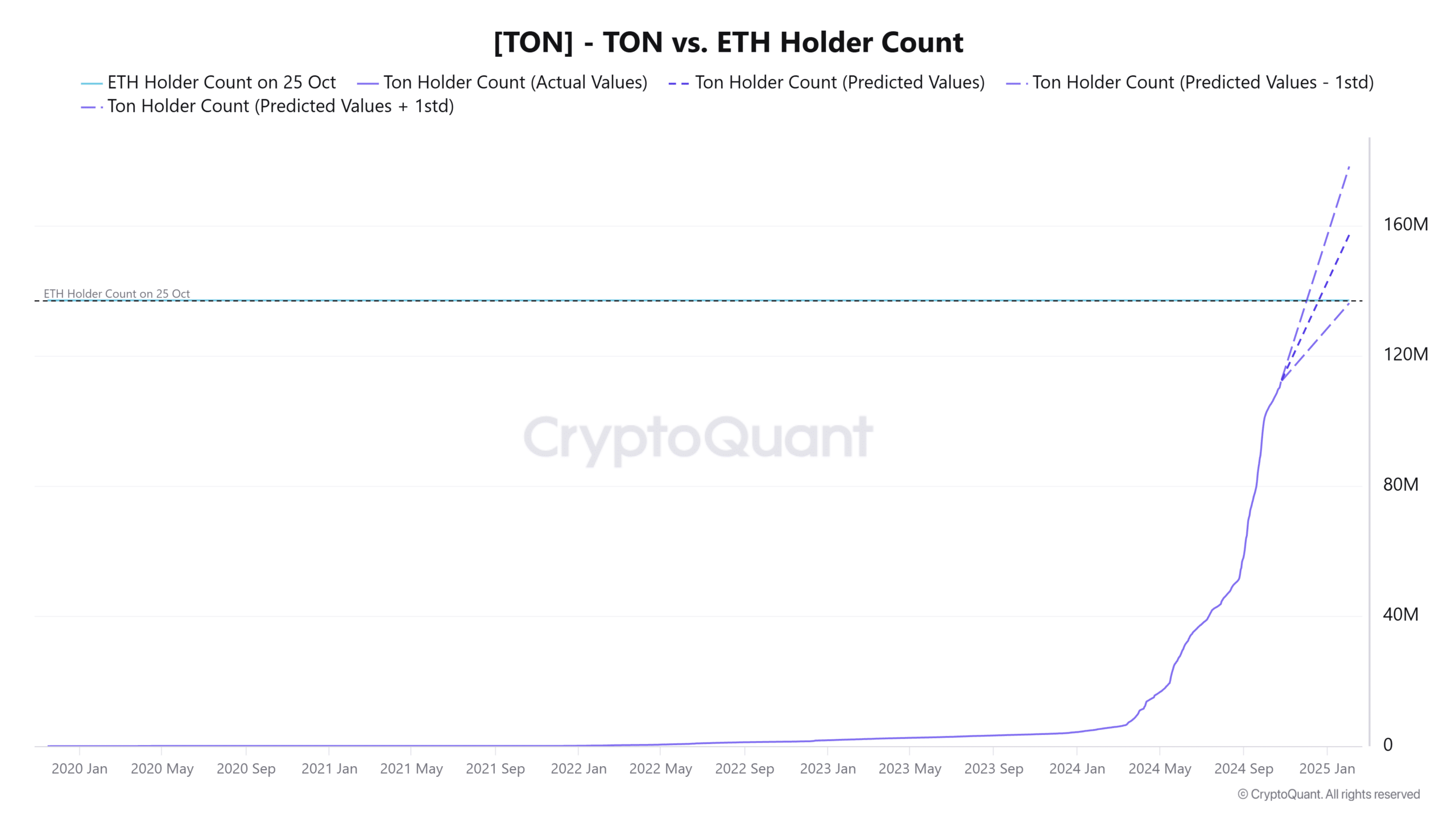

As per CryptoQuant’s analysis, Toncoin has seen a significant expansion in its holder community. Over the period from March 15th to October 17th, the number of Toncoin holders increased from approximately 7.12 million to roughly 108 million.

The growth pace of TON surpasses Ethereum noticeably, as the number of its holders has consistently stayed near 137 million. However, it’s worth noting that TON seems to be gaining approximately half a million new holders every day.

If the current trend persists, Toncoin might outnumber Ethereum’s number of holders by December. Even if the pace lessens a bit, it’s expected that this significant milestone will be reached within the next year, suggesting that Toncoin could soon boast more holders than Ethereum.

Evaluating profitability among Toncoin holders

The rapid rise in holder numbers does not necessarily equate to high profitability for all Toncoin investors. Analysis from IntoTheBlock’s Global In/Out of the Money chart indicates that many Toncoin holders are currently experiencing losses.

Currently, around 75.43 million addresses make up about 80.70% of all owners, and these addresses are considered “Underwater” or “Unprofitable,” meaning they’re not currently generating a profit.

On the other hand, approximately 86% of the total addresses, which amounts to around 13.16 million, are currently in a position where they are not profitable, also known as “Underwater” or “Out of the Money”. Conversely, just about 14% of holders, equivalent to 5.22%, find themselves in a profitable situation, often referred to as being “In the Money”.

In comparison, the current situation with Ethereum appears to offer better prospects for earning a profit. At present, about 67% of Ethereum owners find themselves in a position where their investment is profitable (referred to as “In the Money”), while approximately 29% are not (known as “Out of the Money”). This makes Ethereum a potentially more advantageous asset for its holders according to recent statistics.

Toncoin’s current market position

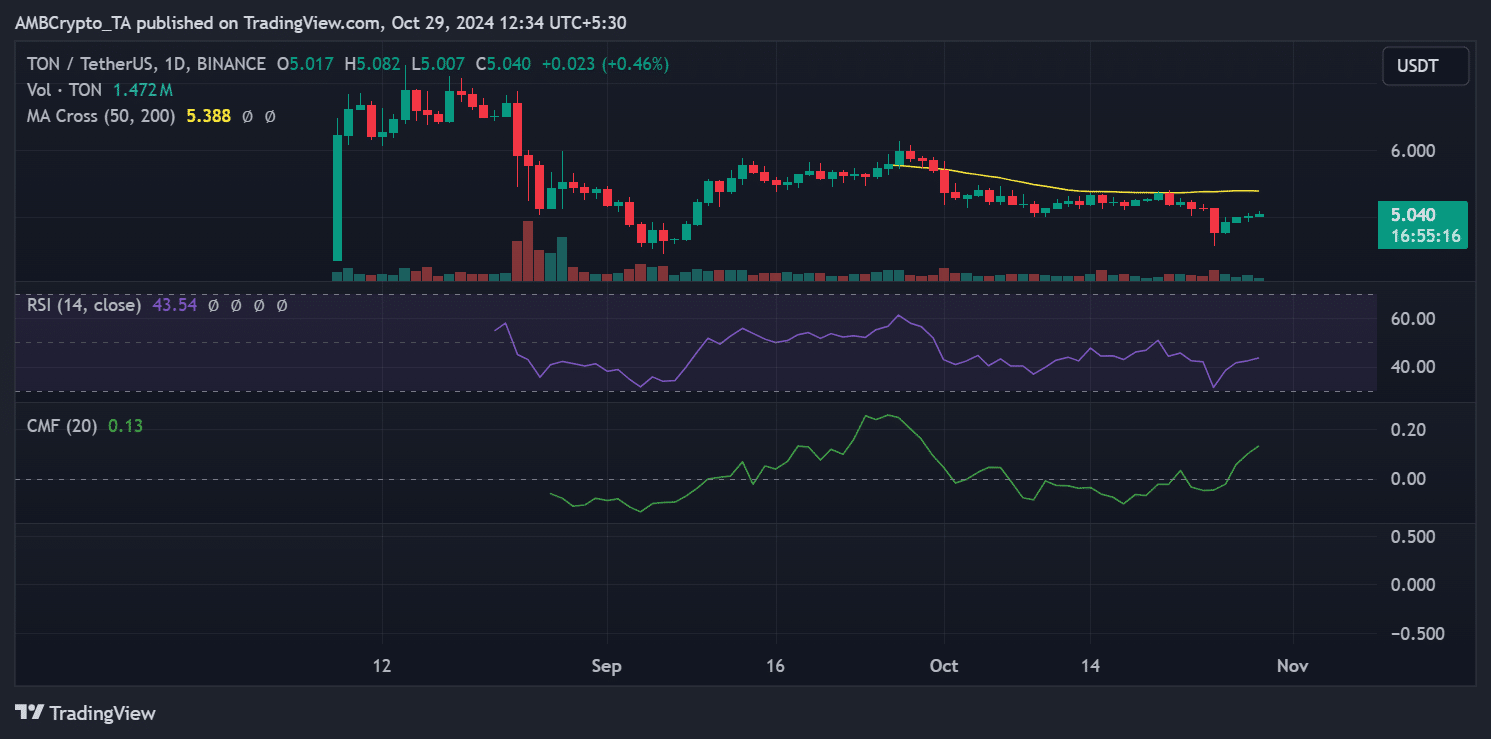

Currently, Toncoin is hovering at approximately $5.04, exhibiting a minor daily increase yet still under its 50-day moving average of $5.388. This suggests that Toncoin may be following a moderately bearish trend in the long term.

As a researcher, I’m observing that the Relative Strength Index (RSI) currently stands at 43.54. This indicates a neutral to mildly oversold state, potentially hinting at an opportunity for upward momentum if buying interest picks up.

In simpler terms, the Chaikin Money Flow (CMF) index, currently at 0.13, suggests that more money is flowing into the market than out of it, signaling a positive trend with some accumulation taking place. For TON to switch to a bullish phase, it needs to surpass its 50-day moving average.

If TON doesn’t maintain its rising trend, it could keep hovering at its current price level or even dip towards the nearby support of approximately $4.90.

In summary, although Toncoin’s expansion of holders is impressive, its profitability is still questionable. The future market performance of Toncoin will primarily hinge on if it manages to surmount these technical hurdles and maintain the attention of investors.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

2024-10-29 18:16