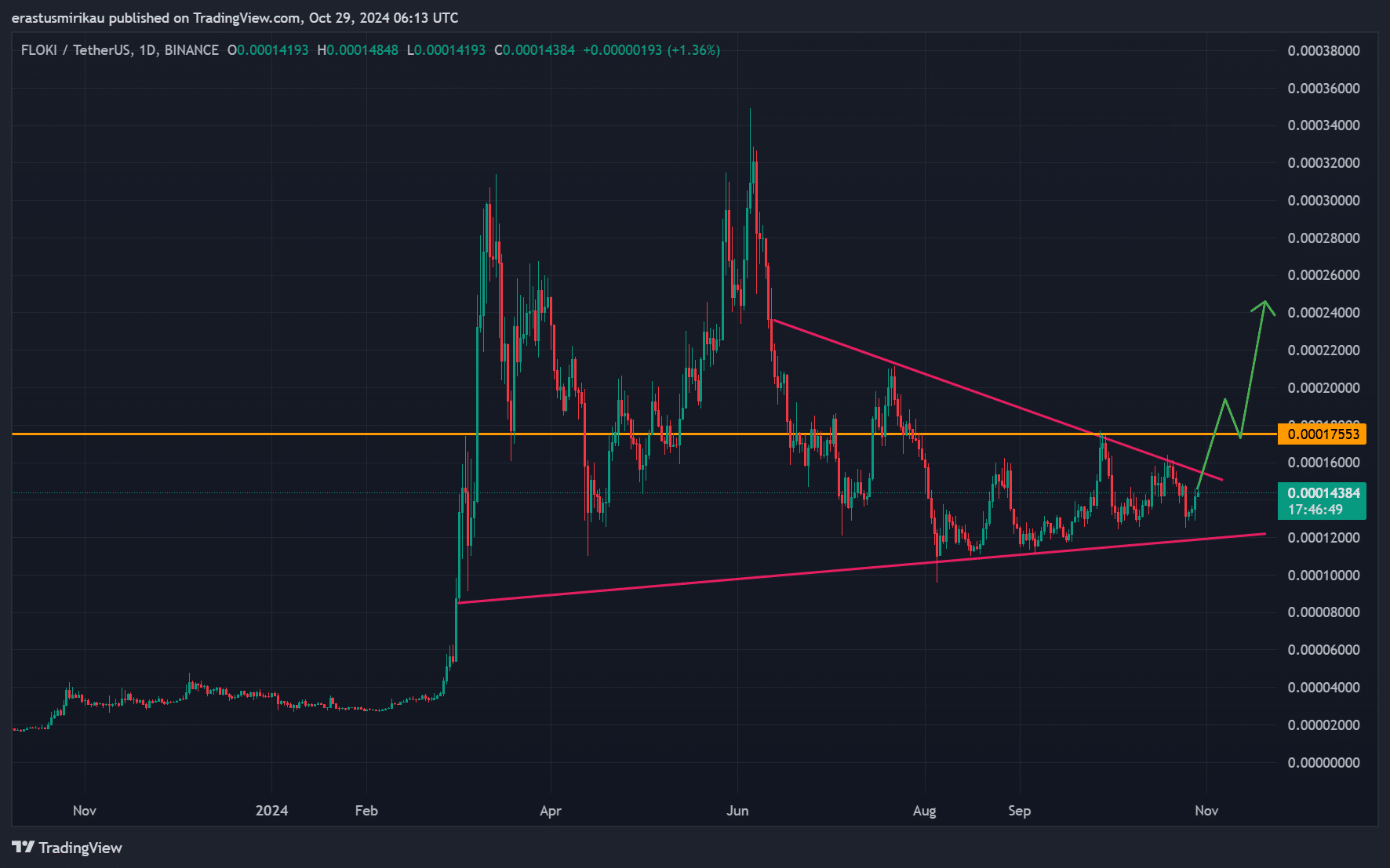

- Floki consolidates within a bullish pennant, approaches key resistance at $0.00017553.

- Positive technical indicators and rising open interest suggest strong market sentiment, indicating a potential breakout.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed countless bull runs and bear markets. The current consolidation of Floki [FLOKI] within a bullish pennant pattern at the key resistance level of $0.00017553 presents an intriguing opportunity for investors.

In simpler terms, the price of Floki [FLOKI] is holding steady within a narrow band, shaping up like a bullish flag or pennant pattern. As it approaches an important resistance level at $0.00017553, this point could act as a significant barrier to break through, potentially leading to a strong surge upward.

Currently, Floki is being exchanged for approximately 0.00014338 dollars, marking an impressive 9.14% surge. Could this memecoin manage to break through this resistance and leverage its current bullish trend to scale new heights?

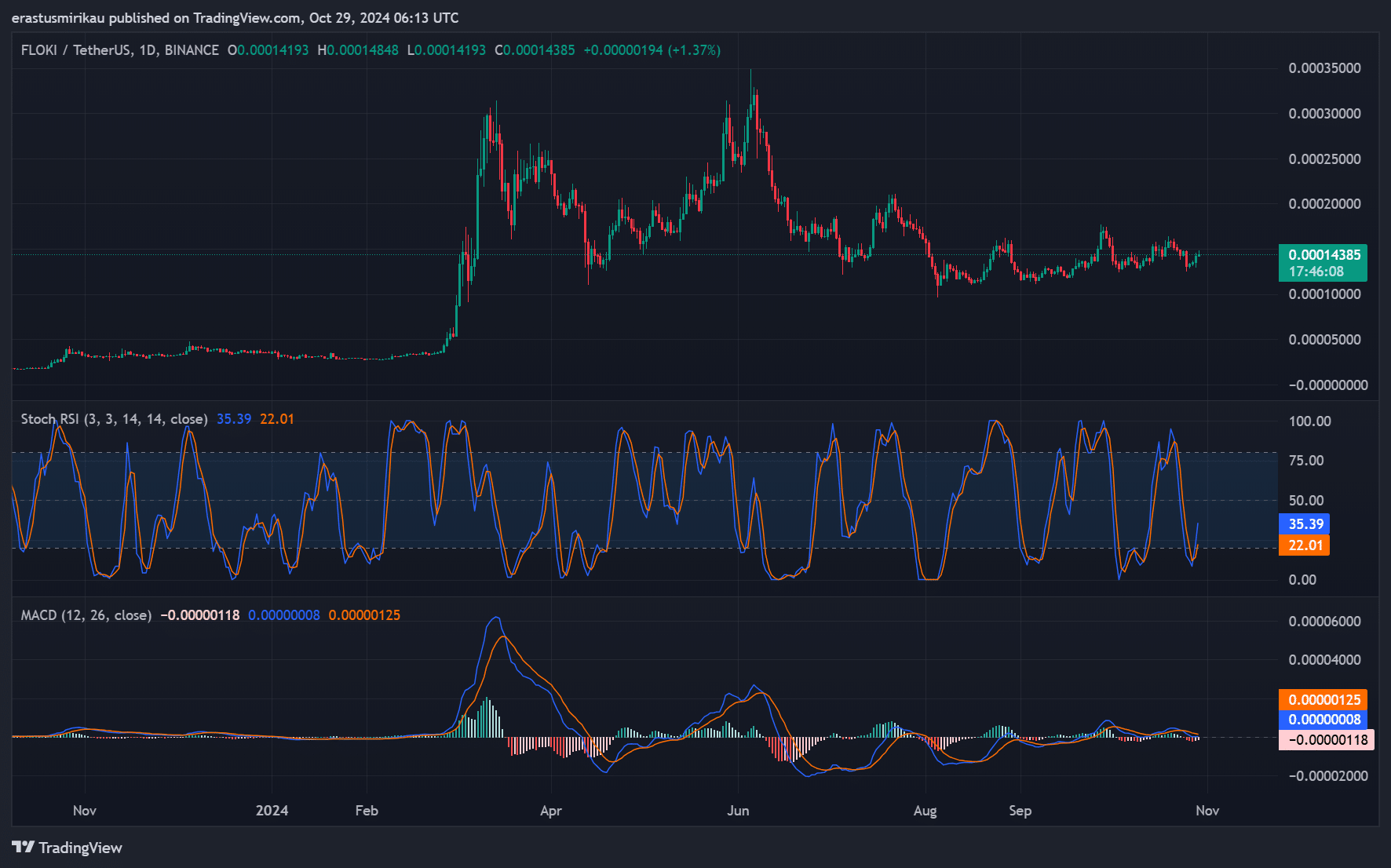

How does FLOKI technical analysis support a bullish outlook?

According to the technical indicators, there’s strong evidence pointing towards an imminent bullish surge. The MACD (Moving Average Convergence Divergence) indicates a bullish signal, hinting at possible increasing trends ahead.

As a researcher, I’ve noticed that the Stochastic RSI currently stands at 22.01 for Floki, suggesting it might be approaching oversold territory. Historically, this kind of positioning has often been followed by price rebounds, implying that buyers could potentially enter the market soon. Given these technical signals, there seems to be a growing probability of an upward breakout in the near future.

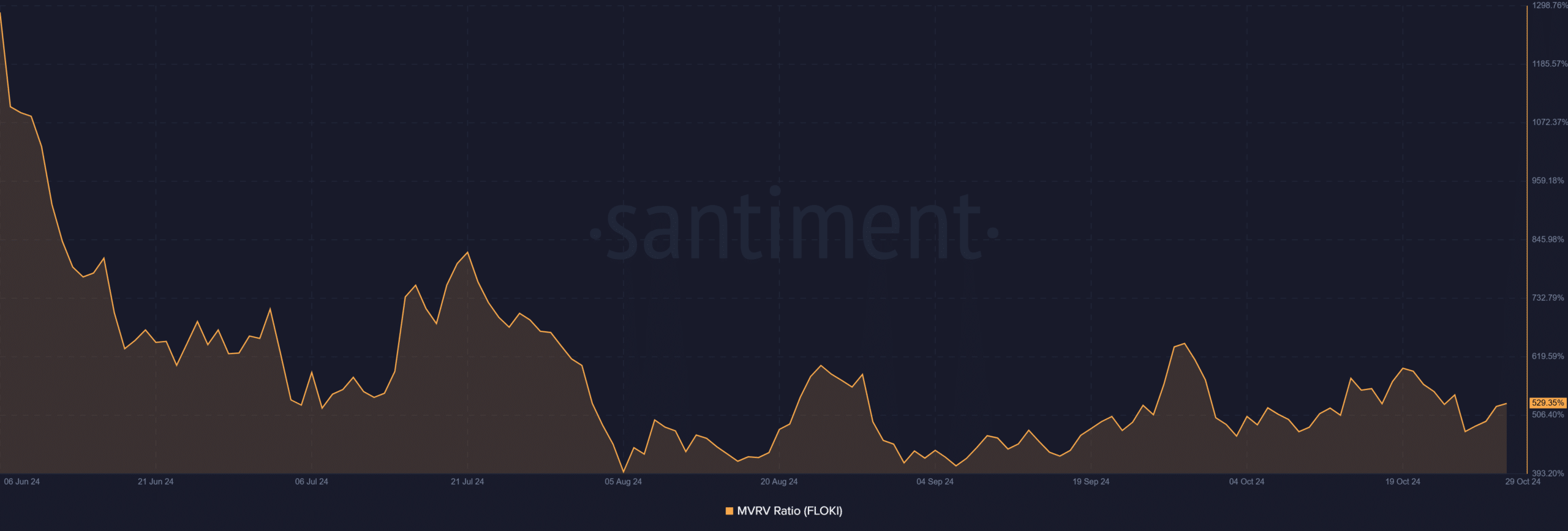

What does the MVRV ratio reveal about market sentiment?

right now, the Market Value to Realized Value (MVRV) ratio is a striking 529.35%, implying that investors have accumulated substantial unrealized profits. Generally, high MVRV ratios are a sign that investors might be preparing for profit-taking, which could indicate a more cautious market atmosphere.

Despite the current selling pressure, a bullish pennant pattern might counterbalance it, as traders are eager for a breakout. This could encourage a more optimistic outlook among investors, prompting them to keep their investments, thereby exerting continued upwards pressure on the price.

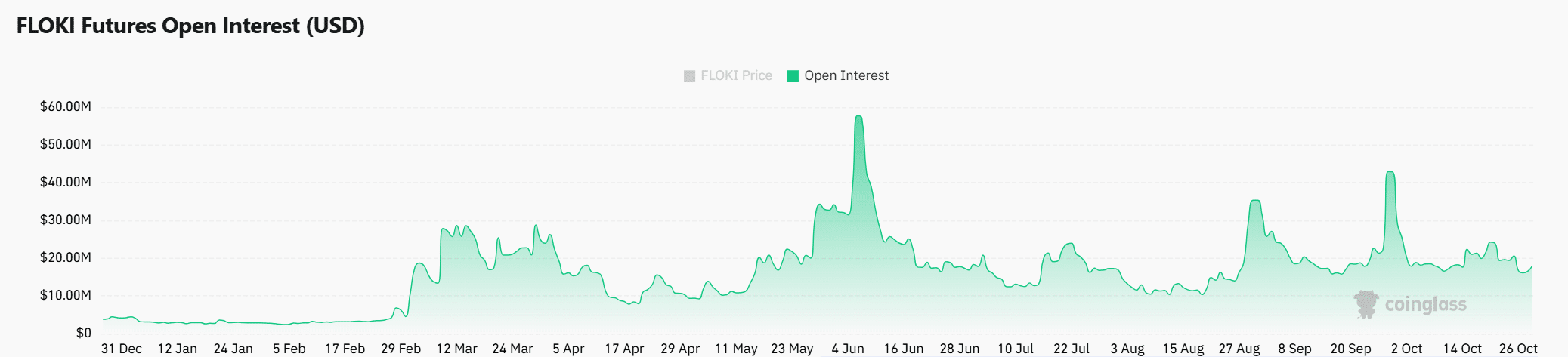

How does FLOKI open interest impact trading sentiment?

The open interest recently surged by 15.53%, reaching $18.84 million. This increase signals growing trader confidence in Floki’s upcoming price movement. Rising open interest typically suggests that more money flows into the market, often leading to significant price shifts.

Additionally, as more individuals place wagers on a surge in Floki’s pricing, it seems that traders are generally hopeful about the direction of its future market movements.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Is a breakout imminent?

The way Floki is currently gathering strength in a bullish pennant formation suggests a possible burst through the significant resistance point at $0.00017553. The technical signs, like MACD and Stochastic RSI, align with this optimistic forecast.

As a researcher, I’ve observed that a higher MVRF (Maker Value Ratio for Floki) and rising investor participation, as indicated by increasing open interest, suggest a favorable market atmosphere. If Floki Inu manages to break through the resistance level, it could potentially trigger a significant wave of bullish momentum.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-29 18:47