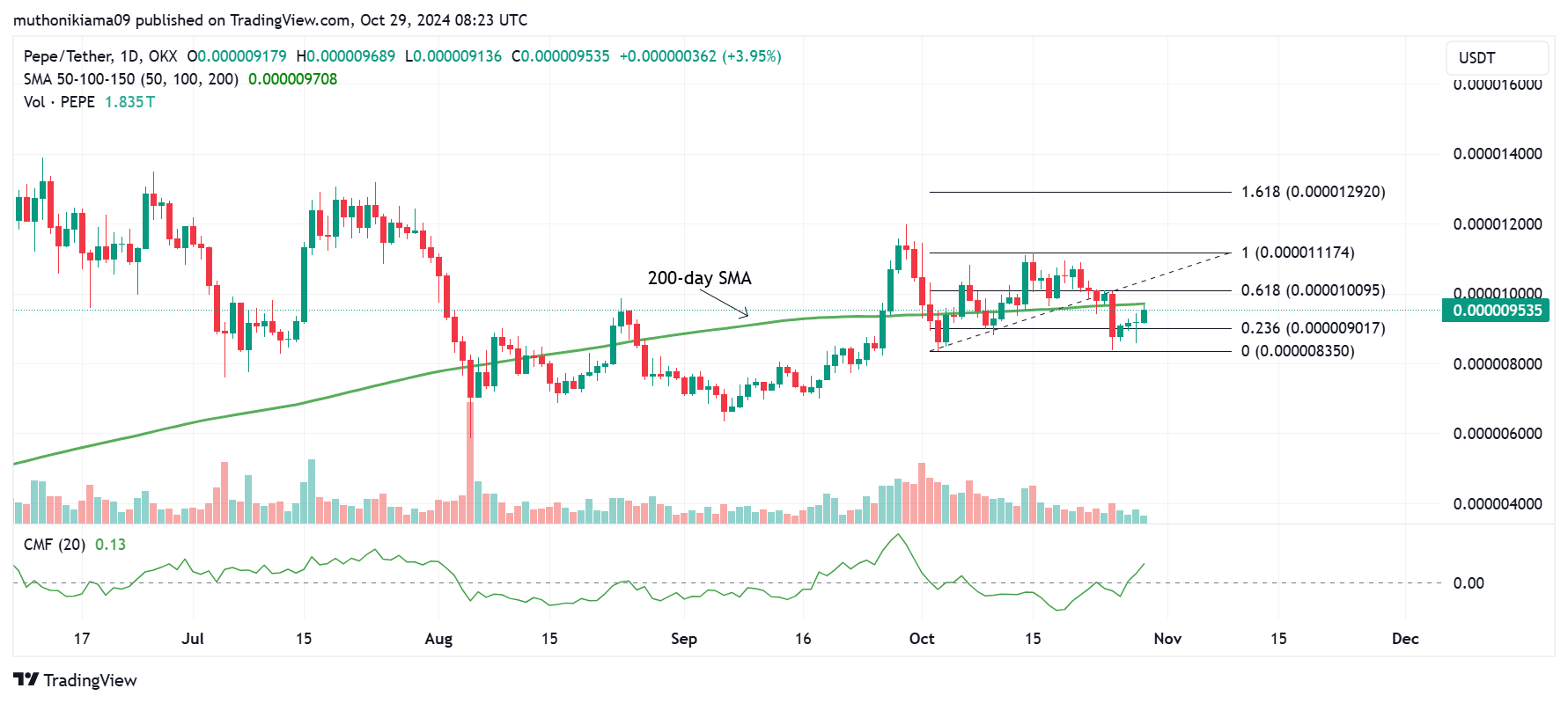

- PEPE has tested resistance at the 200-day SMA as bullish signs emerge.

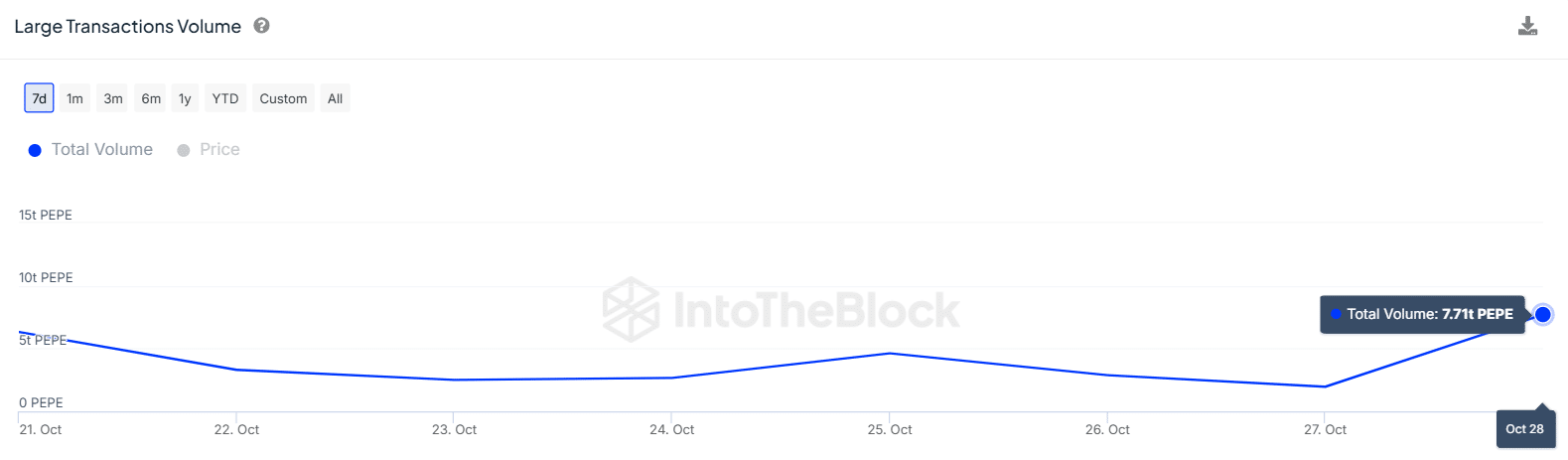

- Large PEPE transactions have also increased from 1.96 trillion to 7.71 trillion.

As a seasoned crypto investor with battle-hardened resilience, I find myself intrigued by the latest developments surrounding PEPE [PEPE]. With its recent 5.6% surge and bullish signs emerging, it seems we might be on the verge of another rally.

At the moment of writing, PEPE was trading at $0.00000947, marking a 5.6% increase over the past day. This upward movement coincides with a positive trend observed throughout the broader cryptocurrency market. However, it’s important to note that over the last week, PEPE has experienced a decline of approximately 7%.

On the one-day chart, several positive indicators are emerging for the meme coin PEPE, hinting at a potential further surge in its price.

As an analyst, I’ve observed that PEPE has been consistently trading beneath its 200-day Simple Moving Average (SMA) since mid-October, suggesting a prolonged downtrend in the market. Yet, there seems to be a potential shift in trend direction following a recent test of resistance at this significant level.

If this resistance is overcome, it might bolster the upward trend since overcoming it would suggest a shift in momentum towards bullish.

The Chaikin Money Flow (CMF) indicates an increase in buying activity over selling activity, suggesting that demand is strengthening.

Currently, the CMF stands at a favorable 0.18 figure, indicating growing enthusiasm for the meme coin. Additionally, the upward trend of the volume histogram bars over the past four days suggests that buyers have outnumbered sellers during this period.

If the positive momentum persists and PEPE manages to surpass its current resistance at $0.0000097, it may initiate a potential 36% surge, reaching approximately $0.0000129 – a level that aligns with the 1.618 Fibonacci extension.

PEPE whale transactions surge

According to data from IntoTheBlock, there’s been a notable surge in large PEPE transactions over the past day. These large transactions jumped from approximately 1.96 trillion, worth around $17 million, to a staggering 7.71 trillion, equating to about $70 million.

Approximately half of the total PEPE supply is held by whales, with around a quarter controlled by retail traders. This means that any significant rise in transactions conducted by these large investors could potentially impact the volatility of PEPE’s price.

It’s possible that these whales are investing in PEPE, as a surge in activity occurred around the same time as the price increase and heightened buying interest. If the overall positive market momentum persists, the meme coin might continue to rise in value.

Read Pepe’s [PEPE] Price Prediction 2024–2025

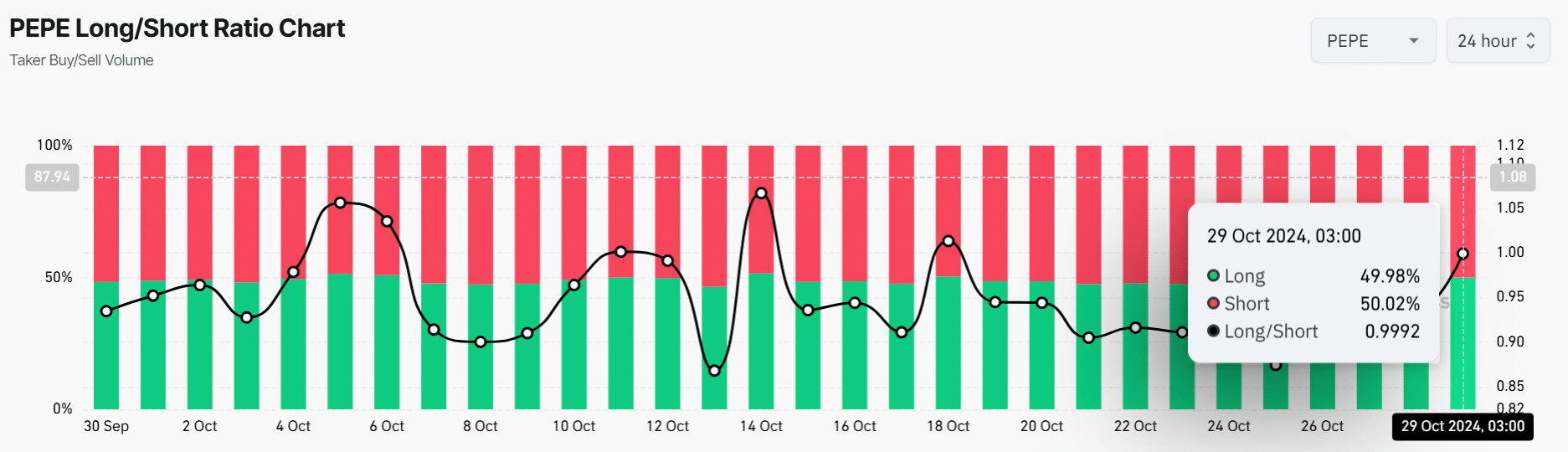

Over the past few days, there’s been a growing optimism towards PEPE, as indicated by the rising long/short ratio. Specifically, this ratio has climbed from 0.87 to 0.99 within the last three days, suggesting that traders are gradually shifting their strategy from holding long positions to opening short ones.

According to data from Coinglass, the PEPE funding rates have hit a new weekly peak. This indicates that an increasing number of traders are creating more long positions.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-30 06:16