- Bitcoin surged past $70,000 as the Stablecoin Supply Ratio Oscillator highlighted high demand

- Open interest in Bitcoin climbed by 8.85%, suggesting potential for further bullish momentum

As a seasoned researcher with a decade of experience in the cryptocurrency market, I’ve seen Bitcoin’s rollercoaster ride more times than I care to remember. However, the recent surge past $70,000 and the concurrent strengthening of various fundamental metrics has left me both intrigued and cautiously optimistic.

Over the past few weeks, I’ve been persistently attempting to breach the $70,000 resistance as a researcher closely watching Bitcoin’s movements. Now, it appears my patience has paid off, as at press time, Bitcoin has surged beyond this crucial barrier and is trading around $72k. The last 24 hours have been particularly noteworthy for Bitcoin, with the cryptocurrency increasing by approximately 3.9%. This recent price action has undeniably piqued the interest of many in the crypto world.

In my exploration, I’ve noticed an upward bounce in the Bitcoin market, signified by several key market indicators. This surge suggests that investor trust in Bitcoin is gradually being restored.

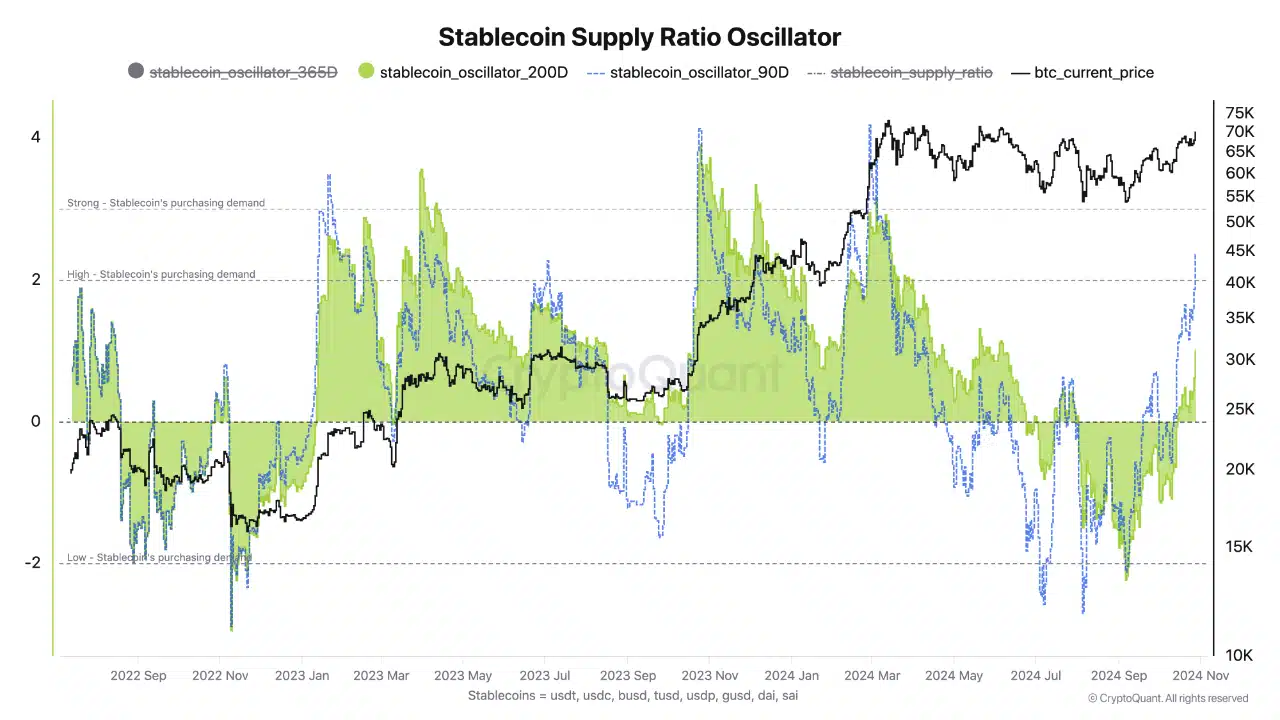

BinhDang, who works as an analyst at CryptoQuant, pointed out that there’s a renewed interest in Bitcoin (BTC), based on his observation of the Stablecoin Supply Ratio Oscillator (SSRO).

The SSRO compares Bitcoin’s market capitalization with that of stablecoins such as USDT, USDC, BUSD, and others, providing information about demand for these stablecoins driving Bitcoin purchases. As per BinhDang, the oscillator’s figures indicated a rise in interest for buying Bitcoin using stablecoins, a trend also observed when Bitcoin reached its lowest point at the end of 2022.

Currently, when I’m writing this, Bitcoin’s 90-day Simple Shifting Range Oscillator (SSRO) suggests a rebound in quarterly demand that has gone beyond the 2-point positive mark. As we move into November with this demand persisting and positive economic news on the horizon, Bitcoin might solidify its position even more, possibly reaching new record highs.

Other key metrics show strengthening fundamentals

In addition to its fluctuating market value, Bitcoin’s underlying key performance indicators are demonstrating a resurgence in power.

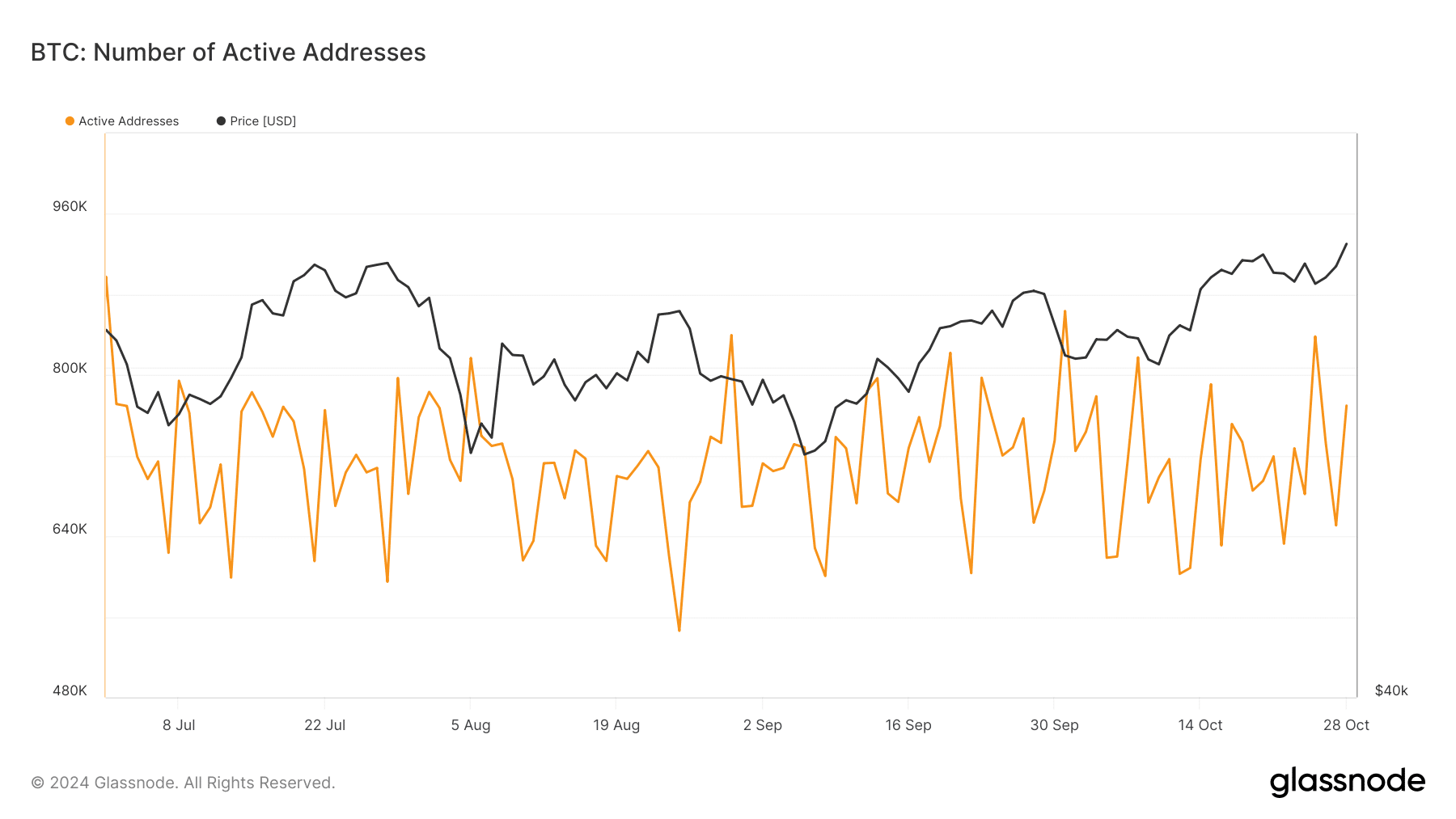

indeed, data from Glassnode shows a rise in the number of active Bitcoin addresses recently, hinting at more individuals returning to the market. By the end of October, these active addresses exceeded 760,000, marking an increase from around 700,000 only a few days earlier.

The changes in this metric suggest a shift in market involvement, as the recent increase indicates revived curiosity. This surge in interest typically aligns with positive price movements. More frequent transactions happening across Bitcoin addresses usually signify increased activity on the BTC network, which is often a positive sign of growing demand and market dynamism.

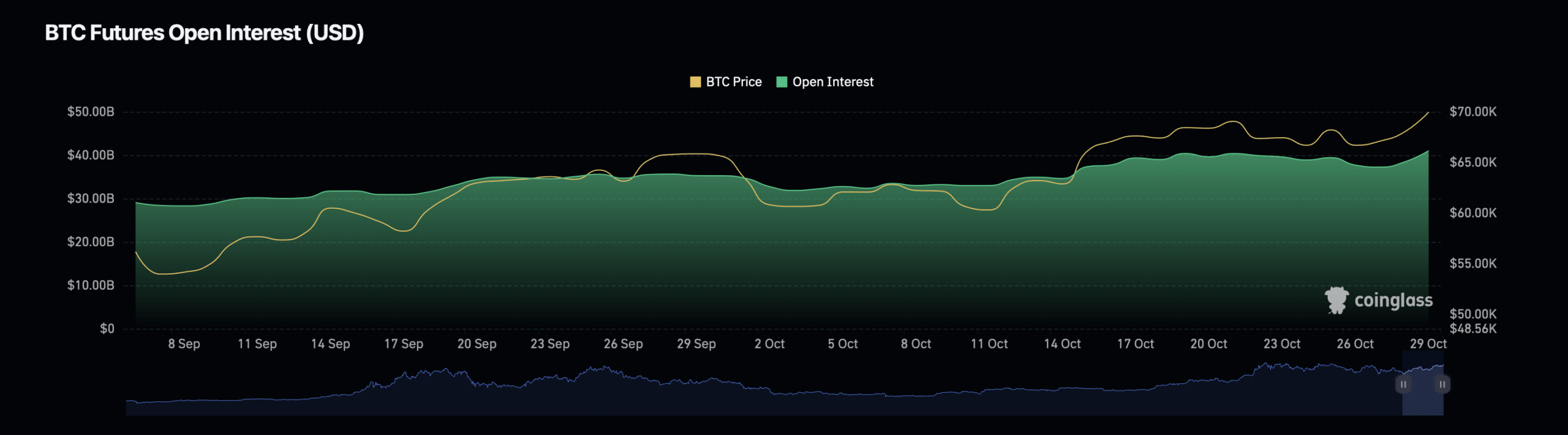

At the same time, the amount of Bitcoin’s Open Interest, monitored by Coinglass, increased by 8.85%, reaching a total of $42.56 billion. This significant rise in Open Interest is worth noting because it also saw an increase of 118.55% in volume to $80.43 billion. This shows that there has been a greater involvement from Futures and derivatives traders.

An increasing number of investors pouring their funds into the market often indicates a surge in Open Interest. This influx can generate momentum, causing prices to escalate as traders prepare for Bitcoin’s possible future shift, aiming to profit from it.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-10-30 10:15