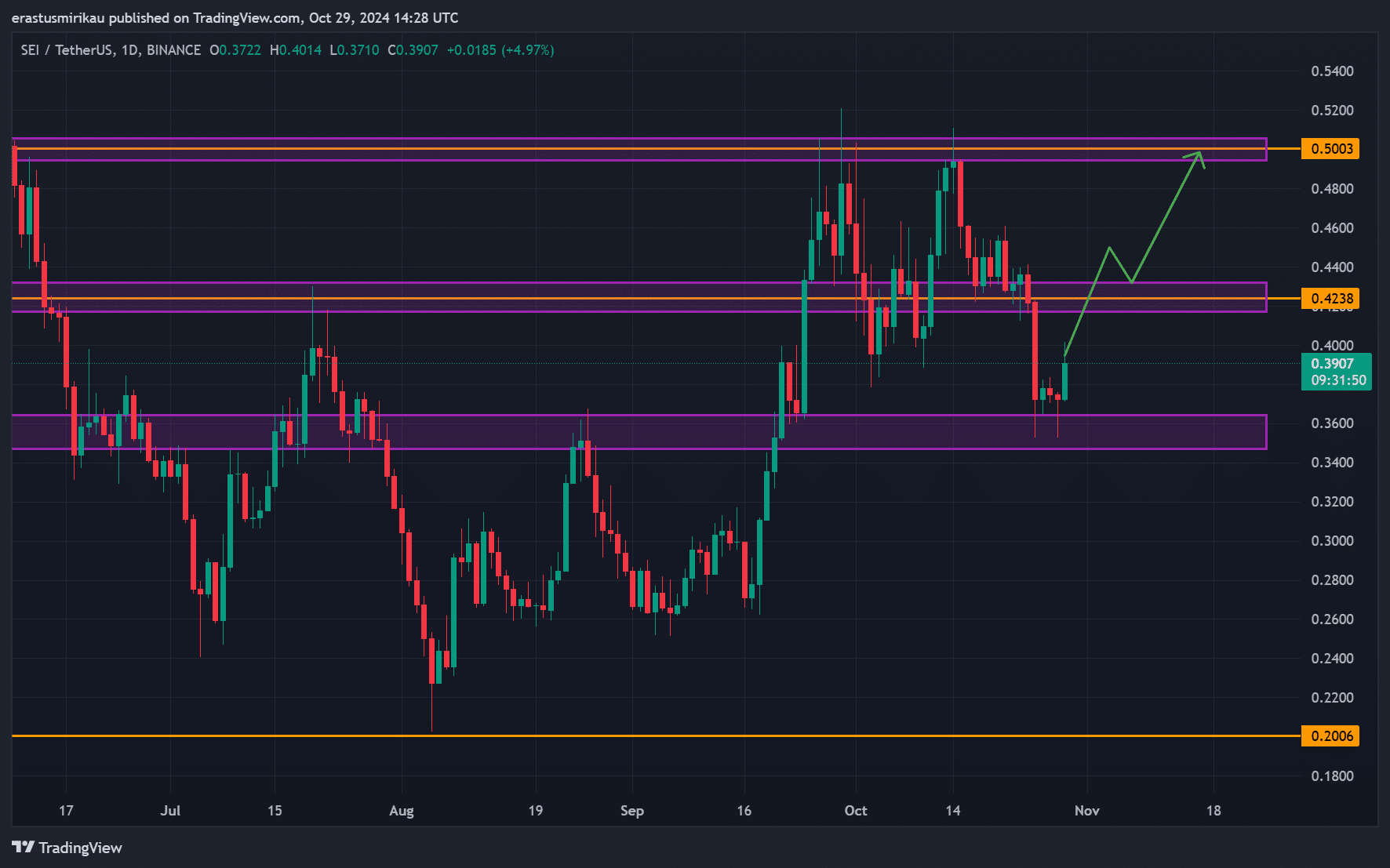

- At the time of writing, SEI was testing the key resistance at $0.40, with indicators showing potential bullish momentum

- Whale accumulation and rising Open Interest signaled confidence, but volatility risks remain

As a seasoned researcher with years spent navigating the volatile waters of the crypto market, I find myself intrigued by the current state of SEI. This altcoin has managed to grab my attention with its impressive integration into Orderly’s cloud liquidity, connecting over 30 DEXs and 60 markets in a single stroke. The resulting rally is certainly noteworthy, pushing SEI up by 8.33% to $0.396 at press time.

In an exciting development, Sei Network has joined forces with Orderly’s cloud liquidity platform, linking over 30 decentralized exchanges (DEXs) and approximately 60 markets in the process. This integration has ignited a substantial price increase, causing SEI to rise by 8.33% to $0.396 as of the latest news update.

As a crypto investor, I’ve witnessed an impressive surge pushing SEI closer to its significant resistance at around $0.42. This crucial barrier could shape its future course. If it manages to break through this resistance, it might pave the way towards challenging the next substantial level around $0.50 – a positive sign for investors.

As a crypto investor, I’ve been tracking the performance of this altcoin closely. If it can’t sustain its current upward trend, we might see a dip, with the coin possibly testing the $0.36 support level. This makes the situation for SEI quite critical right now. Any movement could significantly shape its short-term trajectory.

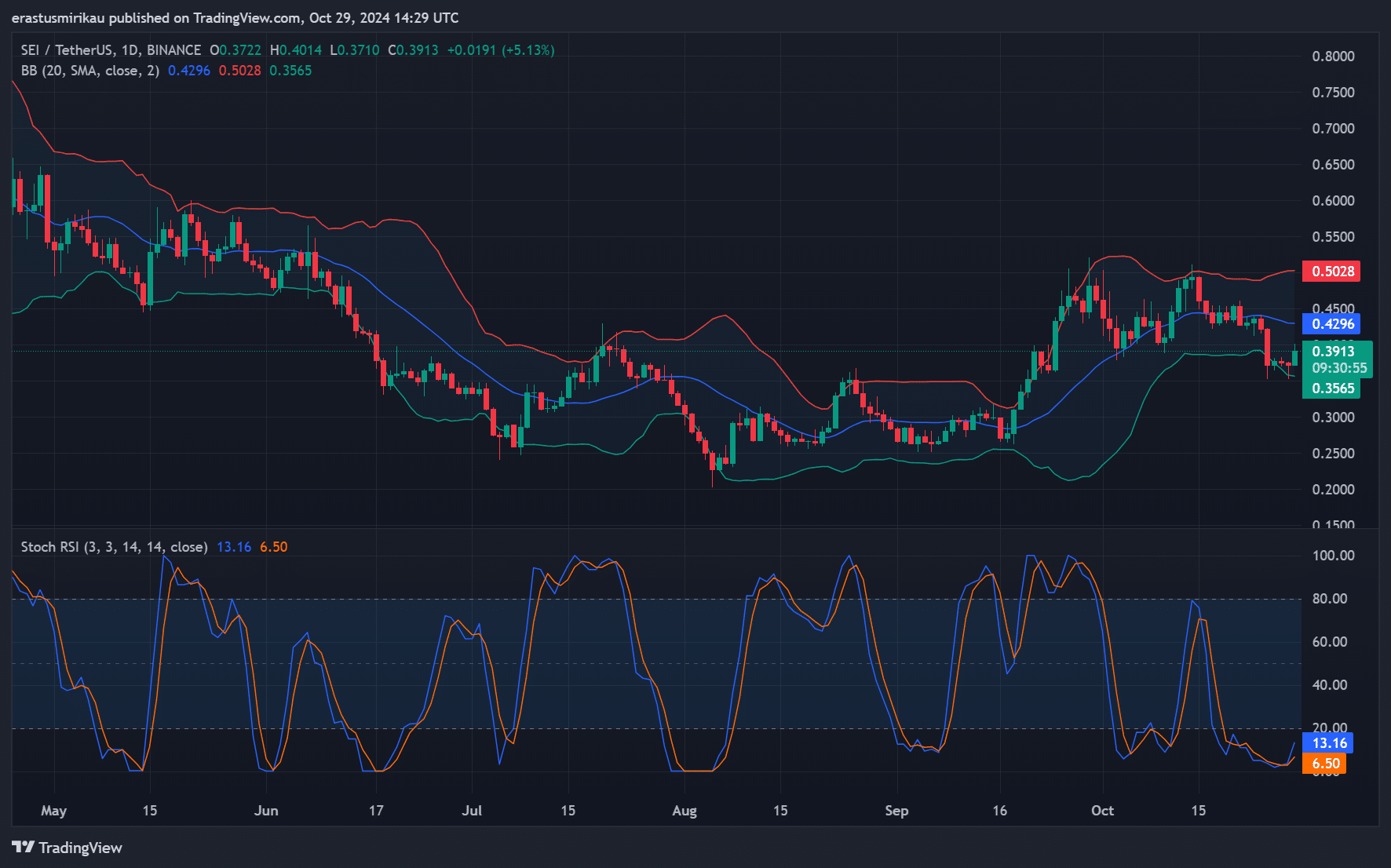

Technical indicators – Bollinger Bands and STOCH RSI

According to SEI’s technical analysis, its current trend became clearer through various indicators. The Bollinger Bands, which had an upper band at $0.4296 and a lower band at $0.3565, indicated a high level of market volatility. Since SEI was trading close to the middle of these bands, it suggested a neutral position; a move above the middle could potentially signal a bullish trend towards the upper limit.

Conversely, a drop could test the lower band, adding selling pressure.

Additionally, the Stochastic Relative Strength Index (RSI), indicating momentum, highlighted a bullish divergence where the K line was at 13.16 and the D line was at 6.50. This rise from an oversold area suggests a possible increase in positive price movement.

Consequently, it’s important for the altcoin to maintain this signal to prevent a swift reversal, similar to past trends. Keeping an eye on these indicators is essential for spotting changes in direction.

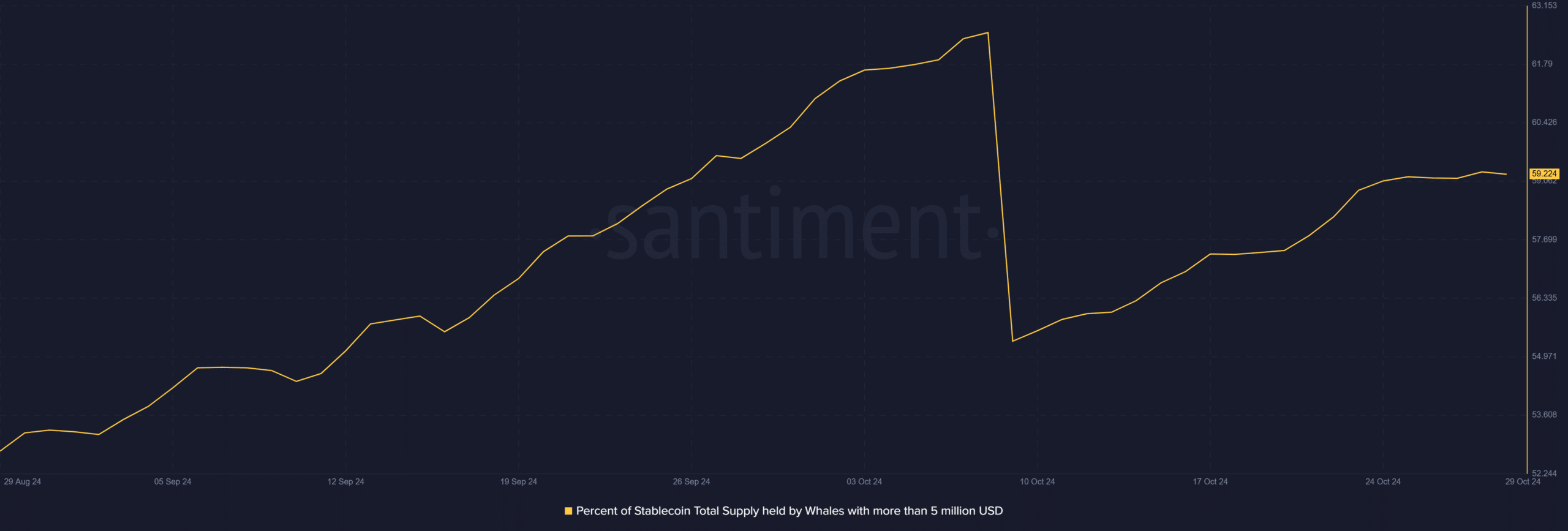

SEI whale activity – Are top holders backing this rally?

Moreover, the whale behavior reinforces the confidence in SEI. Currently, approximately 59.22% of the stablecoin reserve resides within wallets that hold more than $5 million, indicating a substantial buildup by major stakeholders.

As a result, when large investors (often referred to as “whales”) buy more of an asset, the supply on the market decreases, leading to scarcity. This scarcity can cause prices to increase significantly. So, if these whales continue to accumulate this asset, it could strengthen SEI’s growth trend in the DeFi sector, laying a solid groundwork for further expansion within the decentralized finance space.

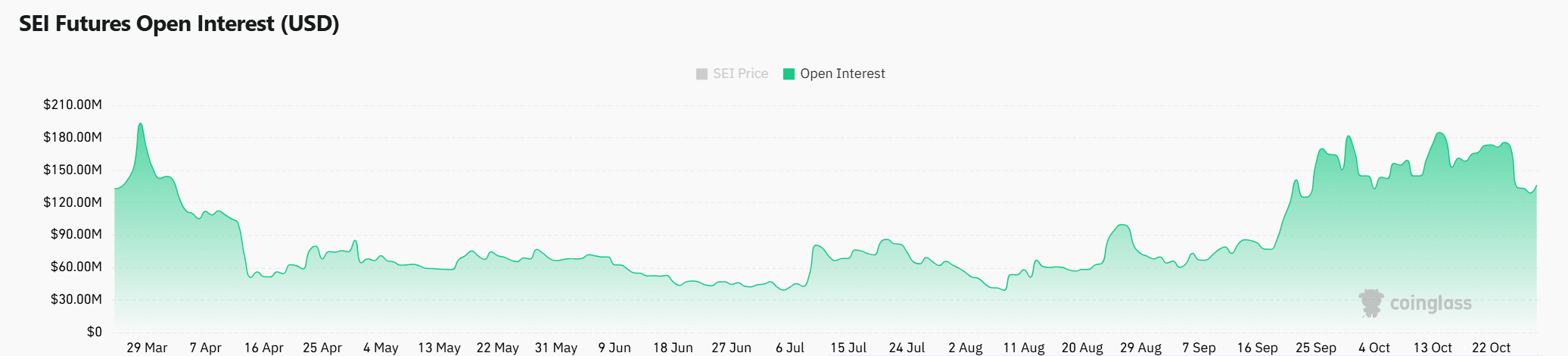

Open Interest analysis – Rising interest and its implications

Additionally, Open Interest grew by 9.93%, reaching $144.47 million, demonstrating increased enthusiasm among traders. A higher Open Interest indicates greater confidence in the altcoin’s potential price trend and coincides with its recent spike in trading activity.

Yet, an increase in Open Interest often indicates a strong market, but it may also signal impending volatility since more traders are expecting substantial price shifts. Thus, monitoring Open Interest closely might offer insights into the likely direction of SEI’s next major price movement.

Realistic or not, here’s SEI’s market cap in BTC’s terms

Can SEI maintain its momentum?

Sei Network’s strategic DeFi integration, bolstered by whale interest and rising Open Interest, supported a bullish case for SEI. Technical indicators and whale backing further highlighted its potential.

Yet, overcoming the $0.40 barrier is crucial to maintain positive momentum. If successful, it will bolster its reputation as a significant DeFi player, encouraging more investor trust and expansion.

Read More

2024-10-30 12:08