- BTC might eye $84K next, according to CryptoQuant data.

- There was more headroom for BTC growth amid renewed whale bets.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous bull runs and bear markets. The current Bitcoin (BTC) rally is reminiscent of the 2017 bull run, albeit with a more mature market structure.

On October 29th, the value of Bitcoin [BTC] reached approximately $73,000 and increased its control over the market to an unprecedented 60%. This additional surge brought it closer to a new record peak (fresh all-time high or ATH), as experts predicted even greater opportunities for growth.

Is $84K the next target?

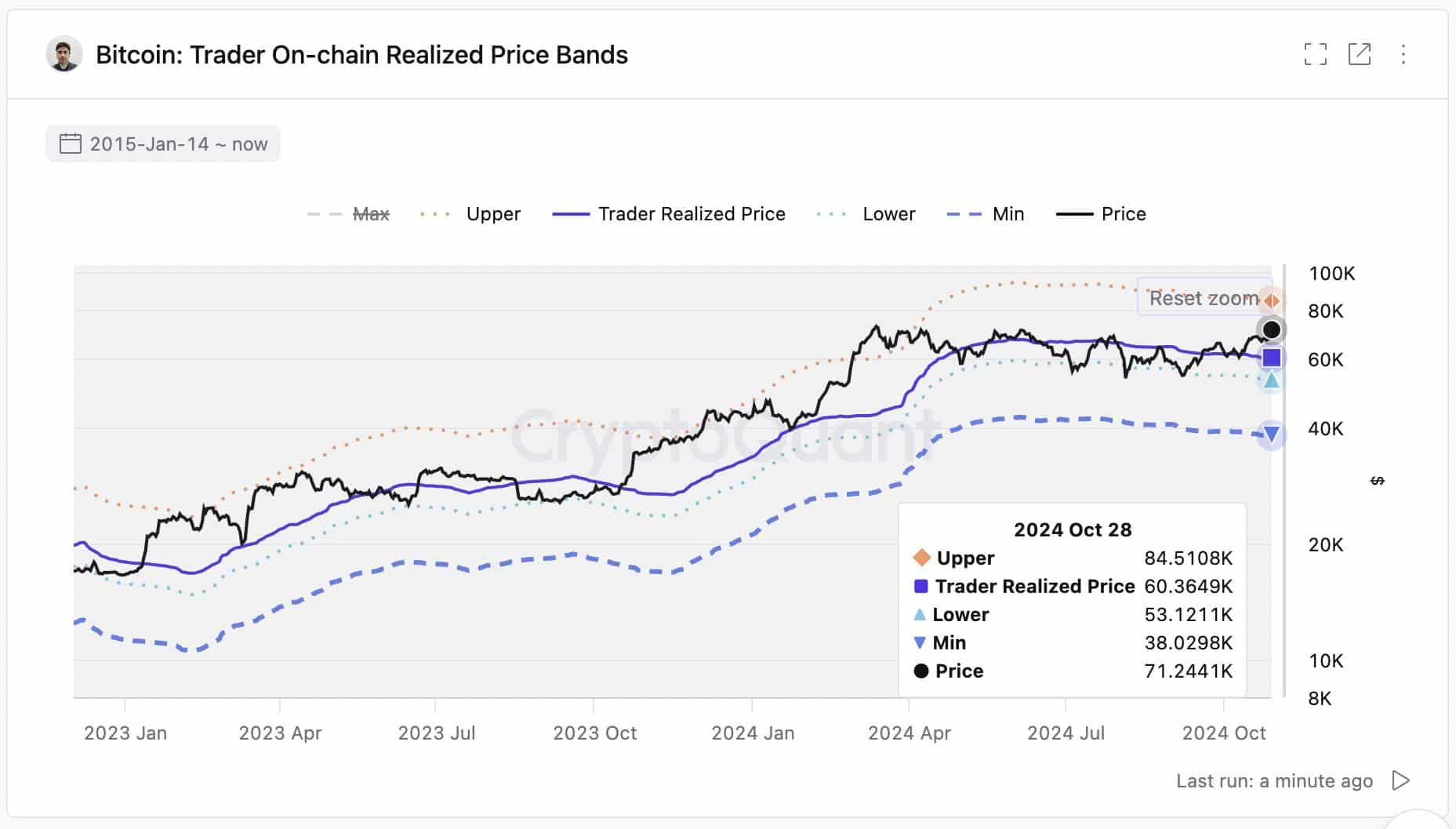

As a data analyst, based on the insights from CryptoQuant’s Head of Research, Julio Moreno, I foresee a potential new target at around $84,000 if the all-time high (ATH) in March of $73,700 is surpassed. This projection comes directly from his recent statements.

Currently, Bitcoin is close to reaching a new all-time high. From a valuation standpoint, it’s expected that the price could potentially hit around $84,000 (which represents the upper limit).

For those new to this, the “on-chain realized price band” is a method used for evaluating Bitcoin’s value, which is derived from past Bitcoin price trends.

The system refers to the average cost at which Bitcoin has been sold by short-term traders (known as the realized price), and sets upper and lower boundaries around it as potential points of resistance and support in the market.

If Bitcoin’s recent trend keeps it trading above its current price, the nearest objective would be the resistance level at $84K, as long as the price maintains above $60K.

As a crypto investor, I find it plausible that we might reach the $84K mark, considering BTC options traders have set their sights on $80K by the end of November, irrespective of the outcome of the upcoming US elections.

As mentioned, the existing market framework seems to have ample potential for expansion, a point underscored by Mathew Siggel, who heads digital assets research at VanEck.

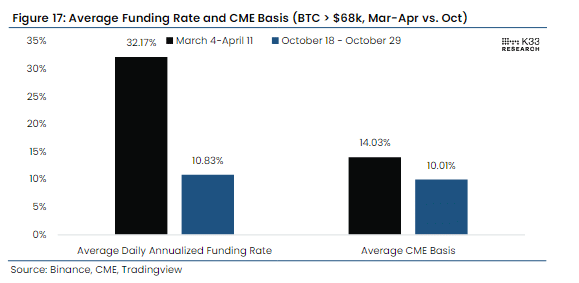

Siggel noted that even though Bitcoin was approaching a new all-time high, the market wasn’t as frenzied as it had been in March and April.

Previous high points in Bitcoin (BTC) have often been preceded by escalating perpetual futures premiums, but this situation is markedly different now. Furthermore, the current trading volumes on the spot market are only half of what they were in March and April, suggesting significantly reduced panic buying among retail investors. This reduction in retail participation could be a positive sign for the continued resilience of BTC’s strength.

As a researcher, I can succinctly say that the market has exhibited greater stability compared to the frenzy observed in March, when Bitcoin achieved a record high (ATH).

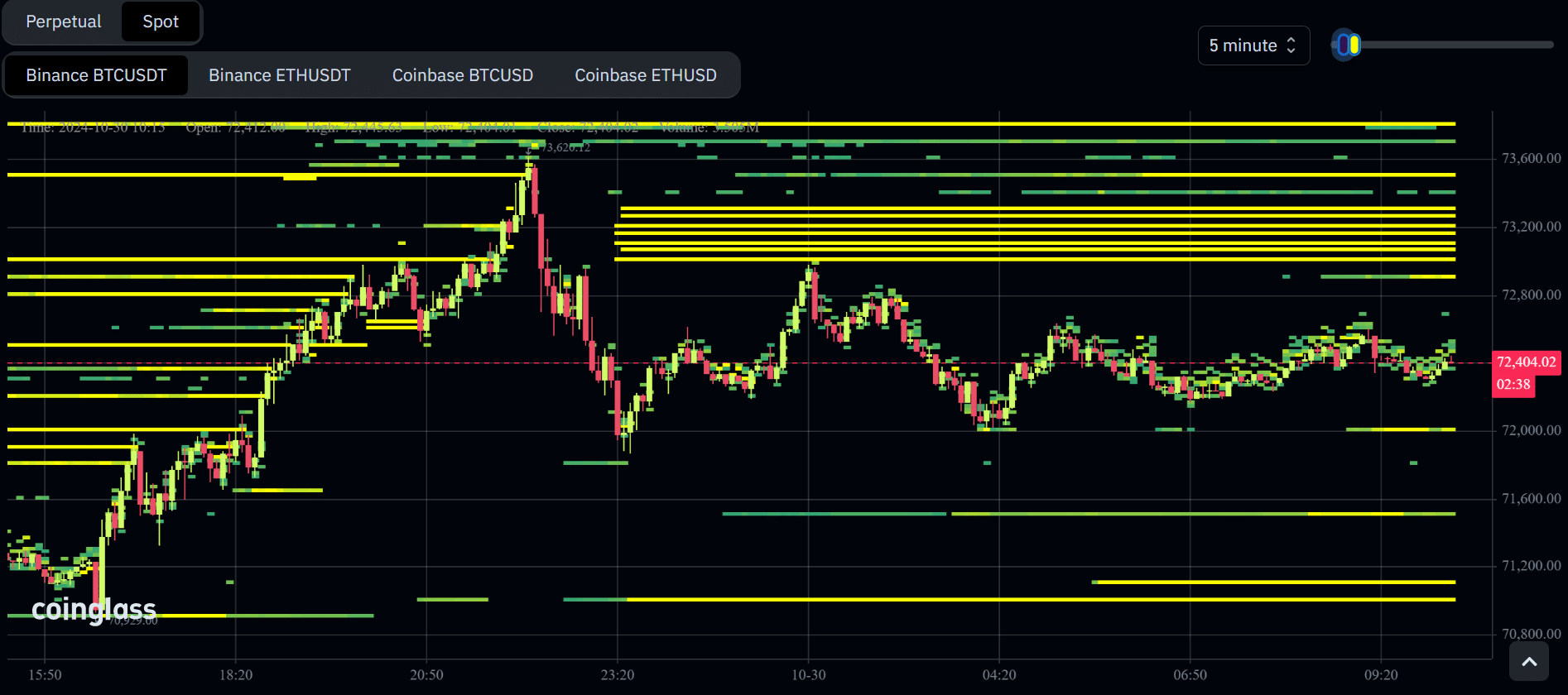

However, it’s important to note that despite reaching the March All-Time High (ATH), there were some temporary obstacles on Binance spot. At around $73.2K and $73.8K, there were significant selling points (resembling yellow lines) which might slow down the price movement for a brief period, possibly extending up to several hours or even days.

Read Bitcoin [BTC] Price Prediction 2024-2025

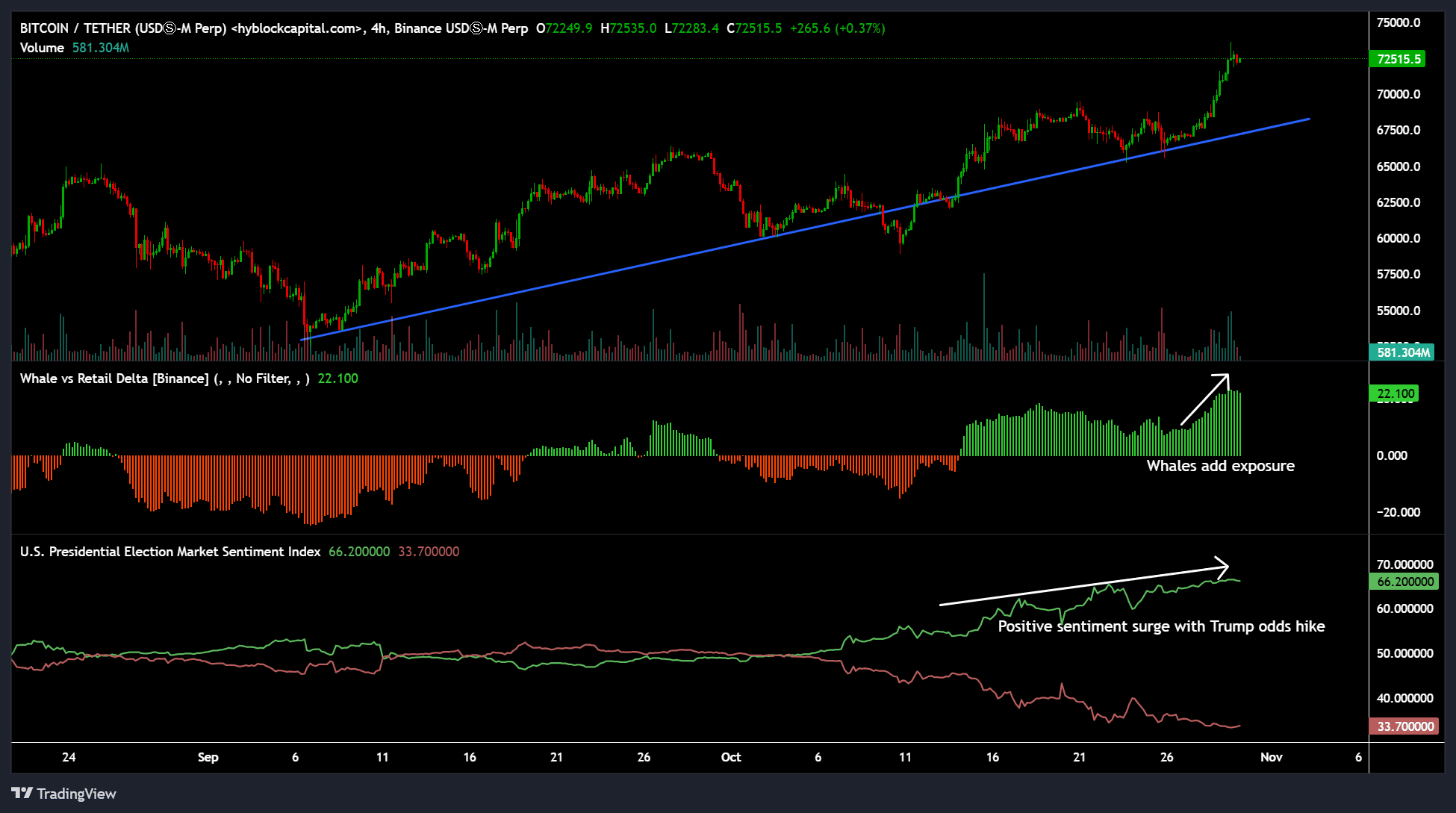

As an analyst, I must admit that despite my initial doubts, whales have displayed unwavering resolve and strong optimism. In point of fact, the surge towards $73K appears to be primarily fueled by major players who’ve been increasing their involvement significantly over the past five days.

This was illustrated by the rising Whale to Retail Delta indicator, suggesting that large players were more bullish on BTC than retail at current levels.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-30 14:18