- Only half of +$1 billion TIA from token unlock could hit the market.

- Will the reduced sell-off risk boost TIA prospects?

As a seasoned crypto investor with a knack for deciphering market trends and navigating through turbulent waters, I find the recent development regarding Celestia’s TIA token quite intriguing. With only half of the $1 billion worth of tokens expected to hit the market, the reduced sell-off risk could indeed boost TIA prospects significantly.

Based on a report from an over-the-counter dealer, it’s possible that the unlocking of Celestia’s TIA tokens with a value exceeding $1 billion may not lead to as much selling pressure as initially expected.

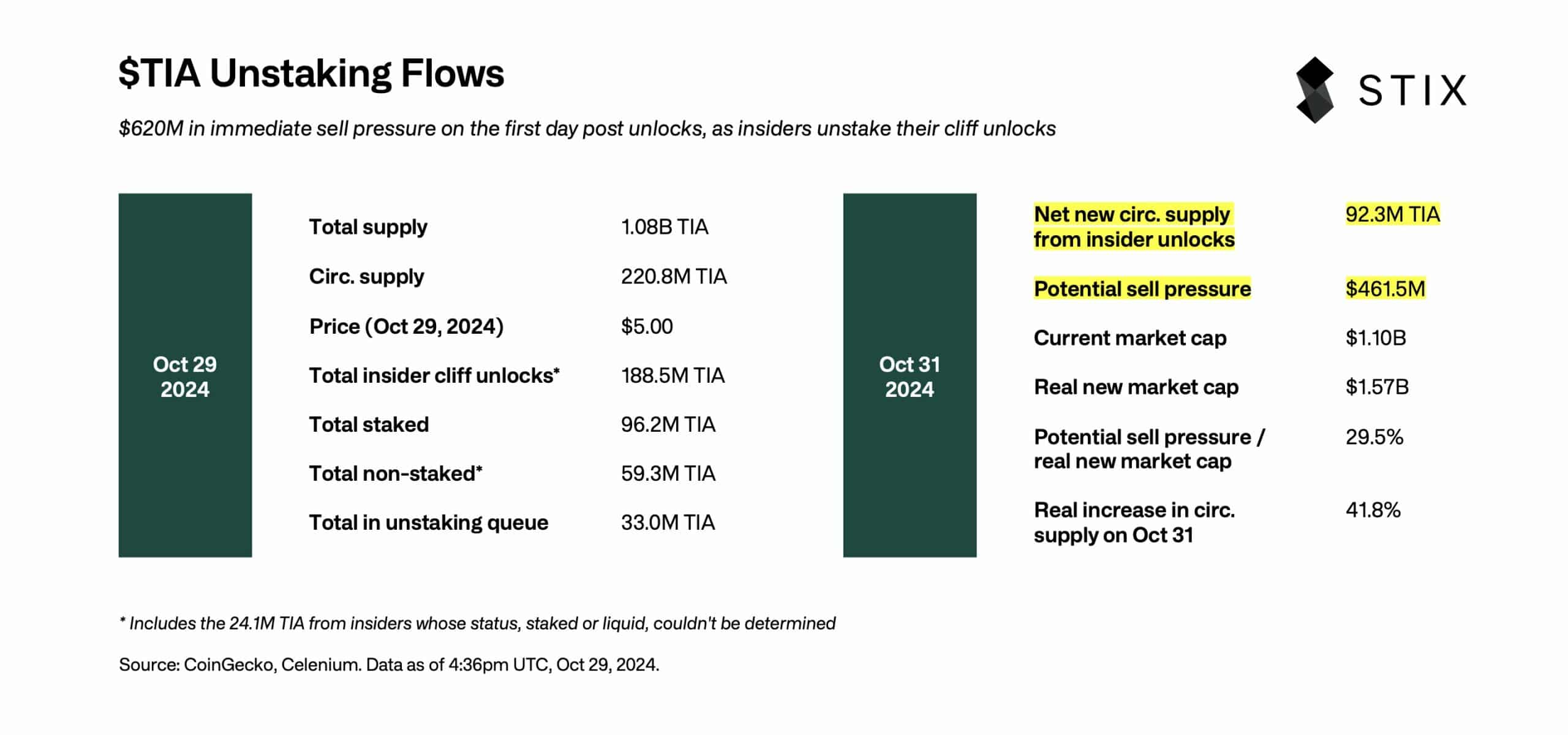

According to Taran Sabharwal, founder of the crypto OTC firm Stix, approximately half of the sell pressure might arise from the release of tokens (which amounts to 188.5 million tokens). This is because only about half of these tokens have been unstaked for potential selling by October 31st.

In summary, 92.3 million dollars worth of TIA will be available for trading after being released from lockup, setting the maximum potential amount that could be sold in the market.

He added,

1) “This amounts to a maximum selling pressure of approximately $460 million. It’s noteworthy that this represents less than 50% of the total cliff unlocks. This implies that the anticipated sell pressure is only half of what was expected.

Better for TIA price?

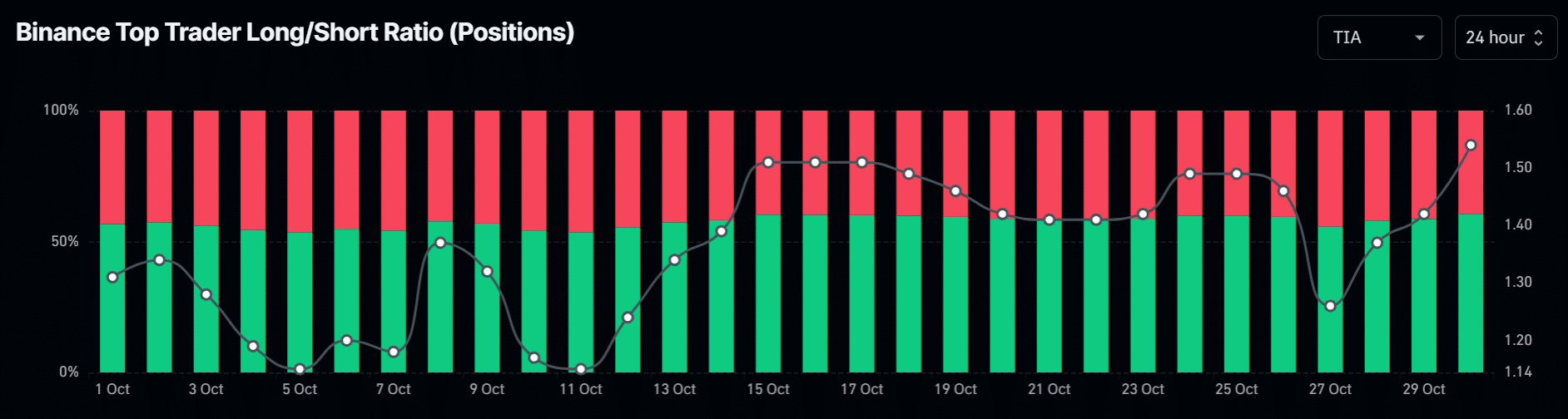

In simpler terms, Sabharwal stated that the unlock could act as a positive indicator for immediate buyers since many short positions were created during the initial unlock, and these will eventually close.

It’s likely that many of these short positions will gradually decrease, reducing some of the selling pressure in the market. This adjustment in financing could potentially indicate a positive sign for those buying directly (spot buyers).

Other users shared a positive viewpoint, anticipating that any possible price drop would offer a favorable opportunity for establishing long positions. One user even highlighted this.

As more unlocks are being bought up by the market and short positions are being closed, investing in $TIA might be an excellent opportunity for those who believe in the storyline of Ethereum‘s modularity.

Although TIA could be unpredictable in the near future due to market volatility, Simon Dedic suggested it was a promising scenario overall.

As an analyst, I’m observing a potential volatility in the near future, but I believe this could pave the way for a significant bullish trend. Given Celestia’s strategic position as the preferred data availability layer, the token $TIA might be gearing up for a surge reminiscent of $SOL‘s movement.

As a DeFi analyst myself, I can’t help but point out a potential prolonged decline in Celestia’s performance, which is concerning. This situation could be exacerbated by the persistent Fear, Uncertainty, and Doubt (FUD) that has been circulating, as Celestia has reportedly generated only $15K since its launch in October 2023.

Market positioning

Read Celestia [TIA] Price Prediction 2024-2025

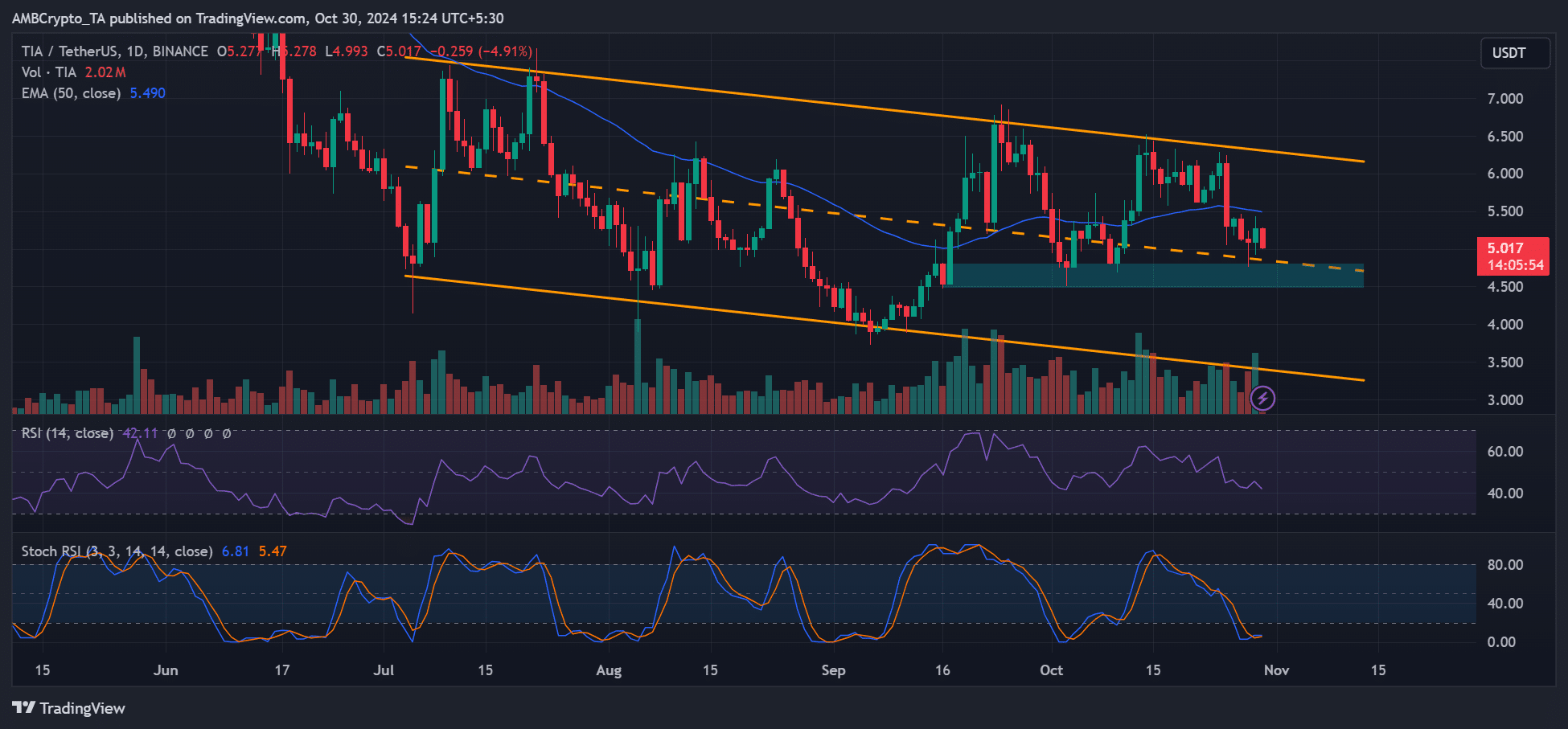

For now, it’s important to keep an eye on the price of $4.5, as it has halted previous drops since early September. A fall below this point could potentially pull TIA down to its lower range around $3.5.

Read More

2024-10-31 01:12