- Bitcoin has seen a slight decline, pausing the revisiting of its ATH.

- The market is now in greed as many anticipate BTC hitting its ATH again.

As a seasoned analyst with over a decade of experience in the crypto markets, I’ve seen my fair share of price rallies and corrections. The recent surge in Bitcoin’s price and the subsequent increase in short liquidations is a familiar sight to me. It’s like watching a rollercoaster ride – exhilarating yet nerve-wracking!

With Bitcoin’s price nearing $72,000, there was a significant increase in short positions being closed abruptly, a phenomenon known as liquidations. This surge in liquidations suggests the market has experienced high volatility recently, as numerous traders holding short positions were taken by surprise by Bitcoin’s sudden upward trend.

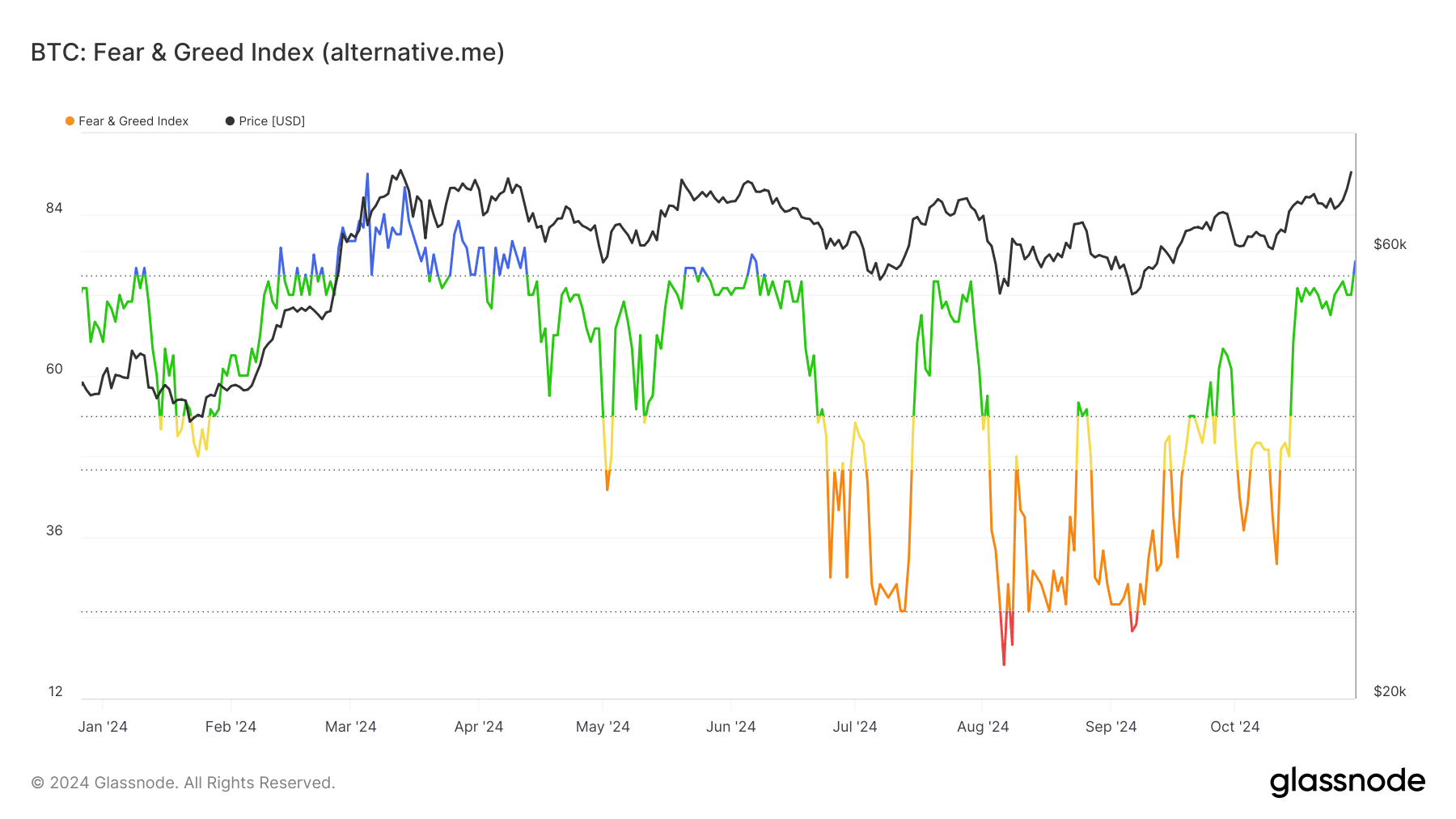

Examining how Bitcoin’s price changes correspond with the Fear and Greed Index sheds light on the emotions fueling these ups and downs.

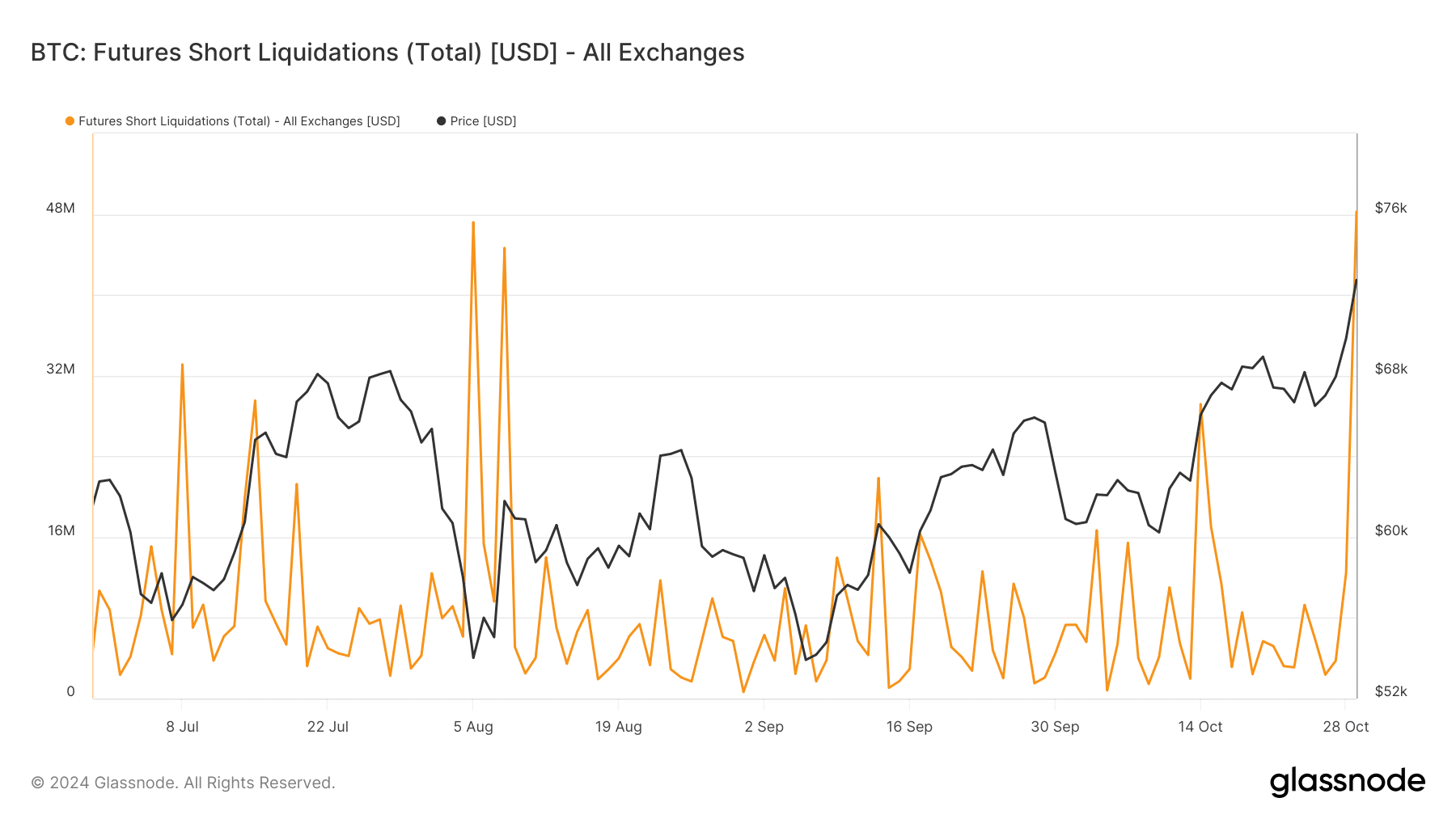

Short liquidations hit new highs amid Bitcoin rally

The recent surge in Bitcoin’s price over the last week has resulted in a notable increase in futures short positions being closed on prominent trading platforms.

Based on figures from Glassnode, the amount of short positions that were closed unexpectedly soared, exceeding previous records by approximately $48 million within a 24-hour period, as Bitcoin surpassed significant resistance thresholds.

The sudden increase in sell-offs indicates how the market is responding to the strong upward trend, as traders who had wagered on falling prices found themselves compelled to liquidate their holdings quickly.

As an analyst, I’m observing that the high liquidation volumes signify the vulnerability of heavily-leveraged short positions towards Bitcoin’s price swings. With the market currently breaching the $72,000 mark, it appears that short traders are strategically stepping back to avert any additional losses due to forced liquidations.

In simpler terms, when a series of sell-offs (liquidations) happens, it often boosts the increase in Bitcoin’s price because investors who have short positions are compelled to buy back at higher prices due to market forces.

Rising Fear and Greed Index reflects shifting sentiment

As a crypto investor, I’ve noticed an upward trend in the Fear and Greed Index, mirroring a transition from a careful approach to a more hopeful perspective within the market. This surge comes amidst the rise in liquidations, indicating increased activity and potentially positive developments on the horizon.

Towards the start of October, the index fluctuated within the “caution” zone, hinting at market uncertainty.

Yet, with Bitcoin’s price persistently breaching resistance points, the sentiment has shifted towards “optimism,” hitting its peak level since the heart of the year.

Historically, the Fear and Greed Index serves as an indicator that may forecast market adjustments or corrections. This is because excessive greed can typically lead to temporary market declines in the near future.

On the other hand, the ongoing surge in optimism, fueled by robust market foundations and institutional backing, may prolong this upward trend. Yet, excessive enthusiasm could indicate a period of intensified heating, where price adjustments might occur if the excitement becomes overly extreme.

What’s next for Bitcoin amid high volatility?

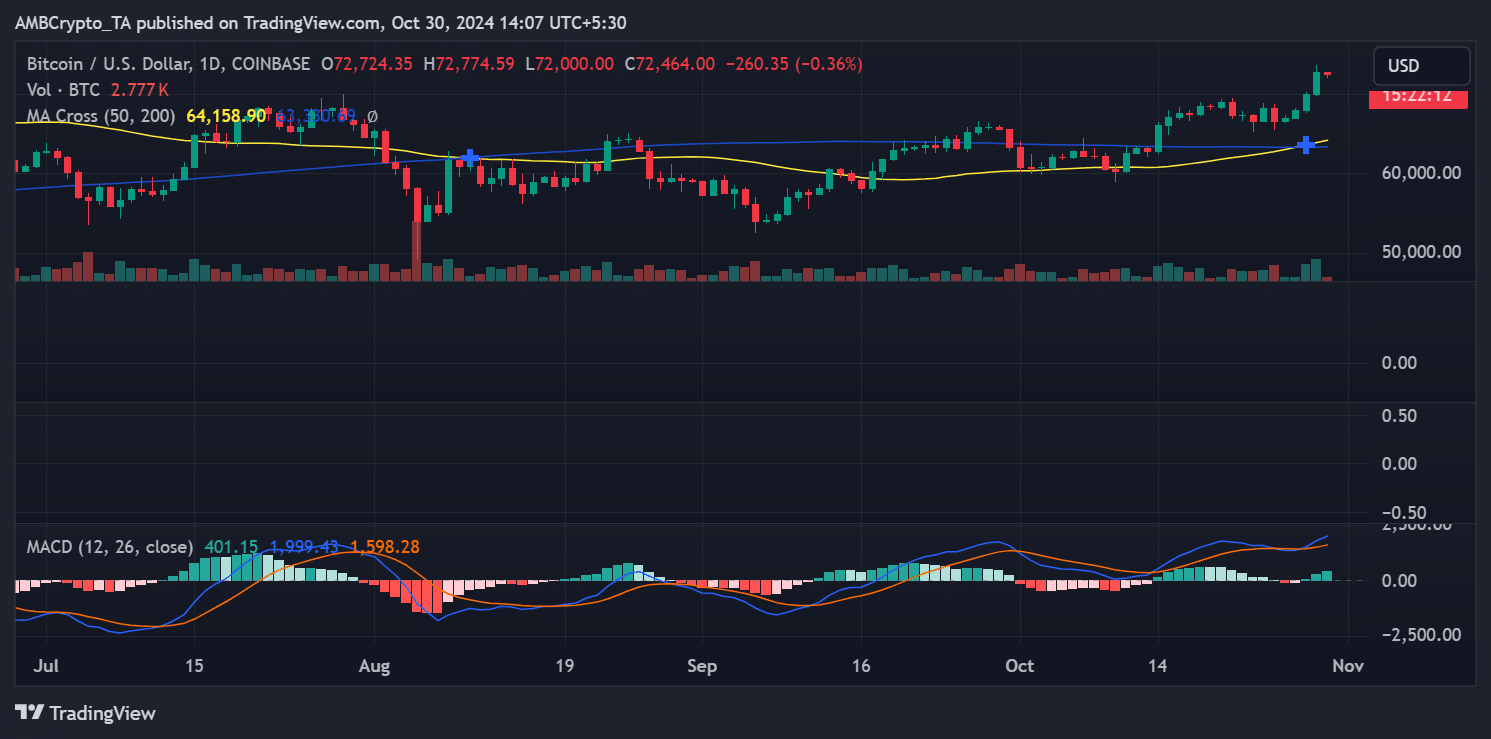

As Bitcoin approaches its record peak, the market is gearing up for increased price swings. The Moving Average Convergence Divergence (MACD) on the daily graph suggests a surge in buying power.

Simultaneously, the Fear and Greed Index suggests a strong positive sentiment leaning towards more upward movements.

However, historical data indicates that excessive greed may lead to significant corrections, particularly when the price is unable to surpass resistance and set a new peak.

Read Bitcoin (BTC) Price Prediction 2024-25

The future path of Bitcoin is probably influenced by continuous investment enthusiasm and possible selling for profits. Traders who speculate on a decrease in price might choose to tread carefully due to recent market fluctuations leading to liquidations.

In summary, Bitcoin’s trend seems optimistic; however, investors should prepare for potential fluctuations given the volatile nature of this market.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-10-31 02:16