- Bitcoin Cash rally stalled after a slight drop in 24 hours but bullish signs on its one-day chart persisted.

- Large transaction volumes surged by 123% in 24 hours as open interest hit a two-month high.

As a seasoned researcher with years of experience in deciphering cryptocurrency market trends, I find myself intrigued by the recent developments in Bitcoin Cash [BCH]. While the 0.58% drop in 24 hours may have temporarily stalled its rally, the bullish signs on the one-day chart are undeniable.

At the current moment, one Bitcoin Cash (BCH) was being exchanged for approximately $379, following a minimal decrease of 0.58% over the past day. However, even with this recent drop, BCH has managed to increase by nearly 7% within the last week.

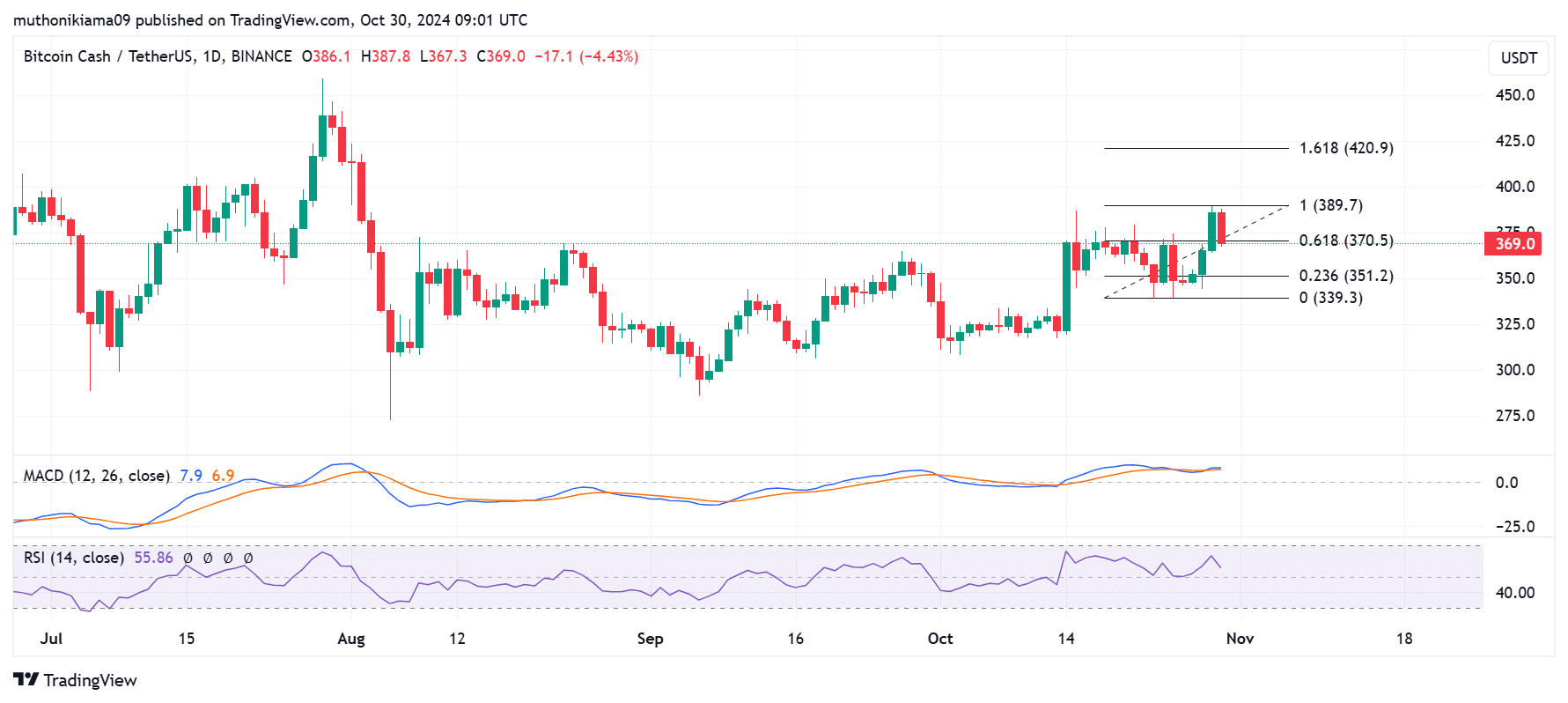

According to a one-day analysis, Bitcoin Cash exhibited several positive trends. Specifically, the Moving Average Convergence Divergence (MACD) was positioned above the signal line, indicating that an upward trend might be in progress.

Based on the Relative Strength Index reading of 56, it appears that buyers had a slight upper hand over sellers. Yet, this indicator seems to be trending downward, potentially signaling a shift in market direction unless there’s an increase in purchasing activity soon.

Bitcoin Cash overcame resistance at the 0.681 Fibonacci point (around $370), but was unable to maintain its upward momentum. If it manages to conquer this resistance once more and the uptrend persists, the next potential objective for this digital currency will be the 1.618 Fibonacci level, approximately at 420.

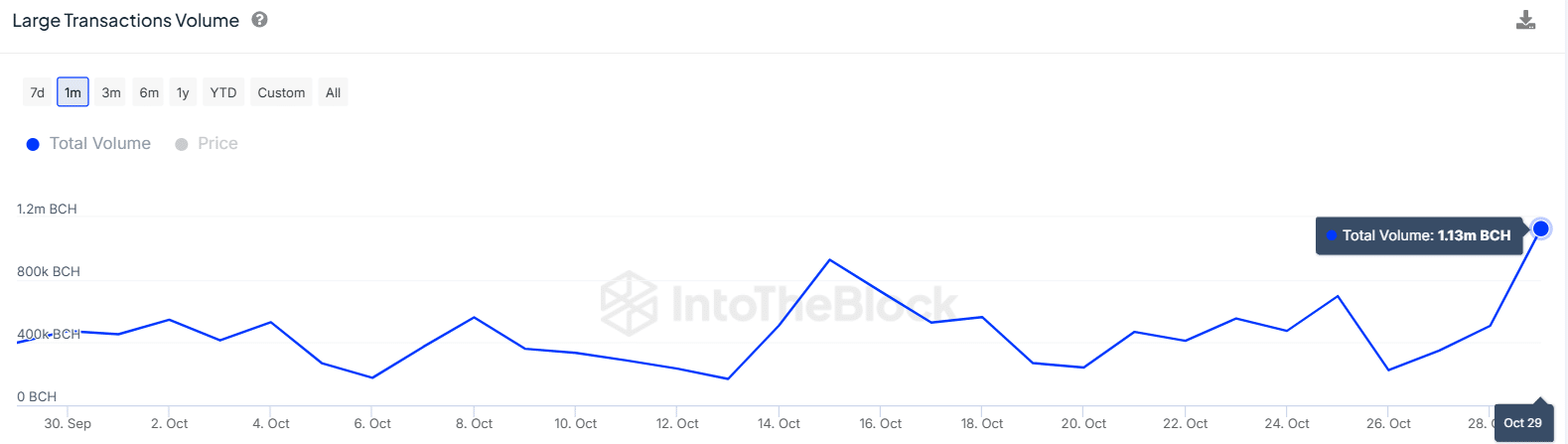

An examination of on-chain statistics indicates that this surge may be due to an uptick in whale activity coupled with a rise in overall network activity.

Whale activity & network growth could fuel the rally

According to data from IntotheBlock, the number of Bitcoin Cash (BCH) transactions valued at over $100,000 has risen significantly, reaching approximately 1.13 million. Remarkably, this represents a staggering 123% surge within a single day.

Whale activity can be a catalyst for price growth. However, whales control only 16% of BCH’s supply, suggesting that for the price to make a significant recovery, interest from the retail market is also needed.

At the same time, the Bitcoin Cash network has experienced rising usage. In 24 hours, the active addresses jumped from 45,000 to 121,000.

A rise in active addresses can fuel the rally as it shows rising interest in a token. If these addresses are actively trading BCH, the price is set for volatile movements.

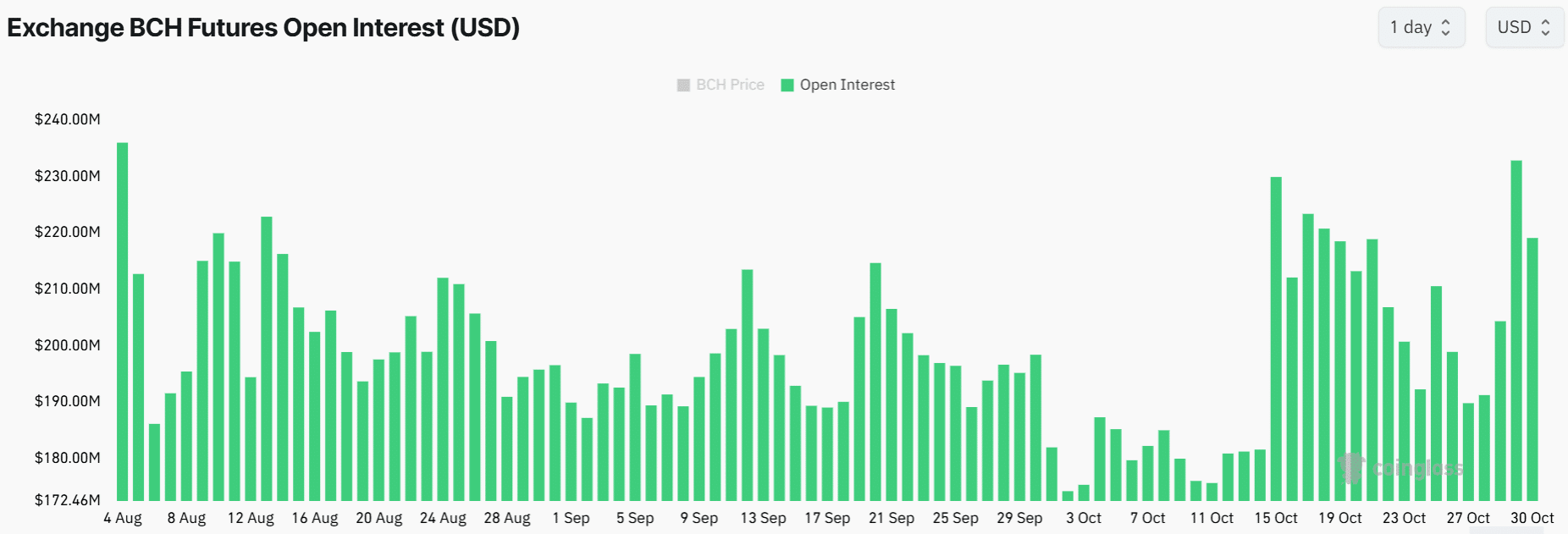

Bitcoin Cash open interest surges

BCH open interest recently surged to $232 million, the highest level in more than two months. This increase points towards increasing market participation by traders as they open and add to their existing positions on BCH.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

As the open interest increased, so did the positive funding rates, indicating a surge in long positions held by derivative traders. This suggests a high level of confidence among these traders that Bitcoin Cash (BCH) may continue to rise and increase in value.

The bullish sentiment in the derivatives market, rising whale activity, and network usage make a bullish case for BCH and the likelihood of a rally past $400.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-10-31 04:08