- Ethereum leads in social dominance and development activity, maintaining a stronger developer presence.

- Both Ethereum and Solana show similar whale interest, while Solana has lower liquidation volumes.

As a seasoned crypto investor with years of experience navigating the ever-evolving blockchain landscape, I find myself intrigued by the ongoing competition between Ethereum and Solana.

Showing strong optimism based on both public and expert opinions, Solana [SOL] is experiencing robust growth, leading some to wonder if it could challenge Ethereum [ETH] for dominance in the realm of decentralized applications (dApps).

At press time, Ethereum trades at $2,680.82, marking a 2.17% increase over the past 24 hours.

As an analyst, I observed that Solana was trading at $178.27, marking a 1.43% drop over the same timeframe. Delving into key indicators such as social dominance, development activity, whale involvement, and liquidation statistics provides valuable insights into each network’s unique position and strengths.

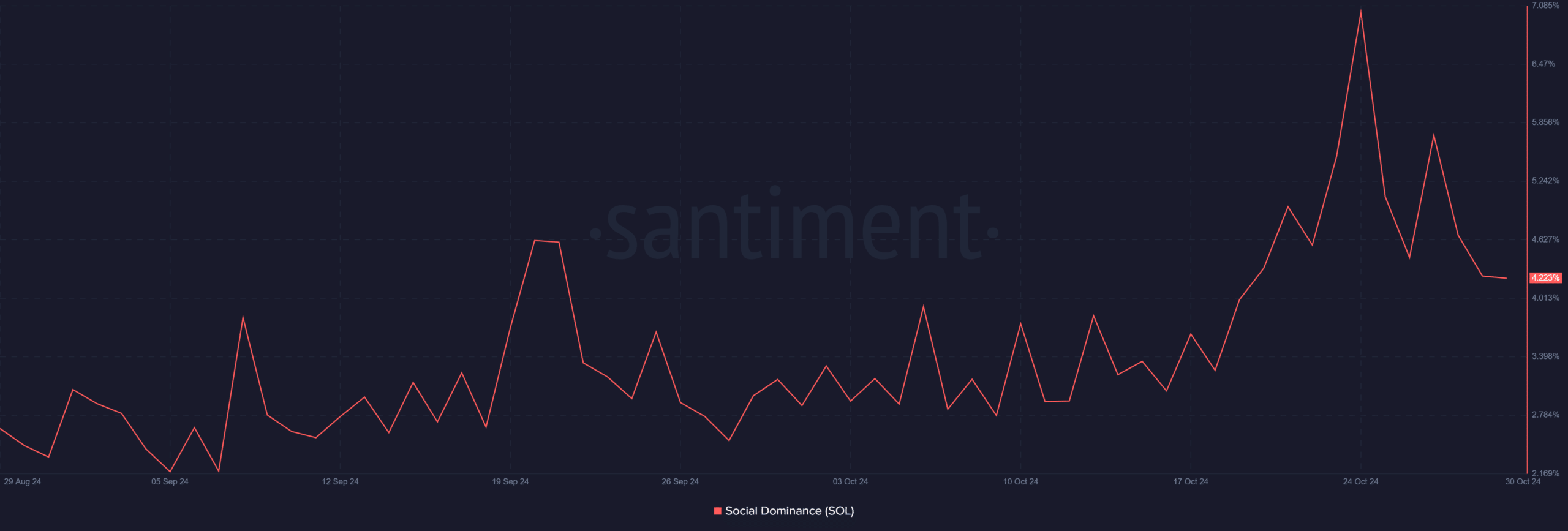

Social dominance: Does Ethereum still lead the conversation?

In terms of social influence, Ethereum outranks Solana more significantly. Over the last four weeks, Ethereum’s social media presence has frequently surpassed 6%, whereas Solana’s maximum reach was approximately 4.22%.

This measurement tracks the proportion of conversations and references about a topic on social media networks, giving an insight into the level of engagement within the community.

As a result, Ethereum tends to be the focus of more online discussions compared to Solana. Yet, the increasing number of Solana users suggests that its social media influence is gaining traction, hinting at an uptick in interest surrounding the network.

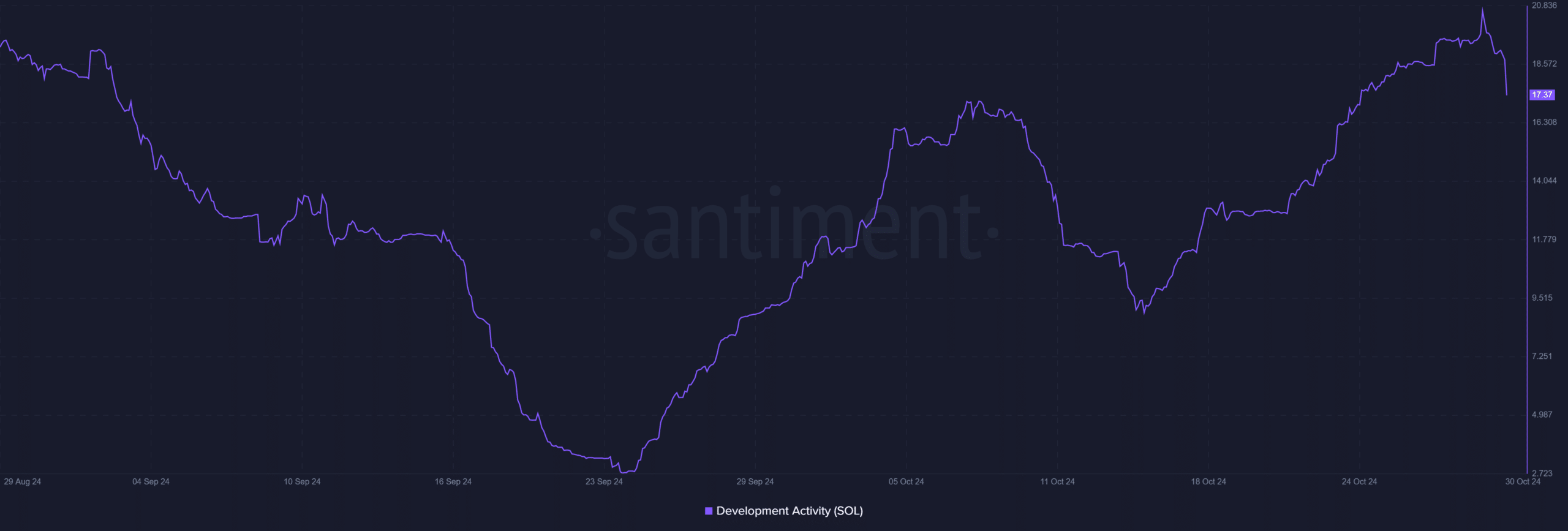

Development activity: Is SOL innovation growing faster?

Right now, Ethereum is dominating in terms of development efforts, scoring 25.5 points compared to Solana’s 17.37. This development activity measures changes in code, additions to projects, and continuous upkeep, indicating the vitality and expansion of each community or ecosystem.

As an analyst, I can attest that Ethereum thrives due to its vibrant, innovative, and continually improving developer community – a key factor contributing to its success.

Furthermore, the level of development on Solana is rising, hinting at growing interest from developers. Nevertheless, it currently lags behind Ethereum in terms of total development activity, which highlights Ethereum’s extensive lead in this area.

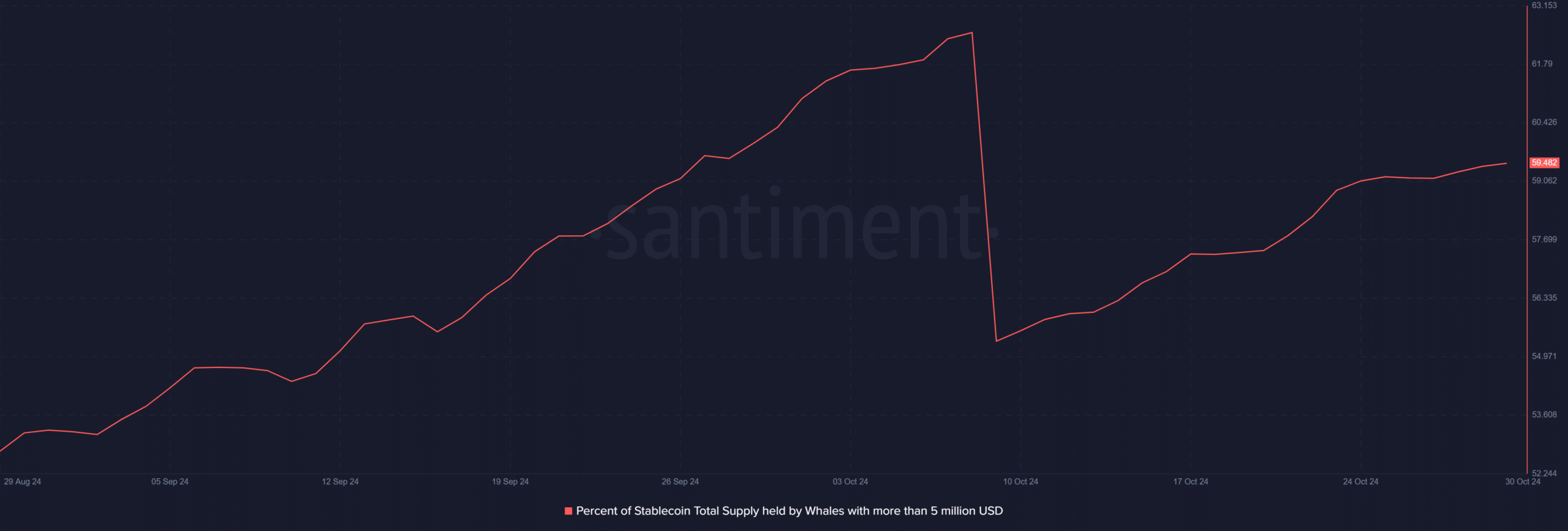

Whale activity: Does SOL attract the bigger investors?

As a data analyst, I’ve observed notable whale activity on both Ethereum and Solana networks. Interestingly, the largest holders on each platform control around 59.48% of their respective stablecoin reserves.

This high concentration among large holders reflects strong interest from major investors across both ecosystems.

As a result, it’s clear that whales find value in both Ethereum and Solana, indicating that these networks are seen as significant assets by major investors in the blockchain environment.

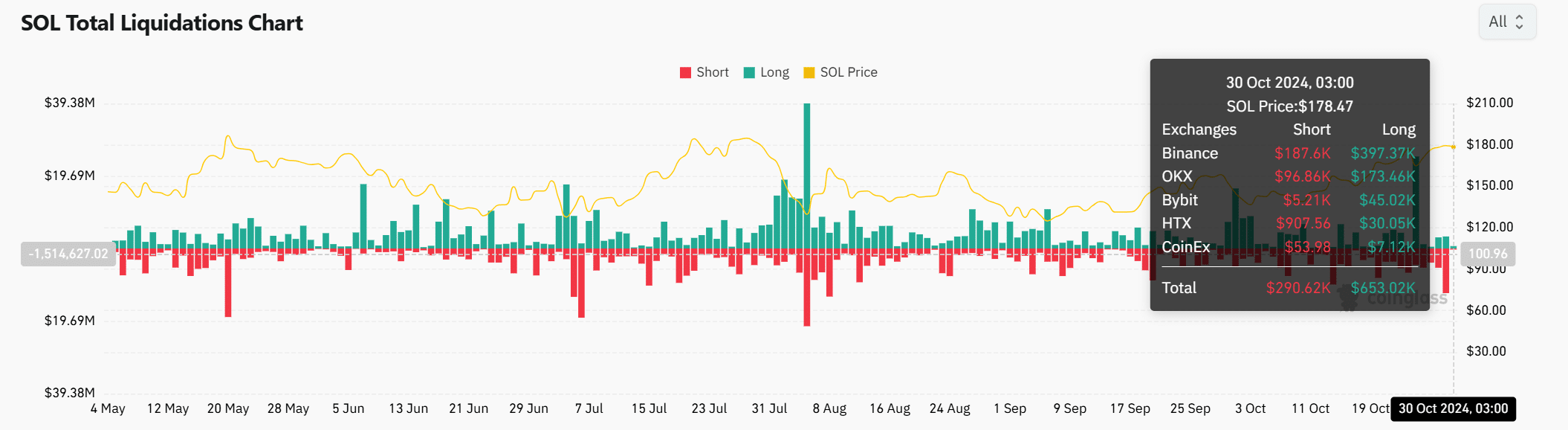

Liquidation data: Which network faces more volatility?

Liquidation data provides insight into leverage-driven activity. Currently, Solana has experienced $653K in long liquidations and $290K in shorts. By comparison, Ethereum saw higher liquidation volumes, with $1.93M in long liquidations and $3.94M in shorts.

Consequently, since Ethereum has a higher level of leveraged trading, it could experience more frequent fluctuations in price. In contrast, Solana’s lower rates of liquidation indicate that it might exhibit less volatility under specific circumstances.

Conclusion

Regarding social influence, project development, participation of whales, and deletion statistics, Ethereum outperforms in multiple aspects. On the other hand, Solana attracts significant investments from major stakeholders and growing attention from developers, indicating possible future expansion.

Currently, Ethereum is leading the pack due to its wide-reaching community of users and developers. However, Solana is rapidly gaining ground, making it a formidable contender in the world of blockchain technology.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-10-31 07:04