- XRP declined over the last 24 hours and on the weekly charts too

- Market sentiment has been lower, compared to other major assets

As a seasoned crypto investor with a knack for deciphering market trends, I find myself grappling with XRP’s recent performance. While the broader market has been galloping like a wild stallion, my beloved XRP seems to be hobbling along on a donkey. The past 24 hours have seen it tread water, and the weekly charts tell a similar story.

Despite a significant rise in the overall cryptocurrency sector, XRP has mainly held steady. More specifically, during the past week, the digital coin experienced a modest drop in worth, adding to its lackluster performance during the previous day.

The absence of progress and fluctuating financial support has sparked debates on the short-term trajectory of XRP.

XRP’s performance falls short of market rally

Recently, the surge in the cryptocurrency market, primarily driven by Bitcoin reaching unprecedented record highs, has caused many alternative coins (altcoins) to follow suit and experience a rise. Yet, Ripple‘s XRP stands apart from this trend, demonstrating an exception or one of the exceptions to the bullish pattern.

Currently, when I’m typing this, XRP is showing a small drop in both its daily and weekly performance indicators, which makes it one of the rare significant assets going against the overall market flow. This underperformance has left investors perplexed given the market’s usual excitement.

1) Similar to Toncoin, XRP’s drop in value suggests both have struggled to make an impact during the overall market uptrend. Typically, a bullish market trend influences altcoins. However, unlike other altcoins this time, XRP seems to have moved independently of the broader market.

Funding rates reflect a shifting sentiment

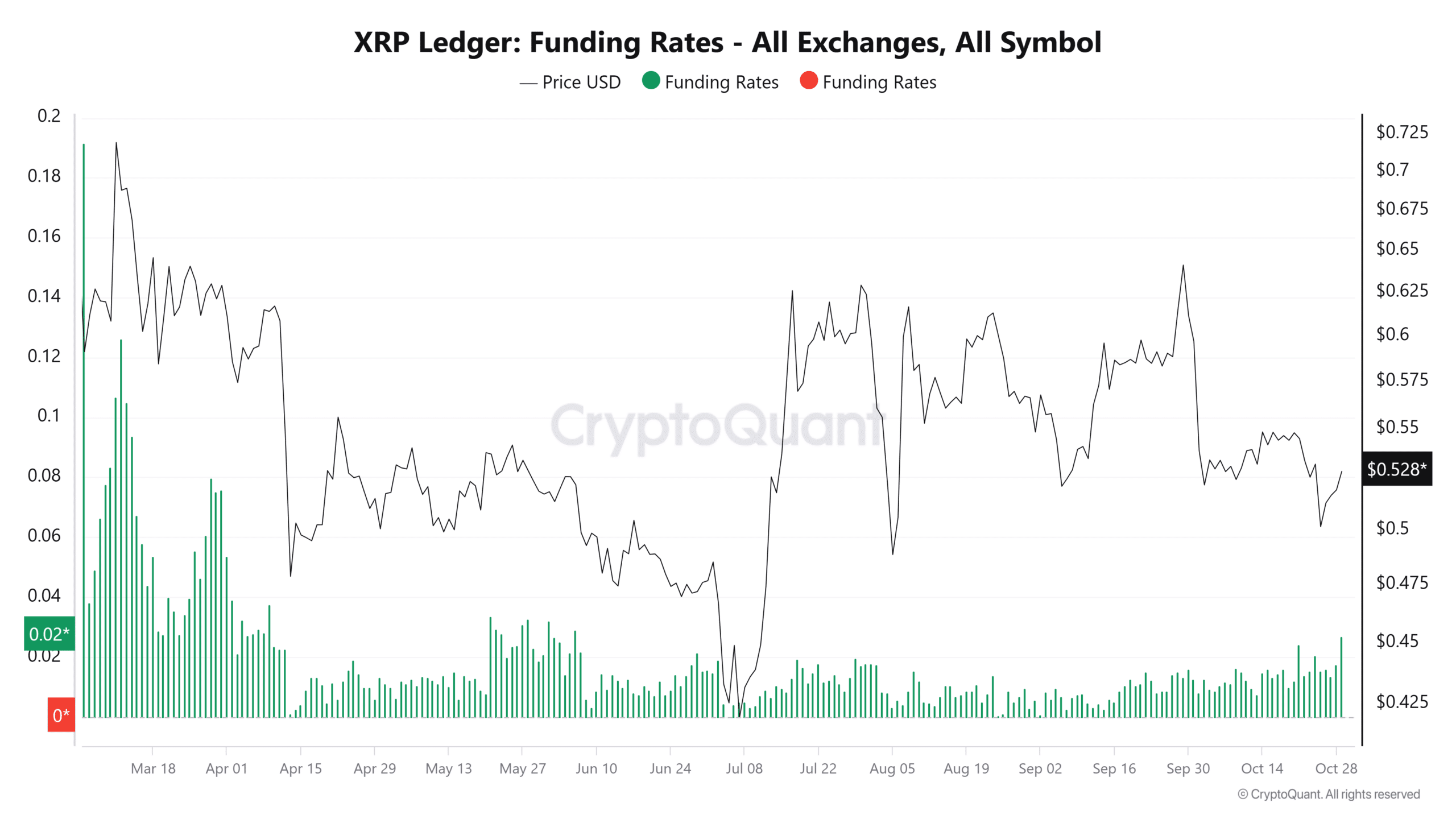

Looking at the funding rates of XRP on different trading platforms gives us a clue about the attitudes in the Futures market. These funding rates have recently undergone significant changes, which could suggest that traders are modifying their positions according to evolving market perspectives.

As a crypto investor, I’ve learned that a favorable funding rate usually indicates a bullish outlook, as traders are ready to pay extra to keep their long positions open. On the flip side, when the funding rate decreases or changes direction, it often signals a decrease in enthusiasm or a move towards bearish expectations among traders.

For the currency XRP, data from Glassnode shows a trend leaning toward neutral or mildly unfavorable funding rates.

This implies that the enthusiasm driving other cryptocurrencies in the market may not be as robust for XRP. This disparity could suggest that XRP is currently separating from the overall market’s bullish momentum.

Potential support levels?

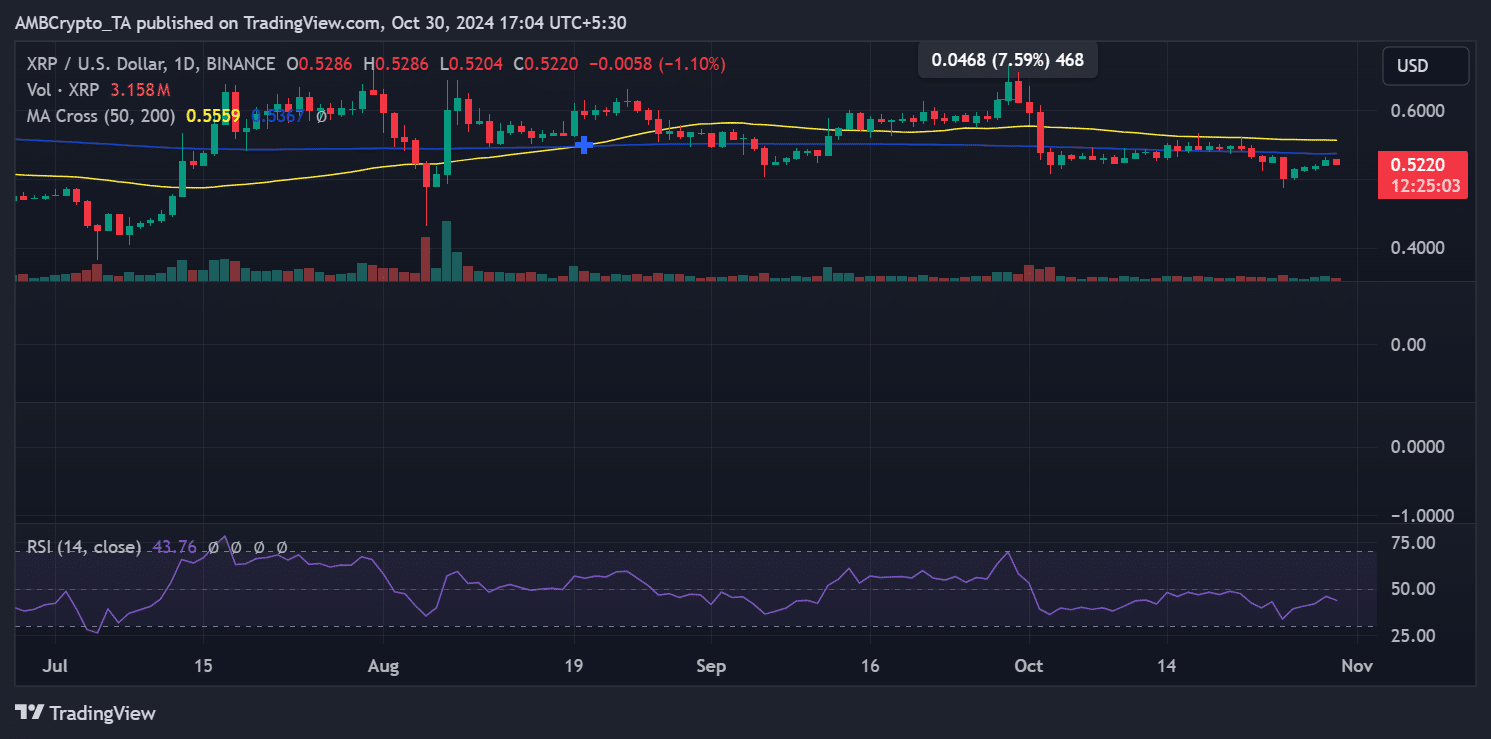

After examining the graph for the altcoin’s price, it appears to be holding steady near the $0.52 mark on various trading platforms.

At this point, the 50-day and 200-day moving averages for XRP were slightly above, approximately at $0.56. In simpler terms, there are strong barriers preventing XRP from advancing, with a negative outlook dominating the altcoin’s market.

In simpler terms, the Relative Strength Index (RSI) for XRP was around 44, suggesting neither an oversold nor an overbought state. Yet, there were signs of potential weakness as the RSI approached the boundaries of the oversold zone.

At this stage, the area could function as a safe haven for potential buyers who believe the asset is underpriced. Yet, the strong indication from the RSI indicates that buyers are still cautious, potentially holding out for more potent market triggers before making a move.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-10-31 10:15