- Coinbase’s Q3 revenue dropped amid reduced trading but achieved a $75 million profit.

- The firm strengthened its crypto stance with a $1 billion buyback and Fairshake PAC support.

As a seasoned crypto investor with over a decade of experience under my belt, I find the recent financial report from Coinbase to be both intriguing and somewhat concerning. On one hand, it’s impressive to see the company achieve profitability amidst a decline in trading volumes, which speaks volumes about their operational efficiency. However, the drop in revenue is a clear indication that the market has cooled down compared to the frenzy we saw earlier this year.

Surprisingly, Coinbase announced a decrease in their quarterly income on October 30th. This suggests that crypto trading among users was lower during the summer season.

According to recent findings, the earnings of the exchange declined to approximately $1.2 billion during Q3 of 2024, compared to $1.45 billion in the preceding quarter. However, Coinbase managed to make a substantial comeback by recording a profit of $75 million.

This is a stark improvement from the $2 million loss reported last year.

Coinbase Q3 revenue sparks concerns

Transaction fees at Coinbase declined by 27% from the last quarter, primarily because trading volumes decreased significantly.

The company’s shareholder letter outlined ongoing market challenges. The letter highlighted that subscription and services revenue had decreased by 7%, bringing in $556.1 million for the quarter.

This revenue comes from products like stablecoins, staking, and leverage for Prime traders.

In its shareholder letter, the firm noted,

Our team is focusing on increasing income by developing items such as derivatives, expanding globally, offering custody services, and more closely integrating USDC within the digital economy.

On the contrary, Anil Gupta, Coinbase’s Vice President of Investor Relations, appeared optimistic, as evidenced by his statements during an interview with a publication, noting that the company has reported four straight profitable quarters in a row.

“It was a solid quarter for the business across the three priorities we set forth early in the year: driving revenue, driving crypto utility, and driving regulatory clarity.”

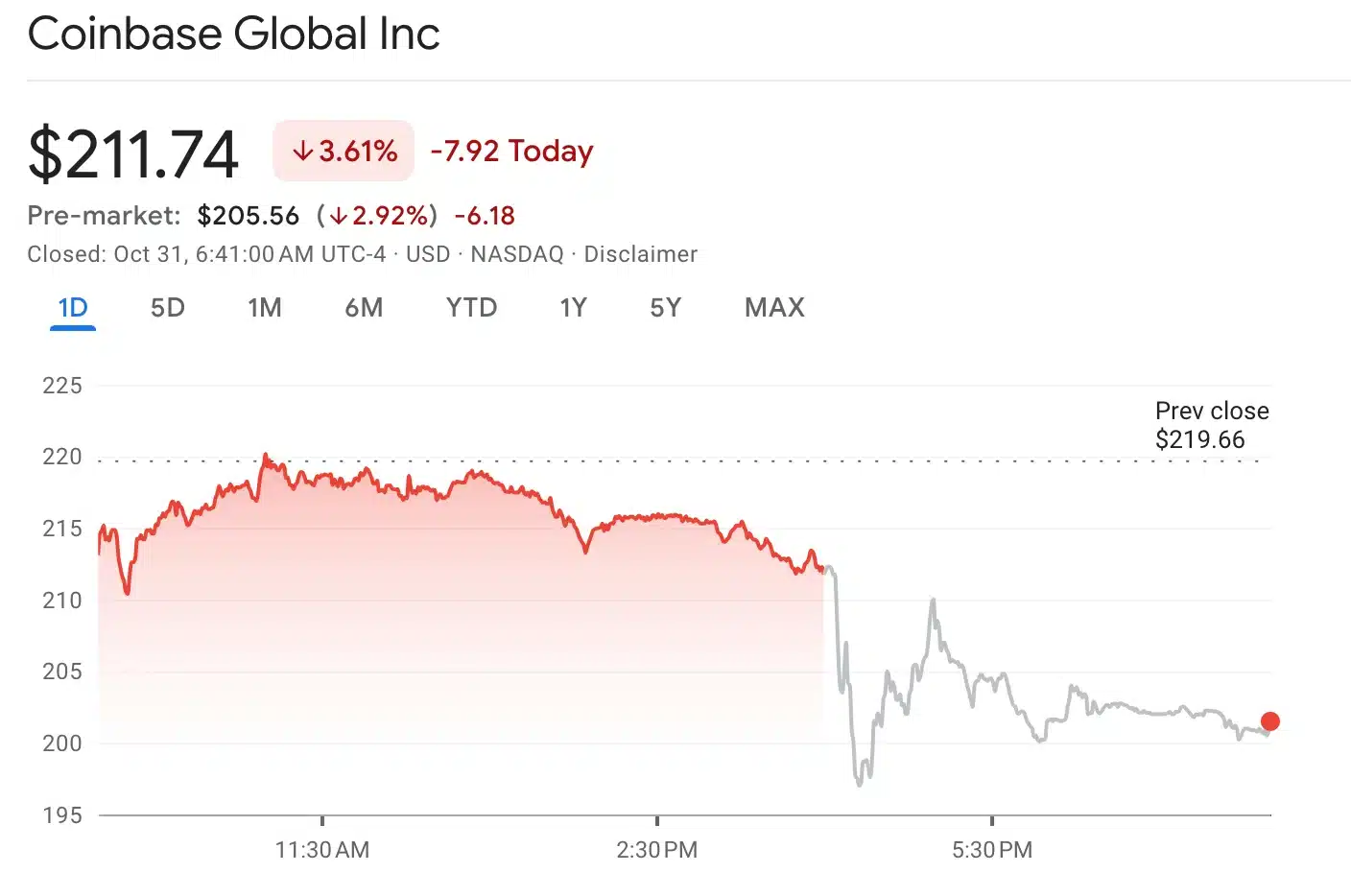

Coinbase stock price trend

As an analyst, I experienced a significant surge in Coinbase’s stock price, peaking at $279 in March. This uptick can be attributed to the remarkable high that Bitcoin [BTC] reached, nearing a record-breaking $73,000 during the same period.

Despite falling to $211 by the end of October, these shares have still increased by 35% so far this year.

However, in after-hours trading, Coinbase’s stock saw a further decline, dropping to $202.

Currently, Bitcoin’s price stands at approximately $72,288.21 following a minor 0.37% drop in the past day. At this moment, Coinbase shares are being traded at around $211.74, marking a decrease of 3.61%.

What lies ahead?

According to the analysis by Oppenheimer, they anticipate a decrease in Coinbase’s trading activity because there are currently no significant market triggers and uncertainties surrounding the election are hindering growth.

Experts continue to express guarded enthusiasm, highlighting Vice President Kamala Harris’s backing for a system to regulate digital assets.

This could drive Coinbase trading activity in Q4, potentially offsetting the slowdown.

A $1 billion stock repurchase plan emphasizes the company’s positive long-term perspective, designed to recognize its investors.

Furthermore, the earnings from Coinbase’s stablecoin, notably USDC, experienced an increase. This growth was bolstered by rewards offered on the platform and broader integration of its products.

In terms of politics, Coinbase is strengthening its support for cryptocurrency policies by donating $25 million to Fairshake PAC. This action aims to endorse pro-crypto candidates during the 2026 election cycle.

This will solidify its role in shaping favorable regulatory outcomes for digital assets.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-31 17:12