- The plunge below $0.5 on the 25th of October underlined bearish intent.

- The liquidity pocket at $0.54 could result in a minor price bounce.

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I find myself cautiously optimistic about XRP‘s near future. The recent bearish sentiment, as underscored by the plunge below $0.5, is concerning, but not entirely surprising given the broader market conditions.

Ripple‘s [XRP] high level of transactional activity indicates growing investor attention, however, its price movement suggests a pessimistic trend in the daily market. In contrast to Bitcoin [BTC], which has risen by 8.3% over the past week, XRP has experienced a decrease of 1.62%.

For November, the forecast on XRP’s price trend shows a predominantly downward direction. Yet, there might be a brief surge of approximately 3%. After this temporary rise, it’s expected that the price may not immediately rebound further.

XRP price prediction- Why the bears have the upper hand

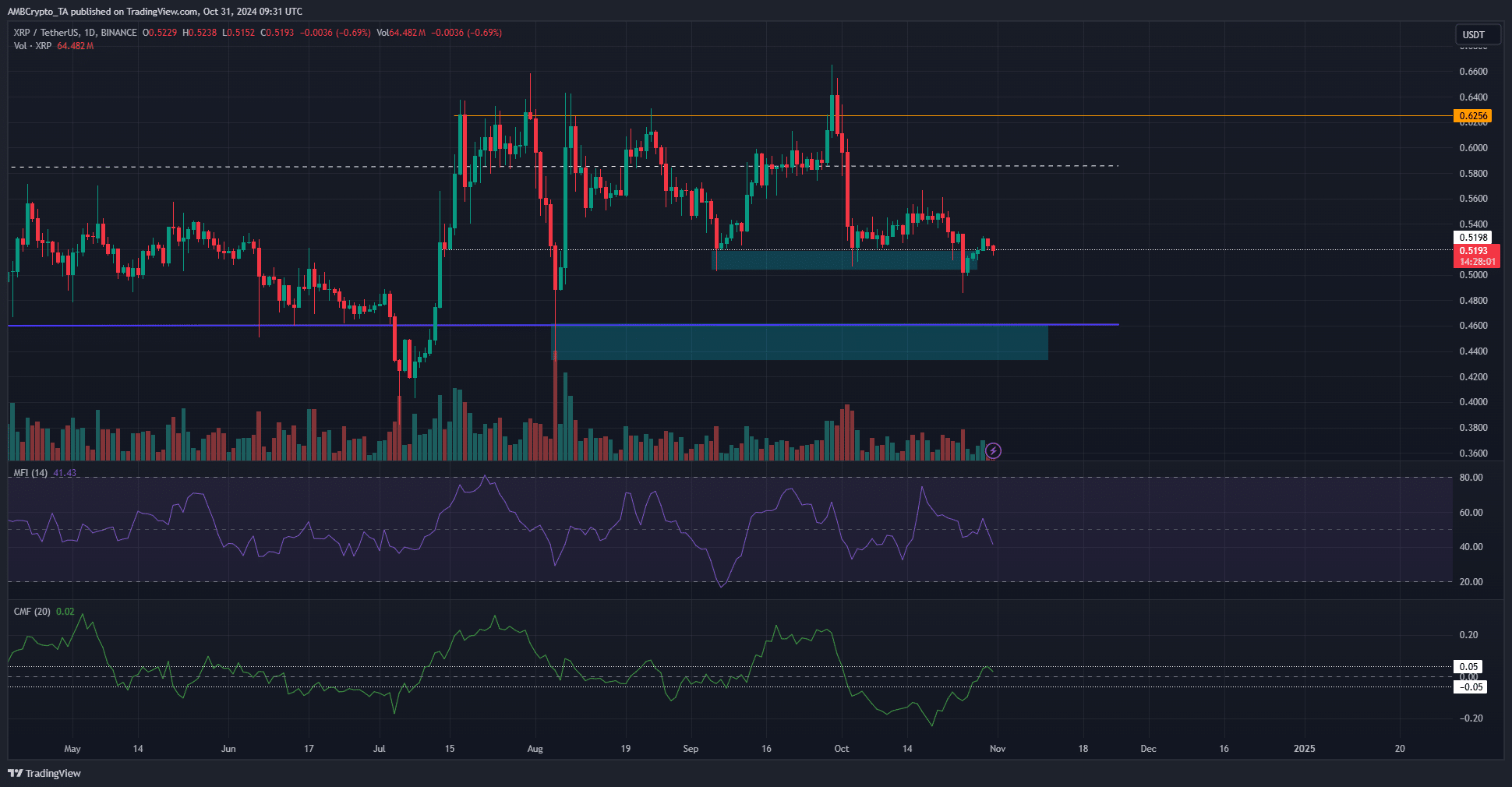

From August 2023 onward, XRP has been moving within a specific price band that extended from $0.72 to $0.46. However, in July 2024, it seemed like the price dropped below this lower boundary, only to promptly rebound and reach up to $0.638.

Over the last four months, the $0.64 region has strengthened into a strong barrier for further price advancement. During this period, the $0.5865 mid-point level transformed into a support level, and an attempt at breaking out occurred around mid-September; however, the breakout was not sustained.

As a researcher, I’ve observed that the $0.52 mark has consistently served as a strong support level for XRP. However, on the 25th of October, an unexpected bearish pressure caused a dip in XRP’s price, pushing it down to $0.486.

As a crypto investor, I observed a strengthening of the bearish trend on lower timeframes, and closing the daily session below $0.52 suggested that sellers were in control. This notion was backed by the Money Flow Index dipping below 50, indicating selling pressure. Furthermore, the Chande Momentum Oscillator (CMF) failed to surpass +0.05, implying that substantial inflows of capital were not evident during October.

Short-term volatility expected

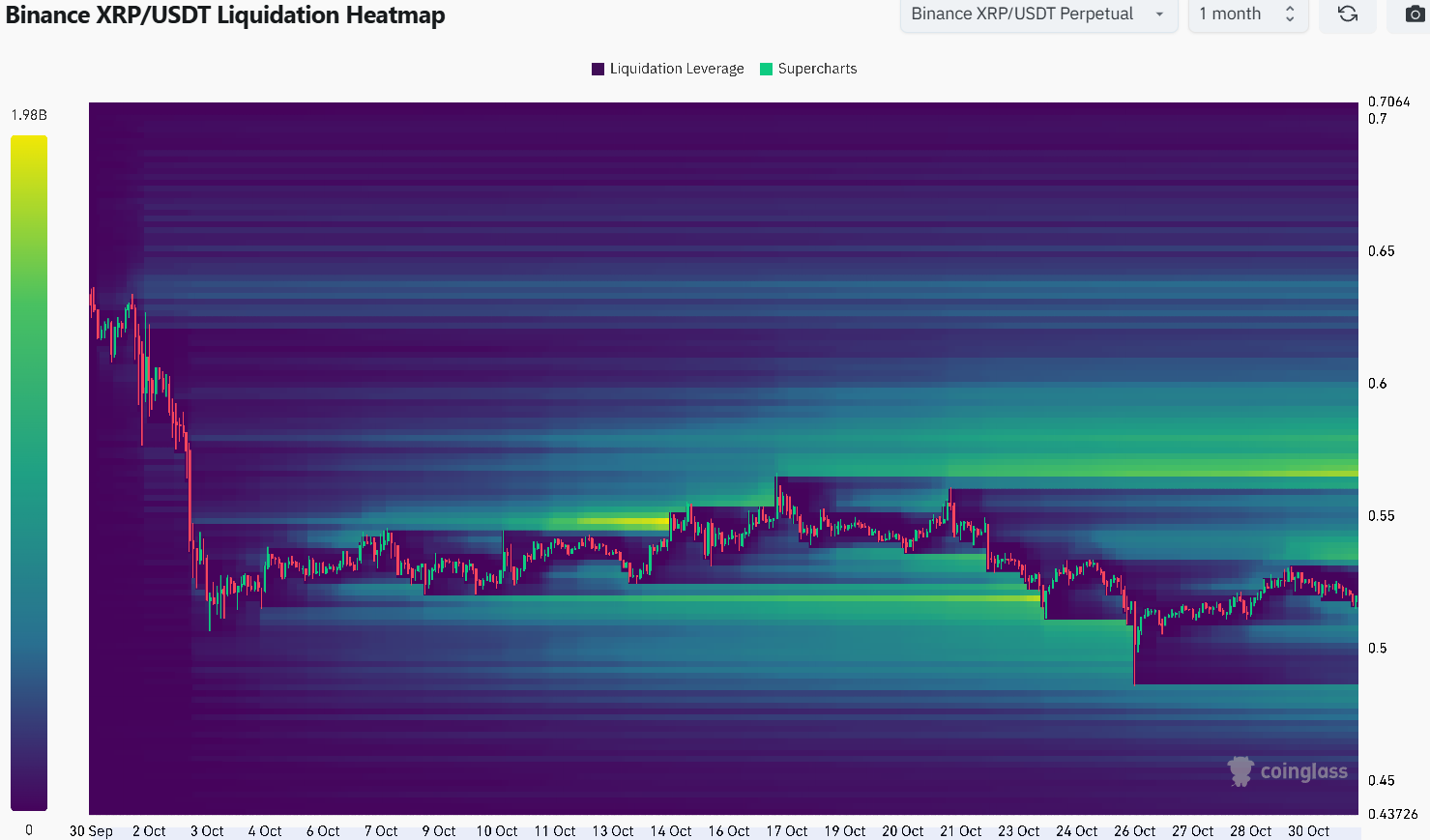

The 30-day liquidation map showed significant pull areas near the price at $0.54 and $0.57, with $0.57 being more powerful. However, considering the market’s recent movements, reaching $0.57 seemed improbable within the next week.

Read Ripple’s [XRP] Price Prediction 2024-25

In simple terms, it’s expected that XRP might drop to around $0.54 in November to gather liquidity before potentially falling below $0.5. If Bitcoin experiences a significant decline from its current high of approximately $73,700, the bearish targets could be as low as $0.46 and even down to the August low of $0.432.

Moving past both $0.54 and $0.57 might potentially lead XRP back to challenging its previous highs near $0.62, however, such a scenario seems improbable due to the reduced demand observed over the last few weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-11-01 00:07