Rihanna Reveals How Her Kids Are Following in Her Musical Footsteps

According to the artist known as “Umbrella,” both RZA, three months old, and Riot, twenty-three months old, have already mastered singing tunes.

According to the artist known as “Umbrella,” both RZA, three months old, and Riot, twenty-three months old, have already mastered singing tunes.

Following the discovery of a teddy bear appearing to be adorned with what seemed like human skin, situated outside a convenience store in Victorville, California on July 13, the authorities had to launch an investigation. However, upon further examination, they found that there was no basis for alarm.

Title #2 of “Trinity: Daughter of Wonder Woman” is penned by Tom King, Belen Ortega, Alejandro Sanchez, and Clayton Cowles. In this issue, our teenage Trinity ventures into Gotham City on a mission to recover Damian Wayne, now transformed into a Robin-Corgi. As she closes in on the pup, Robin, AKA Jason Todd, crosses her path. Given the array of Robins, an encounter with Jason Todd is intriguing. He’s the least favored among the Robins and carries a tragic past, as he was previously killed by the Joker. However, an unusual twist occurs as they team up to find Robin-Corgi; a bond starts to form between them, and they unexpectedly develop feelings for each other during their nighttime search.

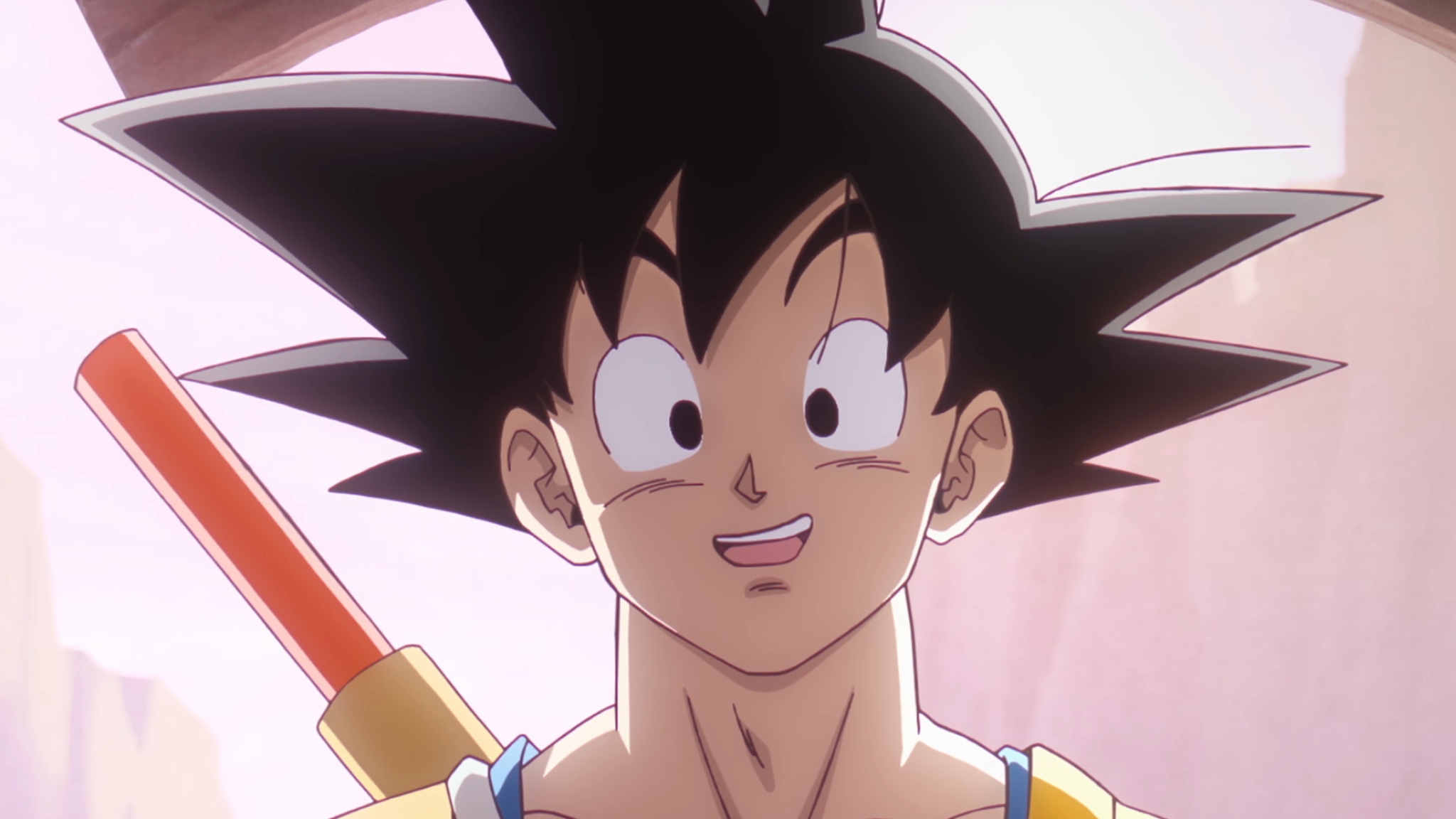

At the new store, everyone involved guarantees that people will discover exclusive, time-limited merchandise and must-have items, making it an ideal shopping spot for dedicated Dragon Ball enthusiasts. The initial Dragon Ball chapter debuted in November 1984, marking the beginning of one of the world’s most successful anime franchises. Regrettably, the series creator Akira Toriyama did not live to celebrate his creation’s 40th anniversary; he passed away a few months before the November 2024 40th Anniversary on March 1st, 2024. The news of Toriyama’s demise was widely reported, with Latin America and even the French president expressing their condolences for the loss of this iconic manga artist.

Additionally, Sideshow has announced that a spectacularly detailed Charizard statue is forthcoming, and while we hope it won’t resemble the cost of a good car or reach life-size dimensions (from the comparison image, it appears to be around the size of Pikachu), these details are subject to change. To be notified when this item becomes available for purchase, you can sign up for an RSVP here. As an accompaniment to this statue, keep reading for a suitable accessory!

In my opinion, Season 8 of “Rick and Morty” might be the best the show has ever produced, and watching the latest episode that referenced a show I frequently watch on Netflix only strengthens this belief. Given that I’m currently immersed in an anime and eager for the live-action Season 2 of “One Piece” to debut, it’s impressive how my favorite comedy series acknowledges and pays tribute to such a cherished series.

After the debut of Superman, DC enthusiasts are now focusing on several forthcoming DC Universe ventures slated for 2026, such as Supergirl and Clayface. Notably, the latter film is being helmed by James Watkins with Tom Rhys Harries portraying the main antagonist, Clayface.

The award-winning actor is set to return to our screens on July 24th for the second season of Sky’s Mr Bigstuff. In this new installment, his character, Lee, along with his brother Glen (played by Ryan Sampson), embark on a quest to locate their father who was previously thought to be deceased.

Recently, the 1998 Nagano Olympics gold medalist shared her feelings as she watched her 2-year-old stepson take his first steps onto the ice for the very first time, accompanied by her husband, Todd Kapostasy.

This list showcases instances where dull gaming elements were transformed into engaging game experiences. These are the games that effectively exploited the tedium of these mechanics. In other words, from creatively using motion control to incorporating intriguing lock-picking sub-games, here are examples of when games turned the mundane into something captivating.