- Render shows potential for a bullish reversal as it nears critical resistance at $6.63.

- Market sentiment leans bullish, backed by a long-short ratio favoring longs and high trading volume.

As a seasoned analyst with over two decades of trading under my belt, I can confidently say that Render [RNDR] is exhibiting some intriguing signs that could set the stage for a bullish reversal. With my years of experience navigating market cycles, I’ve learned to read between the lines and spot trends before they become mainstream.

In the field of decentralized physical infrastructure networks (DePIN), RNDR consistently reinforces its leading position, boasting a substantial market capitalization of approximately $2 billion and an impressive daily trading volume of around $103 million.

Currently, Render is being traded at $4.89, which represents a decrease of 4.18% compared to its price over the last seven days. Nevertheless, there are indications suggesting a possible turnaround, as the technical and market aspects of Render have sparked increased attention from investors.

Could this be the turning point that leads Render towards a bullish breakout?

RNDR price action analysis: Key levels to watch

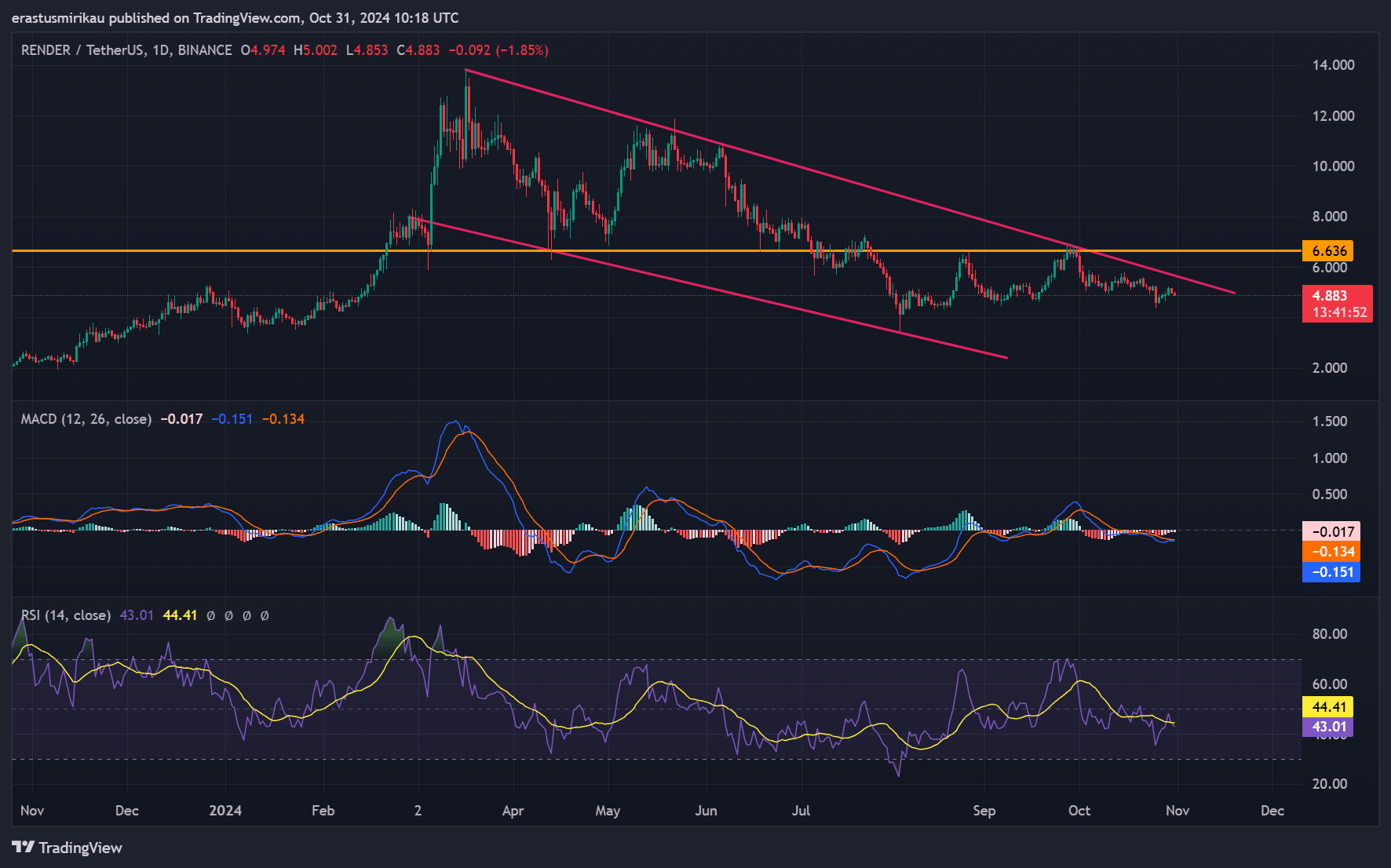

The price chart reveals a consolidation within a descending channel. The critical resistance level at $6.63 acts as a formidable barrier.

Consequently, if we see a significant surge surpassing the current level, it might indicate a bullish turnaround. Examining the Moving Average Convergence Divergence (MACD), we notice a developing convergence trend, suggesting a decrease in selling pressure.

Moreover, right now, the Relative Strength Index (RSI) stands at 43.01, just shy of the neutral level. This implies that although sellers are currently in charge, potential buyers might find an opportunity to enter the market.

Should Render continue to build traction, there’s a possibility it might challenge the $6.63 barrier, potentially paving the way for an upward trend.

RNDR price DAA divergence: Warning signs or opportunity?

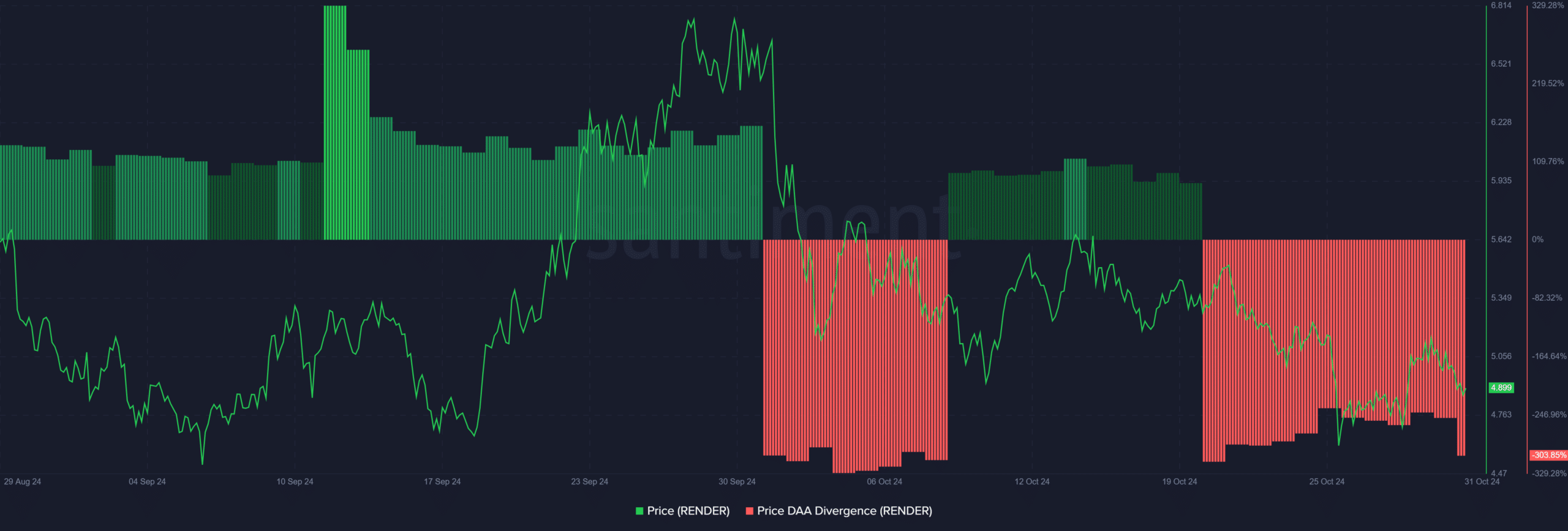

The chart showing Daily Active Addresses (DAA) for RNDR indicates some substantial negative divergences, with the latest readings dropping to a low of approximately 303.85%.

As an analyst, I’ve noticed a discrepancy between the current prices and the active addresses on the network, which suggests that our recent price fluctuations might not be backed by a significant surge in network usage.

Should Render see an increase in active addresses, this trend might flip, providing vital backing for its price. Consequently, changes in network activity may significantly impact the steadiness of RNDR’s pricing.

Onchain signals: What do the metrics reveal?

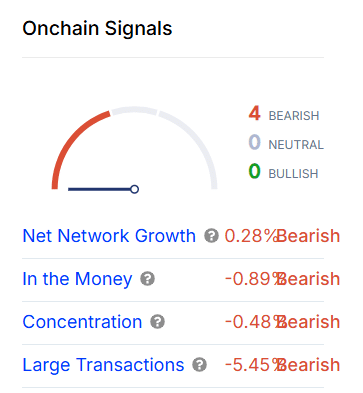

The on-chain indicators provided by Render show a somewhat pessimistic perspective. The Network Growth, In-the-Money condition, Concentration, and High Volume Transactions suggest slight signs of a potential bear market.

In other words, Large Transactions are decreasing by 5.45%, implying that the level of ‘whale’ activity continues to be restrained.

In simpler terms, because RNDR is frequently traded in large amounts, it might have enough market fluidity to handle any downward pressure from sellers. This could mean that adjustments in blockchain indicators could influence investor feelings and pave the way for positive price trends.

Liquidation: A look at long and short positions

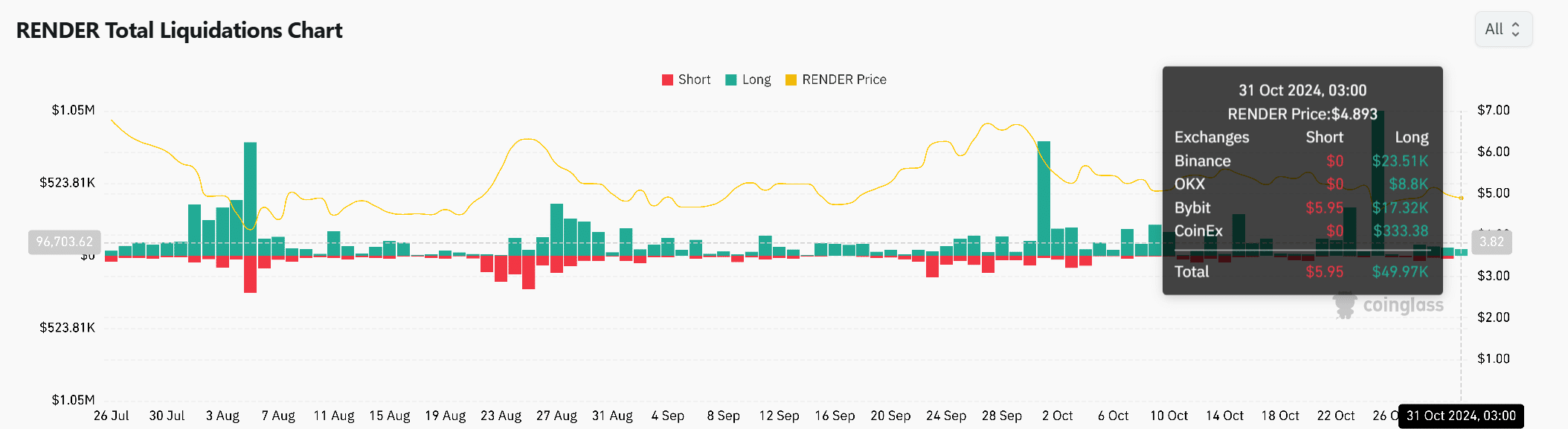

The data from Render’s liquidation shows an increased confidence among traders, as their long positions amount to approximately $49,970 contrasted with only $5,950 in short positions. This significant difference suggests that traders are increasingly optimistic about a potential reversal happening soon.

Moreover, given the continuous trading activity, it appears that traders are preparing for a significant price movement. This suggests that the current bullish trend in long positions vs short positions could indicate that investors expect an increase in prices. However, for this to happen, Render needs to overcome its resistance barriers.

Read Render’s [RNDR] Price Prediction 2024–2025

In summary, Render’s technical and blockchain data show a complex but hopeful perspective. Given its solid market standing and high trading volume, there’s a good chance that RNDR could experience a turnaround, as long as it manages to break through crucial resistance levels and network activity increases significantly.

It seems likely that RNDR may soon exit its slump and spearhead DePIN’s upcoming surge in growth.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-01 07:52