- BTC’s ‘basis trade’ exploded following the recovery in September.

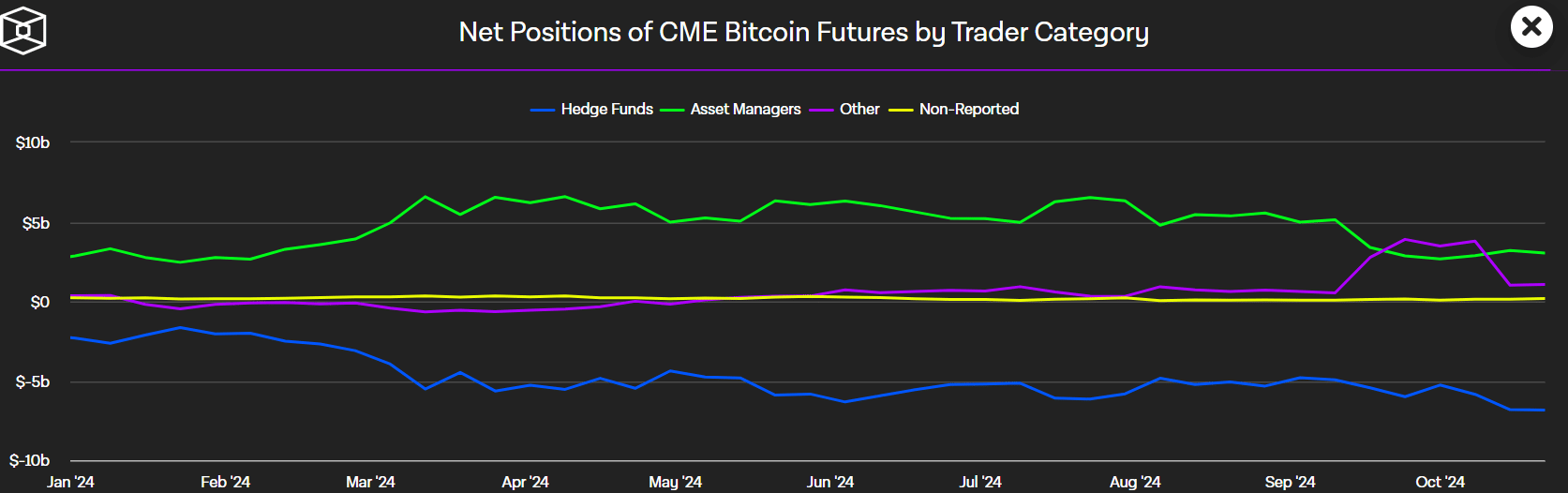

- The rising basis premium was being driven by hedge funds.

As a seasoned analyst with years of experience in the dynamic world of cryptocurrencies, I find the recent surge in Bitcoin’s basis trade particularly intriguing. The doubling of the basis premium within a month is not a common occurrence, especially when considering the current economic landscape.

Investors are once again actively participating in Bitcoin basis trading, which involves purchasing shares of spot Bitcoin ETFs while simultaneously selling CME (Chicago Mercantile Exchange) futures contracts at elevated prices. This strategy allows them to secure profits derived from the difference between the spot and future prices of Bitcoin.

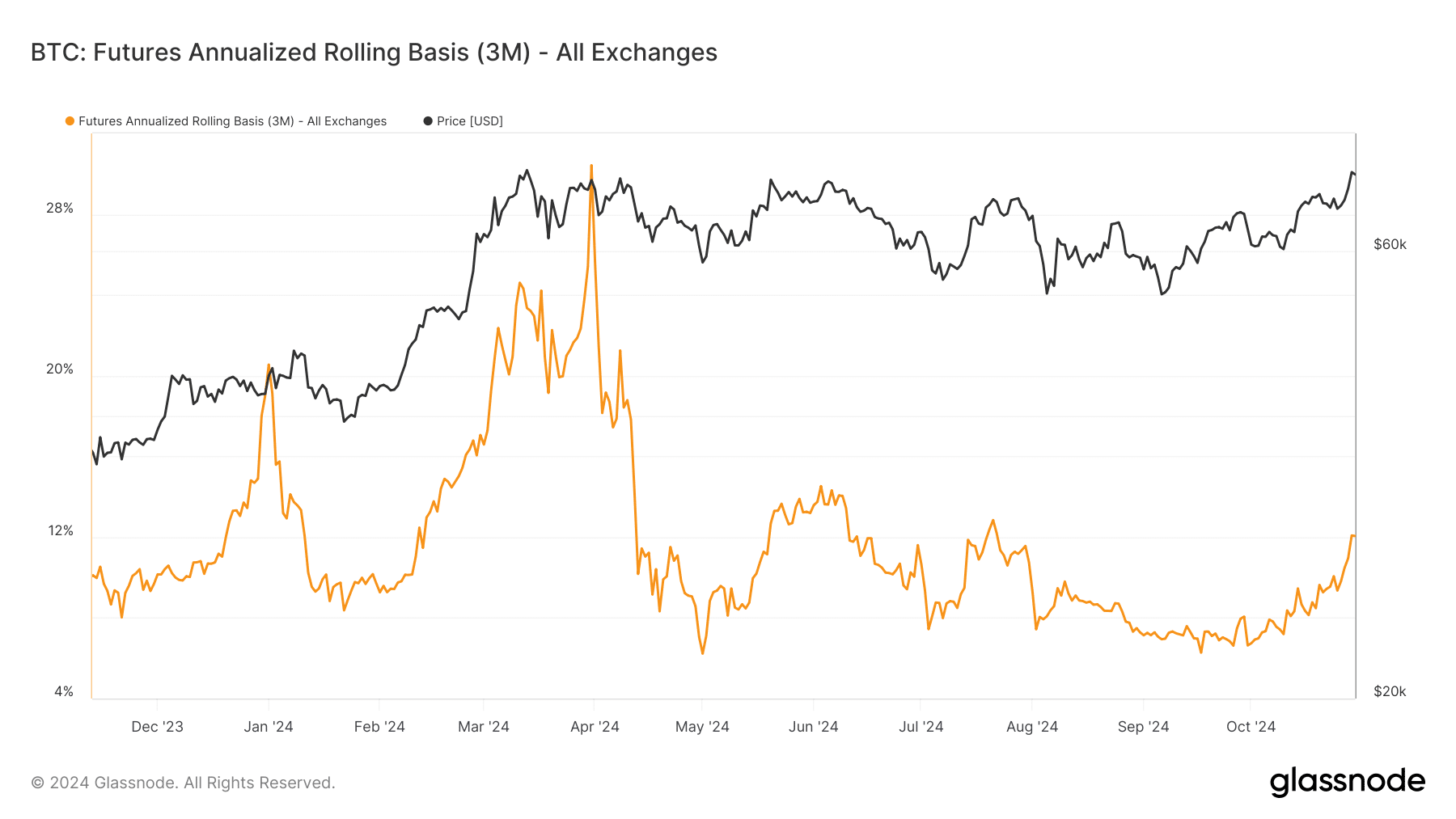

Usually favored by hedge funds and money managers, the premium for basis trades nearly doubled in October. This increase occurred when Bitcoin reached $70,000, as indicated by the Futures Annualized Rolling Basis metric.

By mid-September, the price had decreased to 6.2%, but it was 12% by the end of October – that’s nearly doubling within a few weeks.

The Fed rate cuts and implications

Based on the analysis by James Van Straten, a Bitcoin expert, there seems to be a correlation between the increasing Bitcoin basis trade and the continuous interest rate reductions being implemented by the Federal Reserve.

He stated that the lower interest rates made BTC basis trade a better option with higher returns than traditional opportunities.

The proposed rate is more than twice the existing Federal Funds Effective Rate of 5%. Moreover, there’s a strong possibility of additional cuts within the next three months. Given these circumstances, it seems likely that the popularity of the ‘basis trade’ strategy will grow.

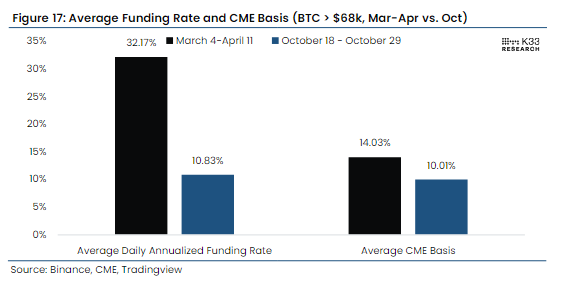

At the height of market fervor in March, Bitcoin achieved its record high (peak value) of $73,700. At this time, the price difference, or premium, reached a maximum of 14%. Subsequently, funding rates soared above 30%.

According to Mathew Sigel, the head of digital assets research at VanEck, the market doesn’t yet show signs of excessive enthusiasm similar to current readings, which he mentioned as a way of suggesting that the market isn’t overheating.

In simpler terms, “Historically, Bitcoin’s peak prices have been preceded by rising futures premiums (when the price of a future contract is higher than the spot price). However, this situation doesn’t exist currently. Moreover, the trading volume for Bitcoin right now is only half of what it was in March and April. This suggests that retail buyers are not panicking and stockpiling as much, which could be good news for its ongoing stability.

Speaking as a crypto investor, I’ve noticed a significant surge in the Bitcoin Open Interest (OI) rate, reaching an all-time high of $43 billion. Interestingly, it’s the CME futures that are leading this charge, accounting for approximately $12.69 billion. This trend suggests a massive institutional interest in Bitcoin, which is quite exciting for the crypto market!

As a researcher, I’ve discovered an interesting trend in the CME Futures market. It appears that hedge funds have been playing a significant role in expanding the basis trade premium through their strategic positions.

Based on information from The Block, it appears that hedge funds (represented by the blue line) held a collective short position of approximately $6.84 billion in Bitcoin. This significant short position suggests these funds have made large bets predicting a drop in Bitcoin’s price.

Extending this concept broadens the gap between Bitcoin’s spot price and future prices, potentially drawing in additional market participants.

As an analyst, I’ve noticed a significant decrease in Bitcoin’s premium, which could be indicative of pessimistic market sentiments and possibly an upcoming pullback in the price of BTC. Currently, at the time of writing, Bitcoin is valued at approximately $72,200 and has experienced a 13% increase this month, reaching a new high for October.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-11-01 08:08