- Riot Platforms reported 65% revenue growth, but faces challenges in U.S facility expansions

- RIOT stock dropped by 32% YTD, reflecting market volatility despite strong operational performance

As a seasoned analyst with years of experience navigating the tumultuous world of cryptocurrencies and blockchain technology, I find Riot Platforms’ Q3 2024 report to be a compelling testament to their resilience and adaptability in an ever-changing market. The company’s 65% revenue growth, despite the challenges faced in U.S facility expansions, is a clear demonstration of their strategic prowess.

Riot Blockchain, a key figure in Bitcoin (Bitcoin) mining operations, announced a substantial 65% increase in year-on-year earnings. This boost in revenue highlights the company’s robustness and continued growth trajectory following the recent Bitcoin halving.

Although the company demonstrated robust financial success, it encountered hurdles in its endeavors to expand its hashrate, mainly due to difficulties within its American operations.

Riot Platforms Q3 revenue report

In discussing its third-quarter outcomes for 2024, the company emphasized continuous expansion along with remarkably affordable energy expenses.

Commenting on the results, CEO Jason Les stated,

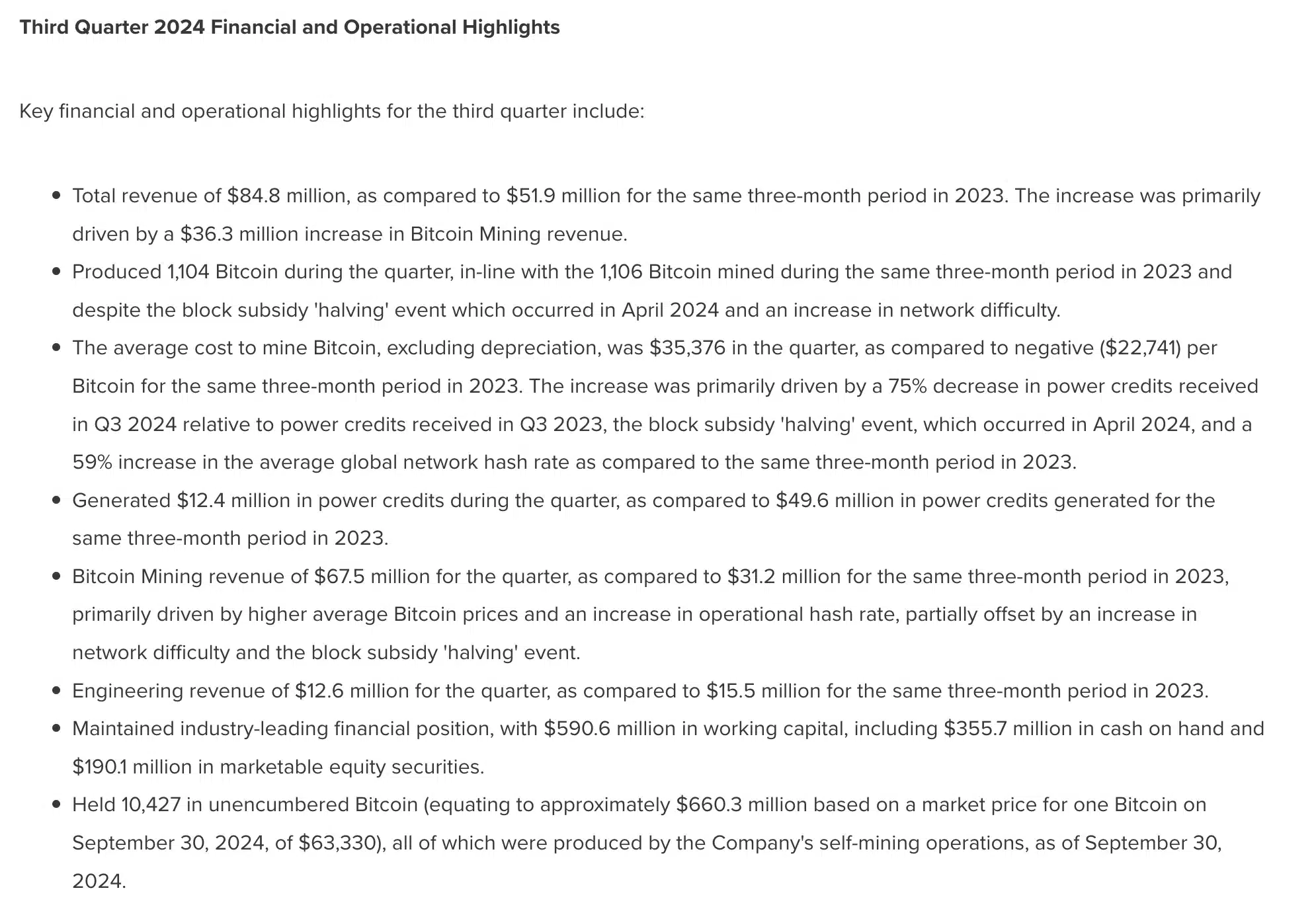

This quarter, Riot reported a significant revenue surge of $84.8 million, marking a substantial 65% growth compared to the same period in 2023. This impressive rise was primarily fueled by an outstanding year-over-year increase of 159% in deployed hash rate, which reached a staggering 28 EH/s as the quarter concluded.

He added,

The substantial boost in our operational hash rate enabled us to mine 1,104 Bitcoins during this quarter, consistent with our Bitcoin production from Q3 of 2023, even given the ‘halving’ event.

Riot platforms’ Bitcoin mining difficulty

In the last quarter of 2023, Riot Platforms announced a loss of $154 million, equivalent to $0.54 per share, which represents a significant increase of 92% compared to their losses in Q3 of the same year. This steep rise is mainly due to decreased power credits, increased operational costs, and the impact of Bitcoin’s halving event.

Nevertheless, facing these hurdles, the company managed to keep its energy efficiency commendable, achieving an average mining cost of roughly $35,376 per BTC – a figure that’s significantly lower than the current market price of approximately $72,000.

Moreover, CEO Jason Les pointed out that the company’s remarkably low energy rates, typically around 3.1 cents per kilowatt-hour, significantly contributed to their cost efficiency.

To sum up, by the end of the quarter, Riot Platforms boasted a robust financial position, with around $1.3 billion in assets consisting of cash, restricted cash, marketable stocks, and 10,427 Bitcoins stored as reserves.

To know more, here are some key highlights from the report –

What’s next?

Just as anticipated, CEO Jason Les expressed confidence about the company’s upcoming prospects, highlighting plans to expand power capabilities and mining output specifically in Texas and Kentucky.

Following these steps can reinforce their aim to boost self-mining capacity up to 100 Exahash per second (EH/s), highlighting their dedication towards expanding Bitcoin mining operations within the United States.

Currently, the company’s stock (RIOT) has faced challenges this year. On October 30, it dropped by 3.6% after hours, closing at $9.86. Since the start of the year, its value has decreased by 32%. At the time of writing, RIOT stands at $10.48, which is 85% lower than its peak in February 2021, when it was above $70.

Consequently, even though there’s an increase in operations and higher hash rates, the stock’s drop suggests that the market’s volatility is indeed a challenge to overcome.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Quick Guide: Finding Garlic in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- K-Pop Idols

- LINK PREDICTION. LINK cryptocurrency

2024-11-01 08:40