- AAVE soared this week, outpacing top altcoins after a dip

- However, despite strong technical indicators, concerns have been starting to surface

As a seasoned crypto investor with scars from more than a few market cycles etched into my psyche, I can’t help but feel a mix of excitement and trepidation when it comes to AAVE. The recent surge has been impressive, outpacing many top altcoins, but the concerns that have surfaced are valid.

In this current bullish market trend, AAVE has managed to outperform several top altcoins on a weekly basis, attracting increased attention and interest from investors. Notably, within the past 24 hours, its trading volume spiked by almost 12%, reaching approximately $180 million.

After a previous significant drop, this coin has bounced back, as pointed out in another AMBCrypto report. At present, the Relative Strength Index (RSI) has fallen into an oversold state, suggesting that the current price presents a good chance for traders to consider it as a “dip.” This could potentially lead to a large, parabolic increase, especially considering the bullish MACD crossover.

Currently valued at $150, will AAVE continue its upward trend and surpass the significant barrier at $200? After two previous unsuccessful attempts, it’s intriguing to observe whether AAVE can now successfully break through.

Technical indicators support this scenario

In simple terms, if AAVE is currently worth about $150, then reaching $200 isn’t out of the question, considering several encouraging technical signals are present.

On the contrary, this cycle presents a contrasting narrative. In March, when Bitcoin reached its all-time high of $73k, the price of AAVE also experienced a prolonged bullish surge that persisted for more than a month, eventually closing close to its current value.

Contrarily, as Bitcoin approaches a comparable high point now, I’ve observed significant pullbacks in Aave. Starting from late September, its value has been consolidating rather than surging, with four unsuccessful attempts to breach the $150 resistance barrier thus far.

As political unrest increases due to the upcoming elections, it’s expected that Bitcoin will draw a significant amount of investment capital. This might cause less expensive alternative cryptocurrencies (altcoins) to lose popularity.

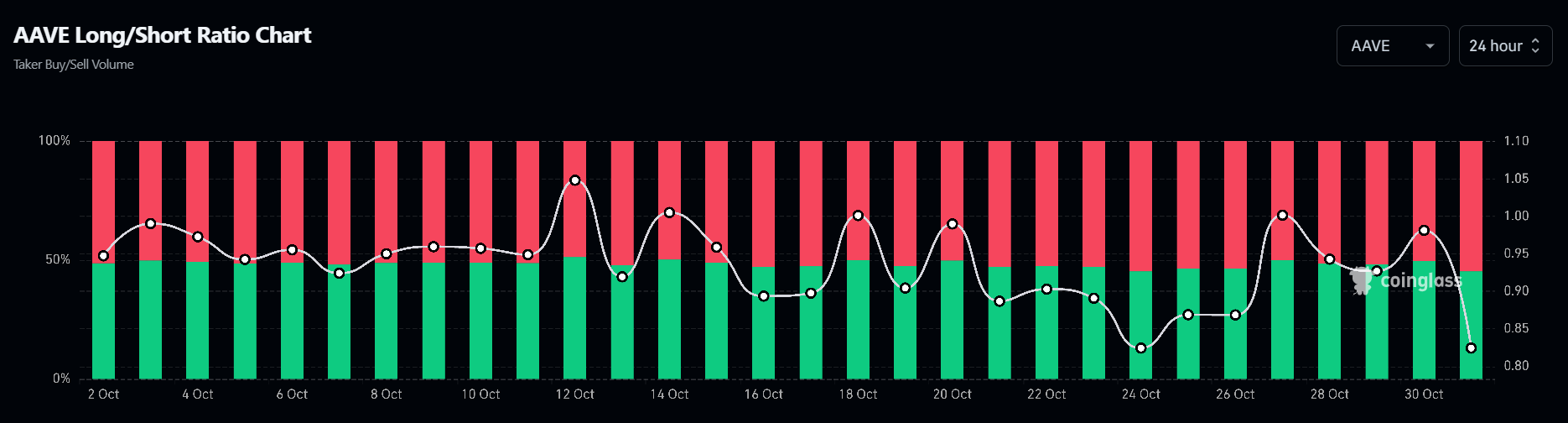

Source : Coinglass

Furthermore, there’s been a substantial increase in short positions in the derivatives market – A pattern that aligns with the present circumstances.

If the current trajectory continues, there’s a possibility that AAVE could decline and reach around $140. For potential new investors, this dip might offer an enticing opportunity, given that some technical signals suggest a positive market trend ahead.

Short-term gains for AAVE seem more likely

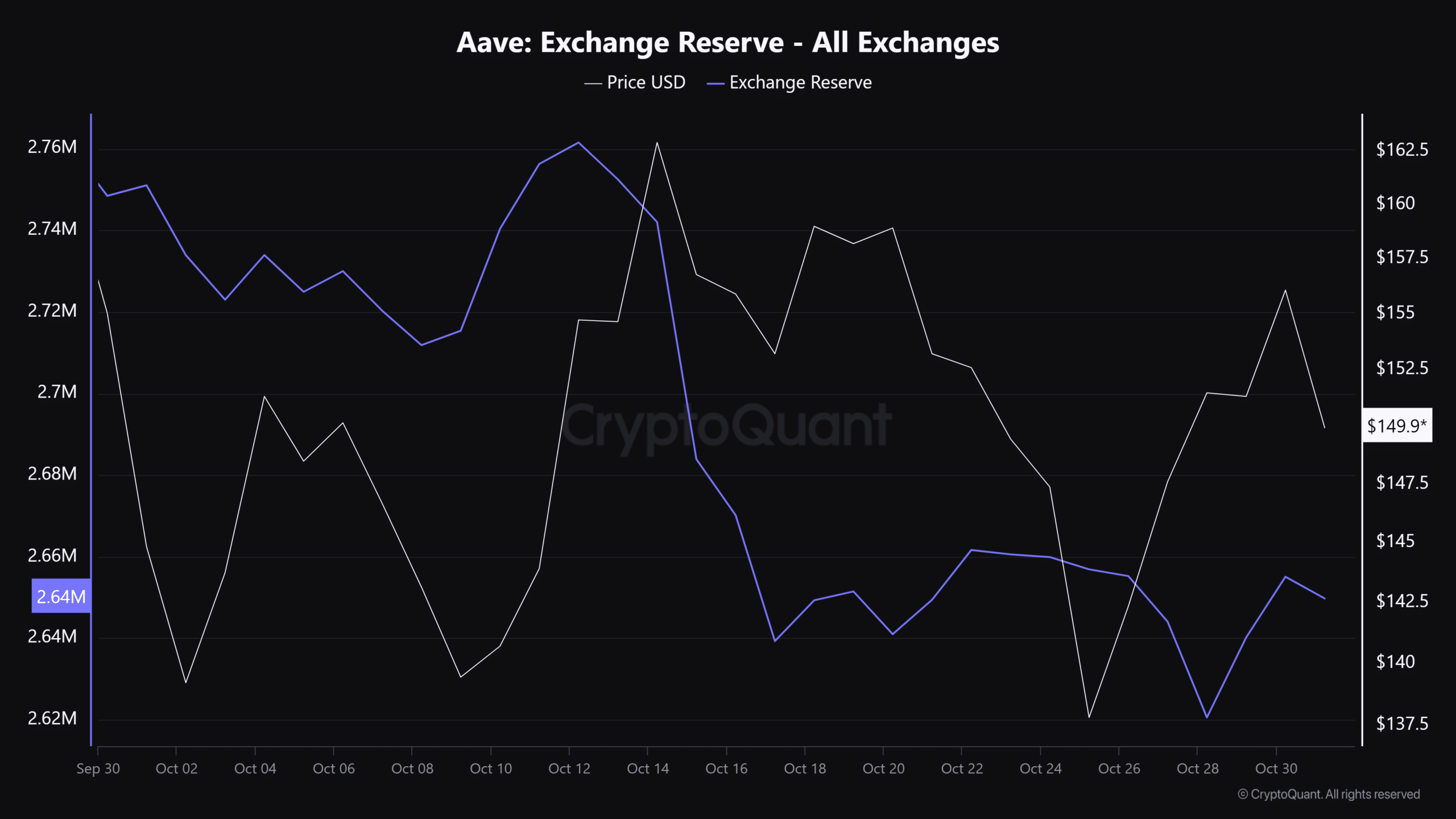

Over the last two days, more than 20,000 AAVE tokens were taken out of exchanges, hinting at the token’s price having a substantial drop. Initially, there was a sense of optimism about this situation, but that feeling soon dissipated as investors started selling off their investments.

Source : CryptoQuant

The logic is clear – the market is experiencing high volatility at present. As long as tranquility doesn’t resume, it’s probable that Bitcoin will be perceived as a secure investment, much like gold, silver, and bonds.

Read Aave’s [AAVE] Price Prediction 2024–2025

Although AAVE’s current price might look appealing for stockpiling, it’s tough to determine if an upward trend (bull rally) is imminent. In the short term, it’s probable that AAVE will hover around $150 due to expected gains. This prediction is particularly valid if Bitcoin continues its bullish trend.

It appears that a drop to around $140 could be more likely at this point. With pre-election uncertainties still lingering, it might prove challenging for whales to push AAVE beyond its current consolidation phase, despite their intentions to capitalize on the downturn.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-01 10:32