As a seasoned analyst with over two decades of experience in traditional finance and cryptocurrencies alike, I find Canary Capital’s recent move to file for a Solana ETF quite intriguing. The firm’s ambition is clear, and their strategy to tap into the growing demand for crypto investment vehicles is noteworthy.

Canary Capital has submitted an S-1 filing with the U.S. Securities and Exchange Commission (SEC) for a spot Solana [SOL] exchange-traded fund (ETF).

According to the provided form, I calculate the Net Asset Value (NAV) of the ETF utilizing the daily CF Solana-Dollar Reference Rate from the Chicago Mercantile Exchange (CME).

As a seasoned investor with over two decades of experience in the financial markets, I’ve witnessed numerous shifts and transformations in the digital asset landscape. The latest move by the asset manager to apply for spot Ripple [XRP] and Litecoin [LTC] ETFs is intriguing, given my own personal investment strategies and market insights. This could potentially pave the way for a new era of mainstream adoption and institutional participation in these digital assets, which I believe have immense growth potential. However, it’s crucial to keep a close eye on regulatory developments, as they can significantly impact the success or failure of such endeavors. In my professional opinion, this move is an exciting step forward for the crypto industry and could potentially open up new investment opportunities for both retail and institutional investors alike.

Despite the fact that Canary currently doesn’t have any live Exchange-Traded Funds (ETFs) available, its latest three submissions suggest a bold venture into the realm of cryptocurrency investments.

Canary’s support for Solana

After catching up on the latest updates, James Seyffart, an ETF analyst at Bloomberg, emphasized Canary’s plans to launch a SOL ETF as he shared his thoughts on platform X (previously known as Twitter).

Reflecting on Solana’s strong standing within the blockchain ecosystem, Canary stated:

Even though the world of L1 (Layer 1) and Ethereum Virtual Machine (EVM) platforms is extremely competitive, Solana stands out as a robust leader in hosting decentralized applications.

The statement also emphasized Solana’s strong DeFi ecosystem, citing sustained metrics like daily transactions, active addresses, and new addresses, all within a low-fee structure.

Moreover, the company is confident that the expanding use of stablecoins will strengthen Solana’s advantage over rival platforms.

Solana’s ETF filings

Filing by Canary signifies another endeavor to launch a Solana Exchange-Traded Fund (ETF) within the United States, as this is not their initial effort.

This year, the investment companies VanEck and 21Shares put forward requests for Solana (SOL) Exchange Traded Funds (ETFs), formally submitting their application documents – the S-1 forms – in June.

It’s worth mentioning that, excluding the United States, Brazil was the pioneer nation to endorse SOL ETFs in August.

SOL’s market performance

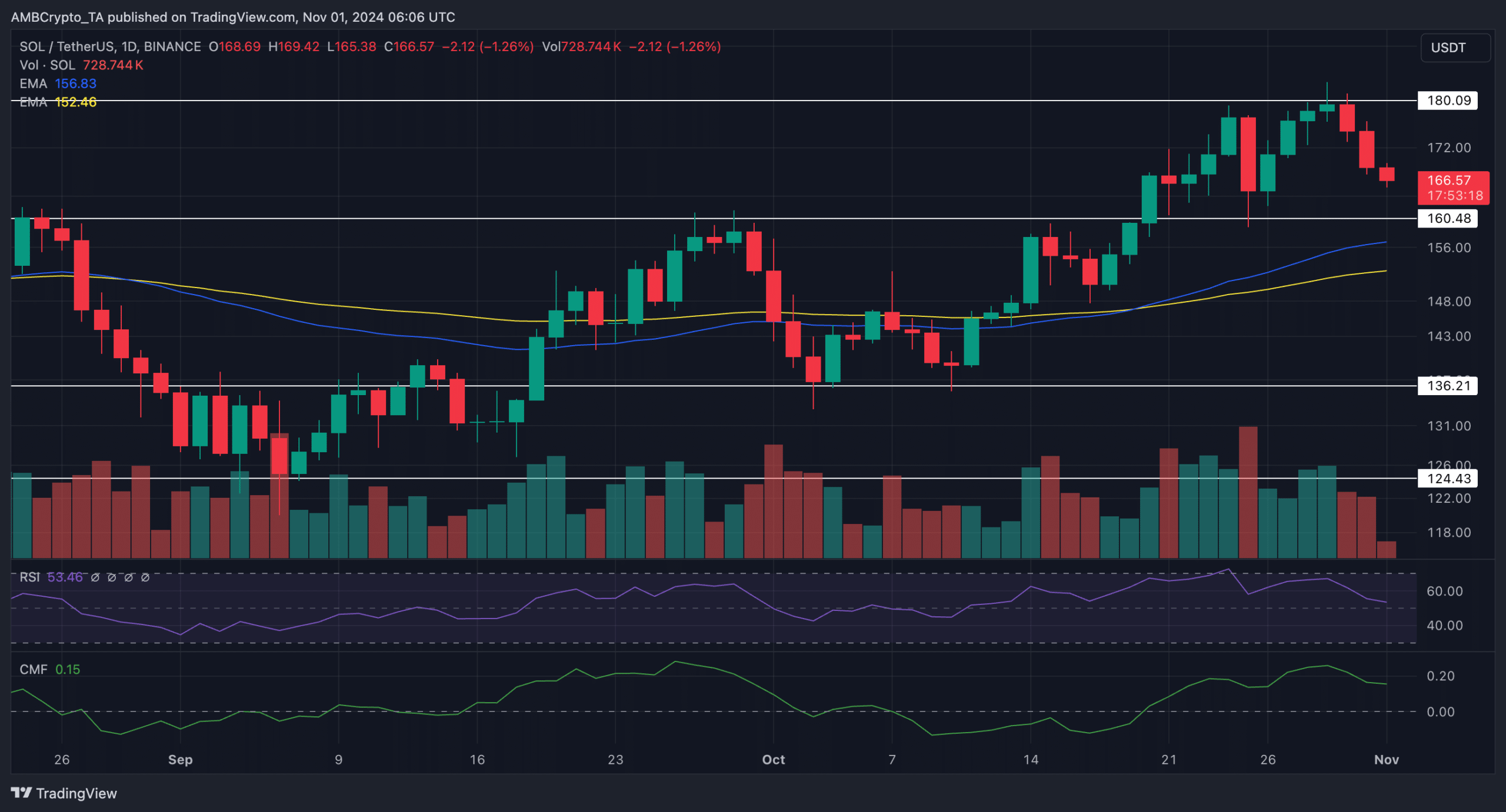

Regardless of the submission, things weren’t going well on the pricing side. After encountering refusal at the crucial $180 level, Solana’s chart showed signs of a downturn.

At the time of writing, the altcoin was trading at $166, down by 4.90% in the past day.

Remarkably, a decline in SOL’s value coincided with broader industry losses, occurring at the same time when Bitcoin [BTC] dipped below $70,000.

In simpler terms, as the market was following a particular trend, the technical indicators (RSI and Commodity Channel Index – CMF) suggested a decrease in the bullish momentum. Currently, RSI is at 53.46 and CMF is at 0.15.

Due to this ongoing downward trend, Solana (SOL) might face a challenge maintaining its $160 support. Should it break, the drop could potentially worsen further.

If the 100-day EMA (Exponential Moving Average) changes hands to the sellers, it strongly suggests that the market direction will shift towards a bearish trend.

The potential upside for SOL ETFs

Meanwhile, all is not bad for SOL in the crypto sphere.

14th October saw AMBCrypto reporting that Grayscale has sought approval to transform its GDLC fund into a diversified ETF, incorporating Solana along with other cryptocurrencies within the portfolio.

On October 29th, the SEC officially recognized Grayscale’s application, signifying a major milestone towards debuting the initial multi-crypto Exchange Traded Fund (ETF) in the United States.

A decision on the application is expected within 45 to 90 days.

With the ongoing competition among Exchange Traded Funds (ETFs), Canary Capital’s latest submission emphasizes a growing interest in investment instruments linked to Solana.

However, will this momentum translate into regulatory approval? That remains to be seen.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-11-01 15:04