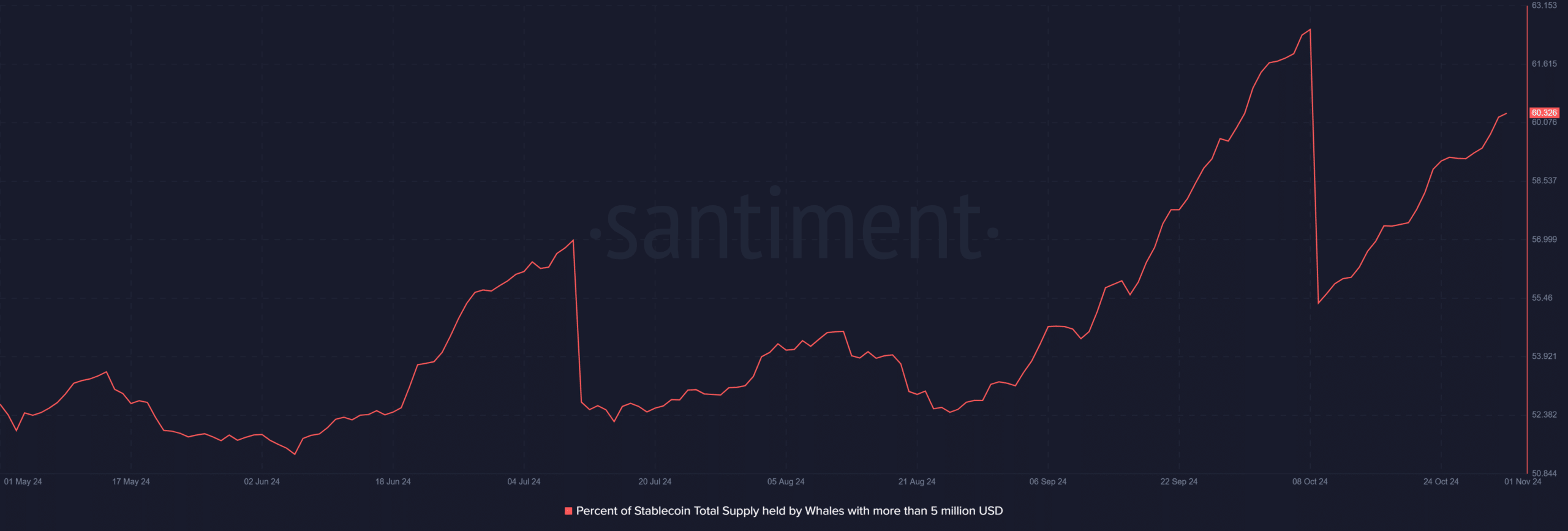

- Solana’s whale concentration reached 60%, historically a bullish signal.

- With $6 billion in total value locked and strong technical support, upward momentum seemed likely for SOL.

As a seasoned analyst with over a decade of experience in the crypto markets, I find myself intrigued by Solana’s (SOL) current position. The whale concentration reaching 60%, historically a bullish signal, and the network’s strong technical support at $6 billion TVL, suggest an upward momentum for SOL.

As a crypto investor, I’ve noticed an intriguing blend of whale interest and technical fortitude within the Solana [SOL] ecosystem. Amidst the stormy cryptocurrency market, on-chain information paints a hopeful picture. The steady accumulation by whales and Solana’s resilience in the face of adversity are signs that could suggest promising opportunities for growth.

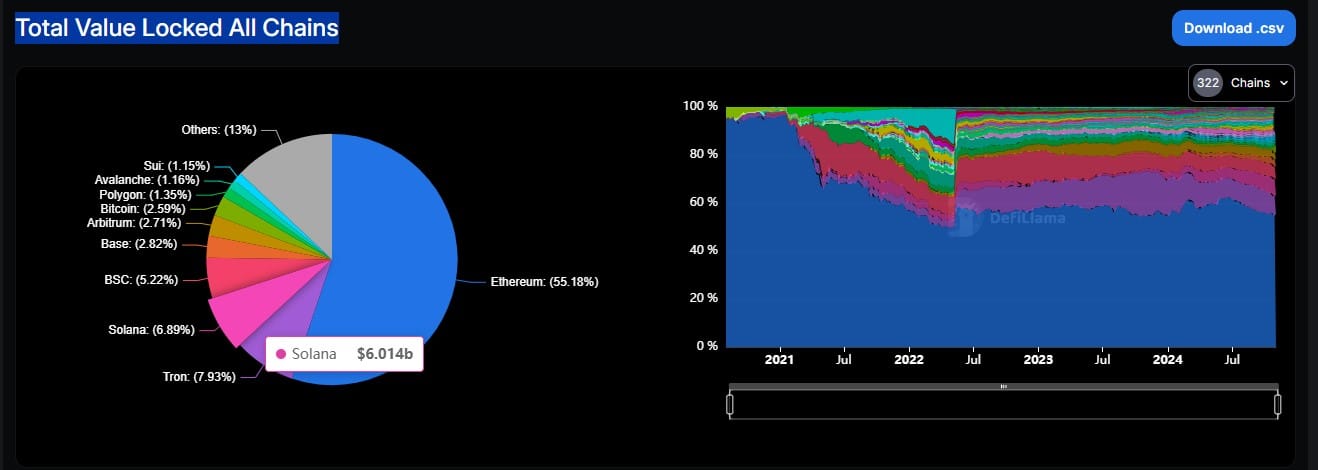

Approximately 60% of all Solana’s (SOL) total supply is currently being held in whale wallets, which have accumulated over $5 million each. At the same time, the Total Value Locked (TVL) on the network stands at a staggering $6 billion. This suggests that institutions are expressing confidence in Solana despite the market’s ongoing uncertainties.

Solana’s network value solidifies

Supporting its whale-related activities, Solana continues to hold a robust position within the DeFi landscape, boasting a total value locked at $6.014 billion. In essence, this positions Solana as the third-largest chain in terms of TVL, accounting for 6.89% of the overall cross-chain market share.

Among current blockchain networks, only Ethereum and TRON have a higher total network valuation, indicating that Solana is steadily gaining significance within the Decentralized Finance (DeFi) sphere.

Technical sentiments highlighted a bullish trend

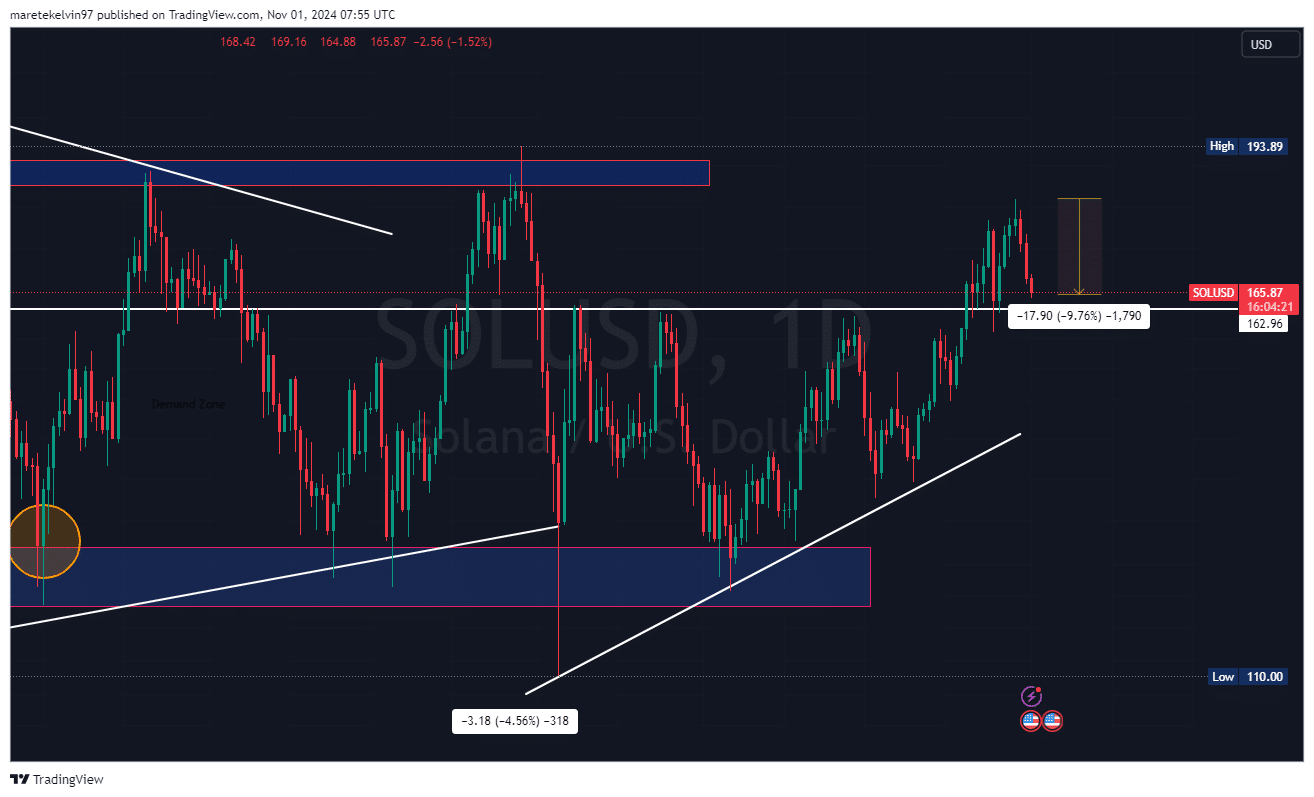

Currently, as I’m typing this, Solana (SOL) is nearing an important support level of approximately $163, following a 9.7% drop spread over three days.

According to AMBCrypto’s assessment, Solana’s extended periods showed an ongoing formation of higher bottoms, which could be a sign of a possible price reversal. This pattern might indicate that investors are amassing more assets at these price levels.

Also, the market structure remained intact, despite the recent pullback from local highs.

Whale activity signals a potential reversal

In my analysis, noticeable declines in whale holdings were observed on both the 10th of July and 10th of October, following periods of accelerated acquisition. These trends lend credence to the technical configuration seen on the charts, suggesting potential future patterns that could unfold.

At the moment, the distribution of large holders in Solana (whales) is reminiscent of past instances that preceded price surges. This pattern hints at potential repetition of similar market behaviors.

What next for SOL?

The important price point of $163 needs to hold steady for a bullish trend to be confirmed. If it falls below, there might be more declines in the value of the altcoin.

Despite Solana’s on-chain statistics appearing promising, the market requires confirmation from increased purchasing demand for validation.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Combining the shared goals of institutions and the worth found within networks, we find a robust base that could lead to an upward trend in the graphs, a situation often referred to as a bullish reversal. If the general market opinion continues to be favorable, this scenario might become more likely.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-11-02 01:11