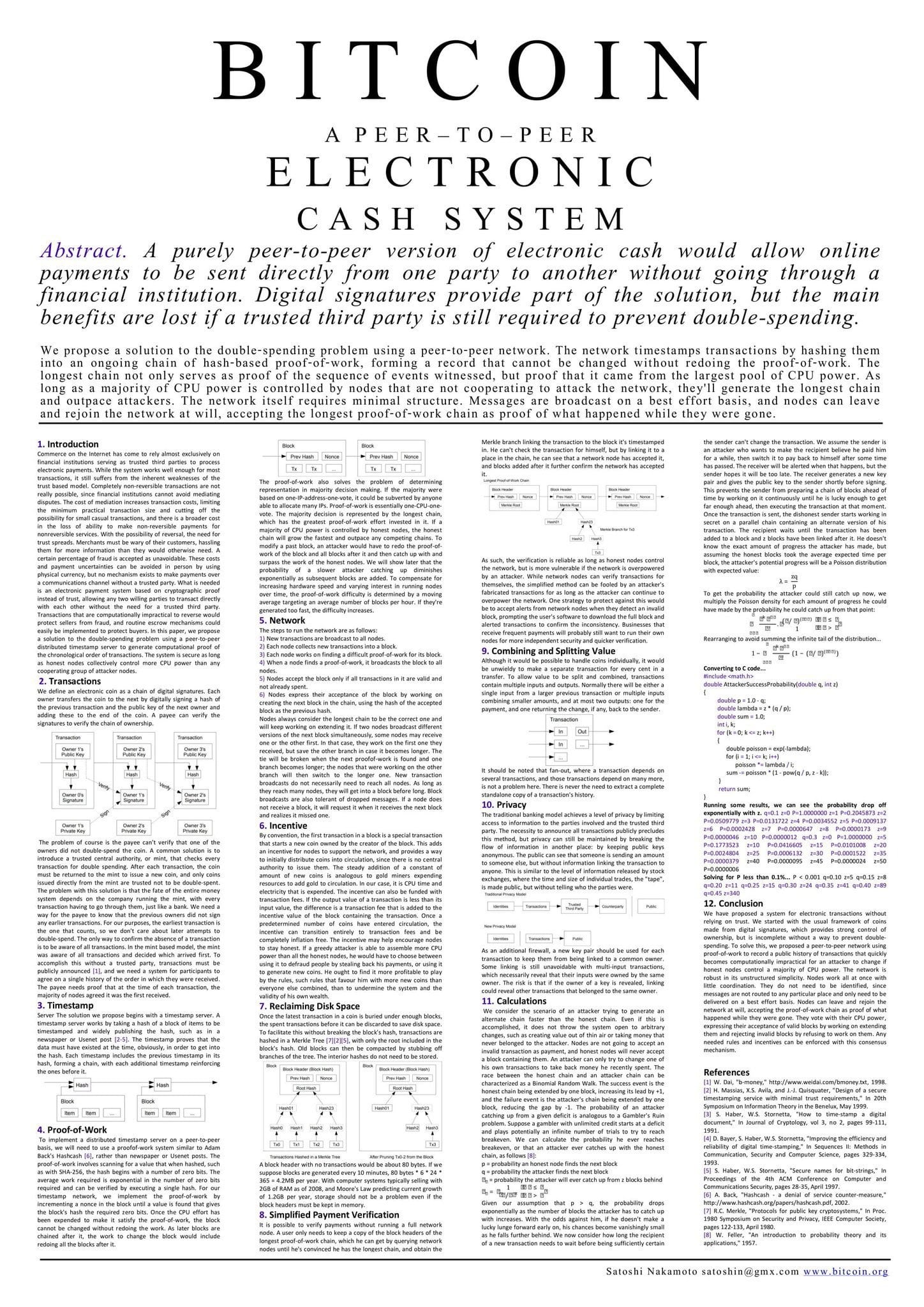

- Bitcoin’s whitepaper was released by pseudonymous Satoshi Nakamoto in 2008

- Whitepaper has had a huge impact on world economy and facilitated a shift in paradigms

As a seasoned analyst who has witnessed the evolution of technology and finance over several decades, I can confidently say that Bitcoin’s whitepaper stands as one of the most impactful documents in recent history.

16 years back, an innovative idea for a decentralized, peer-to-peer digital money known as Bitcoin (BTC) was presented to the world in a whitepaper, authored by the anonymous figure called Satoshi Nakamoto.

This revolutionary paper paved the way for the development of blockchain technology, which later led to the birth of Bitcoin (BTC), the initial form of digital currency.

The Bitcoin whitepaper didn’t merely suggest a novel form of currency; it presented an aspirational concept of financial autonomy, enabling individuals to manage their funds beyond the conventional banking frameworks.

Privacy and ownership

From the moment it was first introduced, Bitcoin has significantly altered the financial terrain by advocating for confidentiality and individual control.

In contrast to conventional banking systems where financial institutions hold the reins, Bitcoin gives individuals direct control and management over their assets. This is achieved without the need for intermediaries.

This change has sparked a movement towards financial independence on a global scale, encouraging individuals everywhere to delve into the potentials of decentralized currency systems.

The idea of self-custody and privacy resonated with users, creating a movement towards a more transparent and accessible financial ecosystem.

Bitcoin laid the foundation for crypto and DeFi

Beyond privacy, Bitcoin’s whitepaper laid the groundwork for the entire cryptocurrency ecosystem.

As a keen observer in the digital currency landscape, I can attest that Bitcoin’s triumph has served as a catalyst for the birth and evolution of more than 20,000 different cryptocurrencies. Each of these digital coins represents an innovative exploration into various potential uses of blockchain technology.

Bitcoin, frequently referred to as “digital gold,” stands out as the most significant cryptocurrency and serves as a representation of this transformative digital economy. Its influence extends beyond the realm of finance, igniting industries dedicated to blockchain applications. This includes decentralized finance (DeFi), tokenized assets, and many other sectors that leverage blockchain technology.

Bitcoin spurred on the decentralized finance (DeFi) movement, which allows for activities such as lending, borrowing, and trading to be carried out without the need for intermediaries. DeFi is based on blockchain technology and has expanded into a multibillion-dollar industry, drawing in both individual users and large financial institutions. Pioneering asset management firms like Franklin Templeton have started tokenizing assets, thus linking traditional finance with the advancements of blockchain technology.

The growth of Decentralized Finance (DeFi) mirrors the fundamental values of Bitcoin, providing a decentralized option to traditional banking systems and promoting wider economic involvement.

Publishing the Bitcoin whitepaper sparked not just the creation of digital currency, but a transformative change in economic and financial perspectives. With growing numbers of individuals adopting BTC and other cryptocurrencies, traditional financial structures are adapting to accommodate digital resources.

The standing of Bitcoin as an investment considered for storing value has progressively strengthened, placing it as a potential safeguard against inflation and unstable economies.

As a researcher delving into this field, I’ve noticed a surge of attention from various institutions. Their focus stems from the belief that digital currencies like Bitcoin are indispensable elements when constructing contemporary investment strategies.

Looking ahead…

Moving ahead, Bitcoin’s fundamental nature might spur more changes in the worldwide financial landscape.

The whitepaper has built a tradition of decentralization, privacy, and financial independence that motivates future generations to envision different economic systems.

With the ongoing advancement and deeper integration of blockchain technology within everyday financial systems, Bitcoin might play a significant role in molding the future landscape of digital currency and decentralized finance.

Fundamentally, Bitcoin’s original document paved the way for a novel economic direction, placing Bitcoin as the pioneer in a financial upheaval.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-11-02 07:10