- $1 billion USDT mints on TRON and Ethereum are fueling liquidity and aligning with bullish sentiment across the market.

- Onchain data shows strong optimism, with 11.83% of holders profiting, reinforcing Tether’s role as a liquidity anchor.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless trends and shifts that have shaped the economic landscape. The recent surge in Tether (USDT) minting across TRON and Ethereum is no exception – it’s an intriguing development that demands close attention.

Due to a significant increase in the creation of Tether (USDT), its current circulation has reached record levels, now standing at approximately $62.8 billion, following the minting of an additional $1 billion on the TRON network, which previously had a supply of around $48.8 billion.

The increasing desire for market fluidity is evident in both TRON and Ethereum, indicating a surge in demand. Yet, these releases have a significant effect on market behavior, shaping trader attitudes, affecting liquidity levels, and potentially impacting price consistency.

TRON plays a significant role in the expansion of Tether, accounting for about half (51%) of its total supply, which stands at approximately $120 billion. Meanwhile, Ethereum is close behind with around 45% of the share.

Consequently, these networks play a crucial role in ensuring ongoing liquidity within the cryptocurrency market. Major emission events, like the recent $1 billion minting on Ethereum, support Tether’s approach of keeping reserves ready to address unexpected liquidity needs.

The effect of previous USDT mints on market dynamics

More recently, TRON’s minting event hasn’t been the only one to pique market interest. Back in September, Tether also minted $1 billion on Ethereum, sparking discussions about potential future market actions. Some interpreted this as a positive sign, while others considered it just a normal adjustment of their inventory.

However, it’s quite common for the launch of new mints to coincide with a positive market outlook. Analysts notice that these events tend to correspond with heightened trading activity. This is because traders view these launches as indicators of increased liquidity and possible profits.

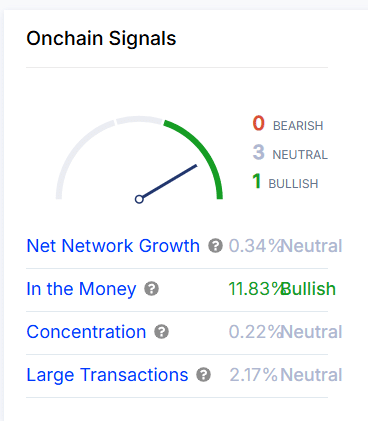

Based on current transactions recorded on the blockchain, there’s a strong positive outlook for the recent issuance of USDT. The “In the Money” statistic shows that about 11.83% of Tether holders are currently experiencing gains, suggesting a bullish attitude among investors.

As a researcher, I’m observing that key indicators such as network expansion, centralization, and high-value transactions seem to be maintaining a steady pace. This equates to a stable yet hopeful perspective, hinting at continuous growth in the ecosystem.

As an increasing number of Tether holders find themselves “in profit,” their faith in Tether strengthens, solidifying its position as a key source for market liquidity.

Can Tether’s peg stability endure the expanding supply?

USDT’s dollar-linked value maintains stability, but swift increases in supply may disrupt this balance during unpredictable market situations. Meanwhile, Tether’s market control, currently around 5.30%, appears to be approaching the 5.47% resistance threshold.

In favorable market situations (bullish conditions), this increasing influence strengthens the tie (peg). But, an unexpected plunge might challenge Tether’s capacity to maintain this link, particularly when a larger volume increases the overall volatility.

Tether’s continuous increase in the creation of new tokens on TRON and Ethereum underscores its significance as a major supplier of liquidity. Each new issue enhances market liquidity and indicates increased interest from significant market participants.

Onchain signals support a bullish outlook, with a significant number of holders “In the Money.”

However, the crucial role that Tether plays in keeping its stability even as its supply grows becomes increasingly important, particularly during economic downturns.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

2024-11-03 13:12