- Large funds expected wild price swings but were bullish on BTC potential.

- However, analysts foresaw BTC sinking lower before a potential rebound.

As a seasoned crypto investor with a few battle scars from past market rollercoasters, I find myself bracing for the potential turbulence that the upcoming US election might bring to Bitcoin [BTC]. Last week’s tease of an all-time high (ATH) was a tantalizing taste of what could be, but this week, I’m more focused on the cautious stance taken by large funds and the potential for wild price swings.

This week, we anticipate the results of the U.S. election, and it seems that hedge fund strategies regarding Bitcoin [BTC] remain generally optimistic, even with a note of caution overall.

Just last week, Bitcoin reached a new record peak (all-time high) as it climbed over $73,000 due to growing interest in the Bitcoin ETF and heightened chances of Donald Trump’s reelection.

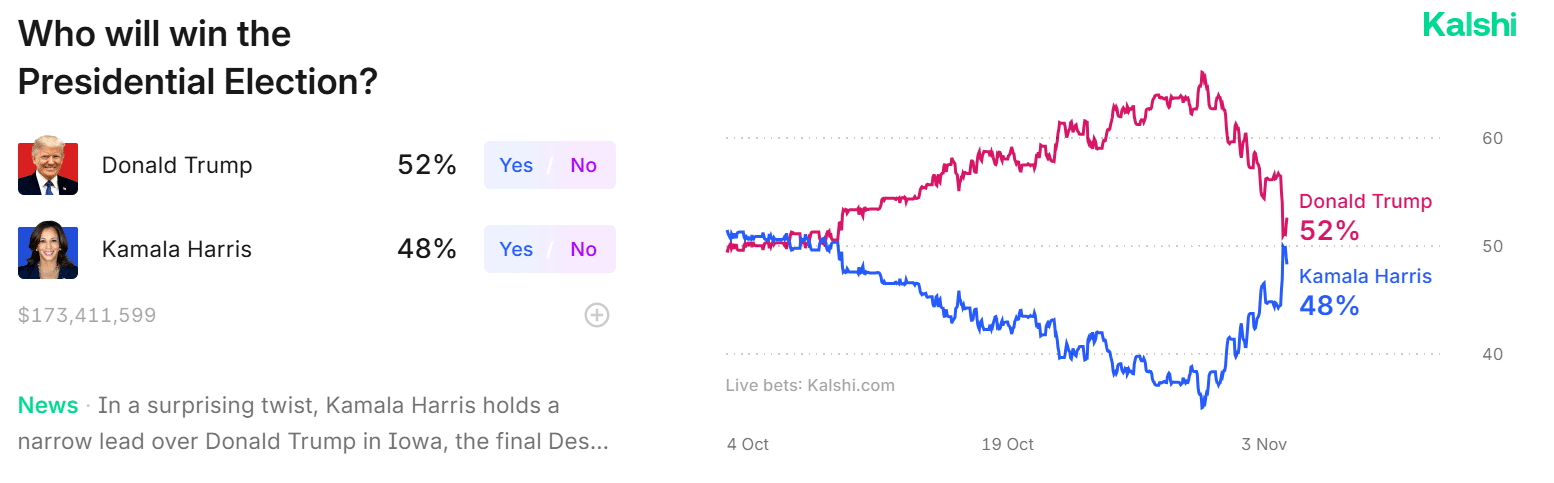

Things were different in the election week. As of the 3rd of November, Kamala Harris had closed in on Trump’s odds on Polymarket and was almost at 50/50 on Kalshi, another prediction site. In short, it was a tight race, and any candidate could win.

Large funds eye $70k-$85k for BTC

Even though the competition was close, most hedge funds exhibited a strong optimism, however, they also took a defensive stance by adopting positions that could work regardless of whether the market would go up or down.

Based on recent Deribit statistics, there has been significant purchase of call options (indicating a belief in price increases) for potential prices ranging from $70,000 to $85,000 by November. The report also mentioned…

During the election period, there was a significant increase in option buying by large funds. This can be interpreted as a form of hedging or reinforcing their positions, as they simultaneously purchased call options for November with strike prices ranging from 70,000 to 85,000, and also bought 70,000 straddles (a combination of both call and put options) for the same month.

Furthermore, significant wagers on straddles (placing large bets on substantial price fluctuations) suggest a forecasted volatile market leading up to the election. Major investors have purchased both call options (offering protection against price increases) and put options (providing coverage for potential price drops) in preparation for possible price swings, regardless of direction.

Likely election outcome delay?

In other words, it appears that the key aspect of the Deribit data was the tendency among traders to concentrate on option expiries not on the 8th of November, but rather on the 29th. This suggests a prediction for an extended delay in the election results, possibly caused by disputes or allegations of fraud.

The data from November 8th still shows an upward trend, but there’s a more significant surge seen on November 29th. This could be because the theta decay might not have been as strong for an extended outcome, causing the latter flow to overshadow the weekly trends.

It seems that taking a careful, short-term approach might have contributed to the risk reduction we observed in the spot market at the end of last week.

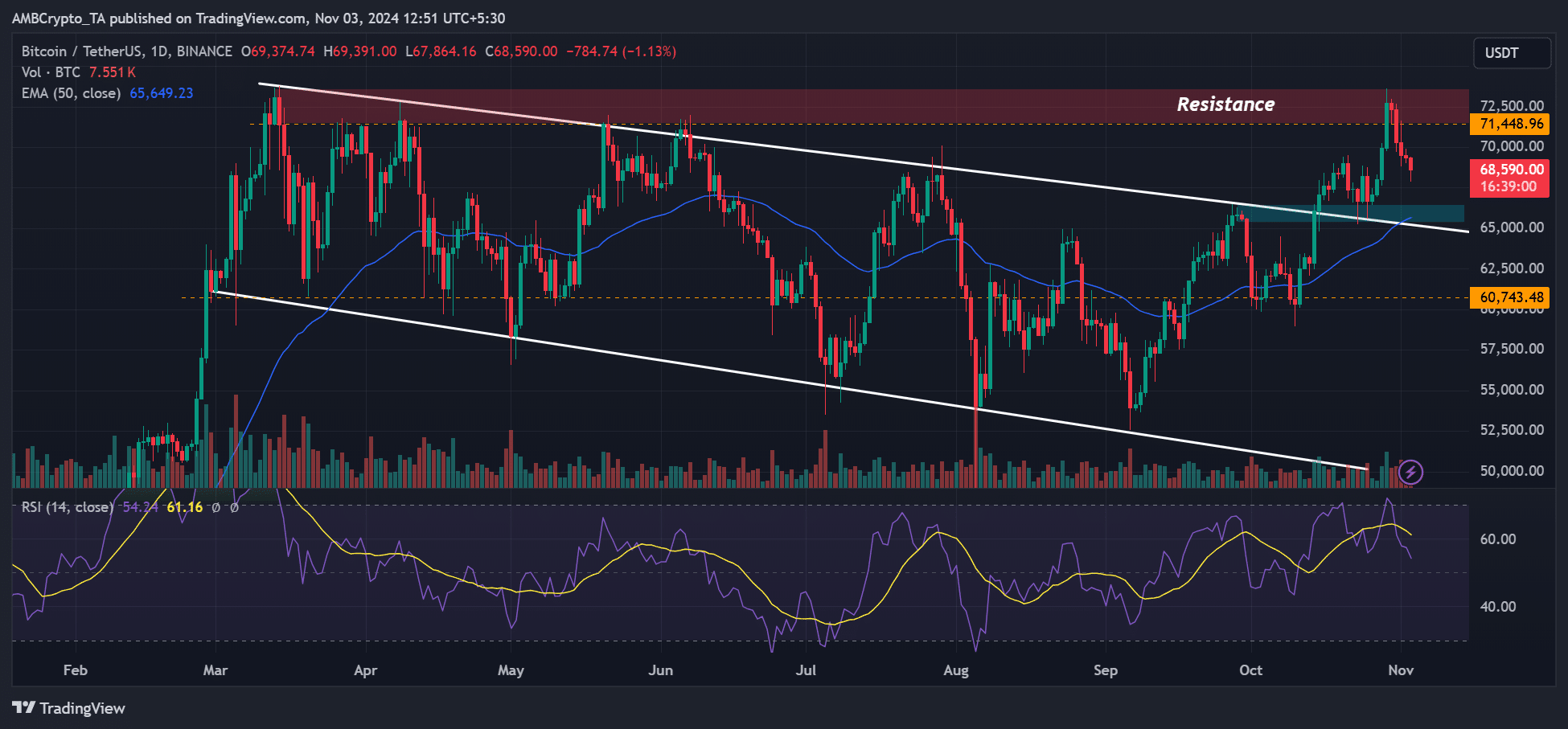

Bitcoin experienced a significant decline this week, falling from its peak of approximately $73,600 to levels below $68,000. Some financial experts predict that the cryptocurrency could drop further, based on past trends associated with election days.

One of the analysts, Eugene Ng Ah Sio, a crypto trader, said,

“Seeing constructive derisking happen just at the right time. The plot thickens…”

Eugene added that he would avoid the markets until the election outcome is known.

The cautious approach was echoed by crypto trading firm QCP Capital, warning that the election outcome could be a sell-the-news event. It said,

No matter the results, it’s our view that these elections will once again function as a ‘buy-the-rumor, sell-the-news’ event, much like the Nashville Bitcoin conference.

Another market observer and investor, Mike Alfred, shared a similar sentiment but pointed out that this might be the last week to buy BTC below $70K.

In every past election cycle, Bitcoin’s lowest price for that cycle was set during the week of the U.S. elections and it has never dipped below that point again. This week might mark the final opportunity to purchase Bitcoin at a price under $70,000.

On the price charts, $65K remained a key level (confluence area) should the pullback extend lower.

Regardless of the election’s final result, the placement of substantial funds suggested that Bitcoin could potentially recover, as this arrangement indicated confidence in its future.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-03 16:08