- Long-term holders’ dominance rose sharply over the last few days

- At the time of writing, Ethereum seemed to be testing its support level

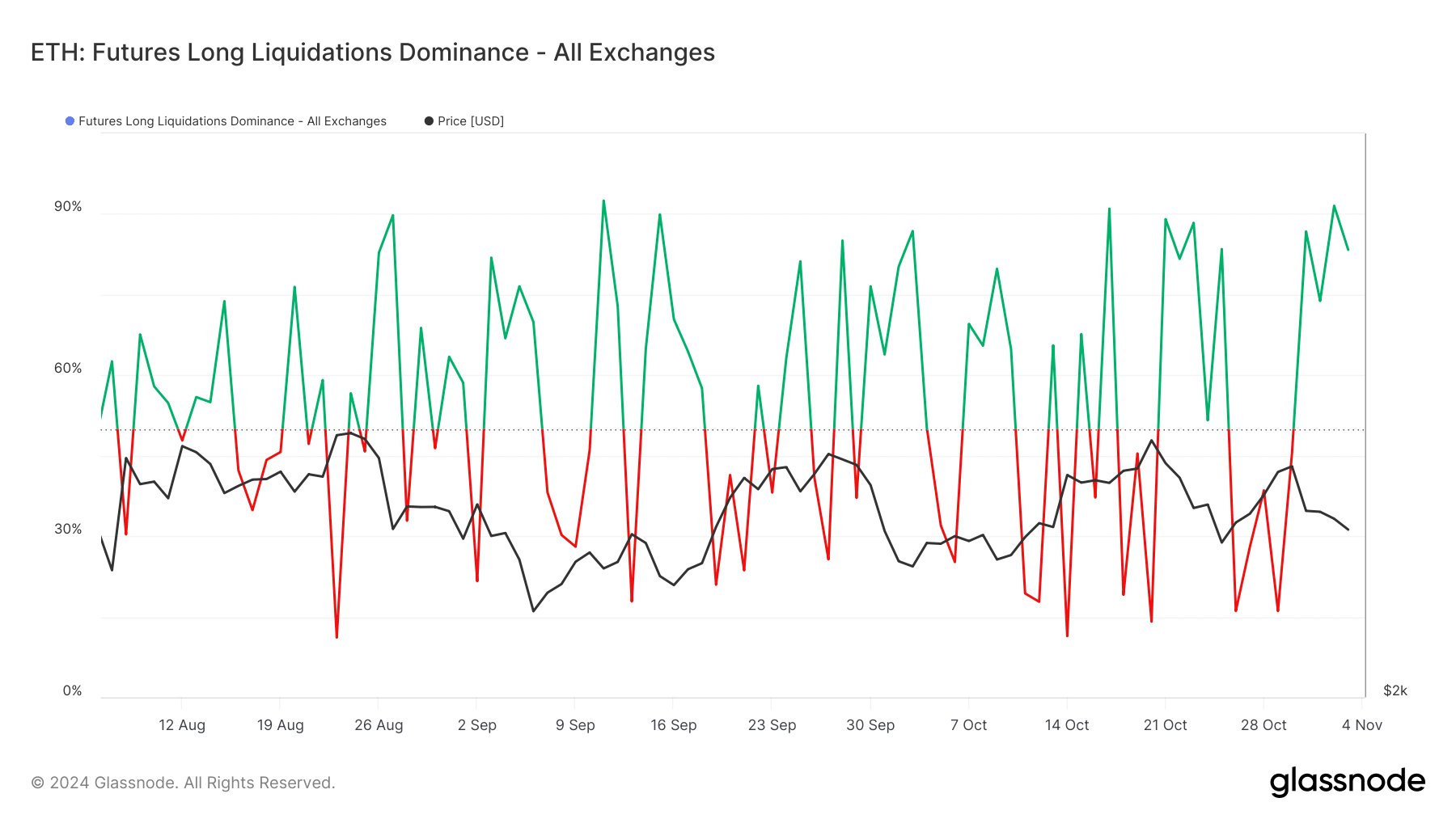

As a seasoned crypto investor with a knack for spotting trends and reading market signals, I find myself increasingly intrigued by Ethereum’s current trajectory. The recent surge in long-term holder dominance, as highlighted by the sharp rise in ETH‘s Futures long liquidation dominance, suggests that we might be on the cusp of a significant bull run.

At the moment, Ethereum (ETH) is making headlines as it inches closer to $2,500, leading some to anticipate a bullish trend. This gradual increase seems to boost optimism in the market. Yet, the question remains: Will this alone drive further price increases?

Long term holders show confidence in Ethereum

Over the past day, Ethereum’s value has experienced a small adjustment and is currently being exchanged for approximately $2,465.36. During this time, a well-known cryptocurrency expert named Ali posted an intriguing tweet about a significant update.

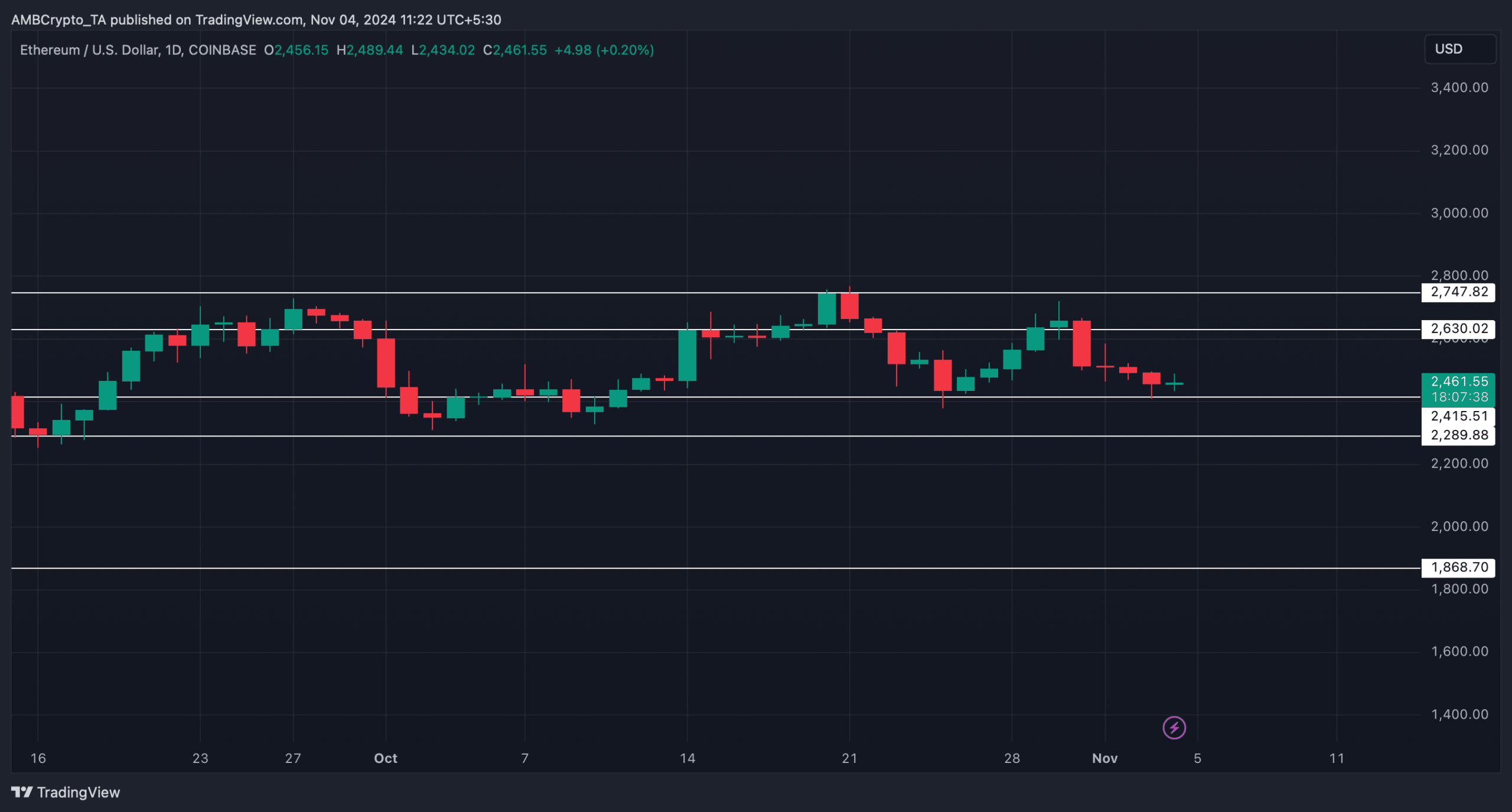

For a while now, ETH’s value has been fluctuating within an upward trending pattern, where it has repeatedly tested both its support and resistance levels.

The tweet also mentioned that the risk-to-reward ratio on Ethereum is too good to pass up for a long position. The analyst set his stop below $1,880, aiming for a target of $6,000.

Based on our examination of Glassnode’s data, we delved into whether long-term holders are indeed expressing faith in Ethereum, the leading altcoin. Our analysis indicates that the dominance of ETH’s Futures long liquidation exceeded 80. When this metric reaches 50, it signifies that the proportion of long-term and large-scale holders is equal.

Hence, at press time, it was clear that LTHs were showing confidence.

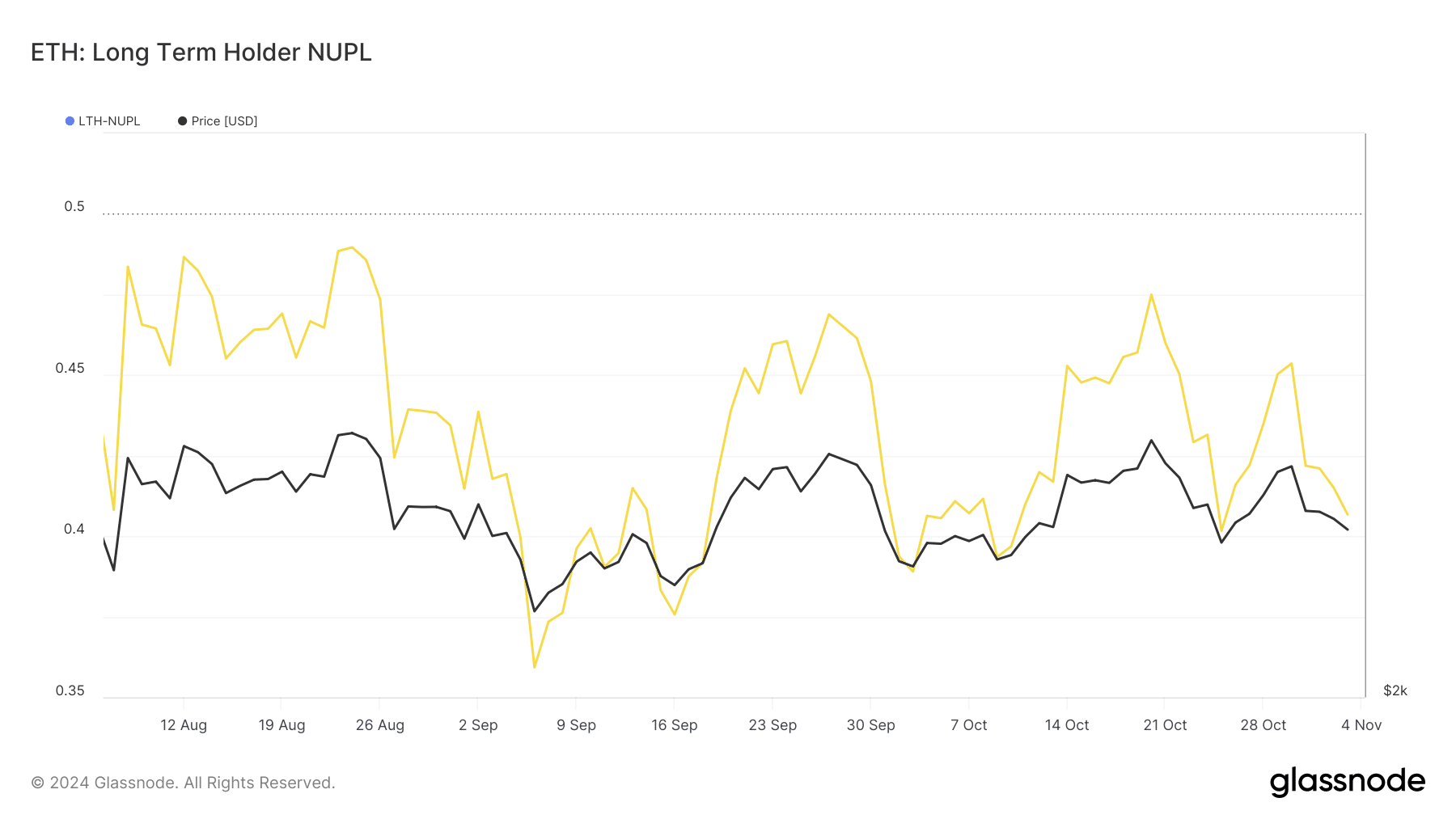

It became even clearer that Long Term Holders (LTHs) held significant market power when the token’s Futures long liquidations resumed their upward trend following a sudden drop. Additionally, we examined Ethereum’s long-term holder Net Unrealized Loss/Profit (NULP).

Initially, this metric focuses solely on UTXOs (Unspent Transaction Outputs) that have been inactive for at least 155 days. It is used to evaluate the actions of long-term investors. At the moment, this metric signaled optimism, suggesting that long-term Ethereum holders are quite confident about ETH.

Indeed, it’s worth noting that AMBCrypto had reported earlier that not just large holders (LTH), but even the larger whales have shown optimism. The report pointed out that their Ethereum balances saw a substantial increase over the past fortnight, with them holding approximately 56.68 million ETH by mid-October.

What to expect in the short term?

Initially, there appeared to be a favorable outlook for the long-term, but let’s focus on where Ethereum (ETH) might trend in the short term based on our analysis. At the moment, ETH is attempting to hold its ground at approximately $2415. If it manages to do so, we could potentially see Ethereum moving up towards $2600 as shown on the charts.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Should the price of Ethereum surpass the current resistance level, I wouldn’t be shocked to witness it reaching approximately $2.7k in the near future.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-04 12:07