- Tether’s CEO clarified the firm’s position on an official blockchain

- USDT hit a new high of $120B, reinforcing its position in the stablecoin sector

As a seasoned crypto investor with years of market observations under my belt, I can’t help but feel a mix of intrigue and cautious optimism upon reading about Tether’s recent developments. The clarification by Tether’s CEO Paolo Ardoino regarding the rumors of an official “Tether chain” is a welcome transparency move that instills confidence in the community.

Today, Tether’s CEO, Paolo Ardoino, made headlines as he refuted allegations that Tether is developing a formal blockchain known as “Tether Chain.

In response to accusations concerning X (previously known as Twitter), Ardoino made it clear that the company endorses certain Layer 2 networks choosing USD Tether as a means of transaction fees.

As an analyst, I’ve been hearing whispers about the Tether Chain once more. However, it’s essential to clarify that Tether itself is not currently in the process of developing an official blockchain. Instead, various independent Layer 2 (L2) solutions are actively working on providing support for $USDt, aiming to reduce gas fees associated with transactions.

He added that the firm’s neutrality is crucial to avoid “centralizing everything.”

One primary factor preventing Tether from launching its own chain immediately is the emphasis on maintaining neutrality.

It must be noted though that Ardoino didn’t rule out having a chain in the future.

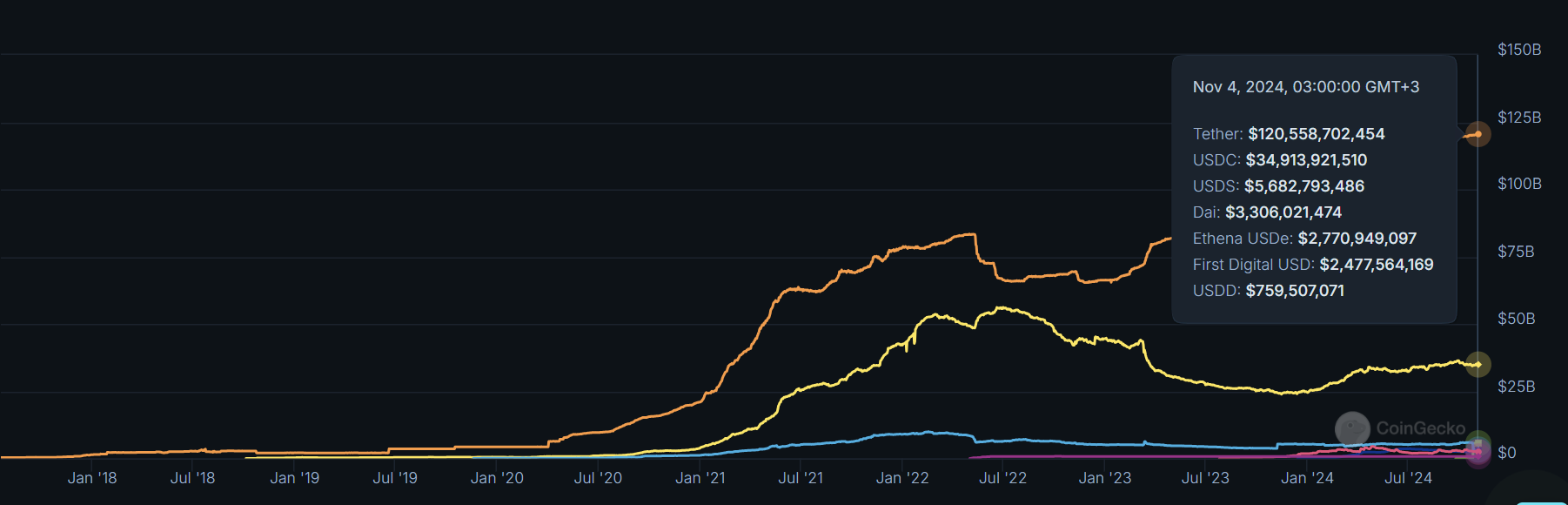

Tether’s USDT growth

On platforms like Polygon within Ethereum L2s, the use of USDT for gas fees is already established. Yet, Tether’s competitive advantage extends far beyond the Ethereum network alone.

For quite some time now, USDT from Tether has held a leading position in the stablecoin market. Lately, its market value reached an impressive $120 billion, outstripping its previous high of $83 billion during the last cycle. A large portion of trading pairs on centralized exchanges are linked to USDT, which contributes significantly to its dominance within this sector.

However, the dollar-pegged stablecoin has also emerged as a favorite for cross-border payments. Especially in emerging markets struggling with massive local fiat currency inflation.

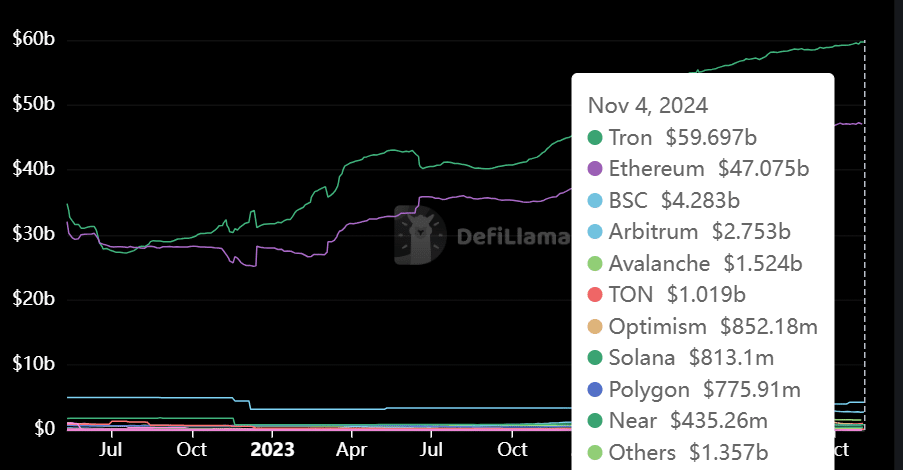

As a crypto investor, I’ve noticed that Tron [TRX] has become a leading platform for cost-effective USDT transfers, moving around $60B without breaking a sweat, even surpassing Ethereum in this regard. Yet, it’s not just Tron; other affordable alternatives are popping up, aiming to make USDT transfers even cheaper. One such example is TON (The Open Network), which has strong ties with Telegram.

The company’s present situation has put it in the crosshairs of both criticism and scrutiny from regulatory bodies. Interestingly, Ardoino has refuted yet another allegation, this time denying claims that the company is currently being investigated for engaging in illegal practices.

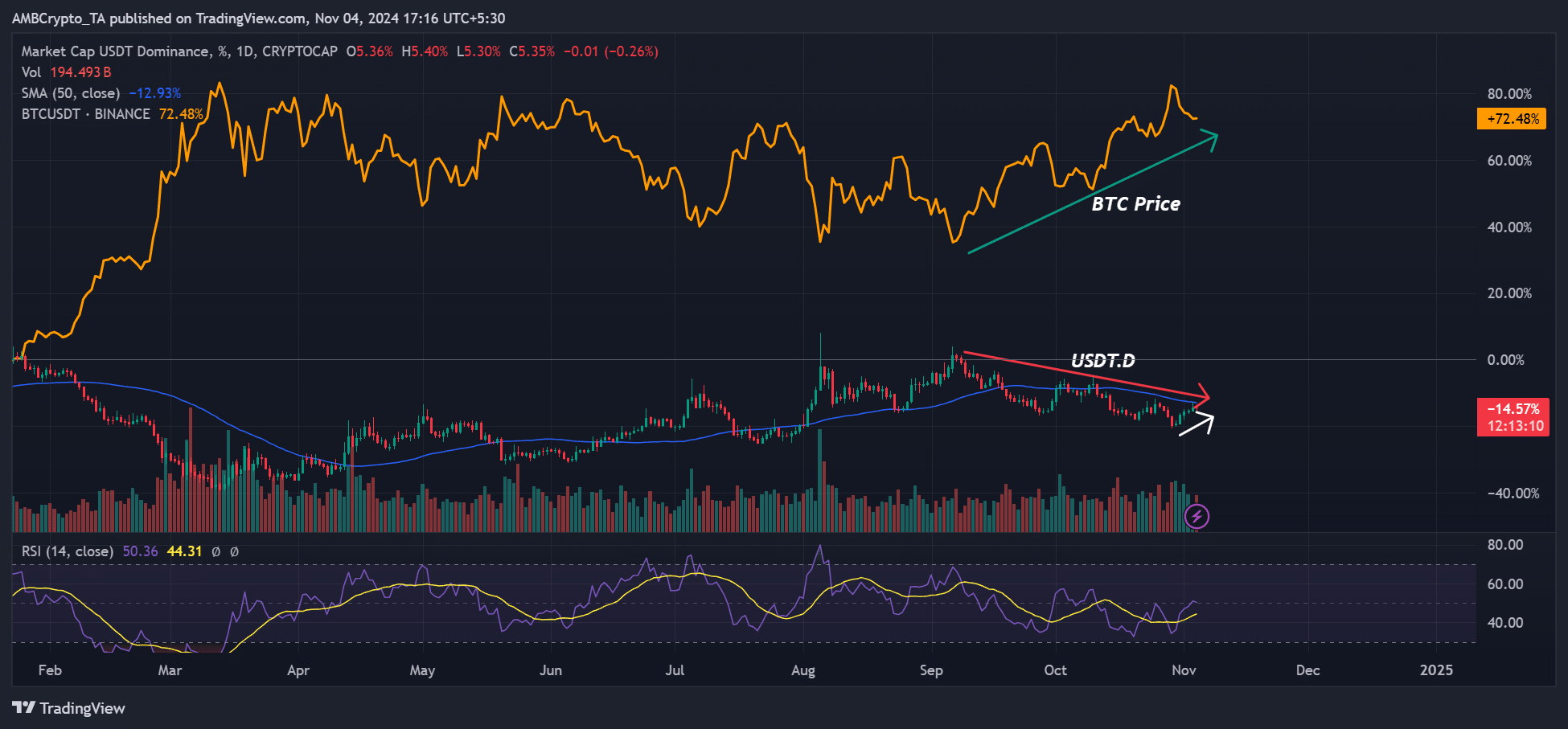

That being said, USDT’s dominance also doubles as the sector’s health barometer and sentiment. While its rising market share indicates rising market liquidity, USDT’s dominance (USDT.D) also gauges whether investors are fleeing to stables (risk-off) or massively accumulating (risk-on).

Currently, USDT.D appears to be following a prolonged downward trajectory, which is mirroring Bitcoin‘s upward movement. However, an increase in USDT.D could indicate increased caution or panic within the market.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-04 20:23