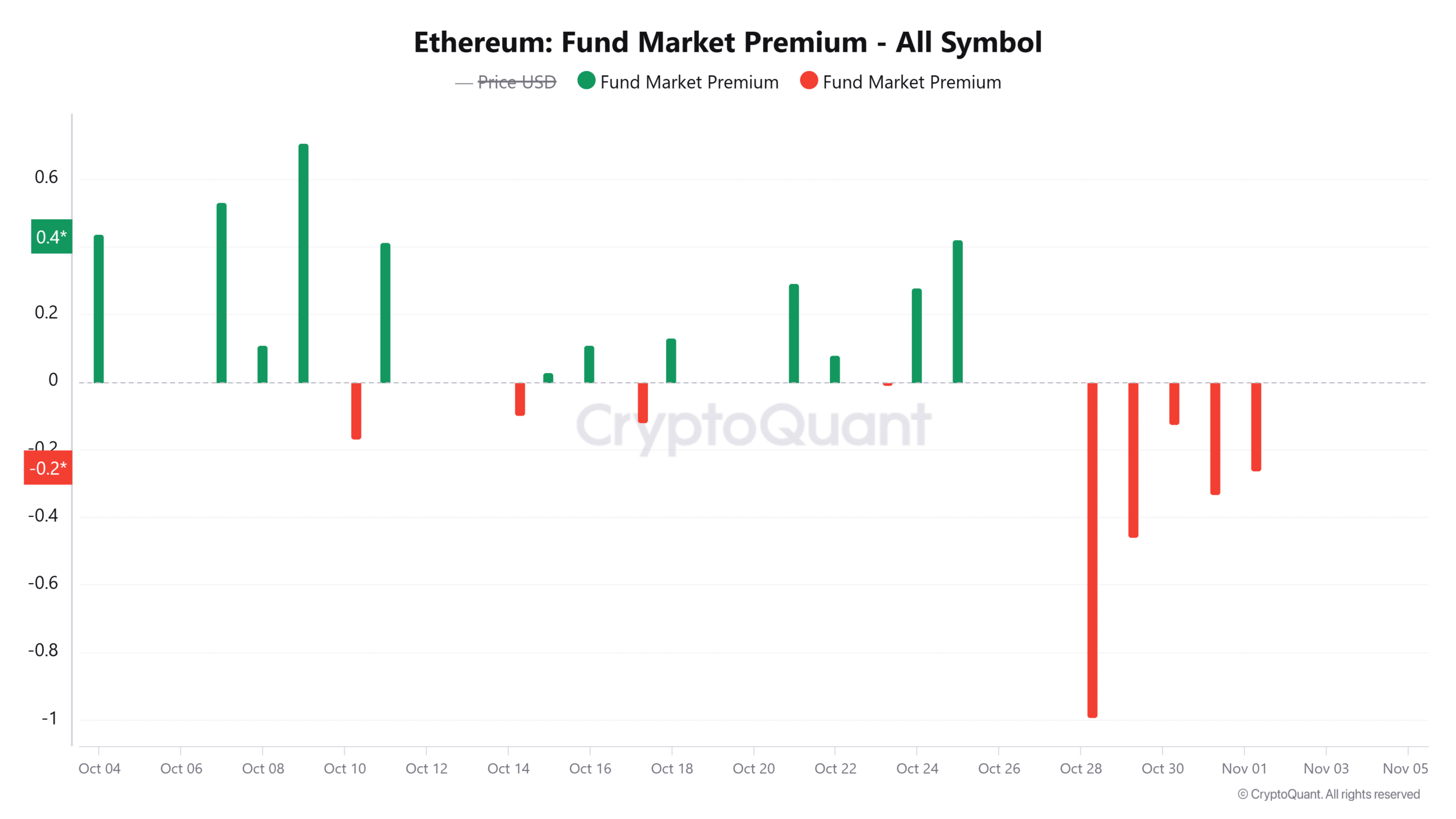

- The Ethereum Fund Market Premium flipped negative, showing weak institutional demand for ETH products

- Nate Geraci believes staking for Ethereum ETFs could happen sooner under the Trump administration

As a seasoned analyst with extensive experience in the digital asset market, I find myself cautiously optimistic about Ethereum (ETH) and its ETFs. The recent drop in ETH price and the underwhelming performance of ETH ETFs are concerning, but not entirely unexpected given the broader bearish sentiment in the market.

Ethereum (ETH) has dropped by 10% in the last two weeks amid bearish pressure. Due to its underwhelming performance compared to Bitcoin (BTC), ETH’s dominance has plunged to range lows of below 13% too.

One reason Ethereum may not be experiencing significant growth is the low institutional interest. This is evident in the subdued investments into Ethereum-based spot exchange-traded funds (ETFs). Since their launch, these ETFs have experienced only four weeks of positive net inflows as reported by SoSoValue, indicating a lack of demand. Consequently, this has resulted in a decreasing premium for the fund market.

Last week, I observed a predominantly negative Ethereum fund market premium based on data from CryptoQuant. In simpler terms, this suggests that Ethereum was being traded at a lower price compared to its value in the ETF market, which could be seen as a potential buying opportunity for investors.

The analysis of unfavorable data indicates a trend of increased supply (selling pressure) and decreased interest (weak demand) in the ETF market regarding Ethereum. This suggests that there is a predominant pessimistic outlook, as major investors have shown caution.

As a researcher delving into the world of digital assets, I find myself pondering over an intriguing observation. Despite Bitcoin Exchange Traded Funds (ETFs) consistently recording impressive gains, with over $2 billion in inflows last week alone, I’m puzzled by the underperformance of Ethereum ETFs. Why is this discrepancy occurring?

Here’s why Ethereum ETFs are struggling

Nate Geraci, Head of ETF Store, offered his perspective on possible reasons behind the low investments in ETH-focused ETFs, aside from the generally pessimistic market atmosphere.

He noted that since Bitcoin ETFs launched first, they had a first-mover advantage and “stole some thunder” from Ethereum.

Moreover, the significant withdrawals from the Grayscale Ethereum Trust (ETHE) ETF have added to the pessimistic view of Ethereum ETFs. Since its inception, ETHE has recorded a staggering $20 billion in outflows. Furthermore, according to Geraci, there seems to be a lack of education among advisors regarding Ethereum, which may explain why institutions are less inclined towards this asset.

It’s likely that the inflow of funds into an ETF based on Ethereum will increase soon, but it could take some time.

A Trump win is good for ETH ETFs

As an analyst, I would express this idea as follows: If Former U.S President Donald Trump were to win the elections on the 5th of November, it might create favorable conditions for the approval of Ethereum ETFs.

Before the U.S Securities and Exchange Commission (SEC) approved Spot ETH ETFs, it ordered issuers to remove the provision around staking. However, Geraci believes that staking would likely be allowed under the Trump administration.

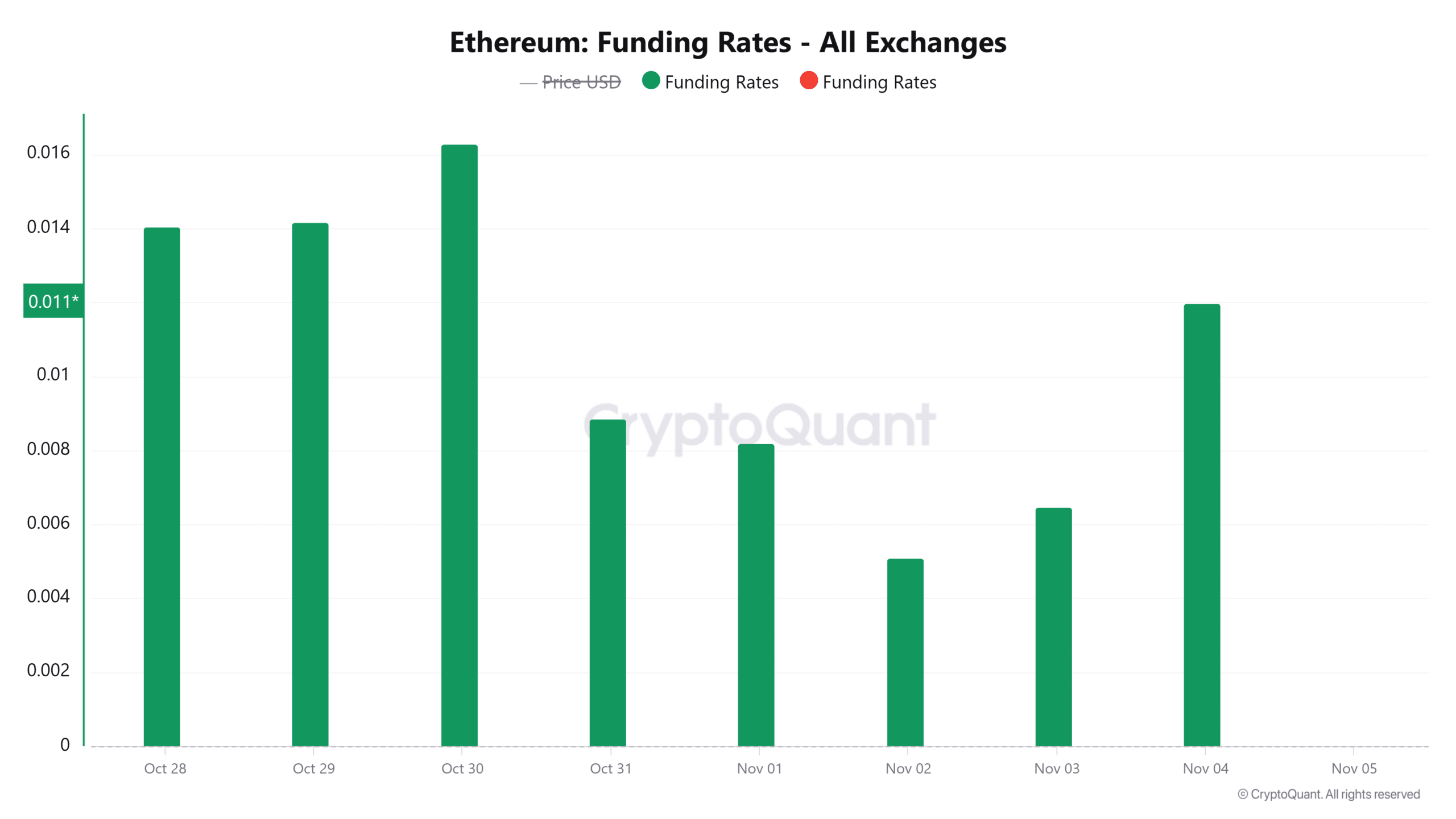

It seems that traders on the Ethereum market are anticipating a victory for Donald Trump in the U.S presidency. Currently, the funding rates for Ethereum have increased by 85% to 0.0119, indicating an increase in optimistic sentiment within the Futures market. This rise can be attributed to a high demand for long positions.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-04 21:27