- Shiba Inu’s Golden Cross remains an uncertainty in the short term

- Binance’s top traders and large funds continue to be bullish about the altcoin

As a seasoned crypto investor with a knack for reading market trends and a portfolio that has weathered numerous bull and bear runs, I find myself cautiously optimistic about Shiba Inu [SHIB]. The delayed golden cross is indeed a cause for concern, but it’s not uncommon for market dynamics to veer off the script.

Traders who are hoping for a significant profit from Shiba Inu [SHIB] due to an anticipated ‘golden cross’ may need to be patient as the event they’re waiting for might take a bit more time to materialize.

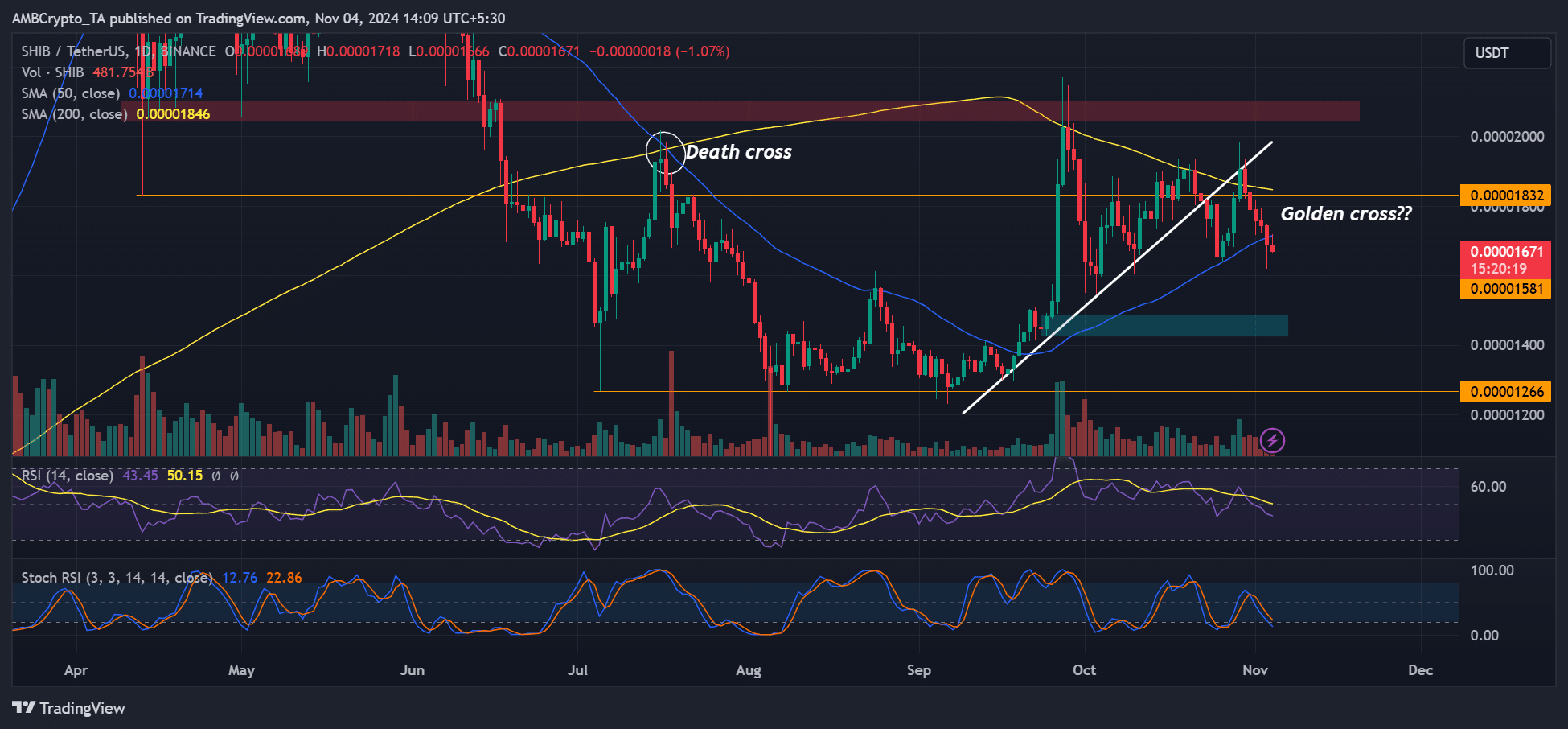

By the close of October, there was anticipation for the golden cross, a positive signal for traders, to occur. This happens when the short-term moving average (50 days) rises above the long-term moving average (either 100 or 200 days). However, at the time of publication, the bullish trend was not visible in the charts.

Delay in SHIB’s golden cross?

The uncertainty surrounding the U.S election has temporarily dampened the enthusiasm of Shiba Inu investors. A fall below its crucial long-term trendline support caused a drop in Shiba Inu’s price, but this decline was halted at the 50-day Simple Moving Average (represented by the blue line).

As a researcher, I was eagerly anticipating the moment when our 50-day Simple Moving Average (SMA, represented by the blue line) would cross above the 200-day SMA (yellow line), an event often referred to as the ‘golden cross.’ This crossover is usually associated with a bullish market trend. However, my excitement was short-lived as the recovery I had observed earlier seemed to lose steam at the junction where the trendline resistance and the 200-day SMA intersected. This intersection appeared to act as a barrier, potentially indicating a pause or even a possible reversal in the market trend.

The price decline caused SHIB to drop by 12%, falling beneath its 50-day Simple Moving Average (SMA) as of now. This development doesn’t bode well for traders because it suggests that SHIB might be weaker in the short term. In essence, the chance of a Golden Cross – a bullish technical pattern – has faced another hurdle.

Keeping that in mind, crucial levels to focus on in the near future are at $0.000014 and $0.000015. If there’s a price increase, potential bullish targets would be the 50-day and 200-day Simple Moving Averages (SMA).

Market sentiment and positioning

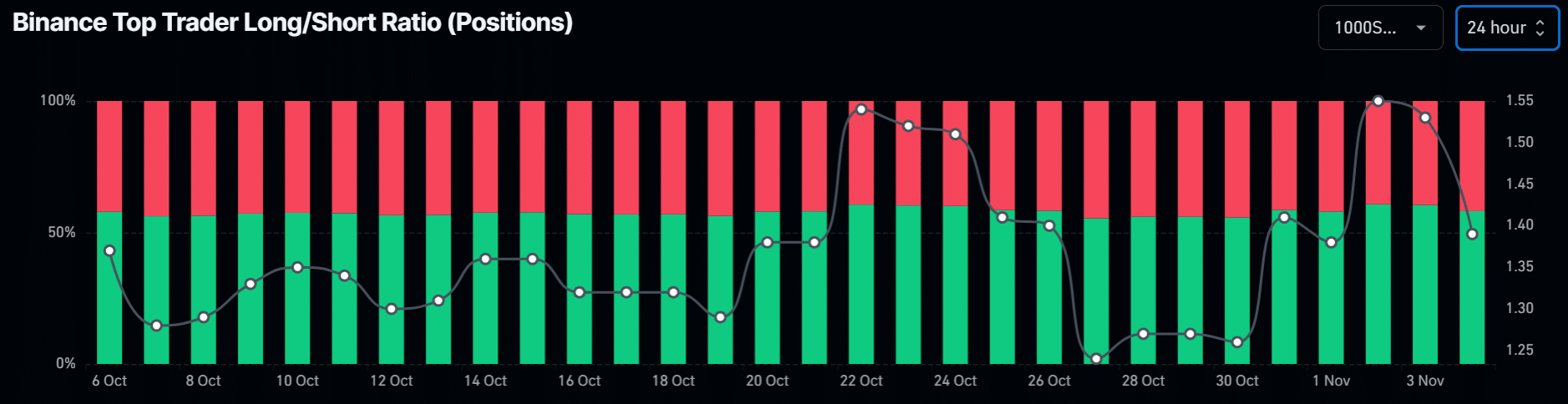

In recent times, the predominant stance among leading Binance traders has leaned towards optimism, as they have held more long positions than short ones, accounting for about 60% of their total holdings.

However, the long positions slightly dropped to 58% at press time. Similarly, the Open Interest (OI) rate slumped from $57 million to $38 million over the same period.

As an analyst, I noticed a trend towards risk mitigation in the lead-up to the U.S elections. However, even amidst a 12% decline in cryptocurrencies, speculators maintained their optimistic stance.

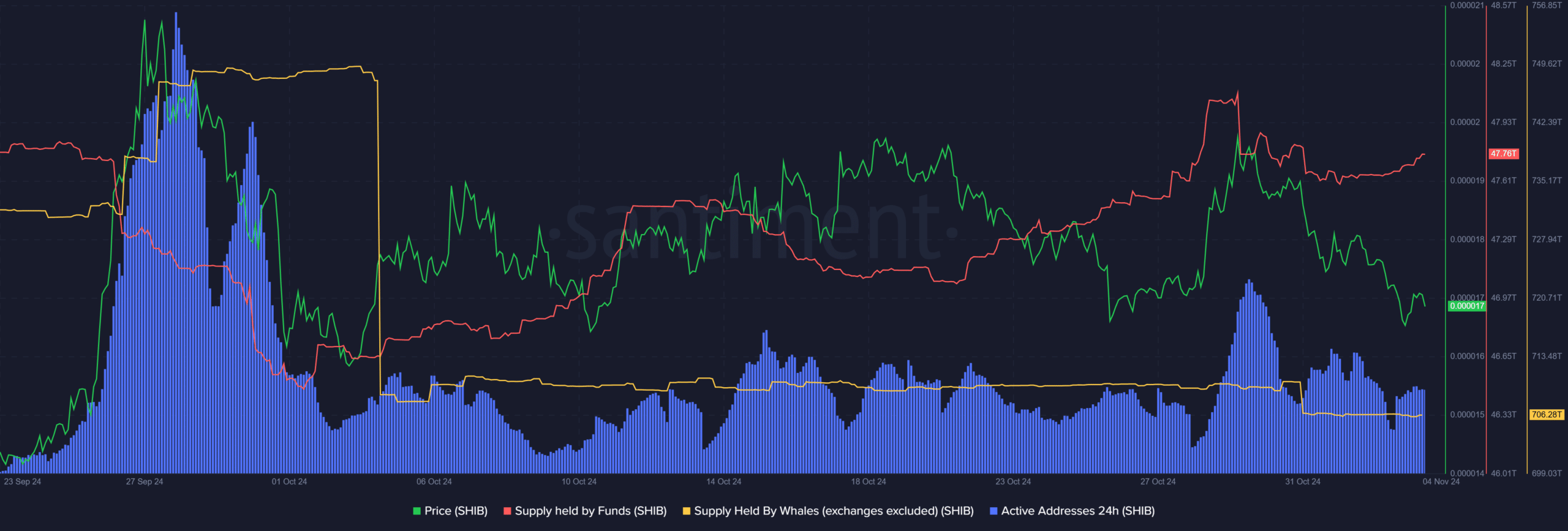

To wrap up, it’s noteworthy that even large investment funds have shown a positive outlook towards SHIB. This is indicated by the consistent ‘buying at a discount’ pattern (represented by the red line) during its latest dip in value.

These trends, coupled with SHIB’s burn rate, are generally indicative of a favorable outlook for SHIB’s potential comeback. In simpler terms, these trends and the fact that SHIB is being burned suggest that SHIB might recover soon.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-04 23:03