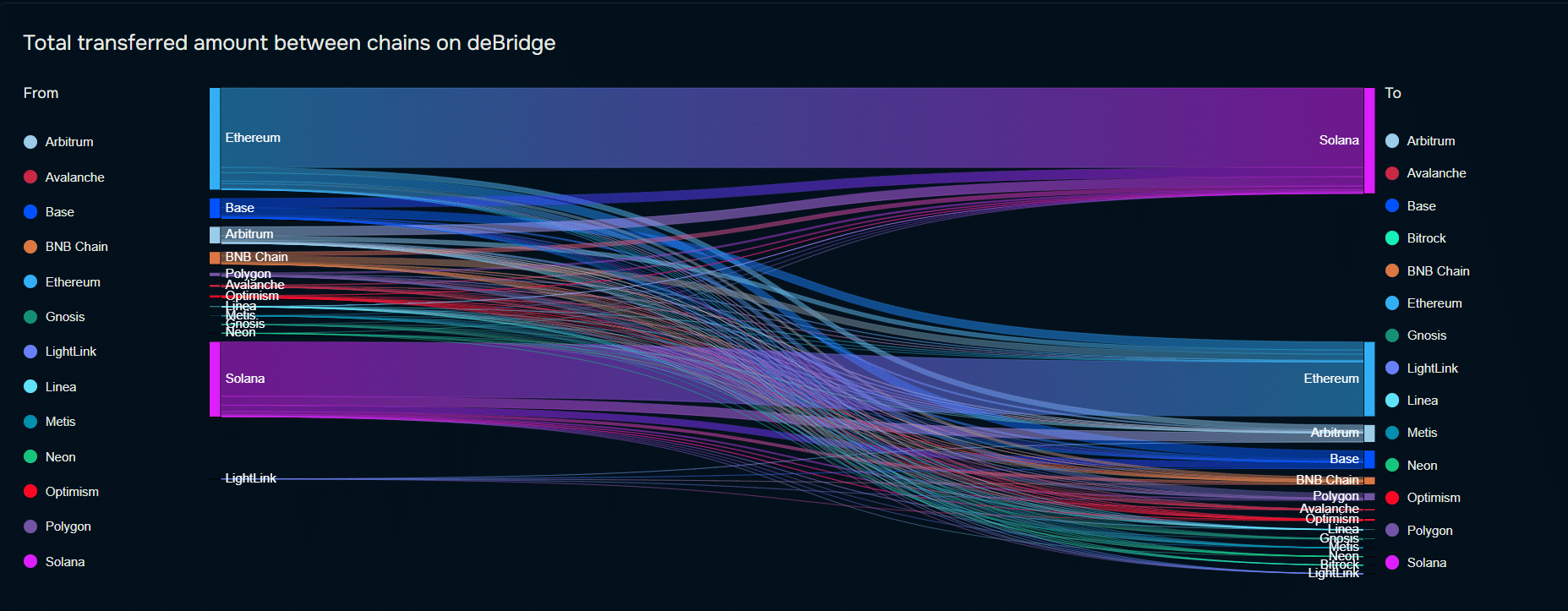

- $600M bridged to Solana in October, with over 90% being from Ethereum

- Influx more evidence of Solana’s role in DeFi, NFTs, and cross-chain innovation

As a seasoned crypto investor who has weathered the storms of market volatility since the early days of Bitcoin, I’ve always kept my eyes peeled for promising opportunities. The recent influx of over $600 million into Solana from Ethereum and other blockchain networks is nothing short of a game-changer in the DeFi and NFT landscape.

In the fast-paced world of blockchain development, more than $600 million in digital assets were moved to Solana [SOL] from different blockchain networks in October alone. Notably, Ethereum [ETH] accounted for over 90% of this migration. This substantial shift highlights Solana’s increasing popularity as a cost-effective and scalable choice for decentralized finance (DeFi), NFTs, and various other blockchain applications.

With more people wanting to move between different blockchain networks due to the variety of ecosystems they offer, Solana’s growing liquidity and project development indicate it’s becoming a stronger competitor. The question now is how this surge will affect Solana’s influence within the crypto market.

Bridging and its impact on Solana’s market position

In simpler terms, “Blockchain bridging” refers to moving digital assets between various blockchain platforms, making tokens from one network, say Ethereum, usable on another platform such as Solana. This process empowers users to utilize services or benefits that may be more advantageous for their specific requirements or offer better yields on alternative chains.

As a crypto investor, I’ve noticed that in October alone, an impressive $600 million was channeled to Solana. Interestingly, Ethereum accounted for over 90% of this inflow, indicating its dominance. This trend further solidifies Solana’s status as a growing ecosystem for decentralized finance and various blockchain applications, making it an exciting prospect for future investments.

The surge of investment capital strengthens Solana’s advantage over competitors. It positions it as a strong contender for projects aiming for fast processing, high scalability, and cost-effective transactions. As the market demands these attributes, Solana’s efficiency in performance has become more appealing, especially when compared to Ethereum’s high fees and slower transaction times.

This investment brings increased cash flow throughout the system, which in turn boosts the development and sophistication of its underlying structures. Furthermore, it encourages both established projects and upcoming initiatives to choose Solana as their primary solution.

Benefits for Solana’s DeFi and NFT projects

An influx of liquidity significantly boosts the advancement and appeal of DeFi and NFT initiatives, sectors that consistently show strong growth. Some notable projects such as Marinade Finance, a protocol for liquid staking, and Orca, an intuitive decentralized exchange, are prime examples benefiting from this surge in liquidity. They immediately tap into increased liquidity resources.

Additional initiatives are joining the Solana network as well, leveraging its interoperability and enhanced liquidity features. For example, Solend, a decentralized lending platform, has seen increased user engagement due to the introduction of new collateral options that attract users from various other blockchain networks.

More recent collaborations and growth of platforms, such as Jupiter Aggregator (which gathers liquidity from various decentralized trading venues), have been leveraged to optimize user convenience and streamline transactions, thanks to the growing interest in the field.

As a researcher exploring the dynamic world of NFTs, I’ve noticed an influx of capital into the Solana ecosystem, with wallets like Phantom and marketplaces such as Magic Eden providing a platform that empowers creators and collectors alike. The momentum of this ecosystem is attracting attention to lesser-known NFT projects, like Tensor and Formfunction. These platforms provide unique trading functionalities for NFTs, reflecting the growing demand for a diverse array of digital assets.

Moreover, the advantage of cross-chain capabilities is significant for Ethereum-based NFT creators. Now they can tap into Solana’s user base while continuing to work on their original projects within the Ethereum ecosystem.

Trends in cross-chain interoperability and future growth potential

The significant movement of assets highlights a broader trend – Cross-chain interoperability. As blockchain networks seek to address scalability challenges and user demand for cost-effective solutions, cross-chain mechanisms are crucial for growth and resilience in the ecosystem.

Users are increasingly utilizing protocols such as Wormhole and Allbridge, designed for transferring assets between different blockchains, because they want to take advantage of Solana’s low-cost and high-speed ecosystem.

Looking ahead, Solana’s increasing collaboration with various other blockchain networks, coupled with its popularity among high-performance application users, suggests a robust path of development and expansion.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-11-05 12:07