- BONK’s price appreciated on the charts, fueled by a 34.44% hike in trading volume

- Following its listing on Gemini, BONK saw a surge in trading interest and adoption

As a seasoned crypto investor with battle-tested nerves and a knack for spotting undervalued gems, I find myself drawn to the recent developments surrounding BONK. The memecoin has shown promising signs of growth, with its trading volume surging by an impressive 34.44% following its listing on Gemini – a move that’s likely to broaden its reach and accelerate its market expansion.

As an analyst, I’m observing a notable buzz surrounding the memecoin, BONK. Currently, it’s trading at $0.00001812, and interestingly, its value has increased by approximately 1.59% within the past 24 hours. However, the real attention-grabber is the significant surge in its trading volume. Over the same period, we’ve seen a substantial increase of around 34.44%.

Due to increasing investor enthusiasm and escalating trade actions, BONK’s market value exceeded $1.35 billion.

BONK to gain momentum after Gemini exchange listing?

Interest in trading skyrocketed after BONK was added to the Gemini platform. This development led to increased adoption as well. Now, the exchange facilitates BONK deposits and withdrawals, handling all asset movements swiftly, and offering instant transfer options for investors.

On the other hand, BONK is simply the newest addition to the collection of well-known meme coins that Gemini has incorporated into its cryptocurrency options. Interestingly enough, Gemini has already introduced Dogecoin (DOGE), Pepecoin (PEPE), Shiba Inu (SHIB), and Wif token (WIF) on its exchange platform.

As a crypto investor, it’s significant to acknowledge the importance of BONK’s listing. With this new platform, BONK has the potential to tap into a broader audience, an audience that could accelerate the growth of this memecoin and increase its market dominance swiftly.

Symmetrical triangle pattern points to rally

Based on the analysis by crypto expert @cryptojack, the BONK/USDT market shows a symmetrical triangle pattern on the price charts. This pattern arises when a trend shifts direction, suggesting a possible bullish breakout might occur once trading volume increases. However, this pattern has been developing for several months now. As it nears a clear breakout point, we can expect increased volatility in the near future.

As a researcher studying the market trends of BONK, I’ve noticed an intriguing technical setup – a symmetrical triangle formation. Historically, such patterns have been seen as signals for trend continuation, suggesting that BONK might continue its upward trajectory. If we observe an increase in trading volume accompanying this breakout, it could potentially propel BONK towards new all-time highs. I’m keeping a close eye on the market activity, eagerly awaiting signs of increased volume that could serve as confirmation of this trend.

As a crypto investor, I’m excitedly watching BONK. If it manages to surge forward propelled by substantial trading volumes, it might just reach unprecedented heights, provided it successfully gains the trust and confidence of a multitude of investors.

Consequently, this surge might provide an opportunity for both quick-moving traders and patient investors to join the rising trend. Lately, BONK’s market behavior has left space for fresh record highs. It seems that BONK is moving towards matching the overall market enthusiasm.

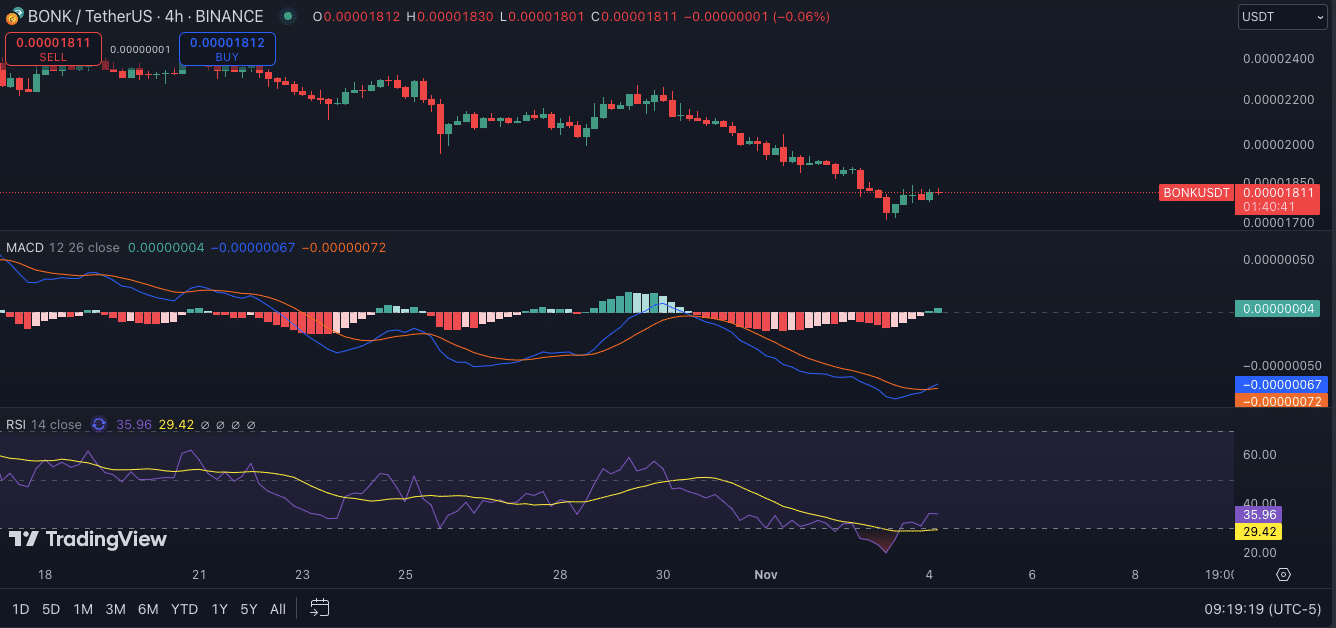

MACD and RSI in favour of BONK’s upswing

According to the 4-hour chart’s Moving Average Convergence Divergence (MACD) indicator, there seems to be a potential change in trend direction, hinting at an upcoming bullish crossover. This pattern, along with the histogram bars changing from deep red to lighter shades of red, implies a decrease in bearish influence, suggesting a shift towards less bearish momentum.

Should this pattern persist, the MACD’s behavior might signal an initial shift in direction, catching the attention of traders who are keen on capitalizing on a possible uptrend.

Currently, the Relative Strength Index (RSI) for BONK is nearing oversold territory at 38.51, which typically indicates lessening selling pressure. As the RSI moves higher, traders might expect a rebound if it surpasses 50, lending additional strength to a bullish outlook if bolstered by increased volume.

If RSI (Relative Strength Index) indicates a possible rebound and the Moving Average Convergence Divergence (MACD) shows bullish signs, these technical indications might suggest a price increase. Increased trading volumes and persistent buying pressure could strengthen this trend, increasing trust among investors and traders. This pattern of signals could generate growing interest as BONK nears significant technical thresholds.

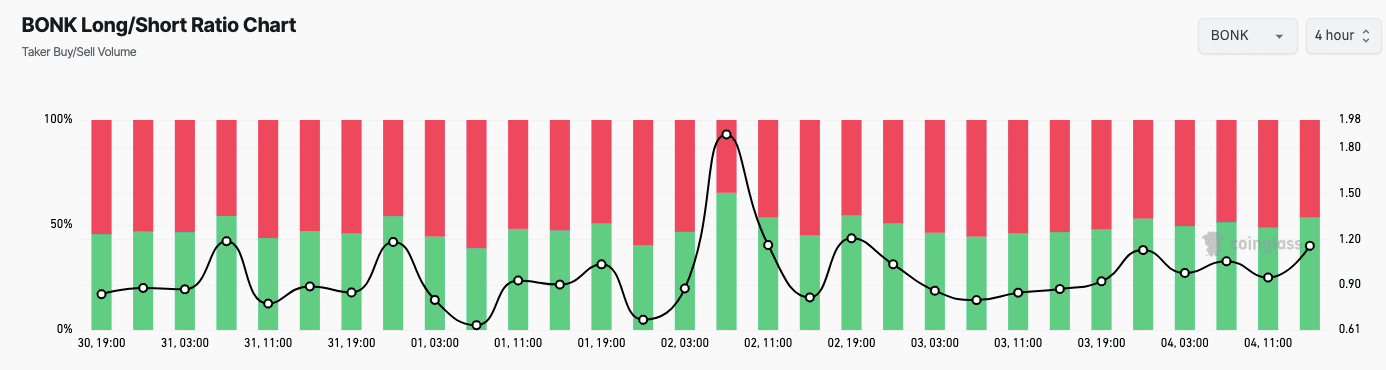

BONK’s Long/Short ratio

Based on data from Coinglass, the Long/Short Ratio of BONK indicates an equilibrium between optimistic and pessimistic attitudes among traders. The graph, which employs green bars to symbolize buy transactions and red bars for sell transactions, suggests a rise in buy activity in recent times.

Currently, as we speak, the Long/Short ratio exceeds 1.0, suggesting an increasing positive outlook for a possible price increase in the near future.

The changes in the ratio indicate that traders are still undecided, however, the increase in purchase activity suggests growing optimism among them. This trend aligns with the overall positive sentiment towards BONK in the broader market, as the Long/Short ratio hints at a possible increase in buying pressure. Given this bias towards buying, some experts believe that the price of BONK may soon experience increased volatility.

Should buying activity continue to be robust, it might fortify BONK’s ascending trend, possibly persuading additional investors to take on long positions. The increased investor attention could push BONK’s value upward in the near future, potentially strengthening its presence within the memecoin sector.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-11-05 12:40