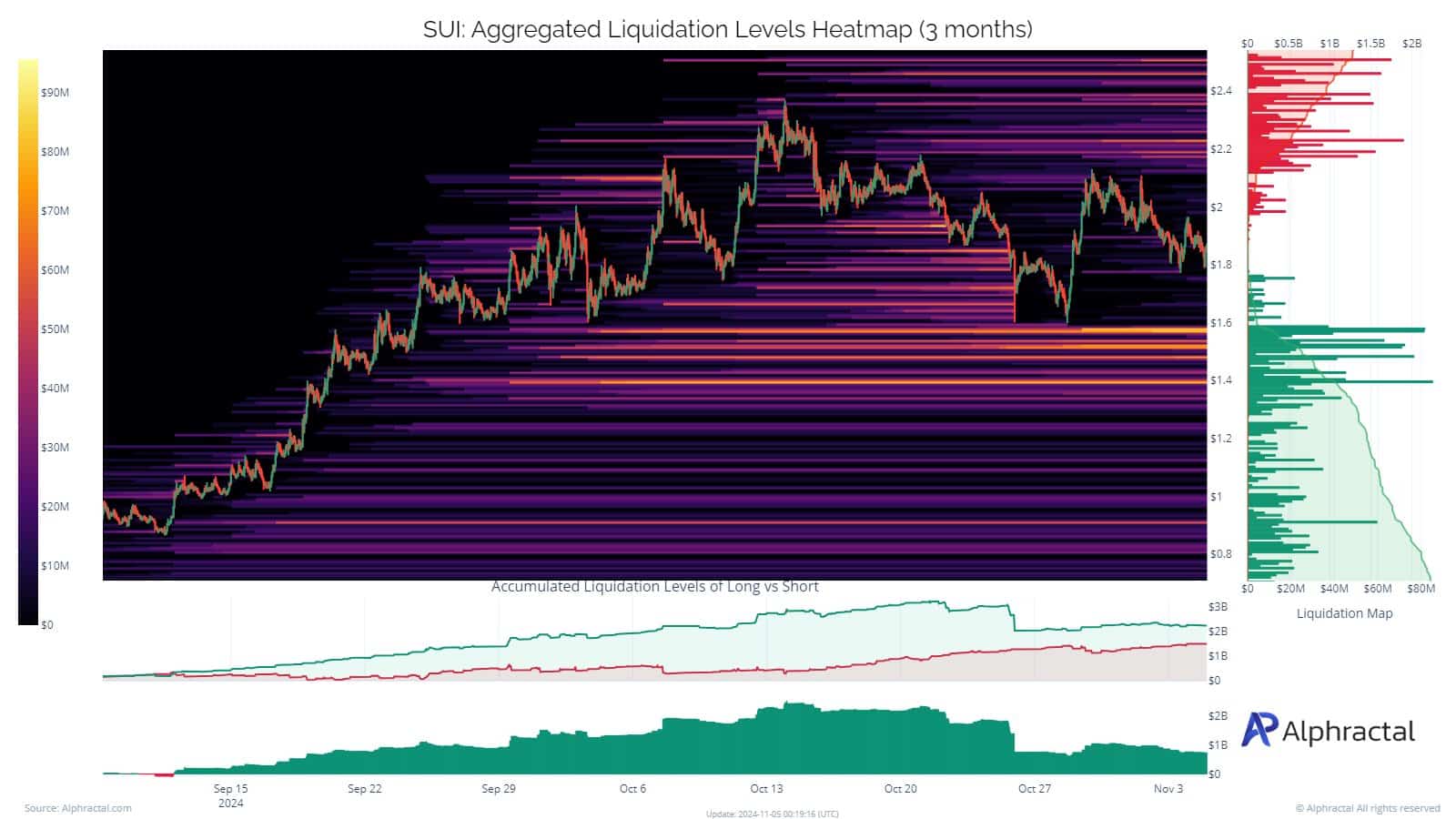

- There was huge liquidity from leveraged longs at $1.6.

- A drop below the level could trigger wild liquidation risk to leveraged bulls.

As a seasoned analyst with years of experience navigating the volatile waters of the crypto market, I must admit that SUI‘s current situation is one that keeps me on my toes. The massive liquidity at $1.6 support, as shown by Alphractal’s analysis, is indeed a cause for concern. However, it’s also worth noting that this same level has been a stalwart of support in the past quarters.

2024 saw SUI consistently rank among the leading layer-1 networks, even surpassing Ethereum and Solana [SOL] at times in certain aspects.

Indeed, one of the investments reached its peak during the market’s rebound in October, a fact that made the subsequent drop in SUI’s price seem particularly attractive to investors who had been waiting on the sidelines.

Consequently, numerous investors established buy orders roughly at $1.6, and there’s been an accumulation of trading activity around this price level, acting as a potential foundation of support.

As reported by Alphractal, if the price were to fall beneath the $1.6 support level, the substantial amount of liquidity there could lead to a chaotic and rapid selling off (liquidation) of positions.

Is SUI liquidation on horizon?

As an analyst, I observed that Alphractal posited a significant build-up of liquidity occurred around the $2.2 level when long positions were established. Subsequently, these positions were liquidated during the latest correction. The question then arises: will a similar scenario unfold for $1.6? This is something I’ll be closely monitoring to determine if historical patterns may repeat themselves.

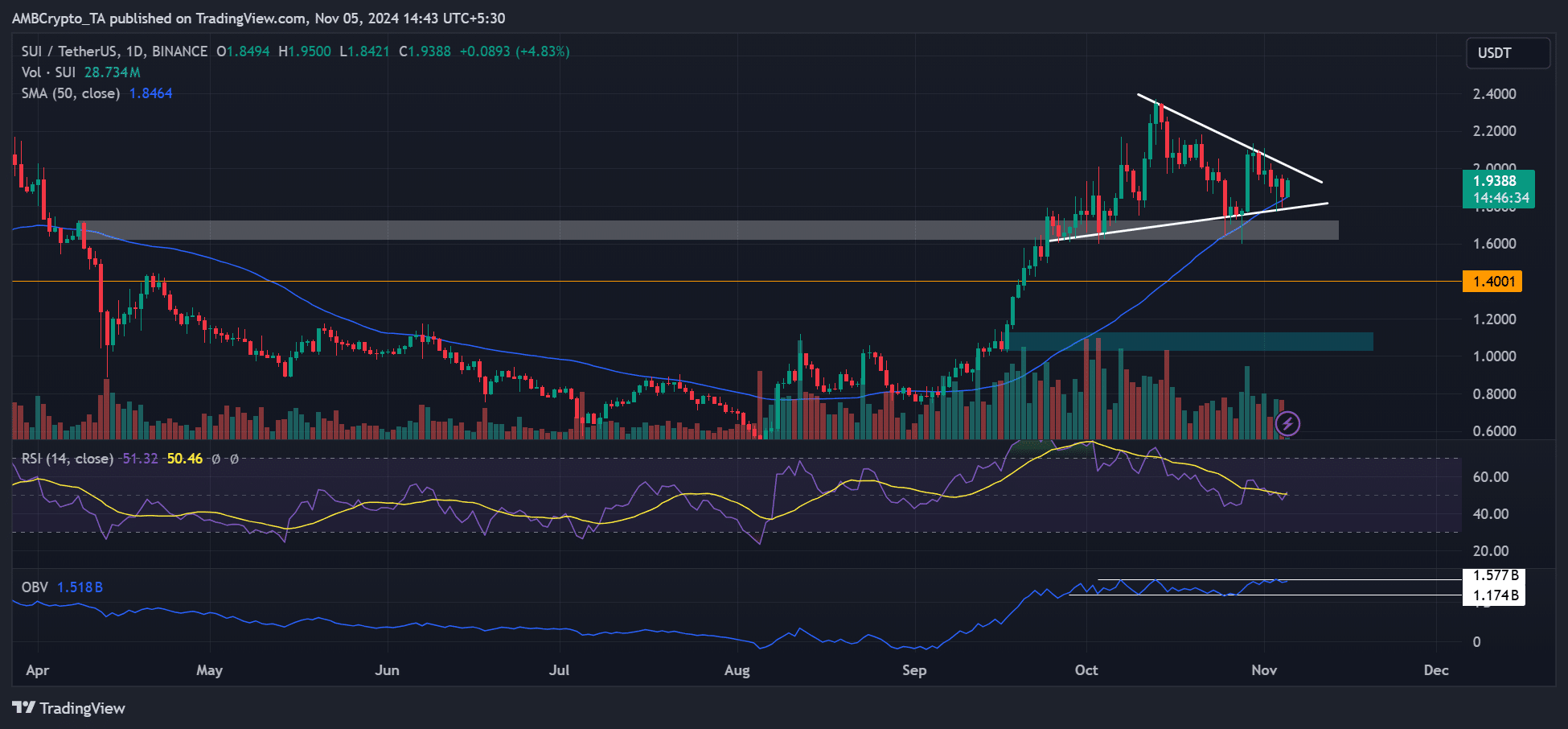

In the price graph, an Order Block (OB) was established in April and has served as a support for SUI in September and October, with the value of $1.6 being a significant area of stability, indicated by the white zone.

Furthermore, the Exponential Moving Average (EMA), specifically the 50-day one, has played a significant role in providing dynamic support recently, helping to cushion the steep declines seen in late October and November.

In another words, the price point of $1.6 played a crucial role in Q4 and triggered significant buying activity along with leveraged long positions. If it breaks this level, the stock of SUI might be pulled down towards its next support at $1.4.

As a researcher, I’ve noticed a plateau in the spot market demand for SUI, indicated by the horizontal trend on On Balance Volume (OBV) charts. This suggests that SUI prices could potentially fluctuate based on the prevailing market sentiment post-US election, moving either upwards or downwards.

Mixed market interest

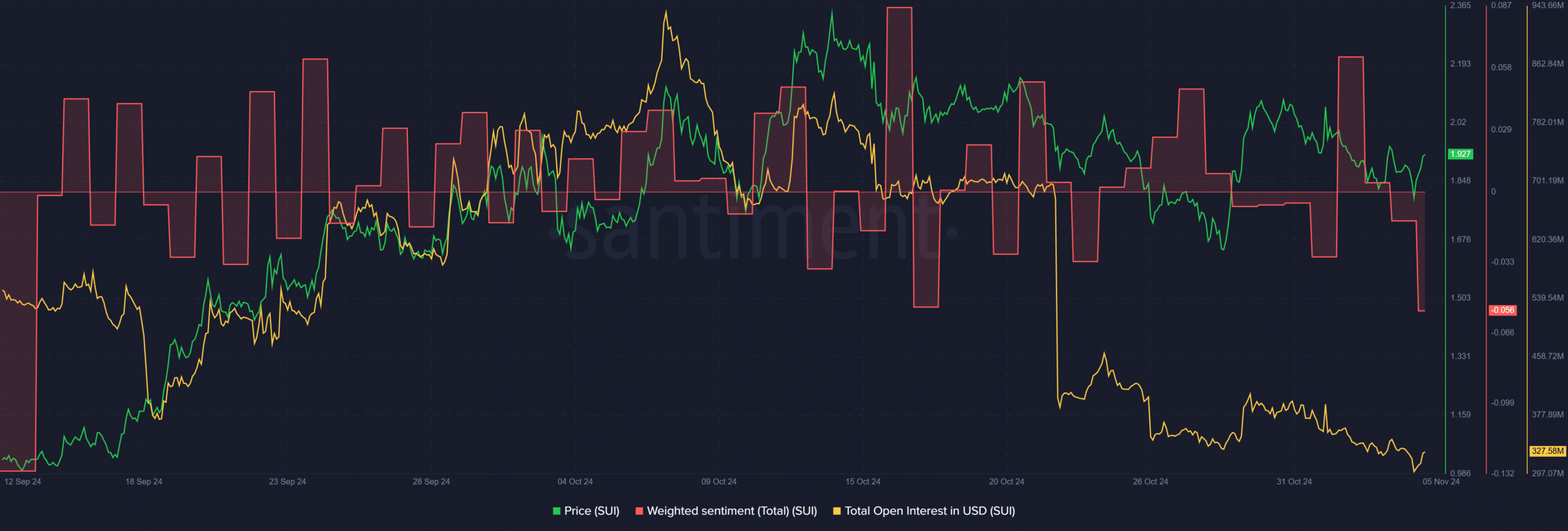

The Santiment data echoed similar sentiments about short-term market wariness. Since October, the Open Interest (OI) for SUI has been consistently decreasing. Given that market sentiment is also dipping at the moment, speculators in the SUI market appear to be adopting a cautious stance before the upcoming US elections.

Read Sui [SUI] Price Prediction 2024-2025

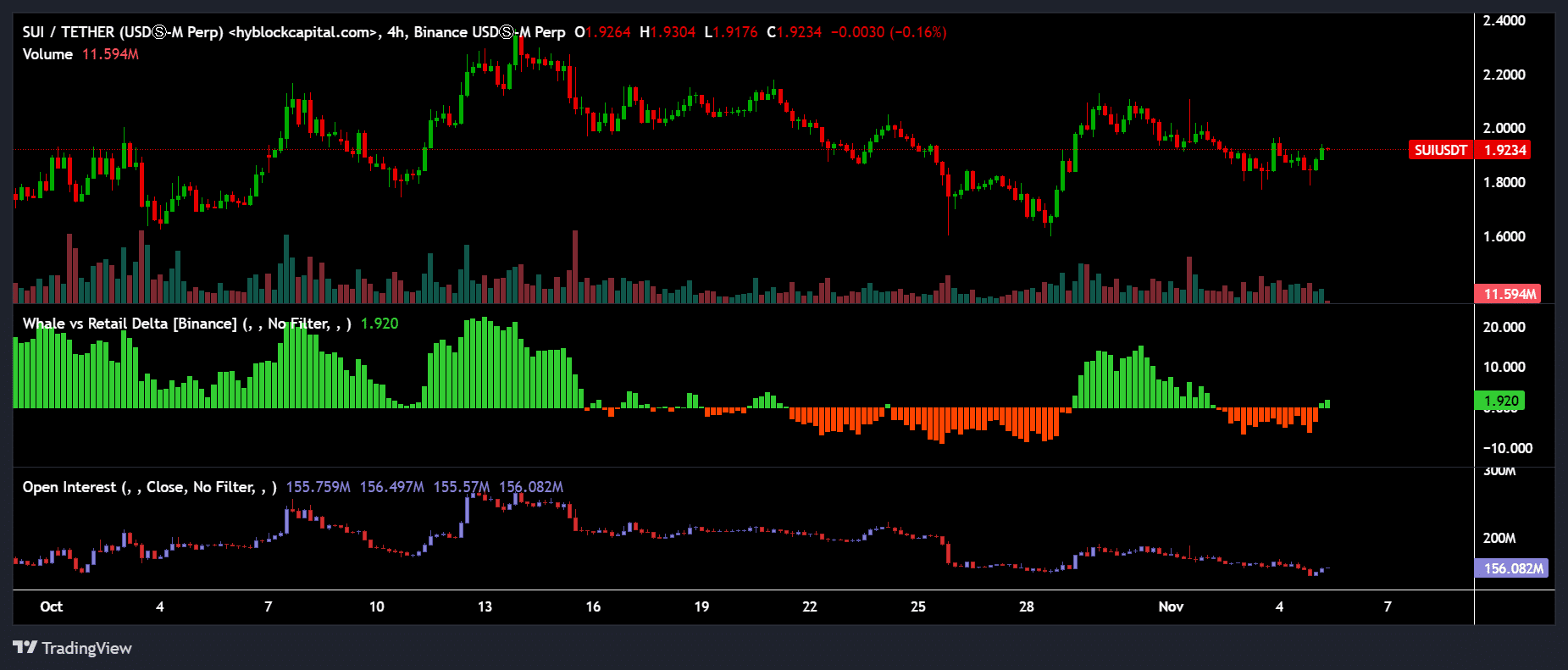

Nevertheless, it appeared that whales were keen on taking up more positions, even with a general air of caution. This was suggested by a favorable trend in the Retail versus Whale Delta indicator, which measures whale long positions against those held by retail investors.

To summarize, there was only a modest level of whale involvement with SUI. Yet, the price was critically important since a drop beneath the $1.6 support level might cause problems for numerous long positions, potentially leading to losses.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-11-05 21:12