- Large transaction volume for ETH has jumped by 58.63%, indicating a bullish outlook.

- ETH could soar by 15% to reach the $2,855 level if it closes a daily candle above the $2,465 level.

As a seasoned crypto investor with a knack for deciphering market trends, I must say that the current Ethereum [ETH] scenario presents a fascinating mix of bullish and bearish signals. The large transaction volume surge by 58.63% indicates a potential bull run on the horizon, but the recent struggles in the broader crypto market have been hard to ignore.

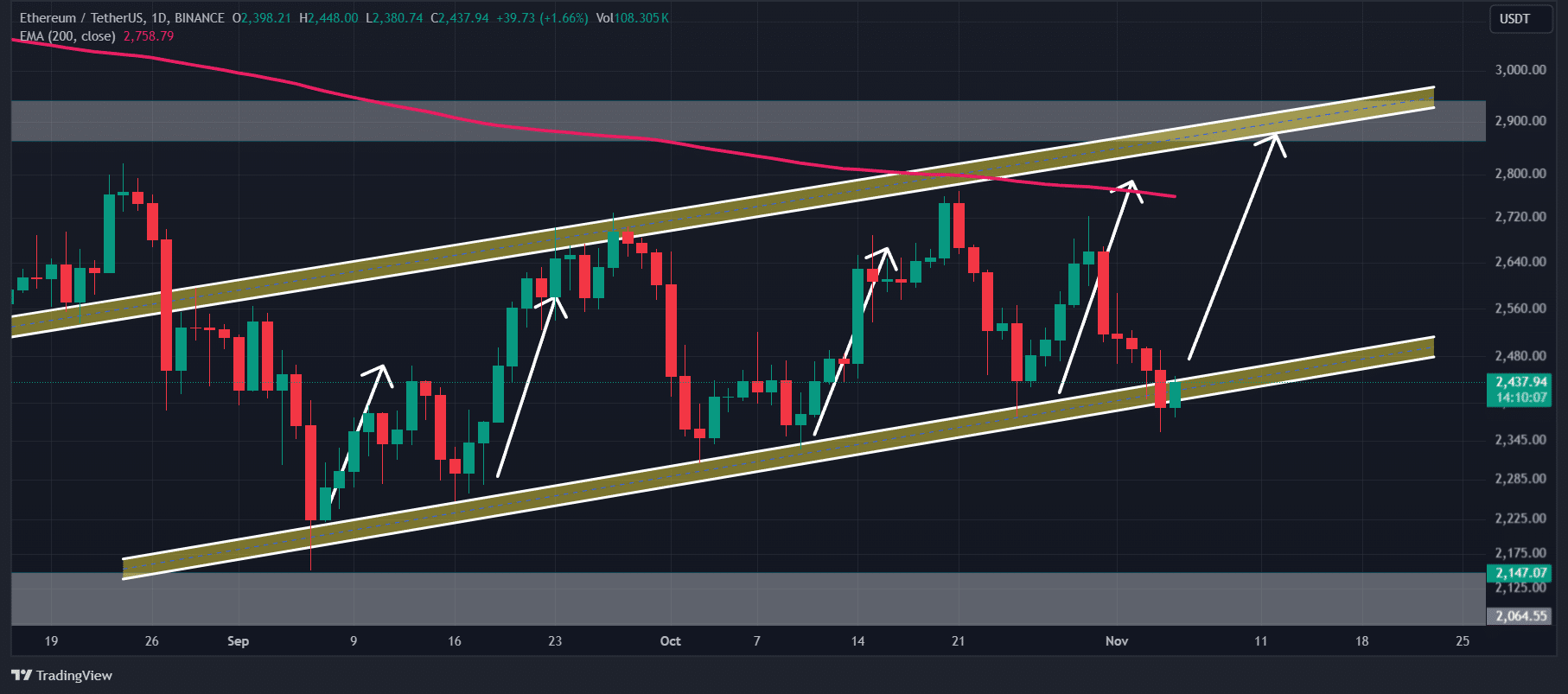

Despite the continued turbulence in the crypto market, it seems that Ethereum [ETH] momentarily broke out of a bullish trend line, but this may have been a false breakout since the price has now returned to the original trend pattern.

In addition to Ether (ETH), the broader cryptocurrency market is finding it tough to pick up speed. Possible explanations for this sluggishness could be the upcoming U.S. presidential election, international political strife, as well as various other influencing factors.

Ethereum technical analysis and key-level

According to AMBCrypto’s analysis, Ethereum appears poised for growth and might experience substantial increases in the near future. At present, it’s hovering around an important support line, which can also be described as the bottom boundary of a favorable parabolic channel configuration.

Historically, when the price hits this point, it tends to encounter strong demand, leading to a rise in its value.

As a researcher examining current market trends, I am observing that the anticipation among investors and traders is running high for a potential price surge similar to the previous one, in the upcoming days. If Ethereum (ETH) manages to close its daily candle above the $2,465 mark, there’s a substantial chance that the asset could experience a 15% increase, potentially reaching $2,855 over the coming days.

ETH’s bullish thesis will only be as long as ETH trades above $2,400, otherwise, it may fail.

Bullish on-chain metrics

The data on the blockchain also reinforces a favorable perspective for Ethereum, suggesting that the value of this asset may be robust.

On the other hand, even amidst market instability and significant fluctuations, there’s been a remarkable increase in involvement from both whale investors and regular investors.

Based on data from IntoTheBlock, a blockchain analysis company, there’s been a significant increase of 58.63% in large Ethereum transactions, suggesting a potentially positive or bullish trend for ETH.

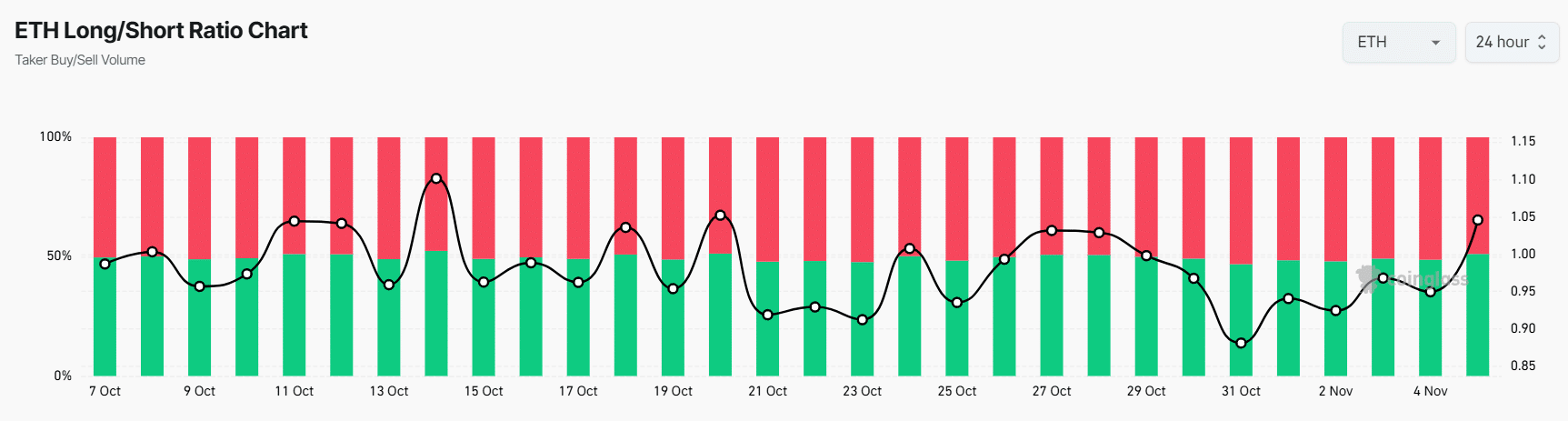

Presently, ETH’s Long/Short ratio is at 1.055, which is its highest since October 21, 2024. A figure above 1 means traders are showing a strong optimism towards buying (bullish sentiment). Moreover, it appears that traders have maintained their positions over the last 24 hours, even with the recent drop in price, suggesting they’ve taken precautions to secure their investments.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Traders sentiment

Based on both blockchain data and traditional chart analysis, it appears that the bulls have the upper hand with Ethereum at the moment, potentially leading to a substantial increase in its value over the next few days.

Right now, Ether (ETH) is being exchanged around $2,440, representing a slight drop of 0.75% in its value over the last day. Interestingly, the trading volume has surged by 24%, indicating that more traders and investors are getting involved during this recent price dip.

Read More

2024-11-05 23:35