- Bitcoin miners are facing escalating costs and operational challenges.

- As a consequence, miners are exploring AI tech to enhance efficiency.

As a seasoned Bitcoin investor with more than a decade of experience under my belt, I have seen the crypto landscape evolve from a niche curiosity to a global phenomenon. The recent challenges faced by miners are nothing new – after all, this is an industry that has always been defined by its volatility and adaptability.

In today’s fast-evolving Bitcoin mining landscape, miners encounter escalating expenses and growing technical requirements. With mining tending towards high capital investment, there is a heightened demand for sophisticated equipment, dependable power supplies, and skilled oversight more than ever before.

Data shows mining expenses have surged, with average costs now exceeding $49,500, while cash flow pressures are compounded by rising interest rates.

In the current situation, miners are investigating artificial intelligence (AI) as they strive to overcome financial challenges and boost productivity within an unpredictable market.

Mounting financial pressures threaten profitability

The mining industry for Bitcoin is facing higher production costs, as the cost of producing a single Bitcoin after the halving is frequently more than its current market value. The escalating operational costs, primarily due to electricity, administrative expenses, and interest payments, are eroding miners’ profitability and intensifying their cash flow problems.

Due to a lack of substantial savings or other income sources, miners might find it challenging to maintain their operations or grow effectively as profit margins become narrower.

Bitcoin mining and price volatility: A double-edged sword

The recent jump in Bitcoin’s price, fueled by expectations of an ETF, temporarily increased miners’ income from each coin. But after the most recent halving, which effectively doubled their production expenses, their profitability continues to be significantly influenced by unpredictable market fluctuations.

For numerous miners, existing debts and steep running costs often restrict their capacity to fully benefit from market price surges, since escalating interest repayments erode possible earnings.

In this setting, volatility presents a double-edged sword: on one hand, it allows for potential profit gains through price surges that boost profits; however, unexpected declines can jeopardize cash flow, potentially leading miners to reduce their operations or liquidate assets as a precaution.

Embracing AI

Instead of selling mined Bitcoins immediately, some miners are choosing to retain the Bitcoin tokens and investigate the use of Artificial Intelligence (AI). Utilizing AI in mining could improve efficiency by automating processes, leading to more effective process optimization and energy management.

Through the application of sophisticated data analysis techniques, they can enhance operational effectiveness and cut down on expenses, thereby facilitating agility during market fluctuations. The incorporation of artificial intelligence into their operations not only expands potential income sources but also equips miners with a strategic advantage in the highly competitive industry.

Reducing Bitcoin’s Carbon Emissions through Sustainable Practices

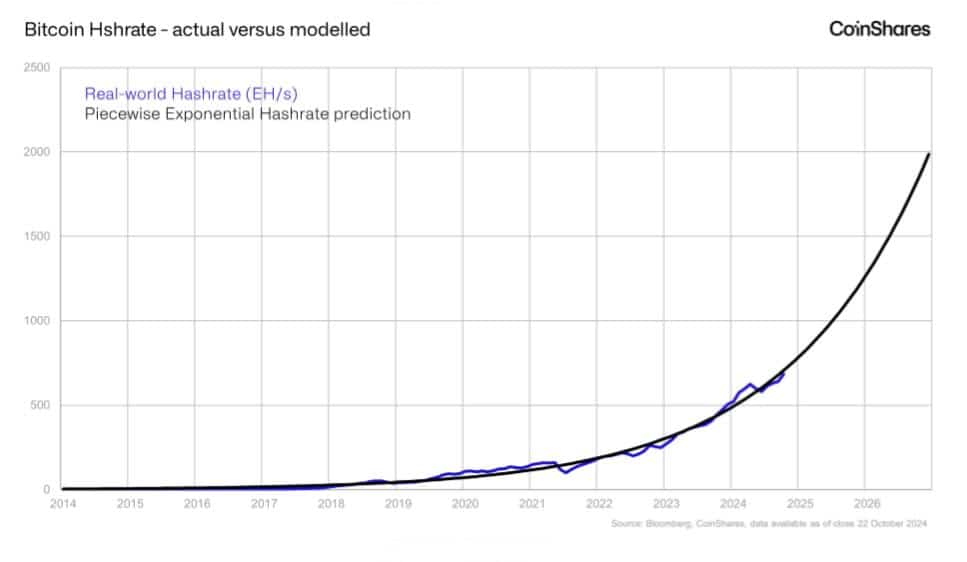

The Bitcoin network’s rising hash rate – projected to reach 765 EH/s – continues to drive up electricity demand, intensifying environmental concerns. As mining operations expand to maintain network security and compete for block rewards, the associated energy consumption draws significant criticism for its carbon footprint.

Based on predictions within the relevant sector, shifting strategies towards renewable energy sources might lower Bitcoin’s carbon footprint by as much as 63% by the year 2050.

Read Bitcoin (BTC) Price Prediction 2024-25

For miners, renewable energy offers a pathway to long-term cost efficiency. By investing in solar, wind, or hydropower, mining companies could shield themselves from volatile electricity prices and mitigate regulatory risks.

This transition could prove vital, impacting both financial success and public opinion, allowing the sector to adjust to growing ecological demands.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-11-06 00:07