- Michigan pension fund reveals substantial Ethereum ETF investment.

- ETH continues to struggle under a bearish stronghold.

As a seasoned researcher with over a decade of experience in the financial markets, I find the recent investment by Michigan’s pension fund into Ethereum ETFs intriguing and noteworthy. The fact that it is the first US state pension fund to do so underscores the growing acceptance of digital assets among traditional investors.

💣 Urgent EUR/USD Warning: Trump’s New Tariffs Unleashed!

A massive forex shakeup could be moments away. Get the inside story!

View Urgent ForecastMichigan has made history by being the first U.S. state pension fund to allocate funds towards an Exchange-Traded Fund (ETF) that focuses on Ethereum [ETH].

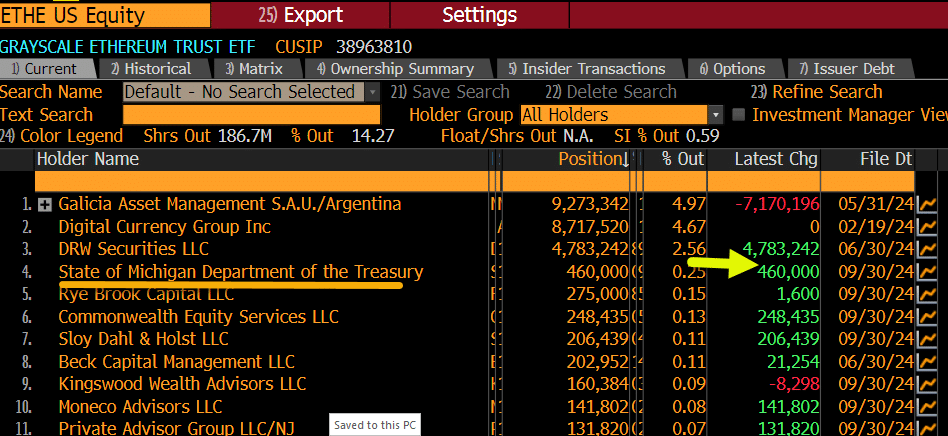

Matthew Sigel, the Chief of Digital Assets Research at VanEck, recently disclosed on platform X that the State of Michigan has risen to become one of the leading five holders for both the Grayscale Ethereum Trust Fund (ETHE) and Grayscale’s Ethereum Mini Trust (ETH).

Michigan pension fund’s ETH holdings

Based on a recent filing with the Securities and Exchange Commission (SEC), it was revealed that Michigan’s pension fund owns approximately 460,000 shares in both the Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust. The value of these holdings is as follows:

Apart from Ethereum, Michigan has also made an investment in Bitcoin (BTC). Specifically, their fund owns about 110,000 shares of the ARK 21Shares Bitcoin Exchange Traded Fund (ETF), which is roughly equivalent to $7 million. This strategic move demonstrates Michigan’s dedication to expanding its portfolio by incorporating digital assets.

The current landscape of Ethereum ETFs

It’s worth noting that Ethereum ETFs have not performed as well as Bitcoin ETFs. In fact, according to data from Lookonchain, there was a significant withdrawal of about 14,206 Ether (worth approximately $34 million) from Ethereum ETFs on November 4th.

Indeed, Grayscale’s ETHE fund experienced withdrawals of approximately 14,673 Ether, equivalent to more than $35 million. However, currently, the fund retains a significant amount of 1,576,248 Ether, which translates to around $3.84 billion in value.

Additionally, Fraside Investors’ data shows a grand total of more than $500 million in outflows, implying a wider apprehension towards Ethereum ETFs, even with notable acquisitions from entities like Michigan.

The recent action taken by Michigan has caught the attention of industry specialists and high-ranking officials, who have offered their perspectives. Eric Balchunas, a senior ETF analyst at Bloomberg, specifically pointed out that Michigan’s investment in Ethereum ETFs is significantly larger compared to Bitcoin ETFs, emphasizing this discrepancy.

Despite Bitcoin soaring high, Ether struggling. Yet, this situation presents a significant victory for Ether, which was in need of a boost.

As a researcher observing recent advancements, I couldn’t help but take notice when Ryan Sean Adams, a prominent figure in the Ethereum community as co-founder of Bankless and an avid Eth supporter, expressed his thoughts on the subject.

His remarks emphasized the growing acceptance of Ethereum among institutional investors, challenging skepticism.

ETH’s price performance

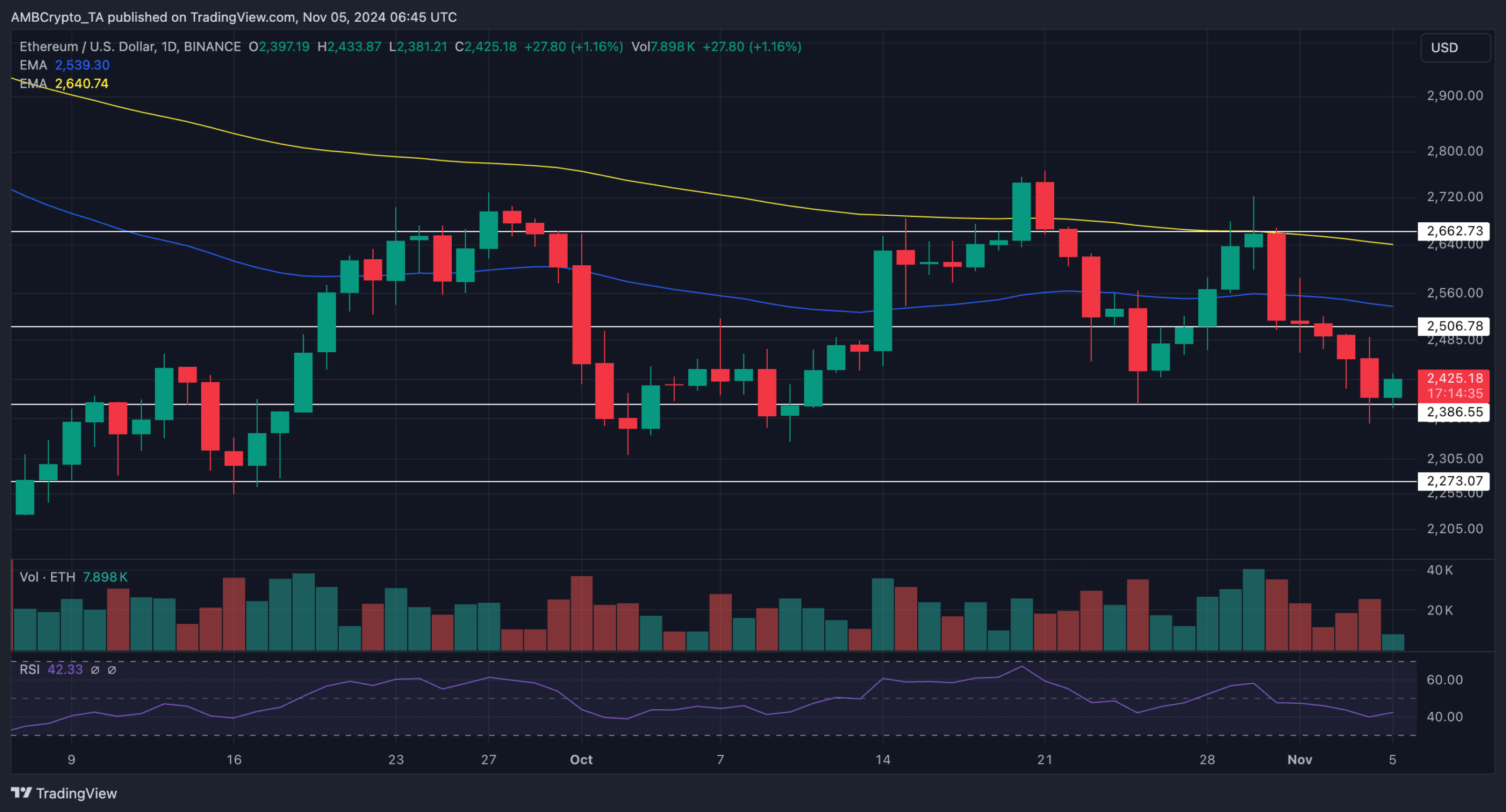

Currently, the value of Ethereum (ETH) hasn’t shone too brightly in recent days. On a day-to-day chart, we’ve seen a significant drop after a refusal at the $2,662 resistance point, only to find stability at the $2,386 support level.

Currently, the value of this altcoin stands at $2,425. This represents a drop of more than 7% in the last seven days. However, its annual increase has been relatively small, with Ethereum growing by around 30%.

In simpler terms, the technical indicators supported a negative outlook as the RSI reading was 42.33. This means sellers are more active than buyers at the moment. Furthermore, the 100-day moving average (represented by the yellow line) is currently above both the 50-day moving average (blue line) and the current price, which suggests a larger downward trend in the market.

If Ethereum bulls want to challenge the current bearish grip, they’ll need to break through the resistance at $2,662. However, if the downward trend persists, it’s quite possible we could see a drop to around $2,273.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As state pension funds and other large investors continue to explore cryptocurrency opportunities, the landscape for Ethereum ETFs may evolve, potentially driving greater adoption and stability in the sector.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-11-06 00:40